CHUNYIP WONG/E+ via Getty Images

By Lynn Song

Property prices continued to decline in early 2024

The National Bureau of Statistics published the February data for a 70-city sample of housing prices in China, which showed a continued price decline in line with expectations. Average primary market prices dropped -0.36% MoM and average secondary market prices dropped -0.62% MoM. Both were similar to the MoM declines in January.

For new homes, 8 cities saw a MoM increase, 3 cities saw prices unchanged, and 59 cities saw a MoM decline. The biggest gain was a three-way tie at 0.4% MoM between Shanghai, Tianjin, and Wuxi. The steepest decline was -1.1% MoM in Nanjing.

The secondary market was more downbeat. 2 cities saw a MoM increase, and 68 cities saw a MoM decline. The biggest gain was in Kunming, which saw a 0.4% MoM increase. The steepest decline was seen in Wuhan, with a 1.5% MoM drop.

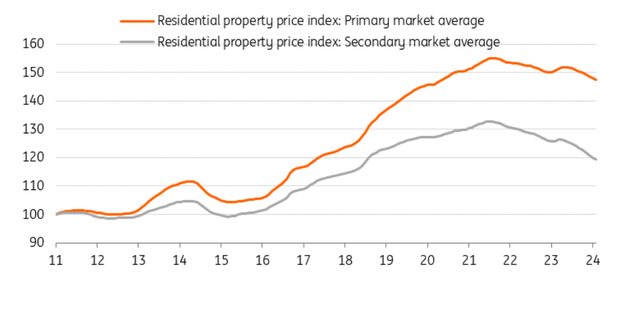

China average primary and secondary market housing prices

Majority of cities’ secondary markets are now seeing double-digit declines from the peak

From their respective peaks in 2021, primary market prices have dropped -4.9% and secondary market prices have dropped -10.1%. Both primary and secondary markets are seeing poor levels of liquidity, as building sales have slowed as buyers have turned cautious.

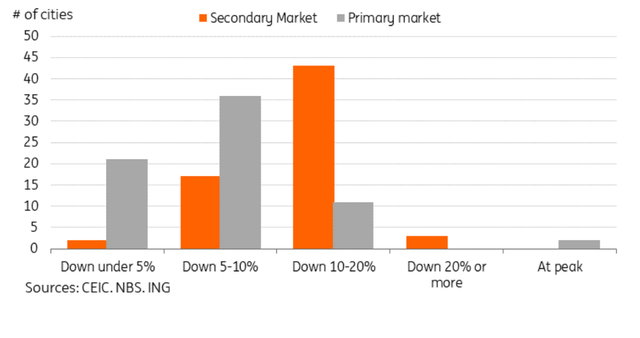

Within the NBS’s 70-city sample, the secondary market prices of 46 cities have now seen double-digit declines from their peak, with 3 of those 46 cities seeing declines of over 20%. The primary market has fared relatively better, with 2 cities still at all-time highs, and only 11 of 70 cities seeing a double-digit decline from their peaks.

City-level breakdown of price changes from the peak

Stabilising the property market remains key

Given the heavy weighting of property in household portfolios, it is of the utmost importance for China to stabilise the property market if it is to restore confidence. Declining property prices will create a negative wealth effect, acting as a headwind to consumption. Measures including scrapping purchase restrictions, property project whitelists, and the February cut to the 5-year loan prime rate to help lower mortgage rates are steps in the right direction, but further supportive policies may still be needed. Establishing a trough for house prices would go a long way toward stabilising sentiment.

We anticipate that real estate will remain the main drag on growth in 2024, and this drag is likely to persist over the medium term, as it will take time to work through excess housing inventories. Real estate investment is likely to remain in negative growth for the year, and the property sector and connected industries will likely continue to see pressure for consolidation.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.