Liudmila Chernetska/iStock via Getty Images

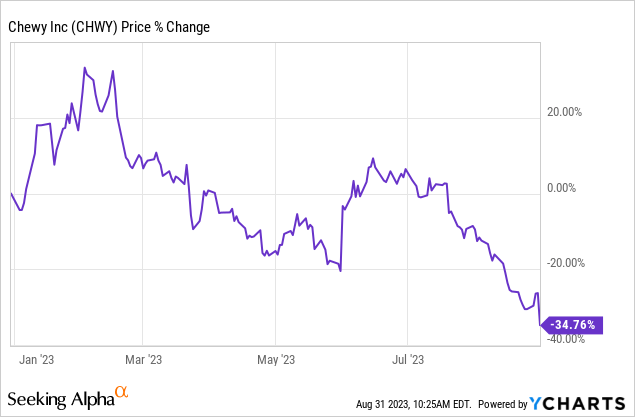

Chewy (NYSE:CHWY) reported better than expected results for the second-quarter on Wednesday that showed not only a significant EPS beat, but also double-digit net revenue growth and expanding gross margins. The retailer’s shares, however, have widely underperformed in the last year, chiefly because of concerns about slowing customer growth and normalizing spending patterns after the COVID-19 pandemic. Despite Chewy’s weak share performance with a year-to-date return of -34.8%, I believe the pet supplies company’s second-quarter earnings card was solid with respect to net revenue growth, gross margins and free cash flow. Since shares of Chewy are trading well below their 1-year average P/S ratio, I believe Chewy might be of interest to investors on the drop!

Previous rating

E-commerce companies have seen significant value destruction since the pandemic as investors started to price in slowing post-pandemic growth. As a result, my buy recommendation from November 2021 didn’t age well: shares are down 62% since. However, Chewy’s business is profitable and the company now generates a significant amount of free cash flow, which I believe could ultimately lead to a revaluation of the company’s earnings prospects.

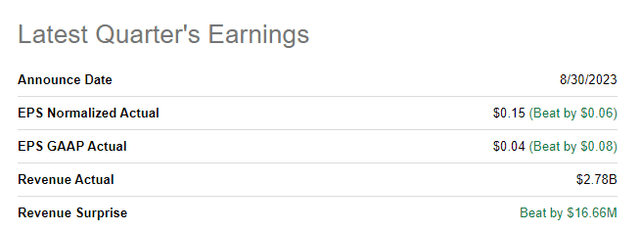

Chewy delivers strong EPS out-performance in Q2’23

Chewy reported total revenues for the second-quarter of $2.78B, beating analyst predictions by $17M. Chewy also reported a large EPS beat with total adjusted EPS coming in at $0.15 per-share, out-performing the average analyst projection by $0.06 per-share.

Source: Seeking Alpha

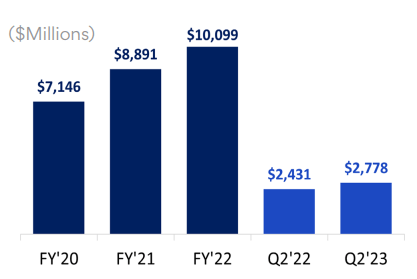

Chewy is growing its top line and gross margins in a competitive business segment

Chewy is a leading online retailer specializing in pet products and with a market cap of approximately $10.4B, Chewy is quite a significant player in the e-Commerce business. In the second-quarter, Chewy generated $2.8B in net revenues, showing 14.8% year over year growth. The firm benefited enormously from the COVID-19 pandemic which lit a fire under the company’s revenues. While Chewy’s top line growth rates have moderated post-COVID, the pet supplies e-Commerce company is still growing its revenue base at double digits, indicating a healthily expanding e-Commerce brand.

Source: Chewy

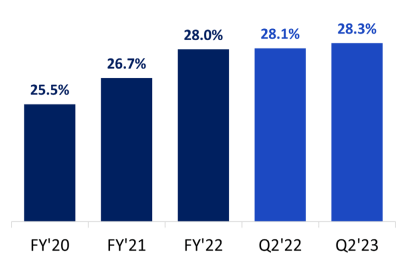

Chewy’s gross margins are also growing, although not as quickly as during the pandemic, but gross margins are also not reverting to pre-COVID levels. In Q2’23, Chewy reported a gross margin of 28.3%, showing a 0.2 PP improvement over the year-earlier period. Gross margin growth and strong free cash flows are two key reasons why I believe the e-Commerce brand has revaluation potential going forward.

Source: Chewy

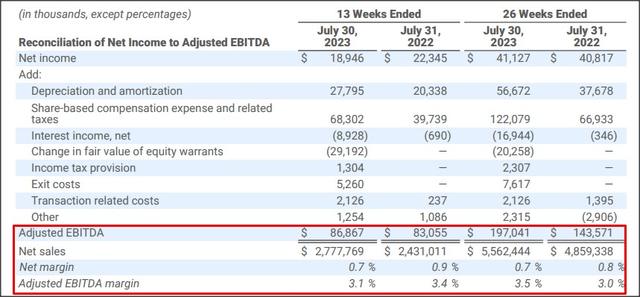

Chewy is profitable on both an adjusted EBITDA as well as net income basis, but Chewy’s business is high-volume and low-margin… which possibly explains why shares have under-performed in the last year. Chewy’s adjusted EBITDA in the second-quarter was $86M and the company achieved an adjusted EBITDA gross margin of 3.1%, showing a small 0.3 PP decline compared to the year-earlier period.

Source: Chewy

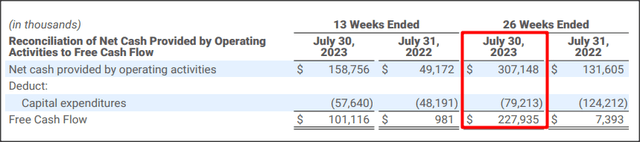

Free cash flow-positive e-Commerce model

What separates Chewy from other large-scale e-Commerce companies is that Chewy is already achieving significant, positive free cash flow. In the first six months of FY 2023, the pet-oriented e-Commerce firm generated free cash flow of $227.9M which calculates to a free cash flow margin of 4%. Two years ago, when I last covered Chewy, the e-Commerce company had a free cash flow margin of less than 3%. These are not Google-like free cash flow margins, but they are quite good for the highly competitive e-Commerce business. In the year-earlier reporting period, Chewy reported a free cash flow margin of 0.2%.

Source: Chewy

Outlook for Q3’23 and FY 2023

Chewy submitted a strong guidance for Q3’23 with net revenues expected to fall into a range of $2.74-2.76B, implying a Y/Y growth rate of up to 9%. For the full-year, Chewy expects to generate between $11.15B to $11.35B in net revenues while projecting an adjusted EBITDA margin of 3%. On revenues of $11.25B (mid-point guidance), Chewy should be able to report adjusted EBITDA just shy of $340M this year.

Chewy’s valuation

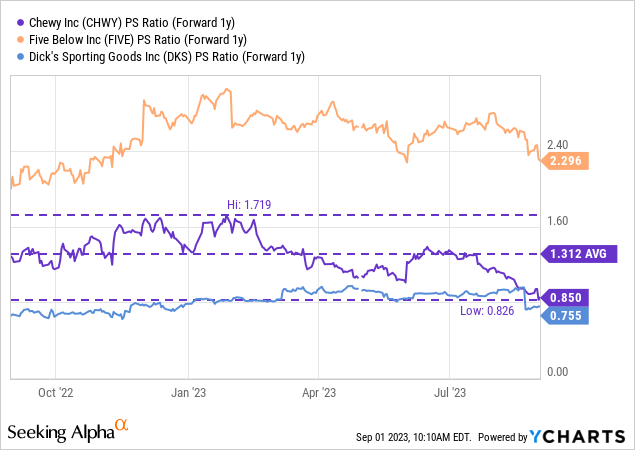

Chewy is expected to generate revenues of $11.33B in FY 2023 and $12.6B in FY 2024, based on SA-provided consensus estimates, implying a year over year growth rate of 11%. Chewy’s revenue potential is currently valued at less than 1X forward revenues and the retailer’s valuation is discounted by approximately 35% relative to the 1-year average P/S ratio.

Other specialty retailers have varying price-to-revenue ratios: DICK’S Sporting Goods (DKS) is trading at 0.76X revenues while Five Below (FIVE) achieves a 2.3X P/S ratio. From a pure valuation perspective, I believe Chewy makes a solid value proposition as its business is healthily growing in all metrics and the FY 2023 outlook indicates that this is not expected to change in the near term. In the longer run, I expect Chewy to at least return to its 1-year average P/S ratio of 1.3X.

Risks with Chewy

Chewy operates an e-Commerce model which implies huge competition from large general stores such as Amazon, but also a lot of smaller niche websites. Margins are low and should be expected to remain low going forward. From a financial point of view, Chewy submitted a solid earnings card and the company continued to see considerable momentum in net revenues. What would change my opinion on the e-Commerce brand is if it saw a decline in its free cash flow and adjusted EBITDA margins.

Final thoughts

Chewy executed well in the second-quarter and the e-Commerce company is seeing solid momentum in net revenues, upside expansion of its gross margin and, importantly, strong free cash flow. The outlook for FY 2023 implies double-digit top line expansion and the company should be profitable on a free cash flow basis as well. Considering that shares of Chewy have revalued to the down-side in the first eight months of the year despite positive business momentum, I believe shares are deserving of a second look. With a P/S ratio significantly below their 1-year average, I believe the risk profile is positive and I am buying the drop!