Jeremy Poland

Disclaimer: I’m not a geopolitical expert and this is all speculation on my part. The information presented is merely an exercise of thought and should be taken with a grain of salt. All opinions expressed are my own based on news releases that may or may not encompass all material information relating to the matter.

President Maduro of Venezuela appeared to further escalated the situation in Guyana, claiming that:

Venezuela has the right to defend itself, to tranquility, to peace.

President Maduro

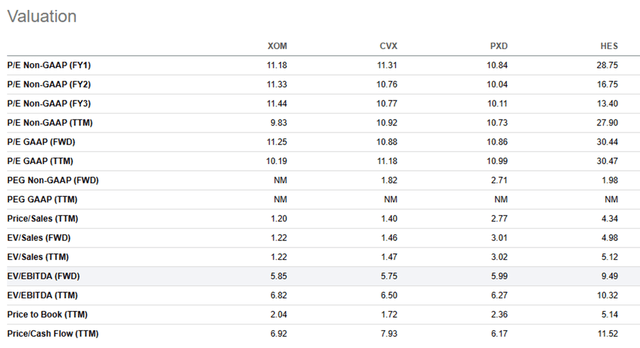

In retaliation to the British military sending Guyana a warship, President Maduro deployed 5,000 troops to Guyana as tensions rise between the two nations. Though many would suggest this is just a border dispute, I strongly believe this is the result of the 11Bboe find in the Stabroek block and President Maduro fully intends on nationalizing this block. This can have huge implications for Exxon (XOM) directly and Chevron (NYSE:CVX) and its acquisition of Hess (NYSE:HES). I have covered both Exxon/Pioneer Natural Resources (PXD) and Chevron/Hess relating to the initial referendum and what could be the result of an invasion. Seeking that, talks have turned into deployment; I believe the tipping point is imminent. I believe any escalation in the region will put Chevron’s acquisition of Hess at risk given the firm’s 30% stake in the assets. I had originally reported an optimistic viewpoint that the border talks wouldn’t escalate. Given the recent update over the holidays, I am gradually becoming more concerned that escalation may occur, resulting in the deal being called off. I am downgrading my recommendation on HES to a SELL and maintain my SELL recommendation for Chevron, maintaining my price target of $136/share for CVX. As discerned in my initial report covering Exxon & Pioneer Natural Resources, I remain bullish on the firm and the deal in place. I will maintain my BUY recommendation for XOM & PXD with a price target of $107.55/share for XOM.

Operating Overview

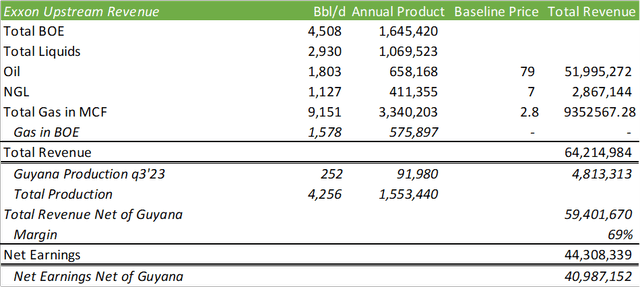

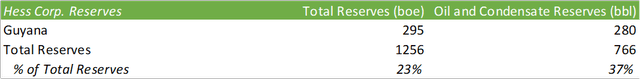

Exxon has made over 25 significant discoveries offshore Guyana in the Stabroek, Canje, and Kaieteur Blocks. With the recent completion of Payara, total production in the Stabroek Block now sits at 620Mboe/d. The Stabroek Block’s equity ownership includes Exxon at 45%, Hess at 30%, and China’s CNOOC Nexen Petroleum at the remaining 25%. Overall, Exxon anticipates to nearly double production to 1.2MMboe/d by 2027.

Corporate Reports

Aside from the oil play, Exxon claims that contractors have spent more than $83b with more than 1,500 Guyanese businesses in 2022 alone and $180b since 2015. Not only is the oil discovery beneficial to the global energy economy, it has strongly benefited the local economy of Guyana that has supercharged their economic development. Accordingly, GDP forecasts, for the small nation of 800,000 people, grew by 62.3% in 2022, is projected to have grown 38% in 2023, and will grow an additional 115% over the next 5 years.

According to Guyana Chronicle,

The 2023 budget saw massive increases in funds for key infrastructural upgrades, such as roads and bridges, housing, and power generation.

Guyana Chronicle

The article goes on to suggest the budget increased from $11.8b in 2019 to $131.5b in 2023 for infrastructure development. $53.1b will be spent on housing development alone. The sudden influx of money has also driven the hospitality sector with a surge in internationally branded hotels being constructed around the nation’s capital, Georgetown. I believe much of this economic growth is what drove President Maduro to pay a special interest to the small nation.

Corporate Reports

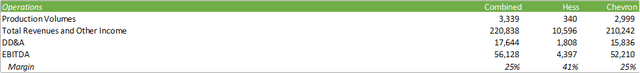

As I had previously covered in my report on Chevron/Hess, Guyana accounts for nearly 40% of Hess’s total production for q3’23. In the article, I had suggested that any escalation may hinder the $53b deal as I believe the primary target of Chevron isn’t necessarily Hess’s domestic assets. Given the recent escalation in Guyana, I have reason to believe that this isn’t going to end anytime soon and may escalate into an invasion. I strongly believe that if the situation were to escalate in Guyana and if the US backsteps from Chevron’s ability to produce with Venezuela, the acquisition of Hess will be at risk.

Corporate Reports

On the flipside, if the skirmish were to deescalate, I do believe the deal, though relatively expensive per the offered valuation, will strongly benefit Chevron. Guyana, along with the short-cycle domestic assets, will offer Chevron a wide range of production flexibility and will be margin accretive.

Valuation

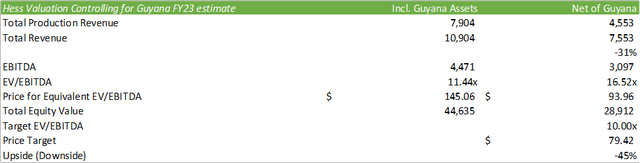

Though the geopolitical risk doesn’t necessarily mean a loss of assets, I do believe it is worth considering as a very real possibility and how it may affect both the firm itself and the deal that’s at stake. Without the Guyana assets, I believe HES’s valuation would look closer to 16.52x EV/EBITDA at its current price. If Hess were to lose their Guyana assets and if Chevron were to either pull out of the deal or adjust their price, I believe HES shares would be worth closer to $79.42/share, a -45% downside risk to the current price level.

Corporate Reports

Given HES’s robust valuation, I believe the firm’s shares will be at greatest risk if production were to but cut off at the Stabroek block and if the deal with Chevron were to falter. One cannot know for certain if this will occur; however, I’m suggesting this as a potential hazard as the geopolitical risks in the region develop.

To reiterate, I provide XOM/PXD a BUY recommendation with a price target of $107.55/share for XOM with no price target provided for PXD as shares will trace XOM upon closing, and CVX/HES SELL recommendations with a price target of $136/share for CVX with no price target for HES for the same reason as PXD.

Seeking Alpha

![The Full List of Stocks That Pay Dividends in August [Free Download] The Full List of Stocks That Pay Dividends in August [Free Download]](https://www.suredividend.com/wp-content/uploads/2022/11/August-Dividend-Stocks-e1667941437689.png)