DNY59/E+ via Getty Images

Charter Q4/23 earnings review

Charter Communications (NASDAQ:CHTR) released its Q4/23 earnings materials on Friday and the market reaction was abysmal: From pre-market trading until the close, the stock sold off heavily and finally lost over 16% of its value.

Key performance indicators were unexciting at best: Only revenues were in line with expectations, while EPS badly missed because of a pension remeasurement which consensus estimates had not accounted for.

Q4 net broadband additions were negative 61,000, which means that Charter only added 155,000 broadband subs for the full year, which is just a tenth of the previously usual expansion level.

The company used all its FCF for share repurchases, which, together with roughly flat EBITDA, means that debt and leverage remained about flat YoY.

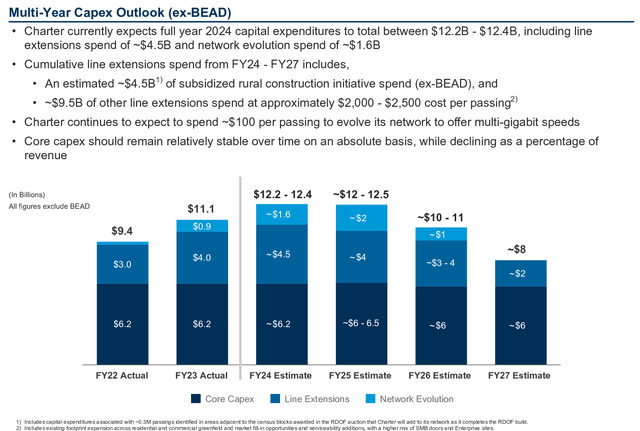

Moreover, Charter released a very unusual long-term capital expenditure outlook within its slide presentation:

Charter Q4/23 presentation

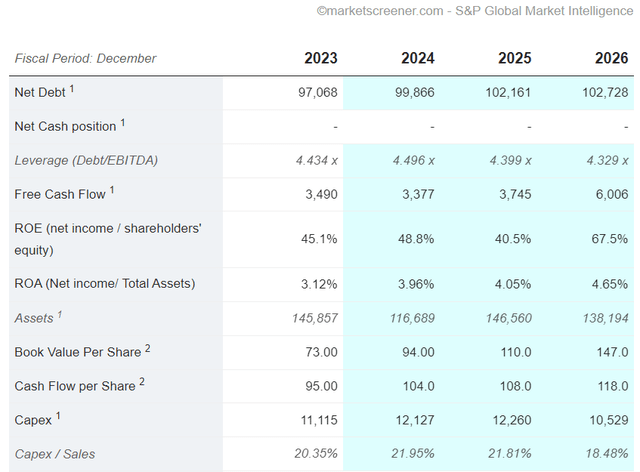

During Charter’s Q4/23 conference call, an analyst expressed surprise about the unexpectedly high cost per passing of $2,000-2,500, since usually residential passings cost about $1,500 each. The company explained that the higher figure is due to a mix of residential and enterprise customer passings and that the expected returns are very attractive. Moreover, on Charter’s Q3/23 call, the company explicitly stated a $3,800/passing cost figure for subsidized rural passings. So the sell-side should have been aware of an unusual mix within the current development initiatives. That said, sell-side models presumably accounted for a much lower average cost per passing and will now need to be adjusted through a lower expected number of new passings. Overall, however, the outlined long-term capex levels announced were in line with sell-side expectations before the release:

Marketscreener.com

Furthermore, the company disclosed some delays of equipment supplies related to its DOCSIS 4.0 upgrade initiative, which is starting to roll out across its entire footprint and should bring 1 Gbps symmetrical speeds to all customers. This upgrade is clearly important for competitive reasons, and a delay is not good news. That said, instead of upgrading its existing footprint faster, the company therefore chose to prioritize line extensions, which usually bring a rather quick and certain return on investment.

Finally, another negative relates to the Affordable Connectivity Program (ACP): As disclosed in Charter’s 2023 annual report, ACP

provides eligible low-income households with up to $30 per month towards Internet service. The FCC has announced that ACP funding is expected to run out in April 2024 and has prohibited service providers from enrolling new ACP customers after February 7, 2024.

Charter has about 5 million ACP-supported customers, most of whom were customers even before they received subsidies. Charter is obviously keen on keeping all customers and has contingency plans in place. E.g., it might offer temporary discounts for all those that would otherwise not be able to pay their bills. In addition, ACP funding could be secured again, as there are bipartisan efforts to allocate fresh funds for the program, which is very popular among Republicans and Democrats alike. The program indirectly helps around 64 million people to stay connected, so a disruption seems a bad move in an election year. CNN has some details on the current efforts to refund ACP.

On the positive side, mobile net ads were strong. The 532,000 new mobile lines added in Q4 alone almost compensated for the subscriber losses in all other segments (Voice + Video + Internet).

Why Charter stock sold off

CHTR crashed over 16% after the earnings release, and many media quickly found the reason in the broadband subscriber loss.

Yet, it is very unlikely that this aspect was the main reason, since it was not a surprise at all. In fact, at the beginning of December 2023, the company’s CFO had already guided to a net subscriber loss in Q4 during an investor conference. And the stock had already sold off 8% on that day. Despite this, the stock subsequently recovered almost the entire losses and traded as high as $392 in recent weeks, with a Q4 net subscriber loss already announced.

Some observers pointed to the long-term capex guidance as an indication for lower FCF for several more years. Yet, as we have seen, consensus had already expected such capex levels.

The reason is also unlikely to be found in the EPS miss, as it was not due to business underperformance, but mainly to a pension remeasurement, which burdened pre-tax income in 2023 by $470m compared to 2022, when the company enjoyed a remeasurement gain of $254m, while it showed a loss of $216m in 2023. This also means that, without the loss and with a similar gain as in 2022, Charter would have likely met or exceeded consensus estimates in Q4.

Even the ACP issues should not have been a surprise, as its funding stop has been abundantly discussed in major news outlets.

So what is the main reason for the sell-off?

First of all, CHTR stock is frequently overreacting to news. Moves in the high single digits or greater are no rarity. This is presumably because of the combined effects of a relatively small trading float (as many shares are in the hands of buy & hold long-term investors), a large short interest with almost 9 days to cover, a relatively high debt/EBITDA ratio, and no dividend acting as an anchor (although there is a way to get an 8%+ yield indirectly through Liberty Broadband Preferred stock (LBRDP)).

With $98B of long-term debt and a market cap which is just around half of that, any change in expectations has a 3x larger effect on the equity. E.g., if consensus EBITDA estimates decrease 5%, the equity value should shrink by ~15%. This helps to put things into perspective: Friday’s 16% crash doesn’t mean that business results are expected to shrink 16%, but only about 5% (assuming the haircut to market value is fair).

In addition, as has been often the case with Charter, sell-offs (and rallies) develop a self-sustaining dynamic, leading quickly into irrational territory. In fact, very frequently sell-offs and rallies have been at least partially reversed rather quickly.

In my opinion, the stock market had anticipated some sort of replay of the Comcast (CMCSA) earnings reaction. Since Comcast actually lost 34,000 broadband subs in Q4/23 and its overall subscriber base declined by almost twice as much in the full year (while Charter added 155,000 subs in 2023), yet CMCSA rallied, the market probably expected something similar to happen on Friday. In fact, Charter closed 3% higher one day earlier.

Since not all losses from the negative news about broadband sub losses in Q4, as revealed in early December, had already been recovered in the case of Charter, while Comcast traded 10% higher compared to those days, the market had probably placed a bet on similar near-term gains following a benign Q4 release.

Yet when I say “the market”, in this case, it was mainly short-term speculation based on superficial fundamental analysis and a favorable peer group and technical setup. These were shaky hands. Consequently, when results clearly did not contain any evident positives to rally on and the stock turned negative, those short-term speculators sold immediately. And short sellers jumped on the bandwagon.

Investment thesis for Charter

My previous investment thesis for Charter remains unchanged. (There are many valuable comments below the article, which I strongly recommend to read for a deeper understanding of the debate.)

Sure, there are several near-term negatives and uncertainties and the stock is unlikely to move permanently higher quickly:

- The lack of further ACP funding remains an overhang which will likely impact at least somewhat Q1 subscriber stats and maybe even other quarters. Over the long term, I believe the program will likely be funded again, as politicians would otherwise face 64 million of disappointed voters. And we are in an election year.

- FCF generation will remain limited, as the investment initiatives require much higher capex for several years. Doubts linger regarding returns on these investments: Will they effectively be growth or rather maintenance investments? I.e. will they grow revenues or simply replace revenues lost to fiber and fixed-wireless competitors? Personally, I believe that the main impact of competition has probably already been felt. In particular, fixed wireless competitors will likely scale back their marketing, as they are reaching capacity limits in more and more areas. Fiber so far has not been a large factor, and I believe it will mainly remain a means for current DSL providers to keep their share relatively constant. Overall, I believe cable broadband’s share of overall net adds should increase again from here.

- Limited FCF means limited buybacks. But a lower share price also means that those reduced buybacks effectively can buy similar amounts of shares as previously.

- The market remains focused on broadband stats and ignores excellent mobile growth. Sooner or later, this will change, as Charter has only started to penetrate its broadband base with mobile service. There are still 87% of broadband subs that don’t have wireless service from Charter.

After this sell-off, CHTR stock is even cheaper than before, while risks have not grown commensurately. Personally, I prefer to own CHTR stock through Liberty Broadband (LBRDA) (LBRDK) (OTCQB:LBRDB), which provides an additional margin of safety of about 30%. In my recent investment thesis for Liberty Broadband you can find all the details and the thesis has not changed because of Friday’s events.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.