jetcityimage

Shares of Charles Schwab (NYSE:SCHW) only temporarily stopped their downward momentum that has built up after Silicon Valley Bank collapsed after a deposit run. A recent Morgan Stanley down-grade and concerns over deposit outflows have reignited fears over larger cash sorting efforts on the part of investors. Since Charles Schwab continued to see large deposit inflows at the height of the financial crisis, I believe the risk/reward trade-off is extremely attractive here as the company’s shares now trade for less than 10 X forward earnings!

Charles Schwab and its current deposit situation

Since my last work on Charles Schwab, published on March 17, 2023, the broker’s shares have continued to slide, despite what I considered was an attractive package: the financial services company has a strong brand, multiple fee streams, a low valuation based off of forward earnings and a huge deposit base of $7.4T as of February 28, 2023. However, in recent days, new downward momentum has been established, in part due to a down-grade from Morgan Stanley and continual fears over investors moving cash to other financial institutions. As to the second concern, I believe the market is wrong as Charles Schwab likely saw continual deposit inflows in the last week of March.

At the height of the deposit crisis in March, in the week immediately following the collapse of SVB, Charles Schwab took in $16.5B in core net new assets, indicating that depositors and investors view the brokerage as a safe place for their assets. To give some perspective, Charles Schwab attracted $428B in core net new funds throughout the entire FY 2022, which calculates to approximately $8.2B in core net new funds weekly, on average. This means that Charles Schwab has seen an acceleration in core net new deposit inflows at the height of this year’s financial crisis, all the while the market expected Charles Schwab to lose funds. While I expect Charles Schwab’s asset inflows to have slowed in the last week of March (due to easing fears in the financial market), the brokerage likely continued to see net-positive deposit inflows.

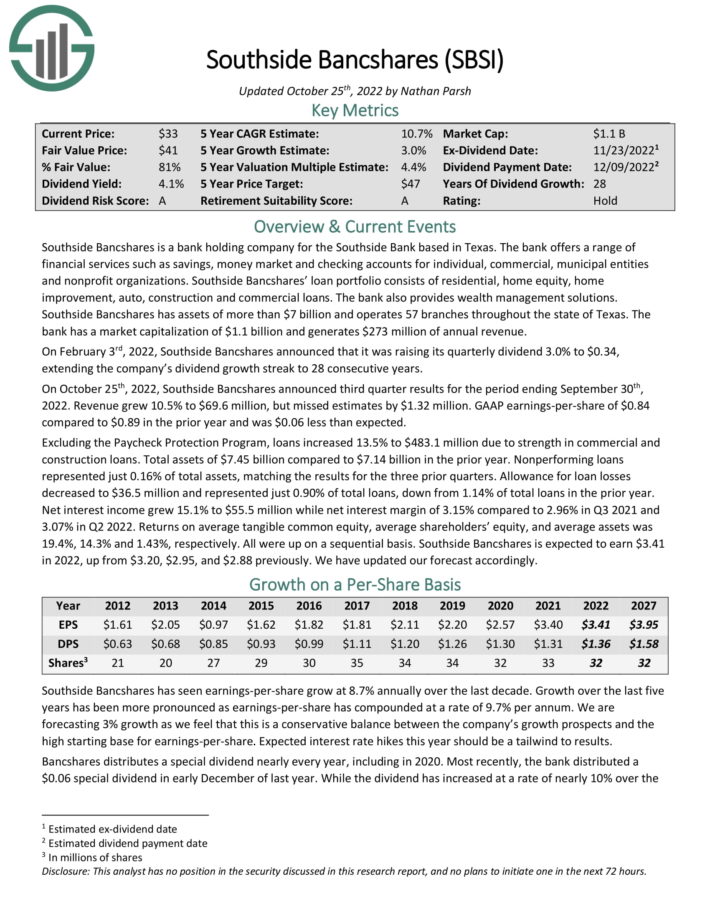

Charles Schwab is one of the strongest deposit franchises in the U.S. financial market and has had no issues attracting client assets over time. The company had more than $7T in assets and is one of the most trusted financial brands in the market.

Source: Charles Schwab

$16B in unrealized HTM bond losses, but Charles Schwab will be fine

The key issue at the heart of the current financial crisis is that Silicon Valley Bank invested customer deposits into U.S. Treasuries and mortgage-backed securities that were marked as held-to-maturity. After SVB’s customers rushed to get their deposits out, the bank was forced to liquidate a $21B portfolio and realize a loss of $1.8B.

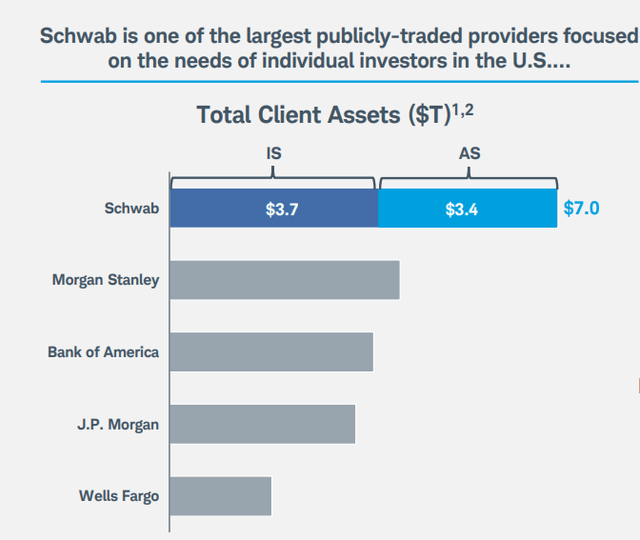

Charles Schwab also owns a considerable portion of so-called held-to-maturity assets which are those assets that a bank/broker doesn’t plan to sell before the maturity date. Since those investments consist largely of U.S. Treasuries and highly-rated mortgage-backed securities, Charles Schwab’s unrealized loss on this position is $15.6B. Since Charles Schwab has significant liquidity on the parent level to fund withdrawals. At the end of FY 2022, Charles Schwab had $12.9B in parent liquidity and the broker could also access the Fed’s liquidity facility, if need be.

Source: Charles Schwab

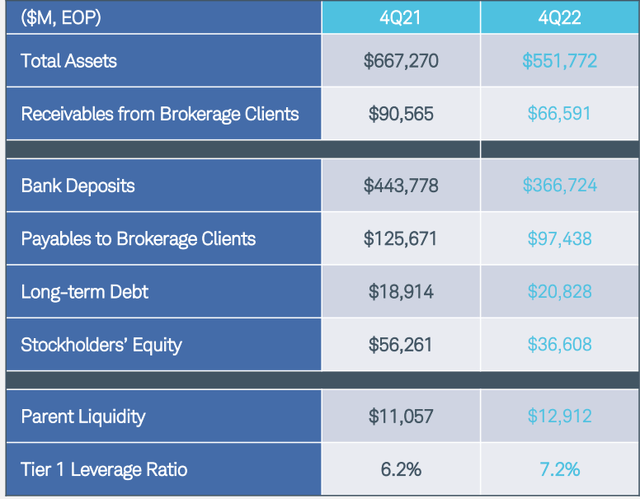

Morgan Stanley recently down-graded Charles Schwab and made a major adjustment to its price target as the investment bank sees cash sorting issues as a major short term obstacle to a valuation recovery. Citing limited visibility and delayed earnings, Morgan Stanley down-graded Charles Schwab to “equal-weight” and reduced its stock price target from $99 to just $68. The earnings revision trend for SCHW, however, is broadly negative.

However, Charles Schwab’s core net new assets inflows were twice as high as during the average week in FY 2022, meaning investors keep funneling money to the brokerage company, not away from it.

Charles Schwab’s valuation is just silly at this point

Charles Schwab presents investors with the opportunity to buy a leading brokerage franchise at a P/E ratio of less than 11 X despite record new deposit inflows and a strong financial brand. As a broker, Charles Schwab may also benefit from increased market volatility following the implosion of SVB which likely encouraged trading activity and could lead to a boost in transaction fee income in Q1’23. I believe the risk profile is extremely attractive here as Charles Schwab sits on more than $7T on deposits and the company’s earnings are valued very cheaply.

Earnings have been revised downwards in recent weeks as analysts weighed the impact of interest rate headwinds on the brokerage’s earnings baseline. However, even with EPS estimates falling, Charles Schwab is attractively valued with a P/E ratio of 10.6 X… which is 32% below the stock’s 1-year average P/E ratio of 15.6 X.

Risks with Charles Schwab

If there were a situation to develop in the financial markets in which there would be an acceleration of deposit outflows, market sentiment would be hurt and Charles Schwab would likely see a lower market cap and valuation. As the Fed continues to raise rates, investors may continue to fear realized losses from Charles Schwab’s bond portfolio.

Final thoughts

Charles Schwab shares have continued to slide although the financial services company has issued a very comforting statement in March that indicated that money inflows at the height of the financial crisis have doubled compared to the 2022 average weekly inflow level. Additionally, the down-grade from Morgan Stanley should not hurt Charles Schwab’s long term earnings prospects in the financial services industry. As a leading deposit franchise in the U.S., I believe that despite down-grades and revisions to Charles Schwab’s EPS estimates, the brokerage offers investors deep earnings value!