robertcicchetti

In no huge surprise, ChargePoint Holdings (NYSE:CHPT) announced another large capital raise, sending the stock down to all-time lows. The EV charging station company has bled tons of cash since going public due to a flawed business model. My investment thesis is shifting more Neutral on the stock after the large capital raise might get the business to breakeven levels.

Source: Finviz

Big Capital Raise

ChargePoint only had a market cap of ~$1.5 billion heading into trading today. The company announced a big capital raise, sending the stock down 16%, though investors probably shouldn’t have been shocked by the move.

The company raised a combined amount of $232 million via $175 million sold to institutional investors $4.23 per share and another $57 million previously sold under the ATM during FQ3’24. In addition, the shocking part is probably increasing the coupon on the $300 million in convertible notes from 3.5% to an alarming 7.0% per year, due in part to apparently getting the lead investor to contribute to the ATM investment.

ChargePoint ended July with a cash balance of $264 million after having raised $38 million during FQ2 via selling shares in the ATM. The company suggests they will not utilize the ATM anymore with the goal of reaching adjusted EBITDA profits next FQ4, or the January 2025 quarter.

The EV charging station company now has a pro forma cash balance of $496 million heading into FQ3. ChargePoint burned ~$80 million in operating cash flows during FQ2 and FQ3 won’t be much different, with similar revenues at slightly above $150 million.

In total, ChargePoint has now burned $200 million in cash for the 1H’23, including $10 million from the purchase of property and equipment. Investors should’ve known the company would eventually need to raise more capital.

View Altered

The large capital raise and plunging stock definitely make ChargePoint finally more intriguing from an investment standpoint. The key now is getting the business far closer to breakeven in order to eliminate the risk of the EV charging station company needing another capital raise in 2024.

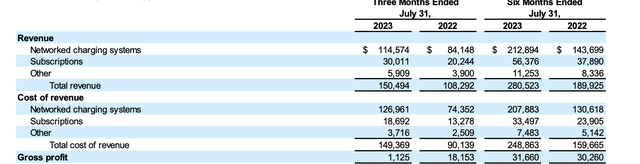

The stock would actually become far more appealing, if ChargePoint had vastly more revenues from the Subscription business. The company grew subscriptions by 50% in FQ2’23, but the quarterly revenue is only $30 million.

Source: ChargePoint FQ2’23 presentation

All of the other revenues are virtually pass-through of costs to sell equipment. The company actually reported negative gross margins for the Networked charging systems in the quarter, and Other revenues aren’t material.

The Networked products normally have slightly positive margins, but ChargePoint is mostly passing through those revenues to generate subscriptions. The EV charging station company still has a long path to reaching profits and positive cash flows, and the goal line can change a lot by next FQ4.

Not to mention, the Subscription business only produces gross margins in the 38% range now. A lot of investors rushed into ChargePoint on the thought of the company having a high-margin software business tied to the soaring demand for EV charging, but the company actually has a low margin Subscription business focused on cloud services, warranties, and the ChargePoint-as-a-Service software offering.

The stock has a market cap in the $1.5 billion range once factoring in the additional 50+ million shares issued as part of the ATM sales in the quarter. ChargePoint might have a target for revenue in the $600 million range in FY24, but gross profit will hardly reach $120 million based on 20% gross margins for the year while the company spends over $125 million in quarterly operating expenses.

ChargePoint cut 10% of the workforce and removed $30 million in annual operating expenses. Without any additional expense growth, the quarterly run rate on a non-GAAP basis is in the $82 million range.

The company has a very long path to get subscription revenues large enough with total gross margins topping 40% to cover this amount of operating expenses. The stock is more interesting here with the growth and possibility of dilution from capital raises being over.

Takeaway

The key investor takeaway is that investors needed ChargePoint to raise significant amounts of cash before the stock became an interesting investment. ChargePoint still needs to cut a lot of the cash burn before the stock is a buy, but investors shouldn’t expect further downside unless the EV charging station company can’t cut the quarterly losses and cash burn.

Investors should now watch from the sidelines, looking for the turning point.