Every year, Credit Suisse puts out an in-depth look at wealth around the world (I often pull a chart or two for the reads). The data always has some interesting findings about how the very wealthy are investing, consuming, and otherwise spending their time and money. I don’t always reference it, but intriguing and anomalous findings are always worth sharing.

This year is one of those times.

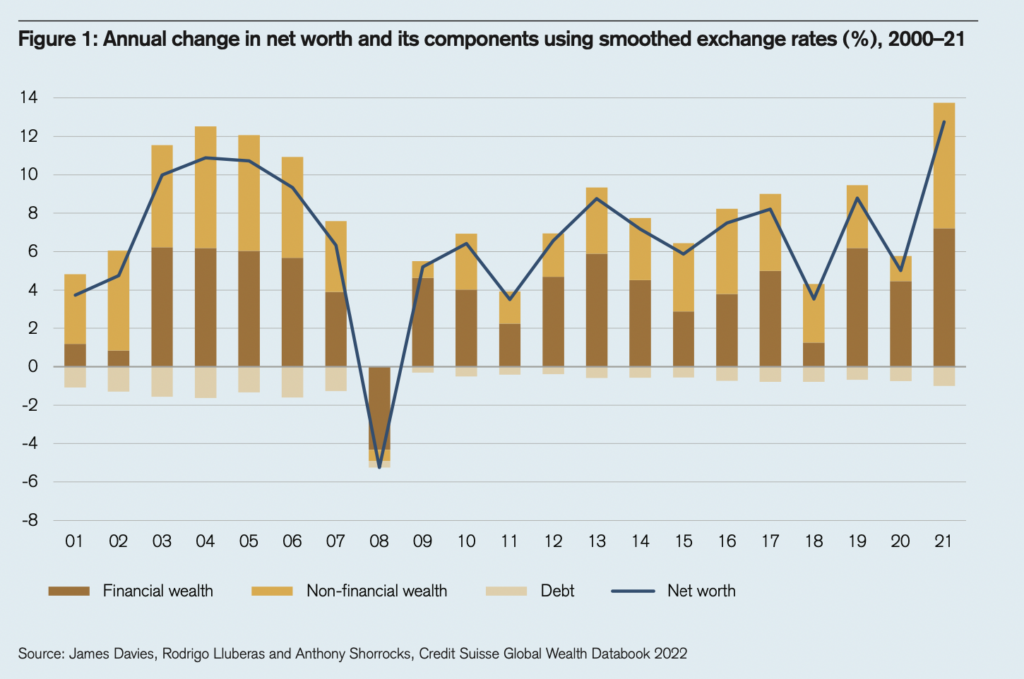

Global wealth, in both dollar totals, and percentage gains, each hit all-time highs. The actual data had some very interesting highlights, including some ginormous numbers:

-Global Wealth: $463.6 trillion (end of 2021)

-Increase versus 2020: +9.8%

-Annual average gains: +6.6% (Avg 2001-2021)

-Aggregate global wealth: +12.7% (Fastest annual rate ever).

-Wealth per adult: $87,489

-Real (inflation-adjusted) Wealth: +8.2%.

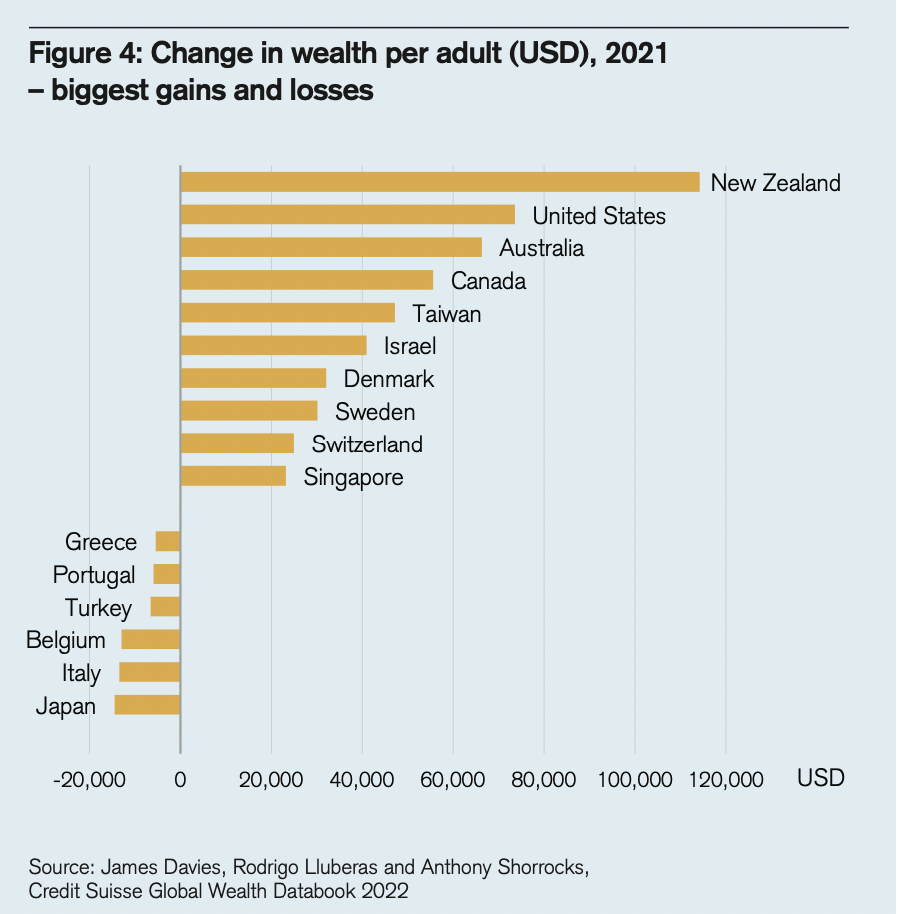

Gains by country

1. United States

2. China

3. Canada

4. India

5. Australia

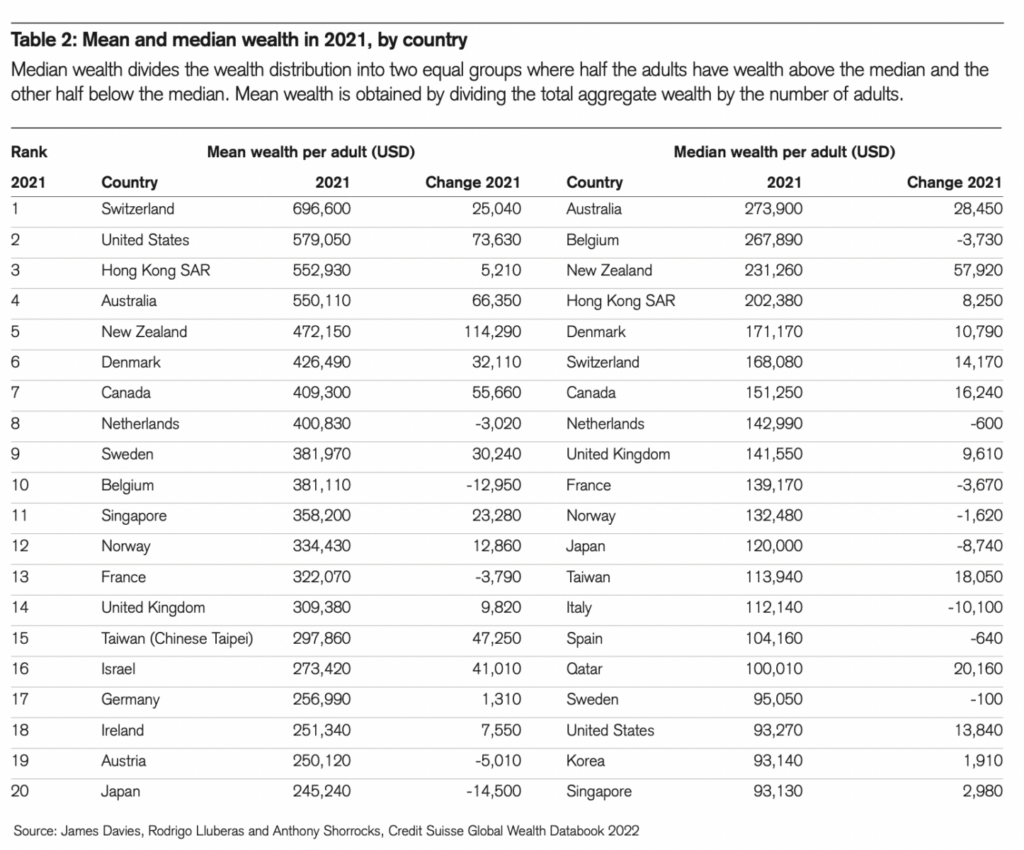

Total Wealth per capita

1. Switzerland ($696,600)

2. United States

3. Hong Kong

4. Australia,

5. Belgium

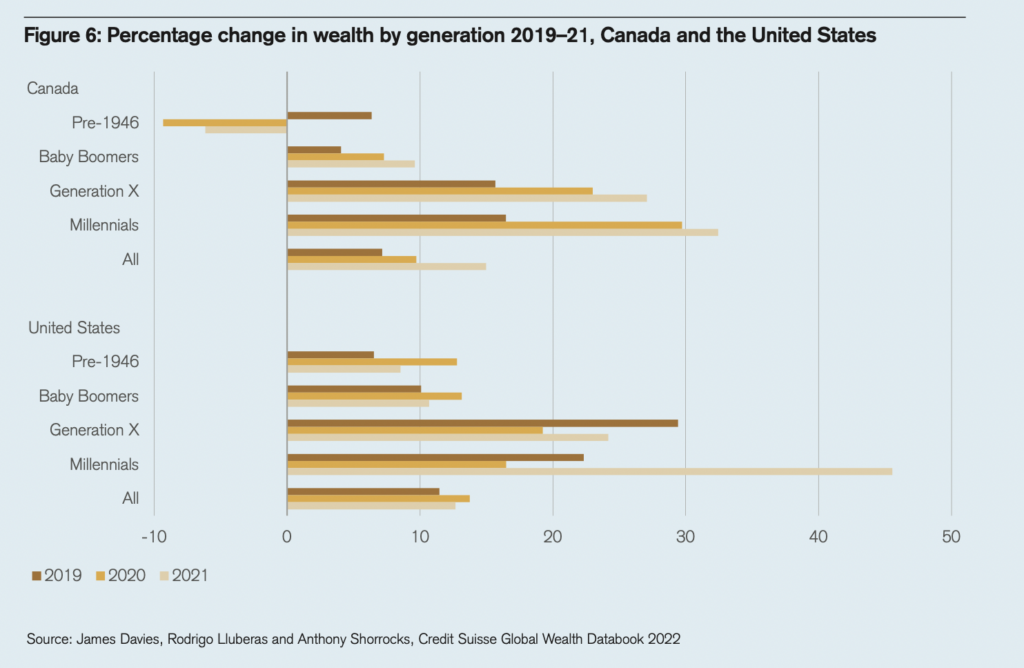

In the United States, African American and Hispanic households saw very largest percentage increases in wealth (+22.2% and +19.9%), but an the biggest surprise was the generational gains by Millennials and Gen X: They grew their wealth most between 2019 and 2022 dramatically:

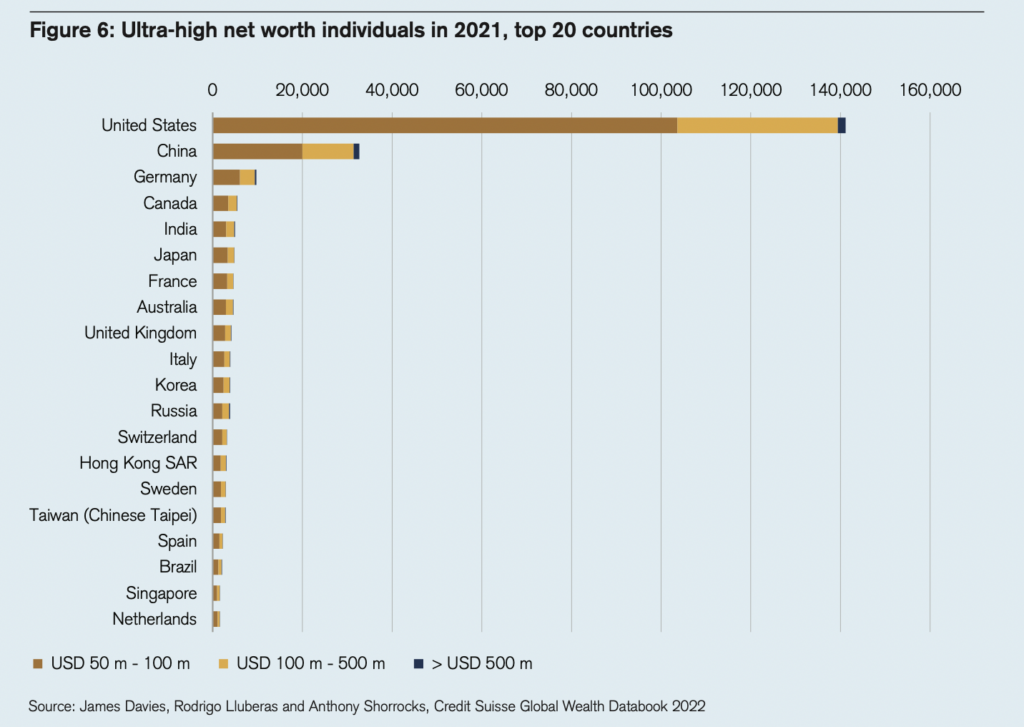

Most ultra-high-net-worth individuals

United States with over 140,000 2

China 32,710

Worldwide there are 62.5 million millionaires (+ 5.2 million from 2020)

The 5-year outlook is global wealth will increase by $169 trillion by 2026; by 2024, global wealth per adult should pass $100,000 and the number of millionaires will exceed 87 million individuals over the next five years. Much of the media focused on a silly number – a forecast of the number of global millionaires by 2026 at >87 million from 62 million in 2021 – a gain of ~40%.

The entire 72-page PDF is definitely worth checking out…

Previously:

Wealth Distribution Analysis (July 18, 2019)

Wealth Distribution in America (April 11, 2019)

Composition of Wealth Differs: Middle Class to the Top 1% (June 5, 2019)

No, Your iPhone Does Not Make You Wealthy (June 4, 2018)

Source:

Global Wealth Report 2022 Leading perspectives to navigate the future

Credit Suisse, September 2022

PDF

See also:

Bloomberg WealthScore

____________

1. Note: Wealth losses almost always associated with currency depreciation against the US dollar, affecting for example Japan, Italy and Turkey.

2. Wealth share of bottom 50% of households in the United States increased from 1.84% to 2.64%, mostly due to a rise in the value of real estate.