When confronted by a problem or challenge, it is useful to try and change your perspective. Merely shifting your frame of view by a few degrees can reveal what you may have missed in your initial viewing. This is very easy to do when you are looking through the viewfinder of a camera, but much more challenging when you are intellectually pondering a set of choices.

The relevance of perspective to investing is self-evident.

Here are a few of my favorite perspective-changers:

Non-Farm Payroll: There are about 158.6 million people in the US labor market. Each month, about 1.5% of that labor pool, or a bit over 2 million people, leave their jobs. Sometimes it is due to retirement, death, sabbaticals, parental leave, but most often, it is to switch jobs and work for another firm or start their own business. Similarly, when you hear about those Non-Farm Payrolls jobs, some are new or returning entrants into the workforce, but most are those people exiting their old jobs and beginning a new one.

Essentially, monthly Non-Farm Payrolls is the net difference between these two groups: The actual number is far smaller and less significant than gets played most publicly. The monthly number (May 2023 = 339,000) is a tenth or so of the ~1.5% of the 159m total. Hence, any given monthly NFP datapoint is a tiny, noisy, modeled number, filled with all manner of adjustments and revisions.

What really matters is the series trend: Are we consistently creating jobs over time? Is that multi-month trend rising or falling?

Monthly NFP is likely the single most overrated economic data point in the US, while the intermediate term employment trend is the most underrated. (When you have 14 straight upside surprises, perhaps somewthing is off in your model…)

Traffic: I love getting a text from someone apologizing for getting stuck in rush hour traffic and they are going to be late.

It’s fascinating how people see themselves apart from the crowd, their ego does not allow them to see themselves as ordinary member of the masses. It always reminds me of the scene from Life of Brian: “You are all individuals.”

Here is the context shift: Driving at rush hour, you are not “stuck in traffic,” you ARE traffic. (Amazing how few people realize this).

Inflation: Similar to traffic, when consumers have to pay up for scarce goods, it is often said they are suffering from inflation.

While it may be painful, that oversimplifies what is actually happening: Purchasing discretionary goods at higher prices is a decision made by someone who has chosen to pay a higher price in order to obtain a good they desire.

Bidding up prices for scarce goods? It is much more accurate to say consumers are not so much suffering from inflation as they are one of the primary causes of inflation.

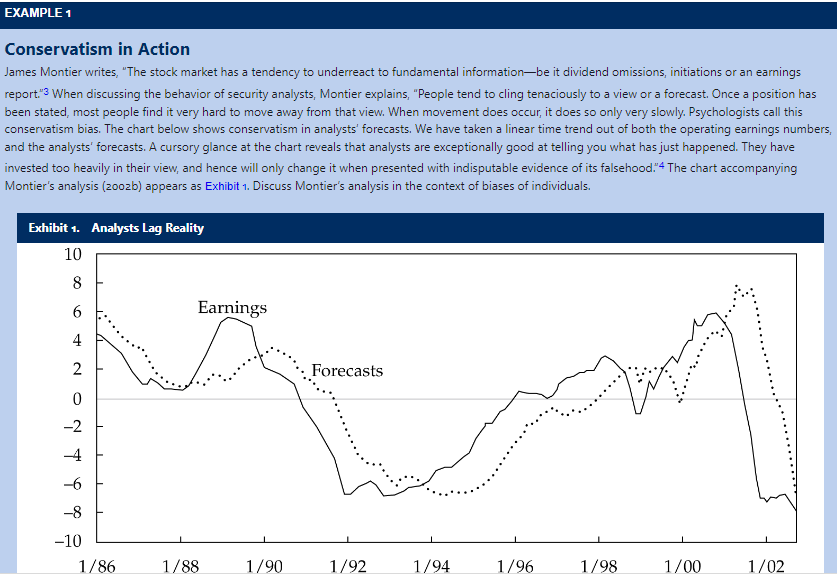

Analyst Estimates: Earnings never miss estimates. Rather, it is the estimates – the opinion of analysts – that were wrong. Morgan Housel loves pointing out that Earnings are whatever they are going to be as a function of a company’s revenues relative to its costs.

Earnings are a fact, analysts’ earnings estimates are an opinion. If a company’s earnings are above or below consensus, it was the analysts who got it wrong and not vice versa.

Fair Value: Valuation of equities is one of those things that seems to confuse so many. About half the time it will be above average and the other half of the time it will be below. By definition, average is not necessarily where you are going to spend most of your time. My colleague Ben Carlson likes to point out that average annual returns for the S&P500 is 8%, a number that market almost never returns on an annual basis.

Fair value is that singular point in a cycle that equities race by in the early stages of a secular bull market to the upside; some years later, these same market averages will plummet past that spot as the bear market ramps up. It is a point in space and time that is incredibly brief.

Stocks do not magically return to of historical average fair value as if they were a Roomba going back to their charging stations.

~~~

Those are some of my favorite perspective shifters, I hope you find them to be a useful way to reset your own perspectives.

Previously:

NFP Day: The Most Over-Analyzed, Over-Emphasized, Least-Understood Data Point (February 4th, 2011)

THE MOST IMPORTANT EVER NFP blah blah blah (June 7, 2013)

Nobody Knows Nuthin’ (May 5, 2016)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Forecasting & Prediction Discussions