Kharchenko_irina7/iStock via Getty Images

I am a long-term follower and chronicler of CEL-SCI (NYSE:CVM). My initial CEL-SCI article was 08/2019’s CEL-SCI: A Risky Bet. My most recent was 07/2023’s “Cel-Sci: Would-Be Cancer Giant Taking Baby Steps”.

In this article I evaluate its investment prospects based up on its latest investor communications. These include:

- 10/25/2023 – Shareholder Letter From The CEO (the “Letter”)

- 01/25/2024 – CEL-SCI Multikine Pre-Surgical Cancer Therapy Presentation (the “Presentation”)

- 12/22/2023 – Fiscal 2023 Financial Results and Clinical & Corporate Developments (the “Results”)

- 12/21/2023 – 10-K for the fiscal year ended September 30, 2023 (the “10-K”)

The CEL-SCI’s Multikine story is intuitively appealing

CEL-SCI is all about its cancer pretreatment therapy Multikine (Leukocyte Interleukin, Injection). It is an immunotherapy consisting of a cocktail of cytokines and select small biological molecules. Critically it is administered at the outset of one’s cancer treatment before treatments have damaged a patient’s innate immune response.

As described in the 10-K (p. 4) Multikine is:

…injected around the tumor and adjacent lymph nodes for three weeks as a first-line treatment before the standard of care (SOC), which is surgery followed by either radiotherapy or chemoradiotherapy. Multikine’s rationale for use is to incite a locoregional immune response against the tumor before the local immune system has been compromised by the standard of care and/or disease progression.

The 10-K goes on to describe Multikine’s target population as:

- treatment-naïve adult patients with resectable locally advanced primary squamous cell carcinoma of the head and neck (SCCHN) located in the oral cavity or soft palate

- who present with no nodal involvement (N0) and no extracapsular spread (ECS) as determined by PET-CT/MRI

- eligible patients must also have low tumor programmed death-ligand 1 (PD-L1) expression (defined as tumor proportion score (TPS)<10)). PD-L1 is a protein receptor on the tumor surface that helps the tumor repel the immune system

It further notes its belief that:

…low PD-L1 patients would be more likely to respond to Multikine because their tumors have lower defenses against the patient’s immune system. CEL-SCI estimates that low PD-L1 patients represent about 70% of locally advanced primary SCCHN patients.

The premise supporting Multikine is that it introduces immune-modulating therapy at an early stage. By doing so before the immune system has been damaged by surgery, radiation, or chemotherapy it stands its best chance of success.

As shown by its pipeline graphic below, CEL-SCI’s Multikine is its only product candidate of near-to-midterm interest:

cel-sci.com

CEL-SCI is primed and ready for a quick FDA Multikine review

The Letter virtually throbs with a combination of certainty and impatience for regulators to unleash Multikine. It opens with the graphic below:

cel-sci.com

Next, it lists its table of contents. It goes on to explain that it is longer than previous shareholder letters. For those new to CEL-SCI, it eschews earnings conference calls in favor of its preferred practice of periodically providing letters from its CEO.

This is a tradeoff that deprives investors of the wider discussion inherent in earnings calls. Earnings calls typically include presentations by a wider range of executives along with a helpful Q&A session that advances discussion beyond management scripting. CEL-SCI investors have to make do with sporadic CEO letters. Accordingly, they should review them carefully.

Its initial pages include the following four headlines set off in bold blue type:

- A Well-defined Target Population – This section of the Letter explains why the data CEL-SCI recently presented at ESMO was superior to that reported the previous year; it describes the change as if it was positive, disregarding any critique that it might be considered as less supportive post hoc analysis

- Multikine Undeniably Helps Patients, Period – This section cites two statements a) and b) as support: a) Multikine leads to pre-surgical responses, meaning that Multikine’s benefits become immediately apparent for many within just a few weeks of treatment and b) if you have a pre-surgical response, then your survival is greatly improved

- The Clinical Data Is Outstanding – this section lists 5 characteristics of its finalized phase 3 target population leading with the following “risk of death cut in half at five years versus the control”

- CEL-SCI Has All The Ingredients For Approval – section at pps 4-5 of the Letter makes impassioned argument supporting prompt approval of Multikine by regulatory agencies without further confirmatory trials

The Letter continues to close on page 17 with the following parting words from CEO Gersten:

The future for CEL-SCI is bright. We have finally achieved what we have worked on for so long-proof that Multikine works and a way to identify the patients who need it. We have world-class advice and are actively engaged with regulators worldwide.

The Letter sets out CEL-SCI’s best rationale for success. It is an example of the unbounded enthusiasm of its long-time CEO, who has been carrying the torch for CEL-SCI for decades as discussed below. Investors interested in CEL-SCI should be sure to carefully consider a full picture of not just its achievements but also its challenges and risks.

My reading of the Letter is that it is amateurish and unconvincing. It overstates its case.

CEL-SCI’s Multikine has had a torturous development path; its future is highly risky

Buried deep within CEL-SCI’s website as accessed on 02/09/2024 is a fascinating review of its history commencing back in the late 1970’s. That is when the germ of the idea which ultimately resulted in Multikine first developed. CEL-SCI was founded in 1983. Its initial Multikine clinical trials took place in the 1990s and early 2000s.

In 08/2007 the FDA cleared its phase 3 clinical trial; various delays have since slowed its progress. As I noted in 03/2023’s “CEL-SCI: Stuck On Its First Next Step”:

It is working to present its Multikine phase 3 head and neck cancer results to the FDA in the form of a BLA. The challenge for CEL-SCI in this regard is that its pivotal phase 3 trial (NCT01265849) in head and neck cancer was first posted on clinical Trials.com in 2010.

The trial was magisterial in scope and in size; as CEL-SCI is fond of noting it is the largest phase 3 trial for head and neck cancer in the world. There is downside to having such a large trial that has taken place at sundry locations around the world. It has had no fewer than 54 amendments.

The article then warns:

Once the BLA can be assembled and massaged into acceptable form, CEL-SCI will face its real challenge. The real challenge is to get the FDA on board that Multikine’s immunotherapy given before surgery shows a head and neck cancer survival benefit, despite its failure to achieve its primary endpoint.

This last is the most worrisome for CEL-SCI. Failure to achieve its primary endpoint is not fatal. It does however complicate ongoing analysis. In CEL-SCI’s case, I would submit that it will likely lead the FDA to review trial results even more closely than is typical.

When dealing with such a large trial as Multikine that has been ongoing for so many years in so many different locales the logistics are truly daunting. Over these long years CEL-SCI’s stock has weathered many a storm.

Its shareholders have fared poorly, having endured three reverse splits over its multi-decadal life. These include an 08/1995 1 for 10 split, a 09/2013 1 for 10 split and a 06/2017 1 for 25 split. As a result of these splits a shareholder with 50,000 shares initially saw their share count drop to 20.

Throughout that time a shareholder’s percentage ownership in the company would not have changed. Rather such ownership percentage would have been reflected by a smaller number of slices. These reverse splits complicate the math associated with looking at CEL-SCI’s historic share prices.

Suffice it to say that shareholders have consistently lost money in this name. It trades at $2.42 with a market cap of ~$142 million as I write on 02/09/2024. Its future depends on Multikine. As it proceeds it will likely continue to be dogged by financial challenges as it has in the past.

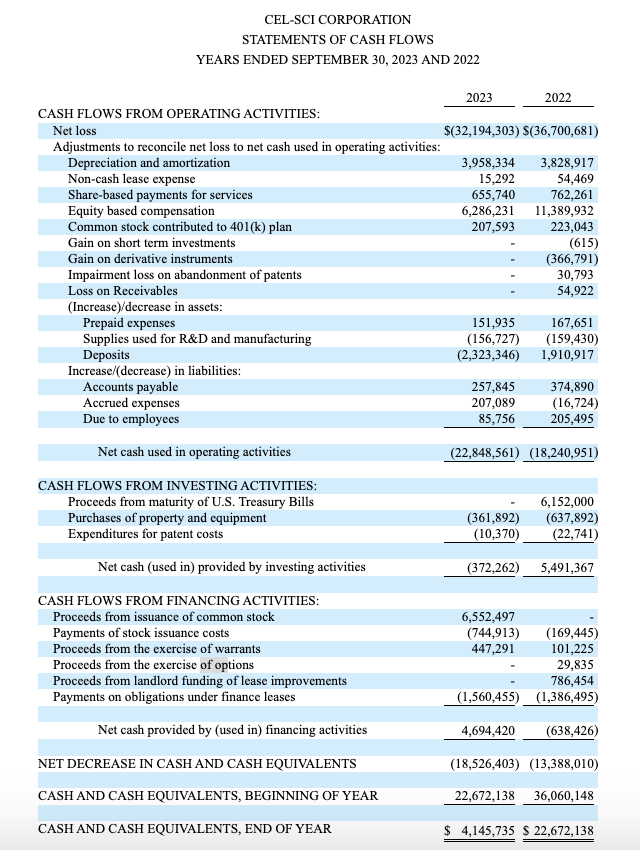

One disturbing aspect of CEL-SCI is its financial opacity. Of all the documents that I list at the outset of this article only its 10-K reports its cash as of its most recent quarter. It does so not in its body but on pg. 6 of Exhibit F buried at the bottom as follows:

seekingalpha.com

CEL-SCI’s cash situation is meager. It used ~$22.8 million in operating activities during fiscal 2023, leaving it with ~$4.1 million starting the new fiscal year. It has since raised:

- 11/16/2023 – proceeds of ~$5 million in a sale of 2.49 million shares to a private investor for $2.00 per share

- 02/09/2024 – offering of 3.88 million shares at $2 per share, for gross proceeds of $7.75 million

Conclusion

Any CEL-SCI investor who had 50,000 shares back in 1995 and who now has 20 shares worth $2.42 each for a total value of <$50 has been roughly schooled. This is the risk inherent in chasing a dream in the high risk high reward clinical biotech space.

CEL-SCI is riskier than most. It has been chasing its dream for decades. I rate it as a tenuous. I own no CEL-SCI shares and have no inclination to buy any. Anyone who does is at high risk of losing their entire stake.