Darren415

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the second week of January. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

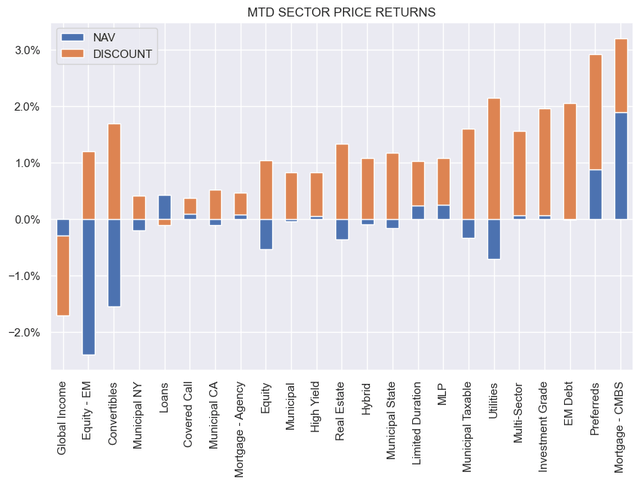

Most CEF sectors were up on the week as both stocks and Treasuries rallied. Month-to-date, however, NAV performance is mixed. CMBS has so far delivered the best return – a sharp turnaround of its 2023 relative performance. Discounts, however, have tightened across all but one sector, indicating renewed investor confidence in the space.

Systematic Income

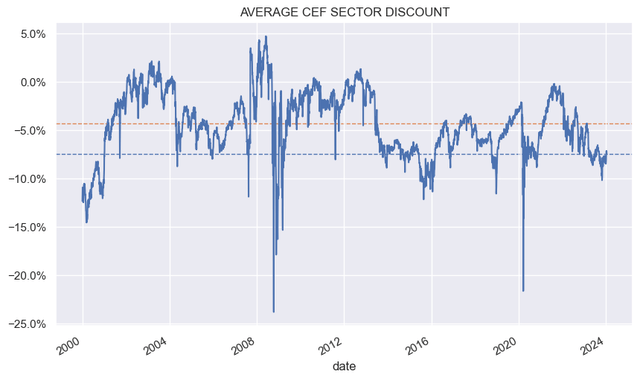

On an average sector basis, discounts have tightened a few percentage points since the bottom last year.

Systematic Income

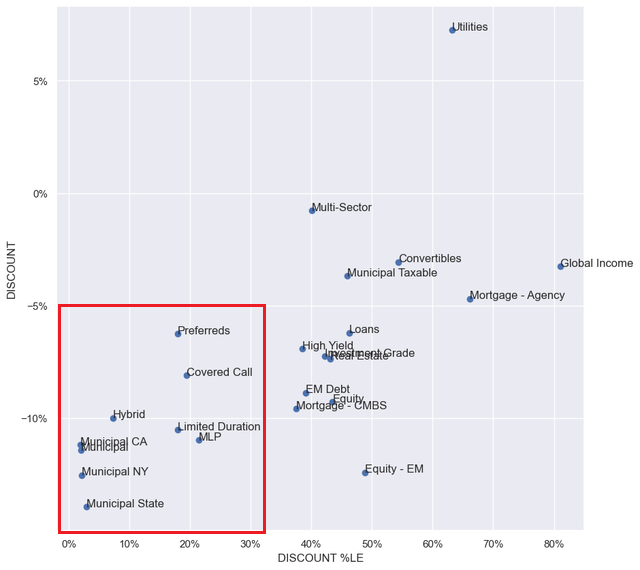

Sectors like Munis, Hybrids and Preferreds continue to trade at double or high single-digit discounts. They also trade at low discount percentiles, meaning their discounts are wide relative to their own history.

Systematic Income

Market Themes

This week CEF sector designations came on up on the service. Specifically, there was a question of why a fund like the DoubleLine Income Solutions Fund (DSL) is placed in the Multi-Sector category in our CEF Tool while it sits in Global Income on CEFConnect.

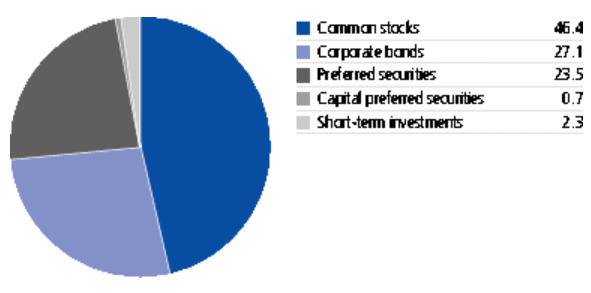

In fact there are many differences between our sector placement and that of CEFConnect. This is because of, roughly speaking, easy cases and hard cases. For instance, a fund like John Hancock Premium Dividend Fund (PDT) is placed in the Preferreds sector by CEFConnect whereas we have it in the Hybrid sector. PDT is an easy case – its allocation is nearly half in common stock with preferreds making up less than a quarter of the portfolio. There is no way it should be allocated to the preferreds sector.

JH

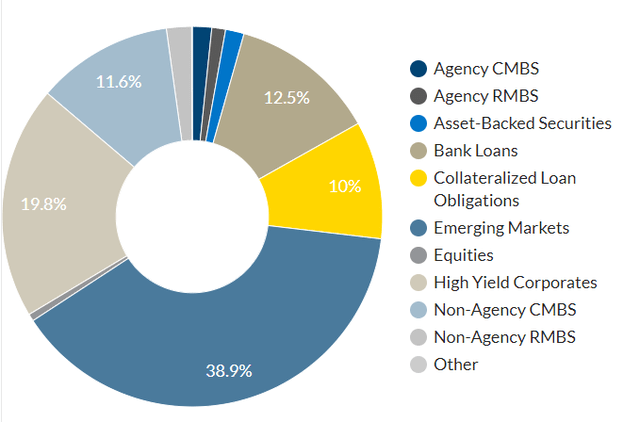

There are also hard cases such as the Ares Dynamic Allocation Fund (ARDC). Its allocation has been roughly evenly split between fixed and floating-rate assets. For example, it was 40% fixed in 2019 which increased to 50% fixed in mid 2021 and is now 45% fixed. CEFConnect places the fund in the Loan sector whereas we have it as a Multi-sector CEF.

The Loans sector placement is obviously questionable as investors would be comparing it to funds that are predominantly allocated to loans. Multi-sector is arguably the right place for it though it’s not perfect as many Multi-sector CEFs tend to allocate to many different types of credit sectors such as ABS, Agencies, investment-grade and high-yield corporate bonds, Treasuries, Munis and others – assets which ARDC mostly avoids.

Coming back to DSL – what is the right sector for the fund? DSL is another hard case in our view. The reason we don’t view Global Income as the right sector for the fund is that Global Income tends to stand in for non-US developed market bonds which DSL doesn’t hold a whole lot of.

Roughly speaking, there are three global bond sectors – US, developed non-US and Emerging Markets. Funds that primarily allocate to EM bonds such as EDF or EDD sit in the EM CEF sector as expected. Funds that allocate to high or medium-quality bonds of G7 (and similar) countries tend to be placed in the Global Income sector.

From its allocation, DSL could arguably be placed in the EM sector rather than Global Income which tends to be a synonym for developed non-US. However, its EM allocation is below 40% which suggests that it is better described as a Multi-sector fund particularly as it holds many other credit sectors such as loans, ABS, MBS and CLOs. This point is clearly debatable but either Multi-sector and EM are better fits for DSL than Global Income.

DoubleLine

The consequence of this discussion is two-fold. One, CEFs that can be perfectly placed in their sectors are arguably in the minority. Some sectors like Munis and Equity are fairly “clean” from this perspective but many credit funds are less so. And two, this means comparing funds within the sector is tricky as both performance and valuation could be impacted by variations in allocation. Investors should be aware of a given fund’s allocation profile and how it differs from its sector counterparts when evaluating its metrics.

Market Commentary

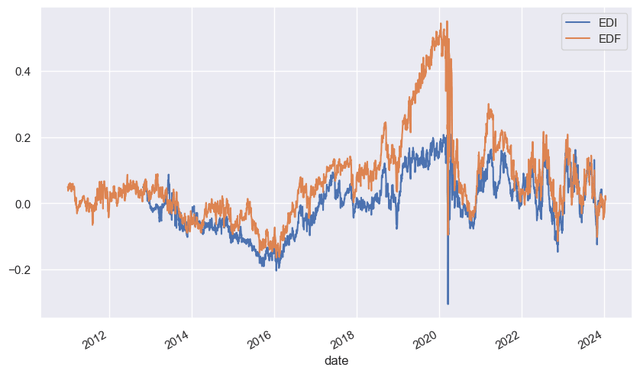

Last month two Virtus Stone Harbor Emerging Market debt CEFs – (EDI) and (EDF) – merged with the latter being the surviving fund. The two funds have been an instructive curio in the space for several reasons.

For one, they have tended to trade at very high premiums, spending much of their time at double-digit levels and rarely trading at discounts. This is despite pretty abysmal returns. For instance, EDF has a 5Y total NAV return of around zero while its 10Y total NAV CAGR is around 1%. A big part of this has to do with the struggles of the fund’s broader sector – hard-currency and local-current Emerging Market debt – but some of it is clearly due to the funds’ lack of alpha.

Two, because the funds’ EM debt holdings are relatively high beta they have suffered from serial forced deleveraging which repeatedly forced the funds to sell low and buy-back higher, damaging the NAV.

Three, their low distribution coverage underlined the fact that the high distribution rates were unfounded. Poor longer-term total NAV returns, serial deleveraging and low distribution coverage eventually forced the funds to cut their distributions a few times, pushing the premiums lower and locking in permanent economic losses for holders.

Another oddity is that, despite being nearly identical funds, they have tended to trade at very different valuations. This had to do with very strange distributions where EDF’s NAV distribution rate was much higher than EDI’s for no good reason. This caused EDF to consistently trade at a higher premium than EDI – sometimes moving out to a premium 25% higher than EDI.

Systematic Income

Obviously this eventually and fully corrected with the merger announcement, further punishing investors who thought they were getting a juicier yield.

Stance And Takeaways

The recent run-up in CEF performance has been nice to see however we are not chasing the rally. That said, we continue to see value in funds like the CLO Equity-focused Carlyle Credit Income Fund (CCIF) and the credit and energy focused PIMCO Dynamic Income Strategy Fund (PDX) as well as the Flaherty suite of preferred CEFs like (PFO) whose valuations have pushed out to double-digit levels. Once the Fed gets going with its policy rate cuts, PFO and its sister funds should start to reverse their previous distribution cuts.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.