Darren415

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the second week of October. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

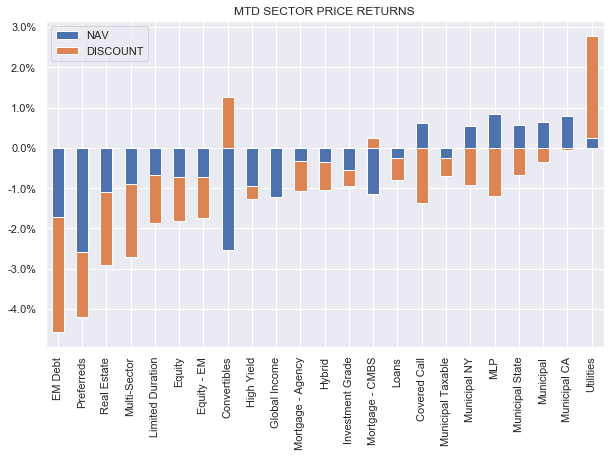

It was a good week for CEFs with all but one sector (Convertibles) putting in positive total NAV returns. Discounts, however, cannot catch a break, as all but 4 sectors experienced discount widening.

Month-to-date, most of the space remains underwater as higher interest rates and wider discounts have taken their toll on returns.

Systematic Income

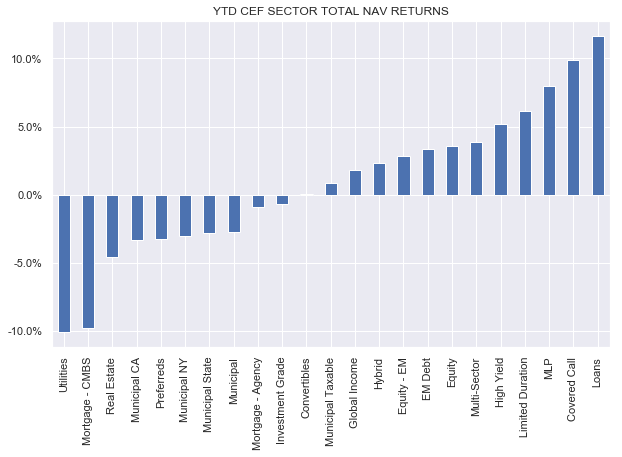

The recent rise in interest rates has particularly hurt the Utilities sector which is now the worst-performing sector year-to-date, surpassing even the troubled CMBS sector.

Systematic Income

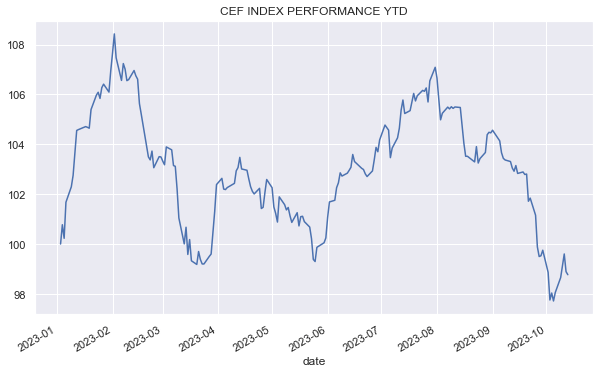

Overall, the CEF space, in aggregate, is in the red year-to-date.

Systematic Income

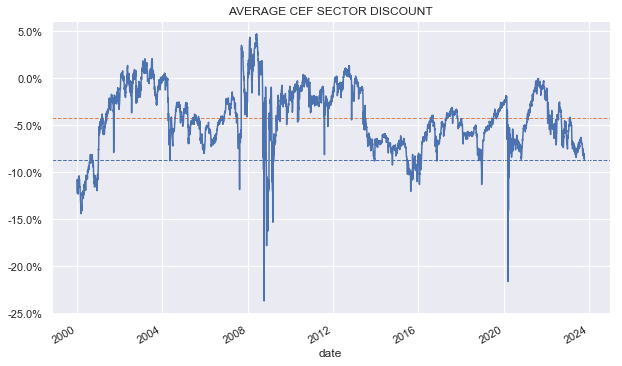

The average CEF sector discount is trading at the widest level since the COVID period and has only been consistently wider during the 2015 Energy Crash market. However, unlike that period, wide discounts today are driven more by high leverage costs and distribution cuts rather than poor risk sentiment and market volatility. This suggests that we could see further widening if risk sentiment worsens from here.

Systematic Income

Market Themes

Earlier in the month we saw cuts for 3 BlackRock equity CEFs: BMEZ, BSTZ and BIGZ by about a third from previous double-digit distribution rates.

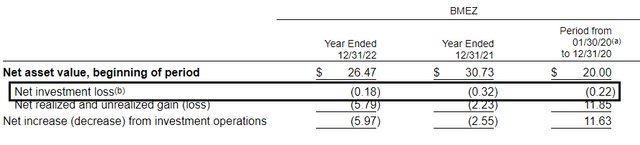

Normally for CEFs, net investment income serves as a rough guide for distributions. This is less the case for equity funds where net investment income has little bearing on the yield. As far as these 3 funds are concerned, there is actually no net income to speak of as they consistently have negative net income due to their low-dividend growth focused portfolios and high fees. To be fair, the funds do generate some “income” from call overwriting, however, that often gets treated as either capital gains or ROC.

BlackRock

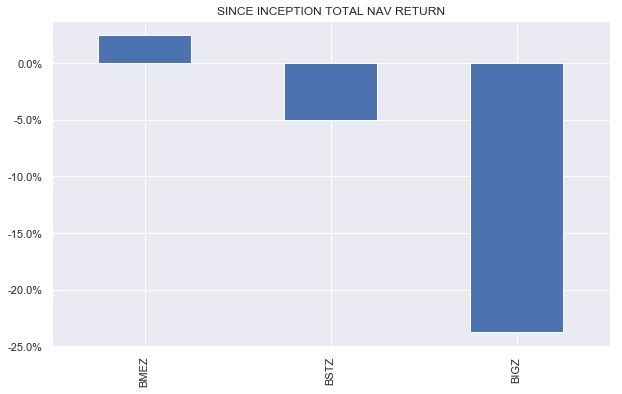

For funds with little net investment income, the distribution anchor has to be total NAV returns. If we look at total NAV returns since inception for these funds they’re not anywhere near their previous (or current for that matter) distribution rates so these cuts are likely an acknowledgment that forward returns are unlikely to match the double-digit distribution rates over the longer term. The cuts across these funds are a good example of how low returns will struggle to sustain high distribution rates.

Systematic Income

Market Commentary

Barings credit CEFs (MCI) and (MPV) raised their distributions. The funds have been raising the distribution consistently since 2022. This makes sense as the funds are quasi-BDCs, meaning they hold primarily floating-rate loans.

What’s interesting is how they differ from typical BDCs. First, using MCI as an example, leverage is unusually low, even for a CEF, at around 10%. Credit CEF leverage is closer to 30-35% while BDC leverage is north of 50%. And two, its floating-rate allocation is fairly low at around 72% – the BDC median is around 96%.

Occasionally these funds get interesting when they trade more like CEFs i.e. at a wide discount and less like BDCs where discounts are much smaller so it’s worth waiting for a good entry point.

CEF Templeton Global Income Fund (GIM) distributions have continued to fall. The fund has a managed distribution policy to distribute an annualized rate of 8% of the monthly NAV.

There is an interesting backstory here which is that Saba won control of the fund from Templeton by holding a ton of shares and then acquiring additional shares at a premium to the market price from select investors.

All of this led to litigation which was eventually withdrawn by Templeton as it paralyzed the fund and created ongoing costs. The fund itself was a global income / emerging market focused fixed-income fund. Its performance was pretty horrendous so no tears will likely be spilled over its change of control over to Saba.

Recall that Saba also took over another CEF from Voya which is now BRW. Saba is a hedge fund and because it holds a lot of GIM we should expect it to do things that will make it money, specifically where it can generate discount amortization via tender offers and distribution hikes.

Stance And Takeaways

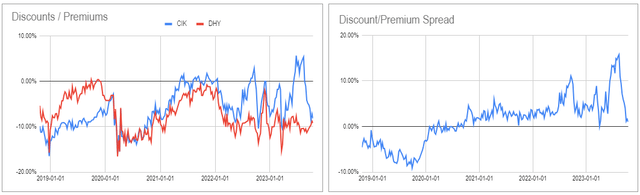

This week we made a relative value rotation by moving to the Credit Suisse Asset Management Income Fund (CIK) from its sister fund Credit Suisse High Yield Bond Fund (DHY). The valuation differential between the two funds has collapsed and CIK, given its much lower management fee, looks more attractive.

Systematic Income CEF Tool

We have used this relative value strategy between the two funds since 2021 to combine alpha (from the relative value rotation strategy) on top of a strong beta (as both funds are among the highest performers in the sector). This relatively “lazy-man” rotation approach has resulted in significant outperformance in the context of the HY CEF sector.