Darren415

This text was first launched to Systematic Revenue subscribers and free trials on Aug 7.

Welcome to a different installment of our CEF Market Weekly Assessment, the place we focus on CEF market exercise from each the bottom-up – highlighting particular person fund information and occasions – in addition to top-down – offering an summary of the broader market. We additionally attempt to present some historic context in addition to the related themes that look to be driving markets or that traders must be aware of.

This replace covers the interval by way of the primary week of August. Make sure you try our different weekly updates overlaying the BDC in addition to the preferreds/child bond markets for views throughout the broader earnings house.

Market Motion

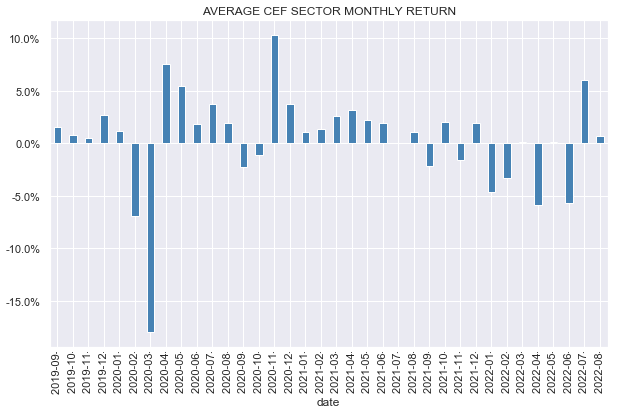

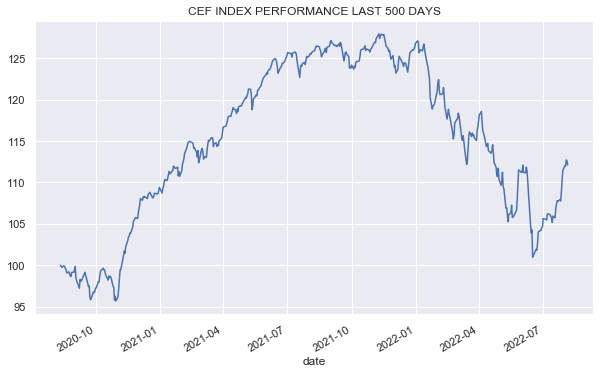

It was a very good week for the CEF sector. Though NAV efficiency was blended, most sector reductions tightened, fueling value positive aspects. July erased the entire June CEF losses and August is, to this point, within the inexperienced as properly.

Systematic Revenue

The CEF house has clawed again about half of its year-to-date losses in whole return phrases.

Systematic Revenue

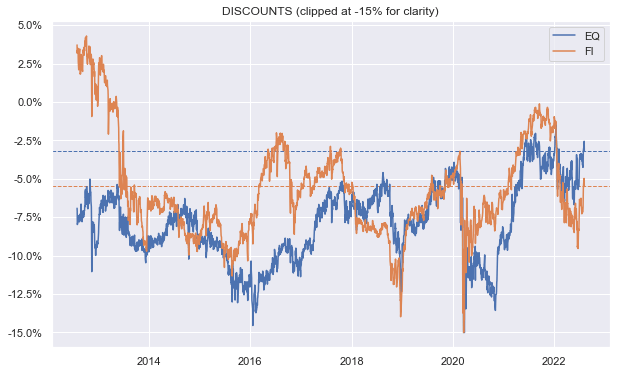

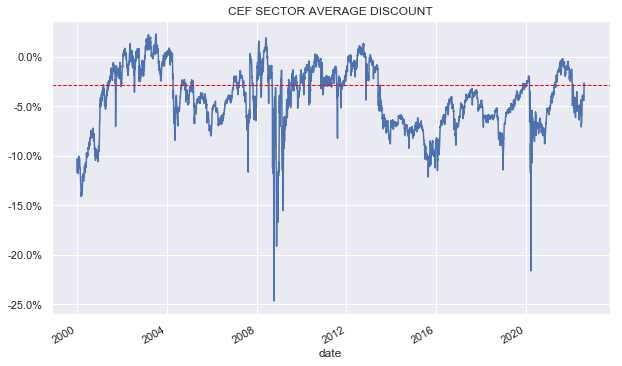

Quite a lot of the current positive aspects had been on the again of a tightening in reductions. Sector reductions have are available in round 3-4% from their current wides.

Systematic Revenue

The common sector low cost is now near its pre-COVID degree. In our view, the CEF market low cost valuation is on the costly facet now, significantly given how way more the Fed must do to convey inflation (and by extension the extent of financial exercise) decrease.

Systematic Revenue

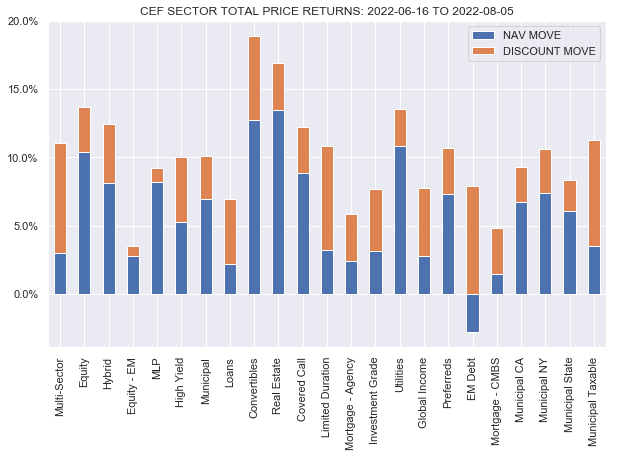

A variety of sectors have rallied greater than 10% from their troughs as the next chart reveals. Convertibles and REITs have rallied probably the most.

Systematic Revenue

Market Themes

The efficiency of the CLO Fairness-focused Eagle Level Credit score Co (ECC) got here up on the service. The fund’s 5Y whole NAV return is on the order of one thing like 2-4% relying on whether or not you DRIP or not and exactly which supply you’re utilizing. Given the fund’s high-octane allocation profile and really excessive yield that looks like a horrible end result for traders. The implication right here is that the fund is simply unhealthy and traders ought to keep away from it.

Though this type of “evaluation” could appear intuitive and compelling, it truly doesn’t present any informational content material. In different phrases, saying {that a} credit score fund has delivered a low return in an surroundings when costs of credit score devices are unusually low is a straightforward tautology.

As an example why that is the case, think about somebody taking a look at a 10Y whole return of the Nasdaq from 2000 to 2010 which was barely adverse and saying, gee whiz these Tech shares are simply not a very good funding I assume. Or think about somebody trying on the adverse 10Y whole return of Banks from 1998 to 2008 and saying nobody of their proper thoughts ought to ever personal a single Financial institution inventory, frequent or most well-liked.

We will maintain going right here for some time, however the level is evident. In case you have a look at the efficiency of a given asset over a interval ending in a low value, you’ll see a nasty quantity – that is simply math. A low return quantity over any given interval doesn’t truly inform traders very a lot in regards to the deserves of a given asset class or fund. And in reality, traders who observe this type of view and who will have a tendency to purchase property which have run up a complete lot (as a result of, presumably that makes them “good”) and promote property which have fallen sharply (as a result of, presumably, that makes them “unhealthy”) are going to see their wealth dwindle fairly shortly as a result of they may maintain shopping for excessive and promoting low.

A a lot better option to strategy the query of whether or not any given fund or asset class is engaging or not requires a bit extra work. Particularly, traders ought to have a look at the fund’s whole NAV efficiency over a flat-yield (for fixed-coupon credit score property) or flat-credit unfold surroundings (for floating-rate credit score property).

For instance, many traders had been seduced to considerably overweighting Municipal bond funds in 2021 when yields had been at rock-bottom ranges as a result of they noticed that these funds generated one thing on the order of 6-7% annual returns over the past decade even supposing a lot of that sturdy efficiency was merely as a result of continued fall in yields which was clearly unsustainable as many subsequently came upon this yr. After we did the identical evaluation of Municipal funds over a flat yield interval we noticed that the sector’s sustainable annual return was nearer to 2-3% which made quite a lot of sense since that is what the underlying yields had been in that sector. Getting a way of a fund’s efficiency over this impartial interval can provide traders a greater sense of what they need to anticipate from it going ahead, all else equal.

One other type of evaluation which is fascinating is to take the interval ending as we speak however examine the efficiency of a number of asset lessons to one another moderately than have a look at the efficiency of a single fund. For instance, over the past 5 years how do high-yield bonds examine to loans, CLOs, CMBS, ABS, RMBS and different property? That type of cross-asset comparability can provide traders a a lot better sense of asset class dynamics than taking a look at a single asset or fund.

A ultimate key level is that traders ought to derive conviction about any given asset or fund from its traits, valuation in addition to the broader market surroundings moderately than from its current efficiency.

Market Commentary

There was not a lot information on the CEF distribution entrance for August – PIMCO, BlackRock, Nuveen had no modifications. Invesco had one reduce from the Pennsylvania Worth Municipal Revenue Belief (VPV). Eaton Vance had 3 raises for mortgage funds. Though it wasn’t as extremely pronounced this week, the dynamic of cuts in fixed-rate sectors and raises in floating-rate sectors continues.

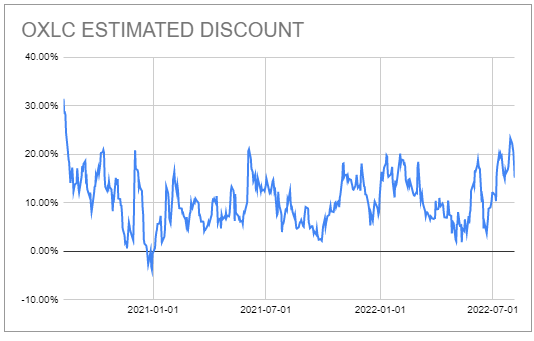

The CLO Fairness centered Oxford Lane Capital Corp (OXLC) launched two month-to-month NAVs in fast succession. The June NAV was delayed by over a month as a result of fiscal quarter finish. The July NAV was launched unusually shortly, after simply 2 days, virtually as if the corporate wished to maneuver previous the horrible June numbers as shortly as potential. The NAV fell 14% to $5.07 in June after which bounced 7% in July, with the general transfer going from $5.92 in Could to $5.41 in July. Our present each day NAV estimate of $5.50 means the fund is buying and selling round a 15% premium, which is pretty elevated traditionally.

Systematic Revenue CEF Software

Stance And Takeaways

Final week, we expressed skepticism that the Fed’s obvious dovish pivot was actual. This week’s sharp rise in short-term charges in addition to a pause within the tightening of credit score spreads seems to bear this out. We suspect that even when inflation does peak within the coming months, it is extremely unlikely to subside shortly again to the Fed’s goal of two% because the market expects. This implies that short-term charges may keep elevated for longer than the market thinks, and that credit score spreads may rise again up. For that reason, we proceed to search for attractively-valued funds with each floating-rate publicity such because the Western Asset Mortgage Alternative Fund (DMO) in addition to higher-quality funds such because the Tax-Advantaged Most popular Securities and Revenue Fund (PTA). We might contemplate including to each on pullbacks in danger sentiment.