Teamjackson/iStock via Getty Images

Breaking Down 3Q Results

Results & Guidance

CECO Environmental (NASDAQ:CECO) reported better than expected results across the board for their 3Q print. Along with this, CECO also raised their 2022 guidance and initiated 2023 revenue and EBITDA guidance, both coming in above Wall Street expectations. While 3Q EBITDA did come below our own estimates along with EBITDA guidance for 2022 and 2023, we note that in the quarter there were several headwinds that artificially depressed margins and should elevate going forward, which we will touch on later. On the forward guidance, we believe CECO management is being diligent in setting a high bar that is achievable, but more importantly beatable if certain cost headwinds subside and synergies from their acquisitions ramp quicker than anticipated.

| 3Q RESULTS | Actual | Consensus Estimates | BxB Estimates |

| Revenues | $108.4 | $95.2 | $99.2 |

| Adj. EBITDA | $9.2 | $8 | $10.1 |

| Adj. EPS | $0.20 | $0.11 | N/a |

| 2022 Guidance | Prior | New | Consensus Estimates | New BxB Estimates | Prior BxB Estimates |

| Revenues | $375-400+ | $410+ | $391.90 | $416.60 | $413 |

| Adj. EBITDA | $37-40 | $39+ | $37.50 | $39.90 | $42.90 |

| 2023 Guidance | Actual | Consensus Estimates | New BxB Estimates | Prior BxB Estimates |

| Revenues | $450-475 | $413 | $489.5 | $491 |

| Adj. EBITDA | $45-48 | $43.1 | $50.2 | $61.4 |

Strong Backlog Will Spur Margin Expansion

The historic backlog CECO reported in 2Q did drop slightly sequentially by 4%, but still remains robust and grew 27% y/y. Also key to note, management continues to iterate that the backlog has a favorable mix toward the higher margin short-cycle industrial air and water products. Our thinking is that by working through the higher margin backlog, CECO gross margins will return to the historical low 30s range which will directly translate to expanding EBITDA margins as well. This is before accounting for any of reduction in the cost headwinds that depressed margins this quarter.

Orders and Revenue Hitting An Inflection Point

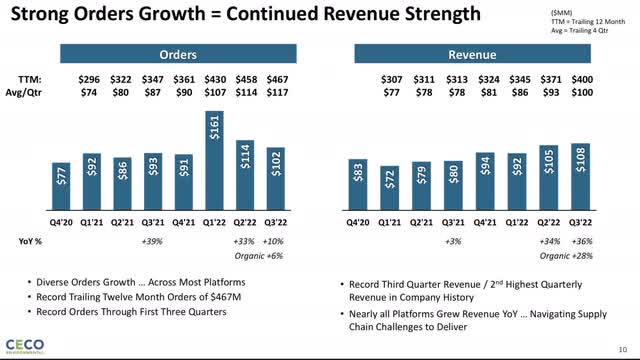

In our eyes, CECO has hit a clear inflection point in growing the business. This can be clearly seen by both TTM/average per quarter orders and revenue growing for an impressive 7 straight quarters. Which is directly correlated to when CEO Todd Gleason came in and began the turnaround.

We view this as CECO validating the business shift strategy implemented by Mr. Gleason and believe the momentum exhibited recently will continue into the future.

CECO Order/Revenue Growth (CECO 3Q 22′ Earnings Presentation)

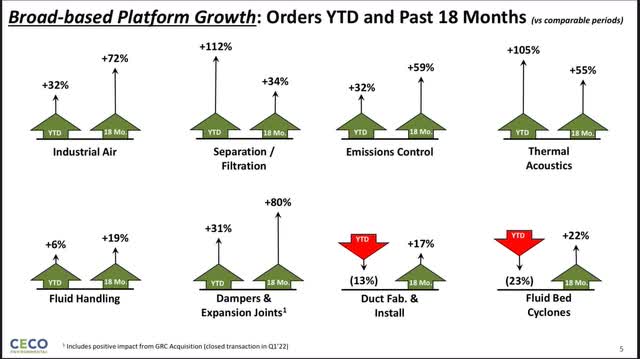

This robust revenue and order growth is not significantly driven through any one single business unit of CECO’s, but rather is broad base and highly diverse across all its end markets. We believe this further strengthens our argument that this business momentum will continue into the future, as it is not reliant too heavily on any one end market.

CECO Order Growth By Unit (CECO 3Q Earnings Presentation)

Shareholder Returns

CECO bought back another $2.2M worth of its stock during the quarter. This was through the $20M share buyback program initiated at the beginning of the year. The average weighted price of the shares purchased in the quarter equated to $8.59. For the year, they have purchased a total $6.5M in shares.

They have $13.5M remaining of the buyback. Management did call out that the cadence of their buyback would likely slow down in the near term, but that they will continue to be opportunistic when they believe the shares are below the intrinsic value. Which we believe is prudent as the stock is up >80% on the year.

3Q Takeaways and Our View Going Forward

Continued Execution

We believe this quarter for CECO was another notch in management’s belt on executing what they have been preaching to the street. They have diversified the revenue streams, switched the focus to end markets with long-term secular tailwinds, expanded EBITDA margins, and acquired excellent bolt on M&A pieces that will expand both the number of projects they sell into and the dollar share on any given project.

On the M&A front this quarter, CECO acquired DS21 which is a South Korean-based design and manufacturing firm that focuses on water and wastewater treatment solutions. We view this as an extremely important acquisition, as this will give CECO their first manufacturing presence in Southeast Asia. This is so crucial because blue-chip companies located in that region will exclusively work with companies who have a manufacturing footprint in the area. With the DS21 acquisition, CECO now is able to gain a seat at the table to bid on a completely new pool of projects going forward. We also believe that the Southeast Asia market should provide a vast number of opportunities to sell into as the region looks to become more environmentally friendly while keeping its robust industrial manufacturing footprint.

Margins Pressures To Subside + Margin Expansion Opportunities

We noted earlier that margins were dragged by certain headwinds that we believe will subside going forward. Some of the one-off headwinds were things such as an FX impact due to quicker repayment on an international loan, investments for additional resources to sustain growth, and an elevated commodity pricing environment. The FX impact will not be a problem going forward, investments for expanded resources will continue over the next few quarters but should gradually begin to taper off, and the commodity pricing environment is already very much improved since 3Q.

In addition to this headwinds subsiding, management outlined specific factors that should drive incremental margin expansion in the coming quarters. These include increasing volumes, pricing increases, higher margin acquisitions becoming a larger piece of the pie, and operational efficiencies gained through LEAN principals implemented into the business. Management was also very excited about the continued investment into their Indian engineer teams This is because this allows CECO to work around the clock on engineering proposals along with the costs for engineers in their Indian HQ is significantly lower. This lower cost however does not result in lower quality though as the quality of their work it is identical to their American counterparts. They now have 80 engineers located in Indian, which is double what it was in 2021. We will continue to monitor the growth of the Indian engineering team going forward.

Building a Nimble Recession Resilient Business

As most Q&A sections of third quarter conferences calls this year, many of the questions revolved around what happens if the macro backdrop worsens and we enter a recession. As we highlighted in our initiation back in September, CECO is very well insulated from a worsening macro due to the diversification of their revenue streams, the non-discretionary aspect of the solutions they sell, and the strong tailwinds in the industrial water and air sectors spurred by recent governmental spending packages. On the call however, management added a new layer to this argument, that they have built a nimble business and platform manufacturing technique that can quickly shift to where the growth is.

What this looks like is that historically at CECO the solutions would only be focused on one or two end markets. This was because the culture in place that encouraged the sales team to only go bid on projects that were likely to be won. If projects were loss, they’d essentially have to report to the principal’s office and explain why they had lost a project. This lead to a sales team focused on only bidding on things they knew they could win.

In contrast to now, where management encourages the sales team to get out bid on a variety of projects and are not focused on batting 1000 but rather .308. What this has led to is a business that can quickly shift gears towards where the growth is.

CECO begins to notice a slowdown in North American industrial wastewater projects? Perfect, CECO can shift the focus to selling the same products but into coastal water filtration projects through their acquisition of Compass water. We believe this added nimbleness to CECO’s business significantly increases its already strong ability to weather any type of macro downturn.

Our Take On Volatility Following The Report

CECO opened up 4% following the stellar report and rose to nearly +7% early on in the trading session. However, the stock quickly began to drop on no news and sunk to a low of $8.41 or down ~28%. The stock than sharply rebounded through the afternoon to only close at $11.27 or down ~3%. The stock is now above where it was going into the earnings print. We believe there were two main factors in this crazy price action.

- Algo Driven Selling – CECO changed its ticker from CECE for this earnings print. We believe that algos began indiscriminately selling the stock as it incorrectly comped CECO Environmental earnings versus the old ticker CECE. This forced selling caused the initial fall in the stock.

- Technical Traders Stopped Out – Going into the earnings print, we began to notice significantly more chatter about CECO across various websites. This chatter was nearly exclusively by technical traders who had stumbled across CECO due to the strong technicals it had. We believe that the algo selling initially knocked the stock down, breaking several key technical levels where these technical traders has stops in place. This then caused a waterfall of stop-selling and sent the stock lower.

Ultimately, cooler mind prevailed and buyers did come in and buy this irrational selloff. To further highlight our belief that this selloff was driven by these two factors we point out that there was a 32% peak to trough drop in the stock during the day and then a 32% rally from the lows to where it closed. Even with this extraordinary price movement, the volume was only ~820K shares, which would not even put it in the top 3 volume days over the past year. We also note the past two earnings saw volume of 763K and 617K.

Our View Moving Forward

We continue to firmly believe CECO is only in the early innings of their turnaround story and there is an opportunity for this to become a multi-bagger scenario over the next handful of years. We believe that their execution on their growth plans has been fantastic, and the plans for margin expansion will have a similar inflection point in 2023 as revenue did in 2022. We will closely be watching to see if that is the case, but ultimately we need to see continued gradual margins improvements next year along with continued diversified revenue growth.

We believe that CECO remains an extremely compelling investment case and we remain happy shareholders.