Mario Tama/Getty Images News

When Sweetgreen (SG) went public in late 2021, I wrote that shares were overpriced and didn’t represent an attractive investment opportunity. Fast-forward to today and SG shares have declined over 75%. SG was unable to turn a profit, and I was skeptical that the valuation would be supported by real earnings. Today, CAVA Group (NYSE:CAVA) is preparing to go public and boasting a similar narrative. Can they avoid SG’s fate?

Comparison To Sweetgreen

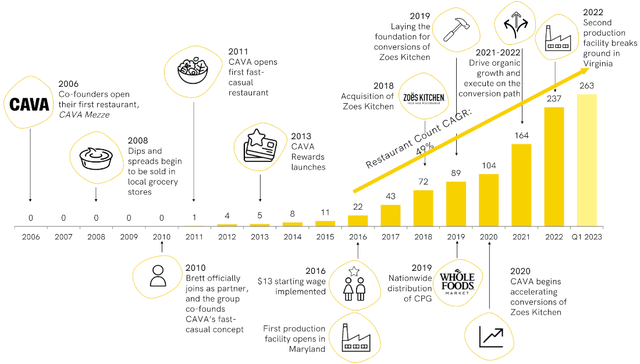

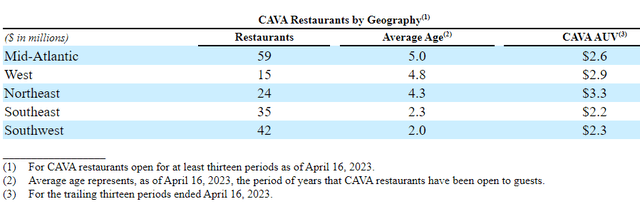

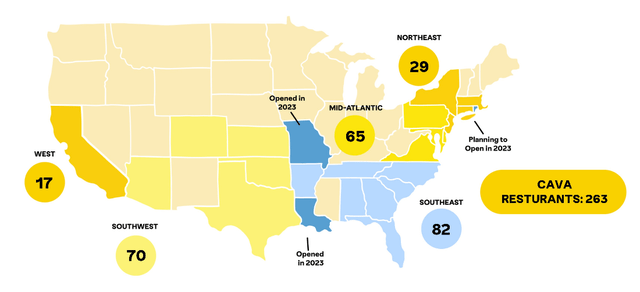

CAVA Timeline (CAVA S1) CAVA Locations (CAVA S1) CAVA Formats (CAVA S1)

CAVA is seeking to raise $280m at a $19-$20 price range (14.44m shares). This represents about a $2.1B valuation ($2.4B market cap) net of cash. How does it stack up against Sweetgreen?

AUV | Restaurant Margins | # of Locations | SG&A (Q1-23) | Same Store Sales (SSS) % | |

CAVA | $2.5m | 25% | 263 | $29.0m | 28% |

Sweetgreen | $2.9m | 14% | 204 | $34.9m | 5% |

(Source – linked public documents)

CAVA is succeeding in several areas where SG has continued to fail. CAVA is generating very favorable (~25%) 4-wall margins using less SG&A than SG, and CAVA is growing same-store sales (SSS) at a much faster clip. Both concepts burned cash in Q1-23, but CAVA earned over $25m cash from operations before CapEx, while Sweetgreen spent $3m cash in operations before growth investments. With $280m in proceeds from the IPO, CAVA can also help fund growth from their cash balance, given established operations are cash flow positive.

CAVA will likely see a spike in stock-based compensation expense after going public, but if they end up similar to SG’s $14m/Q run-rate, they would be averaging about the same SG&A per location and as a percentage of revenue. CAVA will also have various one-time costs from going public in SG&A this year.

Their numbers do stack up well against Chipotle’s (CMG) 25.6% restaurant margins, 10.9% SSS, and $2.9m AUV. Yes, Chipotle has more than 10x the units, but CAVA seems to be on a better trajectory to emulate their success than Sweetgreen.

Risks

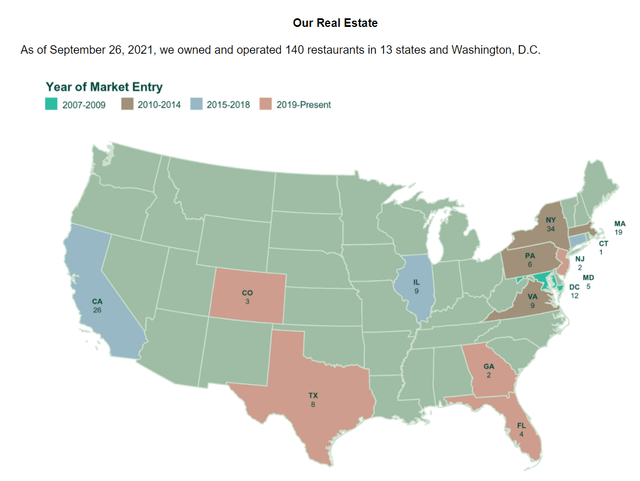

CAVA states in their S1 that they hope to have over 1,000 US locations by 2032. One of my main concerns with Sweetgreen was their ability to expand outside of their heavily urban store base. So far, CAVA has shown good portability to new markets compared to Sweetgreen at IPO. If CAVA experiences reduced AUVs or margins as they expand, their upside case will be thrown into doubt.

CAVA Locations (CAVA S1) Sweetgreen 2021 Locations (Sweetgreen S!)

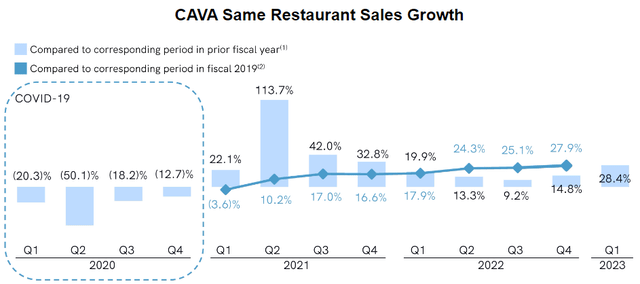

CAVA’s impressive SSS growth comes at a noisy time for the restaurant industry (and while they have been integrating Zoe’s Kitchen). Investors are right to wonder if current trends can be sustained given the various headwinds and tailwinds from Covid lockdowns, inflation, stimulus, etc. CAVA’s recent results appear to be well outpacing peers, albeit over a brief period of time:

CAVA SSS (CAVA S1)

Both SG and CAVA have posted operating losses throughout their existence. CAVA generated positive cash from operations of $3.4m in FY21 and $6.0m in FY22 while Sweetgreen burned $(64.5m) in FY21 and $(43.2m) in FY22 before their large CapEx investments. CAVA offers a larger margin of safety because they could cease growth initiatives tomorrow and operate the business profitably, unlike SG, which appears to need more scale to achieve profitability.

Valuation

In their S1, CAVA discloses $203m of revenue and $16.7m of adjusted EBITDA for the 16 weeks ended April 16, 2023. This is a bit of an odd timeframe, but extrapolating to a full year would suggest $660m annualized sales and $54m EBITDA. So, CAVA is going public at ~3x sales and ~40x EBITDA on a run-rate basis, while still generating operating losses and negative free cash flow after growth spend. Q2 will likely include notable costs related to the IPO, though they may have a shot at a Q3 operating profit if Q1’s impressive growth continues.

Growing peer Shake Shack (SHAK) trades at similar multiples implied by CAVA’s IPO, suggesting this isn’t too unreasonable for a concept with good prospects. SHAK has 449 locations, 18.3% restaurant margins, and did 10.3% SSS in Q1, though with a very impressive $3.8m AUV ($73k average weekly sales). This comparison isn’t perfect because some of the SHAK locations are franchised, but it’s at least a similar data point for valuation purposes.

Comparing to Chipotle, which trades at a $56B market cap and just completed a quarter with $607m of restaurant margin (23x annualized), could suggest CAVA’s $50m of YTD restaurant margin should trade at $50m (52/16) * 23 = $3.7B, or 50% more than their IPO price, but I would consider this an aggressive upside case.

Conclusion

The CAVA IPO offers solid growth numbers but minimal current profitability. While SG seemed like a flop upon IPO, I think CAVA has a chance to return decent value as they continue to scale their concept. Investors may indeed have a turbulent experience as they transition to a public company, and I’m not sure shares will be an immediate buy, but this concept seems worth a spot on your watch list.