bjdlzx

Investment Thesis

Caterpillar (NYSE:CAT) is an iconic company that has become a byword for heavy machinery and construction equipment. The firm focuses on producing a massive breadth of high-quality equipment and providing customers with extensive aftersales support.

I like Caterpillar’s core business operations and believe 2023 will be a strong year for the firm. Excellent topline growth was complemented by operational efficiency improvements, which positioned Caterpillar in a superb position to continue generating long-term value for shareholders.

However, the current valuation is simply too expensive to warrant building a new position in the stock. Therefore, I rate CAT a hold at present time.

Business Profile

Caterpillar Investor Relations

Caterpillar is a leading global supplier of heavy machinery. The firm has a broad set of products on offer to clients, ranging from cranes to diesel locomotives and all the way to massive mining trucks.

Having been in business for almost 100 years, Caterpillar has built an enviable position within the global heavy machinery industry, with the brand’s identity having become synonymous with great quality products.

A focus on expanding its reach within the market has seen Caterpillar become a key player in construction, resource extraction and energy and transport segments.

James (Jim) Umpleby III is the current chairman of the board and CEO of Caterpillar. Having joined one of the firm’s subsidiaries in 1980, Jim has an extensive 40-year history with the firm which has seen him occupy many executive and operationally critical roles.

I think Jim is well suited to run Caterpillar and believe the last eight years of solid performance by the firm illustrates his ability to manage the firm’s massively complex operations.

Caterpillar’s Economic Moat

Caterpillar has a wide economic moat that is built upon the firm’s extensive breadth of products, their intangible assets and the quality of their products.

The iconic “Cat” brand has what I believe is an industry-leading portfolio of products. An objective to serve every possible heavy-machinery customer, be it a local building company, an industrial ore mining operation or a forestry business, has allowed Cat to develop their brand reputation and increase their presence across markets.

Caterpillar Product Offerings

While Caterpillar products are not the cheapest, they are known for their performance and reliability, which helps differentiate their products from competitors.

By not competing on a price, Caterpillar retains critical pricing power for their products, allowing the firm to charge a premium to customers because they deliver a superior product.

The combination of a broad portfolio of products which are also the most capable on the market creates a positive feedback loop when it comes to repeat purchases and mass orders. This allows Caterpillar to increase cross-selling significantly, which further increases the revenues per customer.

Operation of heavy machinery also requires extensive maintenance services to ensure the safety and reliability of the equipment.

Caterpillar Support

Caterpillar is known within the industry for having one of the most extensive customer support systems, which ensures clients receive all the assistance required to continue operating their Caterpillar machines.

This creates recurring maintenance sales for the firm, which is a lucrative and highly profitable business. I fundamentally appreciate Caterpillar’s focus on differentiating the operating experience for customers by delivering outstanding customer service and 24/7 support.

Underpinning their superb portfolio of machines is a huge amount of design, manufacturing, sales and maintenance knowledge. Caterpillar knows their target industries well which allows the firm to accurately develop the products customers need.

Caterpillar’s massive scale of operations, great products and a wealth of industry knowledge cement their position at the forefront of the heavy machinery marketplace. Given these advantages, it would be essentially impossible for a new entrant or even a smaller player to replicate Caterpillar’s business operations.

However, I would like to highlight the growing competition within the space, particularly from cheaper alternatives.

Companies such as China’s XCMG tend to compete on price against established players such as Caterpillar or Komatsu (OTCPK:KMTUF). While Caterpillar’s superior products generate moatiness for the firm, cheaper alternatives may entice price-sensitive customers away from the company, especially if on-paper performance is equivalent.

Therefore, I believe it is critical that Caterpillar does not lose their focus on creating quality equipment that outperforms those of cheaper industry rivals.

Fiscal Analysis

Caterpillar’s five-year average (running from FY23-FY19) ROA of 7.58% complemented by an ROIC of 11.90% are both excellent given how capital-intensive and input-price sensitive the manufacturing of heavy equipment can be.

ROEs of 38.14% are industry-leading, with rivals such as Terex (TEX) and Komatsu only managing ROEs of 15.90% and 10.78% respectively. Caterpillar also outperforms these key rivals in ROA and ROIC by around 3pp each.

These outstanding returns, both in absolute terms and compared to key industry rivals, support my thesis that Caterpillar has real pricing power when it comes to equipment sales and aftersales services.

Running five-year (FY23-FY19) gross, operating and net margins of 30.32%, 14.45% and 11.14% further illustrate how well Caterpillar is able to extract profits from their operations.

These five-year metrics have also notably improved from pre-2018 figures by around 4pp each. I believe this has come as a result of CEO Jim’s desire to improve operational efficiency at the firm and dismantle ineffective corporate structures.

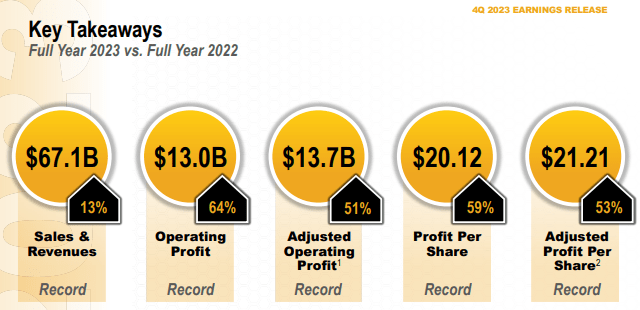

CAT Q4 & FY23 Presentation

February 5, 2024, saw Caterpillar report their fourth-quarter and full-year results for 2023 which were very strong for the firm. The final quarter saw revenues grow 3% YoY along with full-year revenues increasing a superb 13%.

Management reports that this topline growth came as a result of an improved pricing structure for their heavy machinery equipment along with an overall higher sales volume of products.

Indeed, this trend of increased volume demand for heavy machinery pairs well with the greater macroeconomic super-cycle currently beginning across western nations as key infrastructure networks built in the post-World War Two eras require modernization and significant renovations.

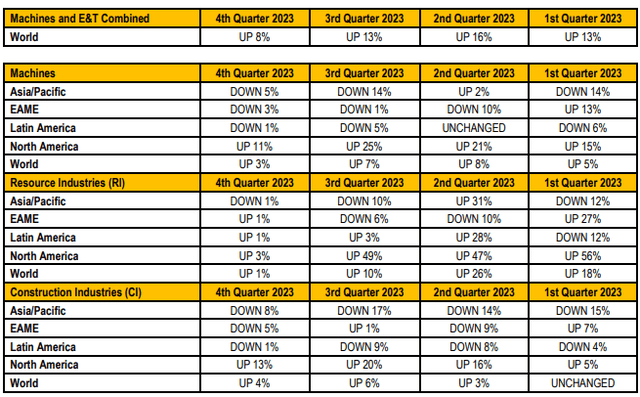

CAT Q4 & FY23 Retail Sales Document

Most of the aforementioned demand for Caterpillar machines came from North America and EAME with Asian and Pacific markets seeing YoY declines in demand.

Analyzing Caterpillar’s operation efficiency reveals the firm has made meaningful progress toward being a leaner business.

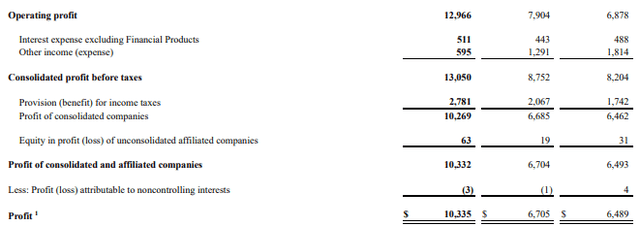

CAT FY23 10-K

Overall COGS only increased 3.4% against the 13% full-year expansion in total revenues which illustrates the benefits an increasingly efficient manufacturing process provides the firm.

Caterpillar continues to spend around 3% of total revenues on R&D which I see as an important expenditure the company must maintain to ensure their new products remain at the forefront of the market.

Total operating costs increased 5% for 2023 as a result of a substantial 12% increase in SG&A expenses.

Nevertheless, the ability of Caterpillar to limit operating cost expansion to just 5% for 2023 illustrates the impact their learning strategy can have on operational efficiency even amidst a highly inflationary and tricky macro environment.

CAT FY23 10-K

Operating margins expanded to 19% thanks to the 64% increase in operating income all the while net income attributable to common shareholders increased a substantial 59% to $10.34B.

This was also assisted by the lack of a $925M goodwill impairment charge which impacted full-year 2022 results.

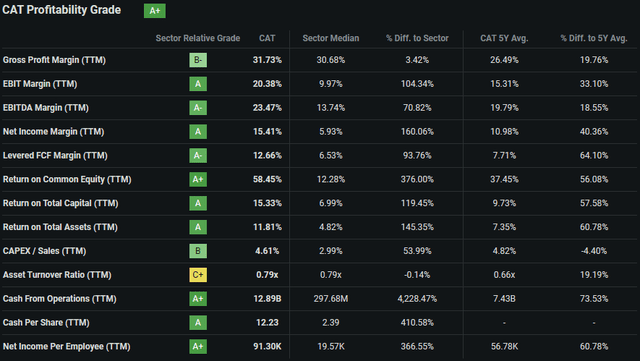

Seeking Alpha | CAT | Profitability

Seeking Alpha’s Quant calculates an “A+” profitability rating for Caterpillar, which I believe depicts perfectly 2023 earnings for the firm.

Caterpillar has $49.9B in total current assets on their balance sheet, while total current liabilities amount to just $34.7B. This leaves the firm with solid short-term liquidity, sporting a reasonable quick ratio of 0.72x and a current ratio of 1.37x.

Total assets total $57.5B, while total liabilities amount to just over $67.9B. Caterpillar has $19.5B in total shareholders’ equity. This implies a debt/equity ratio of 1.91x and a financial leverage ratio of 4.49x for the past year.

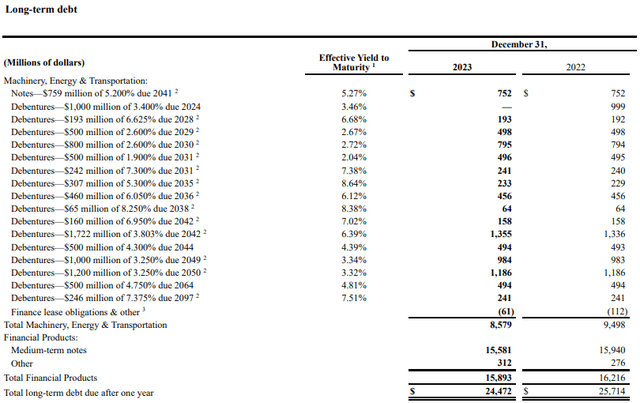

CAT FY23 10-K

The majority of Caterpillar’s liabilities arise from just shy of $8.6B in long-term debt, along with $15.6B in medium-term finance debts. While the overall sum of debentures is quite large, I admire the management team’s conservative approach to managing the schedules of these debentures, with the majority only maturing post 2035.

Moody’s credit ratings agency upgraded an A2 credit rating for Caterpillar’s LT issuer rating, while also upgrading the firm’s domestic commercial paper to a P-1 rating. The outlook remains stable. Moody’s classifies “A2” credit ratings as being of “upper-medium” investment grade, while P-1 is the highest quality short-term debt rating issued by the ratings agency.

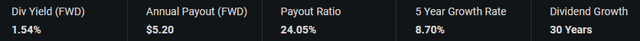

Seeking Alpha | CAT | Dividend

Caterpillar also pays out a reasonable dividend, with a current FWD yield of 1.54% and a projected annual payout of $5.20 per share. I believe the 24.05% payout ratio means the dividend is safe even in the event of a sharp economic downturn, and see the 30 years of growth as evidence of this hypothesis.

While a weak demand environment in 2024 – potentially as a result of a recession in the U.S. caused by the looming CRE debt crisis – could harm Caterpillar’s short-term returns, I really do like the positioning of the firm given the long-term demand of the new $1.2T infrastructure bill should create for heavy machinery.

Valuation

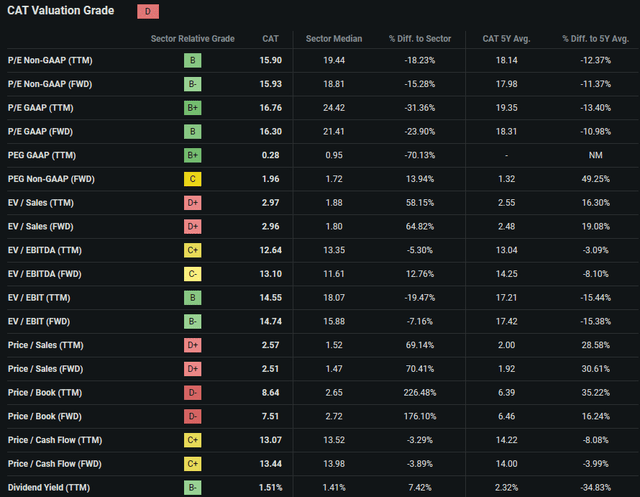

Seeking Alpha | CAT | Valuation

Seeking Alpha’s Quant calculates a “D” valuation rating for CAT stock. Given the underlying metrics, I am inclined to agree with this rating at present.

While a GAAP TTM P/E ratio of 16.76x is 14% below Caterpillar’s 5Y average, it is important to note how other metrics have developed in relation to the P/E staying quite low.

A 35% surge in P/B TTM to 5.86x suggests the share may be quite pricey indeed relative to the firm’s value, while a P/S FWD ratio of 2.51x may indicate that significant growth is already priced-in to the current valuation.

Seeking Alpha | CAT | 5Y Advanced Chart

CAT shares have massively outperformed the broader market (as measured by the popular S&P 500 index tracking SPY ETF (SPY)), to the tune of 60%.

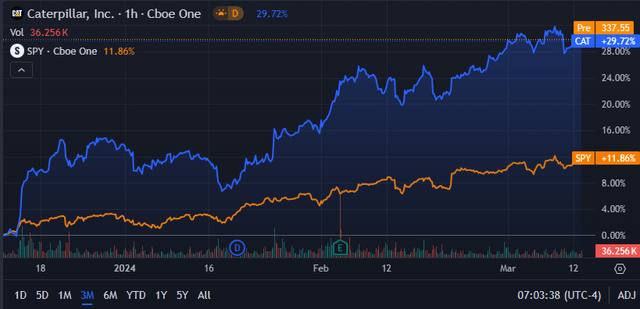

Seeking Alpha | CAT | 3M Advanced Chart

The last three months in particular have seen Caterpillar’s stock go from market-perform to what I deem is a substantial outperformance, given a rally spurred by investor expectations of rate cuts and the firm’s solid earnings reports.

The Value Corner

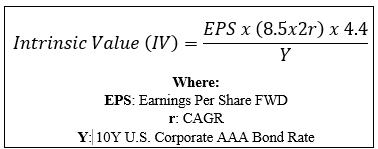

To gain a more objective and quantitative perspective of the value present in Caterpillar stock, we can use The Value Corner’s Intrinsic Valuation Calculation.

Using the current share price of $337.24, an estimated 2024 EPS of $21.16, a realistic “r” value of 0.05 (5%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.03x, I derive a base-case IV of $342.90 per share. This represents a fair valuation at current prices.

When using a bear-case CAGR value for r of 0.02 (2%) to reflect a scenario where a recession results in flatline topline growth, shares are only valued at around $231.70 suggesting a massive 45% undervaluation in the stock.

In the short term (3-12 months), essentially anything could happen to Caterpillar’s stock price. While solid earnings in Q1 and Q2 may suggest greater growth in 2024, a recessionary environment could place real downward pressure on shares, especially as most of the growth for the next 12 months is already priced-in to CAT stock.

In the long-term (2-10 years), Caterpillar has the economic moat and fiscal health to weather any macroeconomic storm and continue generating great results for shareholders.

I really like the core business and I really like their more recent focus on operational excellence, so long as it doesn’t come at the cost of quality.

Caterpillar’s Risk Profile

The firm faces some real risks, with the primary threats arising from many customer groups being exposed to cyclical business environments, along with Caterpillar’s reliance on overall economic health for product demand.

Key markets targeted by Caterpillar’s products, such as forestry, mining and construction, are all sectors that themselves see highly cyclical revenues. Primary resource extraction industries in particular are exposed to a double whammy of commodity price fluctuations and a cyclical demand environment, which adds further volatility to earnings.

This means that some of their key customer groups will only place orders during times of economic prosperity and growth, with recessionary and stagnant macroeconomic conditions presenting a much weaker order book for Caterpillar.

Even Caterpillar’s customers operating in construction will see very cyclical demand for heavy machinery, as economic downturns will decrease the amount of work required by these firms in the economy.

Overall, these factors combine to create an uncertain and potentially volatile earnings profile for Caterpillar. Given that the last 15 years have seen the U.S. economy operate in what was essentially a zero-interest rate environment, the rate of future orders in a higher-for-longer economy may be substantially lower.

Caterpillar 2022 ESG report

I do not see any tangible ESG concerns for Caterpillar, with the firm being committed to reducing their environmental footprint and improving the sustainability of manufacturing processes.

Of course, opinions may vary with regard to ESG material, and I implore you to conduct your own ESG and sustainability research before investing if these matters are of concern to you.

Summary

Overall, I really do like Caterpillar as a business. Their focus on providing customers with a wide range of great quality products acts as a clear operational objective, and I believe their execution of this strategy has been excellent.

Current CEO Jim appears to be positioning Caterpillar for the long run, with a focus on operational efficiency at the forefront of his strategy. While this strategy has generated excellent returns and profits in recent years, I believe the stability a leaner structure provides Caterpillar will become particularly evident during times of economic stagnation.

Nevertheless, the current valuation simply does not provide for any margin of safety when it comes to investing in CAT stock. I see most of the forecast 2024 growth as already being baked-in to the stock price, and believe any underachievement in this regard could place significant downward pressure on shares.

I therefore issue a hold-rating on Caterpillar’s stock. I will continue to watch and analyze developments at the firm and look for an increased margin of safety before I build a position in the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.