PM Pictures

Pricey readers/followers,

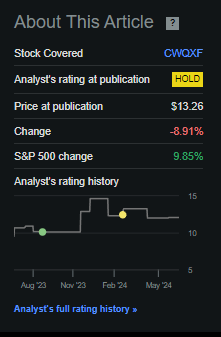

In my final article, I did one thing pretty noteworthy after I downgraded Castellum (OTCPK:CWQXF) (OTCPK:CWQXY) and my expectations for the corporate. Nonetheless, I imagine myself a succesful analyst relating to Swedish actual property and its truthful worth. I take consolation in the truth that my suggestion for the corporate resulted in at the very least a 4-year constructive pattern (relative to that suggestion), in that the corporate dropped nearly double digits and underperformed the S&P 500 by double digits since that point.

Searching for Alpha Castellum RoR

I went forward and bought my stake in Castellum a very long time in the past – when the corporate nonetheless traded properly above 200 SEK for the native, in comparison with the 139 it does at this time. I bought some places and choices in opposition to the inventory a yr in the past and made some cash off that, however withdrew from that as properly as the corporate went up above 110 SEK.

That is the place I stand at this time.

My reasoning for this was that the corporate has basically modified, from a really protected dividend-yielding forever-stock to a considerably riskier play underneath new administration and following a administration “battle”. New administration seeks to, in my estimate, change how Castellum operates and the attraction of the inventory, and my curiosity in proudly owning a low-growth, 1-2.5% yielding Swedish actual property firm stays very low.

As a result of that’s the place I imagine Castellum goes.

Discover my final article right here – on this one, we’re updating on the corporate and the place it would go.

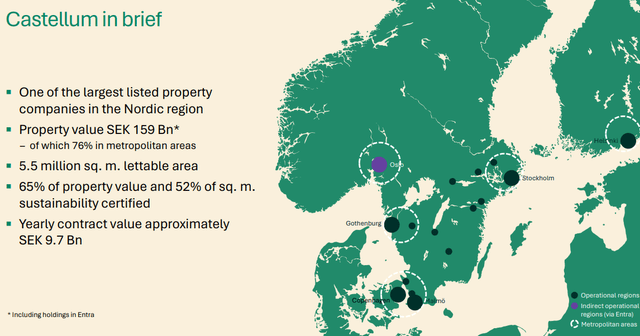

Castellum – enticing fundamentals, however unappealing upside with an unsure dividend potential.

First off, I imagine there are higher European actual property investments with higher threat/reward ratios than Castellum. That is why I now not personal any inventory in Castellum – and I have been protecting Castellum for quite a lot of years, from when the corporate was nonetheless truly enticing.

Let me be clear; Castellum was a 5%-yielding inventory after I owned it, and with a YoC of virtually 6%. I don’t imagine Castellum will ever actually return to being that.

This does not imply it might probably’t ever be enticing or investable once more. Something has a value the place I might purchase it (generally that value is unfavorable – i.e., they should pay me to take it), and in Castellum’s case, I keep that this value is the native at double digits.

The corporate can nonetheless be seen as a “good enterprise”, however there are actually a number of caveats to that assumption that some make, or this “assertion” (which some make it as). Now we have 1Q24, with the 2Q closing in and changing into related quickly sufficient.

However whilst of 1Q24, weak point is beginning to present. Whereas NOI is up and property administration revenue is up, cracks are beginning to present within the firm’s bottom-line tendencies. I am speaking about an revenue decline, however I am additionally speaking a few near-1% change in property values on the unfavorable facet.

I am additionally speaking about the truth that Castellum, which as soon as was essentially the most conservative RE in Sweden, now has an occupancy of 91.6%. There are many workplace REITs within the US that sport considerably higher occupancy charges – in addition to healthcare REITs, residence REITs, and lots of different European REITs and RE corporations as properly. Anybody in Sweden who’s specializing in Castellum is blinding themselves to the attraction of a broader, extra worldwide market. That’s my view.

Castellum IR

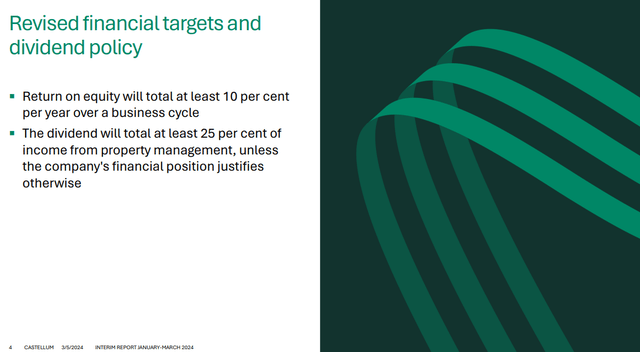

The corporate has now additionally declared its dividend aim – and it is with that in thoughts that I present you my expectations for the targets.

Castellum IR

Because of this Castellum is popping into a way more conservative, a lot much less shareholder-friendly enterprise – as was my expectation after the takeover. The one shareholders that can benefit from the fruits of this, on this rate of interest atmosphere, are these with substantial property to contemplate low single-digit yields enticing in context with out good potential for capital appreciation.

I’m not a type of.

The corporate can be going through points with occupancy, as talked about, and is specializing in retaining current tenants and leasing vacant areas. There’s additionally substantial discuss of recycling capital by means of divestments. And let me guarantee you that CRE at at this time’s threat/reward and monetary scenario in Sweden is usually not being bought at an enormous premium.

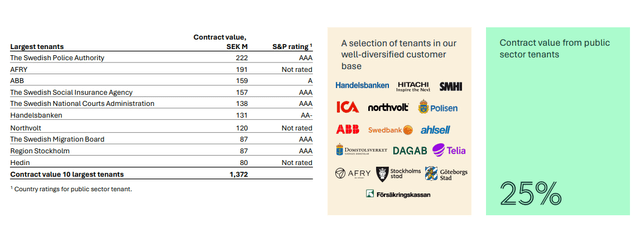

As soon as, Castellum was 35-40% public tenants. That’s now right down to 25%, and a few of these are questionable as properly (in how lengthy they continue to be), given how a lot change has been occurring in Castellum.

Castellum IR

P&Ls usually are not a pleasing learn this quarter. Earnings is down regardless of operational efficiencies coming in. A lot of the OpEx declines have been electrical energy – not one thing the corporate had a hand in precisely – however the discount in debt and loans has resulted in much less curiosity expense – and that is after all a constructive. It is one of many few positives to remove from what Castellum has completed – the leverage is now considerably lowered.

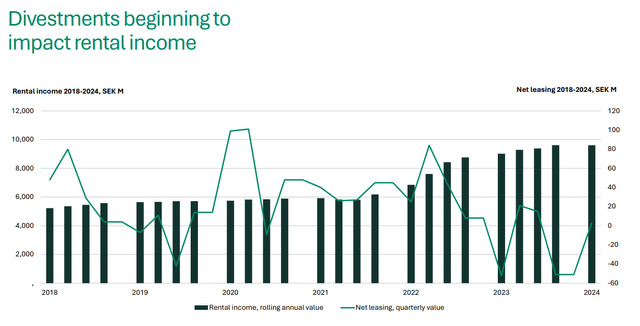

The aforementioned divestments are beginning to affect the underside line in rental revenue. That is additionally prone to proceed on a ahead foundation – so, as they are saying, the “ache isn’t over” right here.

Castellum IR

And it is anybody’s guess when the corporate’s portfolio is “by means of” being revalued. Not now, at any price, with the property portfolio worth being down nearly 1B SEK. Whereas declines appear to have tapered off in some instances, the valuation yield is unlikely to develop, and worth modifications are prone to proceed for a while.

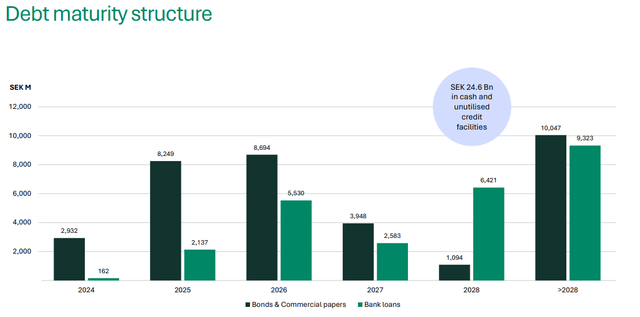

LTV is definitely up YoY, with rates of interest as much as 3.1%, and a Baa3 steady ranking and outlook. The corporate has brief maturities even in comparison with most US REITs, at 4.3 years, and stuck curiosity at 3.3%. Solely 64% is hedged, and the corporate’s debt is barely down half a billion, with 61.1B SEK of liabilities.

Debt maturities are inferior to some US REITs both, with near 20B SEK between 2024-2026E.

Castellum IR

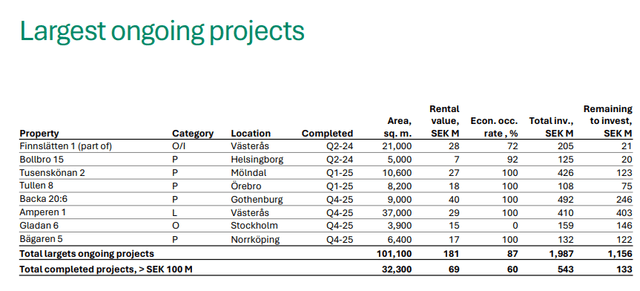

Clearly, the corporate isn’t in any elementary hazard presently, however I additionally would not say that the corporate is in any form of constructive scenario right here both. The corporate’s new properties and initiatives are so-so enticing. Here’s a record of them.

Castellum IR

A few of them at glorious percentages, however portfolio-wide at 87% with a WALT of 6 years. Once more, there are higher corporations on the market. I evaluate many French and Spanish REITs – I take into account them to be higher positioned (by far) and extra interesting than Castellum in each method right here.

So – no – I nonetheless don’t take into account Castellum to be all that enticing right here on the half of 2024 and going into 2024 2Q.

Actually, I take into account the most effective strikes over the previous 5 years to be the sale of Castellum at 210.50 SEK, the place I not solely locked in substantial earnings following COVID-19 but in addition averted all the drama and devaluation that occurred afterward.

The corporate may grow to be extra enticing sooner or later, however it might require a considerably decrease valuation for me to be desirous about buying its inventory.

Castellum valuation – Nonetheless not a lot to love if we transfer conservatively and evaluate it to the remainder of the market.

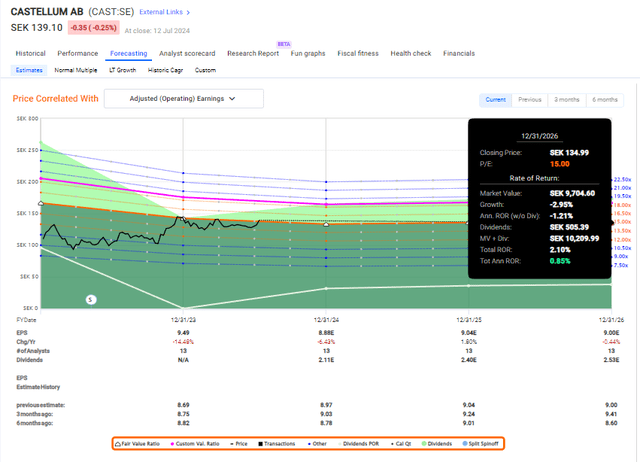

Castellum was at a PT of 140 SEK in my final article. The corporate has nearly reached this. I used to be additionally very clear in that article that if it goes above 120, placing choices or buy-writes is the way in which to go for me right here. My present set will expire inside a number of months, at which level, I am going to be capable of, if I wish to, write new ones. No matter widespread shares I purchased beneath 120 SEK are actually bought as properly. As a result of my earlier PT was 140, however I now maintain a much more unfavorable view on the corporate than earlier than, I am reducing my Castellum PT to 130 SEK, representing a 15x P/E for 2026E. P/E as a result of Castellum isn’t a REIT – Sweden doesn’t have REITs, and as such, evaluating them on that foundation doesn’t work the identical method.

The present estimate for the dividend beginning subsequent yr is 2 SEK (Supply: Paywalled FAST Graphs hyperlink). That signifies that the implied yield at at this time’s value is 1.43%. Are you beginning to perceive why I am not that constructive in regards to the firm?

Actually, for instance you have been to estimate the corporate at 15x P/E ahead, even with the supposed next-year dividend, that is not even 1% per yr.

FAST Graphs Castellum Upside

Once more, it is onerous to discover a good upside right here. In my final article, I stated the next about Castellum and its dividend.

But when the dividend will get reinstated, I do not see that stage being shut to six SEK and even 4 SEK, as is forecasted right here. I might say a 1.5-2 SEK stage, paid quarterly, is the most probably final result as the corporate’s administration has made their conservative method very clear. That will put the corporate at a 2% YoC or much less at this time.

(Supply)

So this estimate, and my information of how these corporations and their administration take into account issues, is one thing I do know properly. As earlier than, I wish to make clear that there’s an earnings decline anticipated for Castellum because of the corporate’s asset recycling tendencies. We’re anticipating a 5% earnings decline, adopted by slight stabilization and 1-2 development. No matter dividend the corporate chooses to go by won’t be sufficient to offset this. What’s worse, I imagine this decline to be very possible.

For all of these causes and the truth that we now have an official estimate backed by firm knowledge for the dividend, I select to chop my firm goal right here. It’s now at 130 SEK, which presently makes this firm overvalued.

For that cause, my thesis is as follows.

Thesis

- I bought Castellum at a big revenue, and I’m very pleased that I did so. It was maybe one of the best instance of me following my “SELL”/Trim guidelines when a inventory turns into overvalued. The capital I reinvested from Castellum has stayed comparatively steady and has not declined over 45% since. The corporate stays a enterprise with a strong asset portfolio however has taken harm from the administration/belief perspective, and I’m unwilling to maneuver any nearer right here with my capital till I see some indicators of issues calming down.

- My later method in 2023 concerned writing medium-dated CSPs with strikes at the very least 15-20% beneath the present share value, and I did so efficiently for 3-4 months with no single project.

- I’m now bearish on the corporate at this value, and I might say put choices are the way in which to go right here if the worth is above or round 120 SEK. The widespread shares work at this PT of 130 SEK/share long-term.

- I am conserving “HOLD” in my ranking for Castellum. I don’t imagine the corporate makes for a horny play right here, and I might look elsewhere.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

2. If the corporate goes properly past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is basically protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a practical upside based mostly on earnings development or a number of enlargement/reversion.

I view the corporate as a “HOLD” as a result of firm’s outcomes and outlook.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.