yujie chen/iStock Editorial via Getty Images

Carnival (NYSE:CCL) should see a boost as occupancy recovers to pre-pandemic levels, but its balance sheet keeps me on the sidelines.

Company Profile

CCL operates a fleet of cruise vessels. It operates under the Carnival Cruise Line, Princess Cruises, Holland American Line, P&O Cruises, Seabourn, Costa Cruises, AIDA Cruises, and Cunard brands. The company serves the contemporary, premium and luxury cruise markets.

North America is the biggest source of guests for the company, representing over 66% of its customers last year. Continental Europe accounted for over 20% of guests, while the U.K. represented over 8%.

Approximately 34% of its cruise program were to the Caribbean, while 18% were to the Mediterranean. About 20% of its voyages went to Europe without the Mediterranean, while Alaska was 8% and Australia and New Zealand was 3%.

CCL generates revenue from ticket sales, as well as onboard activities. Onboard activities include things such as beverage sales, casino games, shore excursions, spa treatments, art sales, laundry services, and specialty restaurants. Often these services are provided by concessionaires, and CCL just collects a percentage of revenue. Sometimes these services are prepacked and bundles with tickets.

Opportunities & Risks

The cruise industry was one of the hardest hit industries with the pandemic. While the industry has been recovering, getting back to 2019 occupancy levels remains an opportunity. As the worries about Covid start to fade, CCL and the industry should be able to see a return to pre-pandemic level occupancy.

Different markets are also at different points in their recoveries. North America is strong, with bookings exceeding 2019 levels the past several months. Europe has been strengthening, while Australia is considered about a year behind in its recovery and Asia about two years.

China, meanwhile, just reopened the cruise industry in the country in mid-April, and international operators will likely be about to return in 2024. China is a big opportunity for CCL and other operators, but the country will also likely see competition from local operators given the size of the opportunity. CCL for its part, has a joint venture with one local operator, to help expand the market.

Increasing capacity and the number of ships is another growth driver. Currently, CCL has 6 new ships on order, with capacity of over 22,500 passengers. That’s a nearly 9% increase in capacity for CCL, and newer ships should also be able to command higher pricing as well. The ships are expected to be delivered between July 2023 and July 2025. Four of the ships will be powered by LNG (liquefied natural gas), which can also help on the cost side of the business.

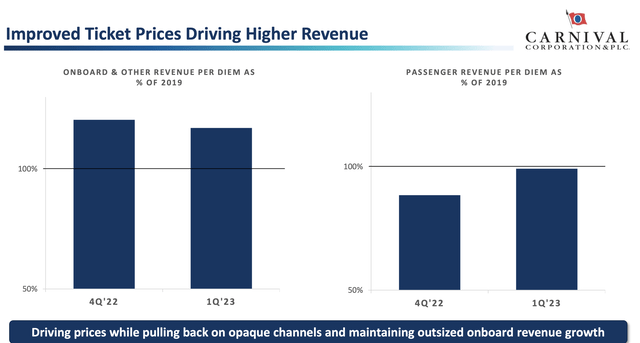

In addition to the current recovery going on, the industry also has the opportunity to drive revenue through higher ticket prices and onboard revenue. Cruises still offer a very good value compared to many other vacations offerings, such as Disney (DIS) theme parks. As occupancy gets back to 2019 levels, CCL and the industry should be able to boost pricing.

Company Presentation

Discussing it’s the current environment on its Q1 call, CEO Josh Weinstein said:

“Overall, with normalized onboard protocols, we are on an even playing field to land-based alternatives, enabling us to close the unprecedented and unwarranted 25% to 50% value gap to land-based offerings over time. We are well positioned to capture incremental demand given our high satisfaction and low penetration levels. We’re capitalizing on pent-up demand for cruise vacations, building on our large base of loyal guests as we work to increase awareness and consideration among new to cruise guests. This has been helped by the ongoing efforts of our travel agent partners who remain a critical source for new to-cruise guests.”

For 2023, the company said it should see a 3-4% increase in net per diems versus 2019. However, the company did note that European passengers drink more but gamble less, so as Europe catches up to the U.S., overall spending by guests will go down. In addition, as occupancy continues to increase, less expensive inner cabins will be the ones getting filled, also impacting average net per diems.

When looking at risks, another Covid wave or other disease outbreak would obviously top the list. CCL and the industry survived Covid, but there was certainly much damage done.

The economy is another potential risk. The travel and leisure industry got a boost coming out of Covid as cooped up people looked to get away and have experiences. However, there is a lot of uncertainty with the macro-environment right now. If North America and/or Europe hit a recession, CCL’s occupancy and bookings could take a hit. Right now, the U.S. economy seems pretty resilient, but it’s not out of the woods completely.

Fuel cost is another risk. While CCL has some LNG vessels, oil prices still impact its results. OPEC+ has been lowering output, and Saudi Arabia just announced output cuts. So, if there isn’t a global recession and demand remains strong, oil prices could spike.

With about $29.7 billion in net debt, CCL’s also carries a fair amount of debt on its balance sheet. With the company projected to generate between $3.9-4.1 billion in adjusted EBITDA this year, that comes out to over 7x leverage. Now its ships obviously have asset value, but that is a high amount of leverage.

Valuation

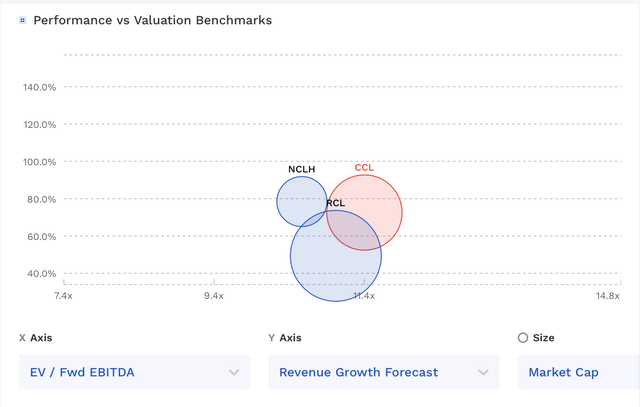

CCL stock currently trades at 11.3x 2023 EBITDA estimates of $4.09 billion. Based on the 2024 consensus projecting EBITDA of $5.48 billion, it trades at an 8.4x multiple.

On a P/E basis, the stock trades at 15.6x 2024 estimates. The company is projected to report a loss this year.

The company is forecast to grow its revenue by over 72% in 2023. For 2024, sales growth is forecast to be nearly 11%.

The big three cruise operators trade around a similar valuation.

CCL Valuation Vs Peers (FinBox)

Conclusion

In a recent upgrade of CCL stock, Citigroup analyst James Hardiman called the cruise industry the “last remaining Covid reopening story.” That has some merit, but with CCL having occupancy above 90% last quarter and projected to be 98% in Q2 and 100% for the year, there isn’t that much more runway left after this year.

In addition, the industry certainly isn’t recession proof, and then there is the big issue of its bloated debt load and high leverage. While adding new capacity and new vessels should drive growth, it will also add to its debt load, albeit at favorable rates through its use of export credits. That said, company also has a fair amount of floating debt, and some of its fixed debt is at pretty high rates.

While the improvements CCL should see this year are notable, its balance sheet will keep me on the sidelines.