SeregaSibTravel

Carnival Is not Immune To Journey Business Headwinds

Carnival Company (NYSE:CCL) traders had been possible surprised because the inventory fell right into a bear market after failing to clear the resistance degree beneath the $20 zone in July 2024. Nevertheless, dip patrons returned in August, serving to the inventory backside out simply above the $14 zone, underpinning CCL’s April 2024 lows. Consequently, traders are possible assessing whether or not its latest restoration represents a major turnaround after its August plunge because the journey trade faces intensified headwinds.

In Carnival’s FQ2 earnings launch in June, CCL surpassed Wall Road’s estimates, underscoring the market’s confidence within the main cruise operators. Strong outcomes by Norwegian Cruise (NCLH) corroborated the trade’s tailwinds. Nevertheless, fears of a progress slowdown in Royal Caribbean’s (RCL) prospects dimmed shopping for sentiment. Consequently, I assess that motels, resorts, and cruise traces traders possible de-rated the trade as an entire as they reassess more and more worrying shopper spending headwinds.

There’s little doubt that Carnival operates in a extremely cyclical shopper discretionary sector. Nevertheless, Carnival and its friends are assessed to be within the nascent levels of gaining market share in opposition to their land-based friends. JPMorgan Analysis initiatives that cruise operators might acquire vital market share by 2028. Regardless of that, they’re anticipated to account for almost “3.8% of the $1.9T world trip market by 2028.” Different estimates recommend that an 11.5% income CAGR for cruise operators between 2023 and 2030, corroborating its secular progress tailwinds.

Carnival’s Execution Stays Strong

Given CCL’s stable efficiency in Q2, bolstered by stable ahead bookings tendencies, I assess vital visibility on its earnings profile. A number of vital drivers are anticipated to energy Carnival’s earnings progress past 2025/2026. The cruise chief reported a yield improve of greater than 12% in FQ2. Whereas North America’s efficiency was sturdy, the restoration in its European enterprise was extra spectacular as yields surged greater than 20%. Consequently, Carnival advantages from a worldwide restoration momentum that ought to assist diversify its North American enterprise (virtually 70% of its complete income base). Decreasing focus dangers ought to assist underpin a extra resilient earnings progress visibility even when US journey spending weakens additional.

As well as, Carnival additionally posted “document buyer deposits and bookings” in FQ2, which is anticipated to translate into greater pricing energy. Unexpected shopper spending weak spot might nonetheless permeate the cruise trade from its land-based trip friends. Nevertheless, administration’s confidence in its restricted stock and sturdy occupancy ranges (104% in FQ2) ought to undergird income visibility. Furthermore, cruises are more and more being seen as extra value-for-money choices. Consequently, it ought to assist bolster Carnival’s main place in attracting vacationers, significantly amongst new-to-cruise (up 10% in FQ2) and Gen Z vacationers.

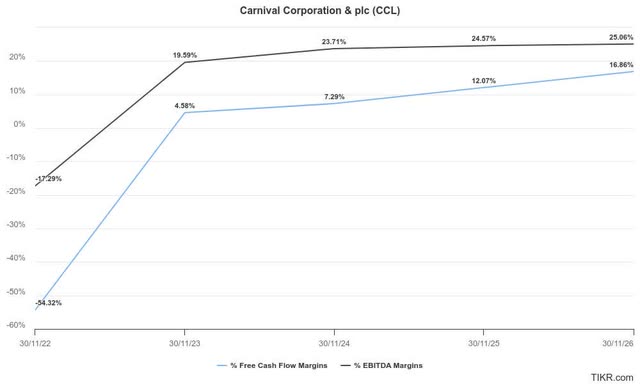

Carnival profitability estimates (TIKR)

Consequently, I believe optimism on Carnival’s profitability progress inflection appears affordable. Wall Road’s estimates on CCL have additionally been upgraded, corroborating its constructive outlook. As well as, Carnival’s capacity to realize working leverage whereas enhancing its free money move conversion by 2026 is anticipated to assist shopping for sentiments.

Watch Carnival’s Debt Discount Fastidiously

The corporate’s execution prowess has additionally been validated because it inches nearer to its 2026 SEA Change targets. Accordingly, administration highlighted the corporate is “two thirds of the way in which to attaining these targets after only one yr.” Therefore, it also needs to present extra confidence for traders whereas they await extra readability from CCL’s debt discount technique.

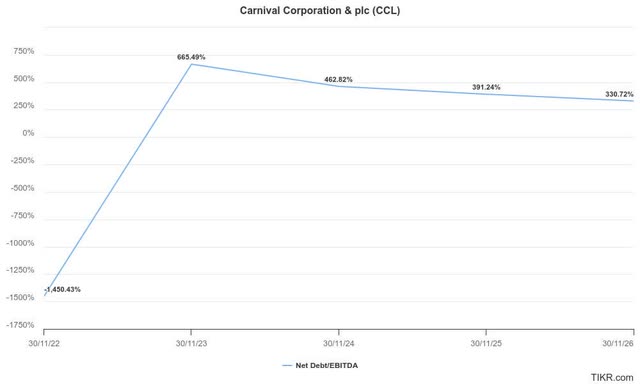

Carnival adjusted EBITDA leverage (TIKR)

Accordingly, Carnival’s adjusted EBITDA leverage ratio is anticipated to proceed trending downward (3.3x by FY2026) however nonetheless nicely above its pre-COVID highs (FY2019: 2x). Subsequently, some traders might nonetheless be involved about Carnival’s comparatively excessive leverage ratio, which might hamper a extra sturdy FCF margins accretion.

As well as, Carnival’s determination to not reinstate its dividend might ship earnings traders towards RCL, as Royal Caribbean reinstated its dividend in late July 2024. Regardless of that, bullish CCL traders might additionally argue that Carnival continues to be projected to be FCF worthwhile (whereas monitoring its 2026 SEA Change targets). Moreover, the valuation bifurcation between CCL and RCL has possible mirrored Carnival’s comparatively excessive debt load.

CCL Inventory: Valuation Is Comparatively Engaging

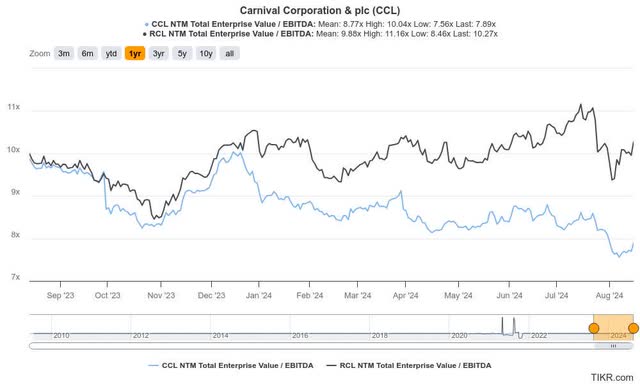

CCL Vs. RCL valuation metrics (TIKR)

As seen above, CCL’s ahead adjusted EBITDA a number of of seven.9x is markedly under RCL’s a number of of 10.3x. Therefore, the market is assessed to have accorded considerably greater dangers for Carnival inventory, suggesting its debt burden might hinder a extra aggressive valuation re-rating.

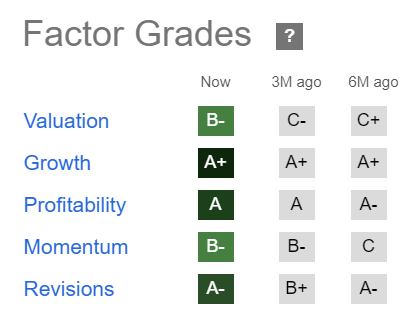

CCL Quant Grades (In search of Alpha)

Regardless of that, it hasn’t considerably impacted CCL’s shopping for sentiments (“B-” momentum grade). Carnival’s sturdy execution (“A-” earnings revisions grade) accentuates the market’s concentrate on its capacity to ship earnings accretion because it seems to recuperate its investment-grade credit standing.

Coupled with its best-in-class “A+” progress grade, CCL’s “B+” valuation grade suggests a marked enchancment from its “C” grade three months in the past. Its ahead adjusted earnings a number of of 13.3x can be virtually greater than 15% under its sector friends, implying relative undervaluation. Therefore, I assess a possible dip-buying alternative as well timed.

Is CCL Inventory A Purchase, Promote, Or Maintain?

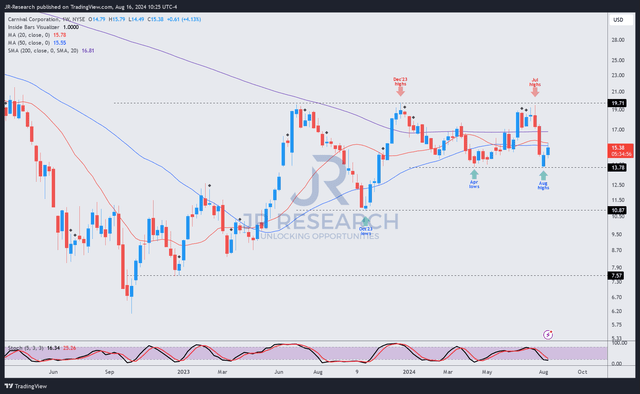

CCL worth chart (weekly, medium-term) (TradingView)

CCL’s worth motion suggests a bear lure (false draw back break) might have occurred simply above its $13.5 degree. I assessed a bullish reversal over the previous two weeks, though it suffered a bear market decline.

Furthermore, its stable momentum grade underpins my conviction that purchasing accumulation is anticipated to undergird its restoration, predicated on its stable elementary thesis.

Nevertheless, traders should not throw warning to the wind, as Carnival’s debt overhang might nonetheless impression the market’s confidence. RCL’s reinstatement of its dividend might additionally stretch the valuation bifurcation, placing additional stress on CCL. As well as, the journey trade headwinds afflicting its land-based friends might persist and broaden if the US economic system slows down greater than anticipated. Traders should think about that even the main cruise operators aren’t resistant to a tough touchdown, impacting CCL’s latest restoration.

Score: Preserve Purchase.

Essential observe: Traders are reminded to do their due diligence and never depend on the data offered as monetary recommendation. Contemplate this text as supplementing your required analysis. Please at all times apply impartial pondering. Notice that the ranking isn’t meant to time a selected entry/exit on the level of writing except in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a vital hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark under with the intention of serving to everybody in the neighborhood to study higher!