Darren415

In this article, we catch up on the Q2 results of Carlyle Secured Lending (NASDAQ:CGBD). Overall, the stock delivered an OK result with a 0.5% total NAV return, underperforming the sector after a strong run, due to a writedown in one holding. We recently downsized our large allocation to the stock on valuation grounds after which it cheapened quite a bit. If it cheapens further, we would look to upsize our position. CGBD is trading at a 12% discount to book (vs. 0% average sector discount) and a 11.9% dividend yield.

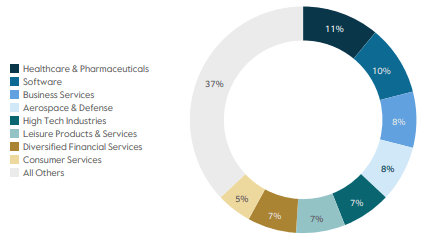

CGBD has a fairly typical BDC portfolio profile with an 80%+ first lien allocation. Its median company EBITDA of $73m is also in the sweet spot of the middle-market segment. Its sector exposure is tilted to Healthcare and Software – also fairly common in the BDC space.

CGBD

Quarter Update

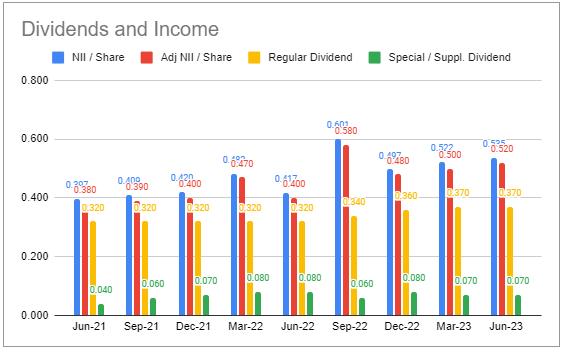

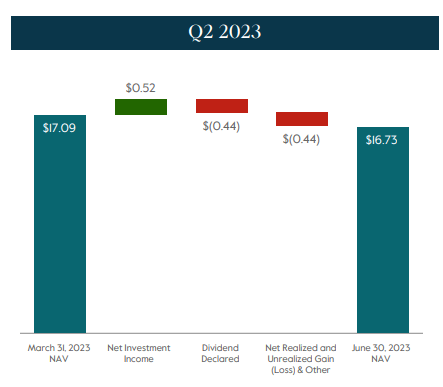

Net income came in at $0.52 – a 4% increase from the previous quarter, due primarily to a further rise in base rates. Outside of a non-repeatable income item in Q3 of last year, Q2 was the highest net income quarter for at least several years and a 30% increase year-on-year.

Systematic Income BDC Tool

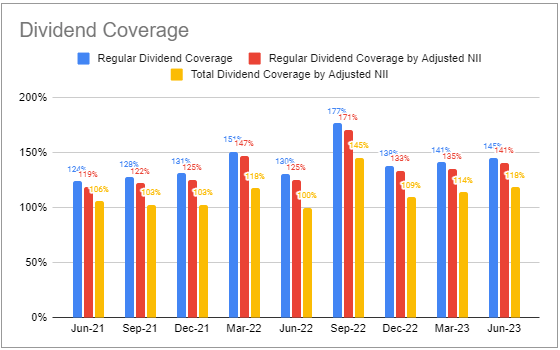

Base dividend coverage rose to 141% with total dividend coverage rising to 118%.

Systematic Income BDC Tool

The company declared the same base dividend of $0.37 and supplemental of $0.07 as the previous quarter.

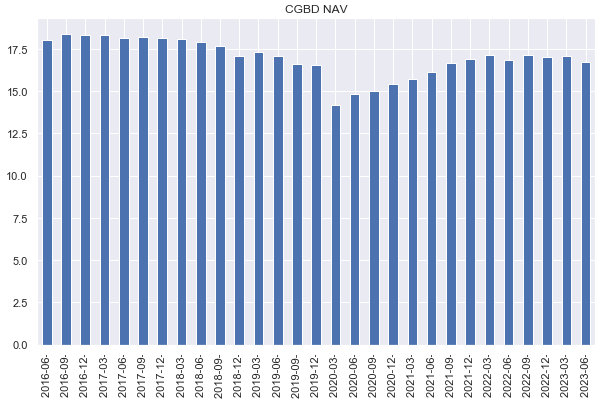

The NAV fell by around 2%.

Systematic Income

The drop is due primarily to unrealized depreciation, partly offset by retained income.

CGBD

Overall, the NAV is not far from its pre-COVID period, which is a good result for investors and suggests that the underwriting process is pretty good.

Income Dynamics

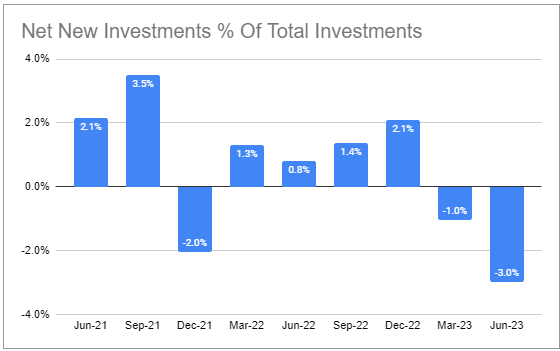

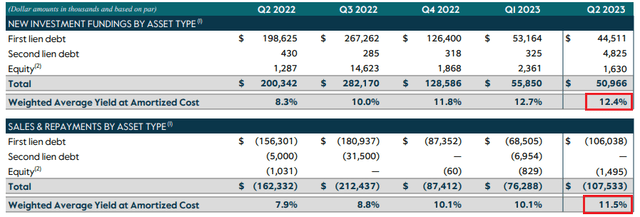

Net new investments fell for the second quarter as sales and repayments outpaced new fundings.

Systematic Income BDC Tool

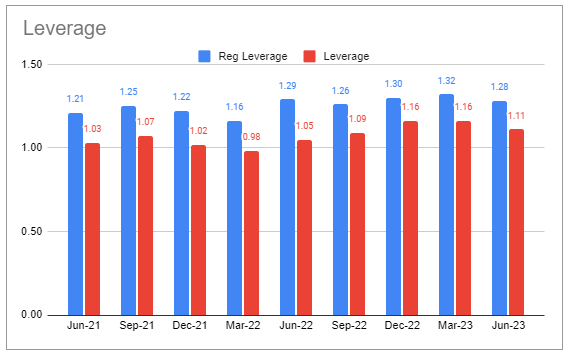

This caused net leverage to fall to 1.1x, not far from the sector average level.

Systematic Income BDC Tool

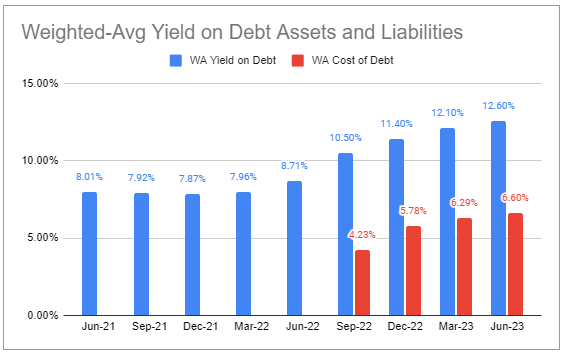

Portfolio yield ticked higher, as did interest expense due to the increase in base rates. The company’s yield differential between assets and liabilities is slightly below the sector median level of 6.2%. This is primarily due to its above-average floating-rate liability profile.

Systematic Income BDC Tool

The yield on new fundings continues to run ahead of the yield on repayments which provides another net income tailwind.

CGBD

Net income has risen nicely over the last several quarters. The pace of the rise, however, has not matched the broader sector due to a greater reliance on floating-rate debt. The company’s fixed-rate debt (at sub-5% coupons) is also coming due next year which will push its interest expense higher. Overall, we shouldn’t expect a much larger boost to net income from here on.

Portfolio Quality

The American Physician Partners position was fully written down from about 86% as of the end of 2022 which was about 1.7% of the portfolio at cost. The APP – a medical staffing and emergency medicine management company – will close. The sector has seen challenges recently. A KKR-backed physician staffing company, Envision Healthcare, filed for chapter 11 in the first half of the year. CGBD pointed to headwinds from labor shortages, wage inflation and regulatory changes.

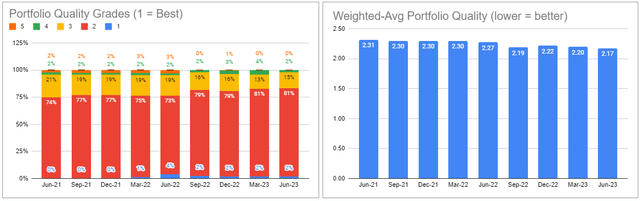

As far as internal portfolio quality metrics, the number of holdings in the worst two buckets was reduced, improving the overall portfolio quality profile.

Systematic Income BDC Tool

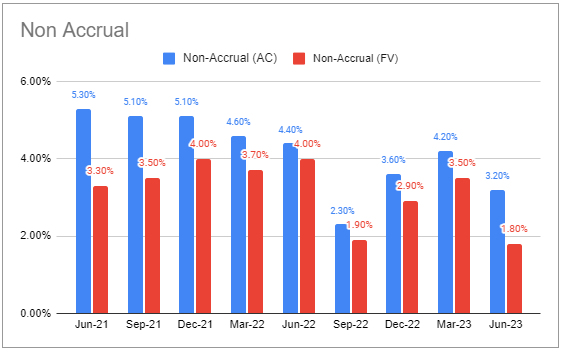

Non-accruals fell to 1.8% as a result of one restructuring to around the sector average level.

Systematic Income BDC Tool

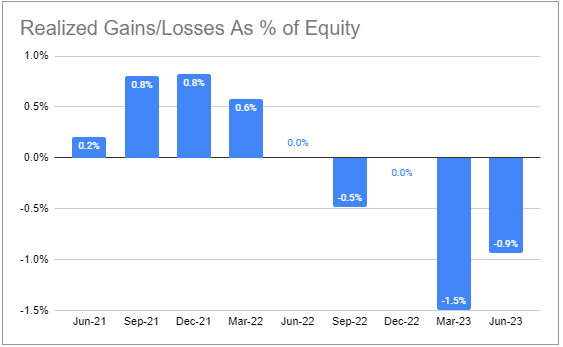

There was another quarter of net realized losses.

Systematic Income BDC Tool

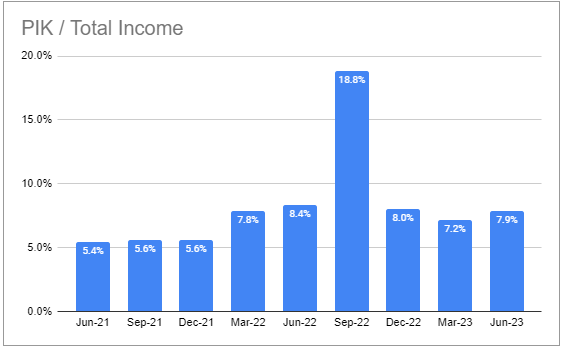

PIK remains a bit above the sector average.

Systematic Income BDC Tool

Overall, the portfolio has held up pretty well, even as we have seen some losses. Revenues of portfolio companies are up more than 30% with margins flat. Management have guided that interest coverage has been relatively stable.

Valuation And Return Profile

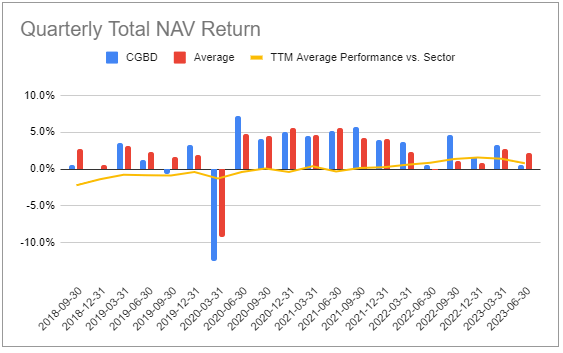

Although CGBD underperformed this quarter due to the APP writedown, it has performed very well over the last few years. On a twelve-month trailing basis (yellow line) it has continued to outperform the sector for two years.

Systematic Income BDC Tool

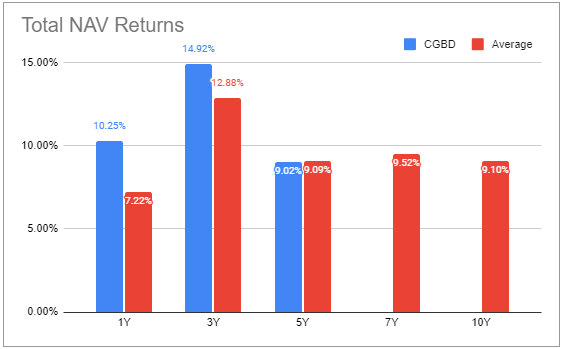

Over the last 5 years it has performed in line with the sector average in total NAV terms and has outperformed across shorter time periods.

Systematic Income BDC Tool

Stance And Takeaways

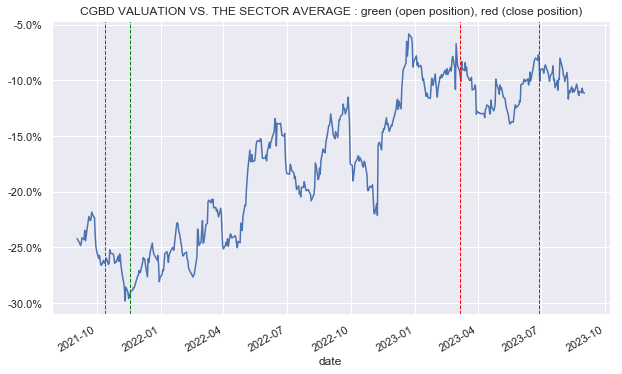

The chart below shows the timing of our initial CGBD buys (green lines) as well as recent sales (red lines) in terms of relative valuations to the sector average. Our initial allocations to the stock were when it traded at a valuation 25%+ cheaper to the sector. We pared down our allocation when the valuation gap closed to within 8% or so. Since then, the valuation gap increased to 12%. We would consider adding more if this valuation gap increases further.

Systematic Income

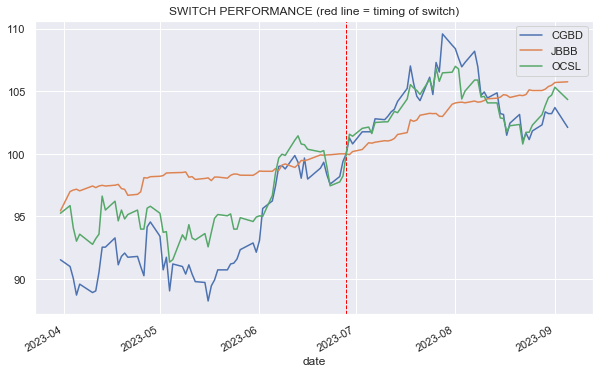

Our most recent shift was to halve our allocation to CGBD when its discount to the sector average valuation fell to a single-digit level. We allocated the capital to another BDC OCSL as well as a floating-rate CLO ETF JBBB, both of which have outperformed CGBD since the rotation.

Systematic Income

Given its strong performance trend over the last 3-5 years, we will likely add to our CGBD position when the valuation discount moves closer to 15% relative to the sector.