Robert Approach/iStock Editorial through Getty Photos

A fear-induced drop is very anticipated as the worldwide economic system is anticipated to decelerate this 12 months. Whereas issues appear unsure, in search of a nicely positioned firm that may climate out the anticipated recession like Capri Holdings Restricted (NYSE:CPRI) will present traders and merchants with good reward alternatives in right this moment’s financial standing.

Capri Holdings is a world luxurious style firm with a portfolio of manufacturers that features Versace, Jimmy Choo, and Michael Kors. Their merchandise cowl many of the ‘fashionista’ wants, ranging from luxurious footwear, purses, jewelries, perfumes, and progressive ready-to-wear equipment corresponding to good watches, and many others.

Capri Holdings Restricted has been capable of develop its internet earnings at a CAGR of 14.82% over the past 3 years by controlling its margins nicely. That is spectacular contemplating right this moment’s financial headwinds, particularly in comparison with its friends. CPRI additionally has a greater stability sheet than its pre-pandemic degree, making it nicely positioned within the anticipated international recession.

The corporate has at the moment dropped 43% from this 12 months’s excessive, providing a greater margin of security. In response to my DCF evaluation, Capri Holdings ought to commerce at a mean worth of $68ish, making it a pretty inventory at right this moment’s worth.

Firm Background

CPRI was based in 1981 and continues to indicate resilience because it combats headwinds from provide shortages, which snowballed into rising inflation and right this moment’s battle between Russia and Ukraine. Regardless of such headwinds, CPRI generated a file gross margin of 65.94% in FY2022. That is due to the corporate’s efficient retailer optimization program which compelled a number of retailer closures, in addition to the efforts to scale back working hours, inducing price financial savings.

In response to the administration, they efficiently closed a complete of 167 out of its deliberate 170 retail shops and incurred impairment costs amounting to $14 million as of FY2022. Therefore, there’s a likelihood that we’d see a continued decline in its impairment costs in its future monetary report.

CPRI’s FY2023 will likely be attention-grabbing because the administration resumed their main multi-year ERP improve and expects a portion of the system to go stay of their Q1 2023. A quick background on the corporate’s ongoing data know-how improve: this was postponed in the course of the peak of the pandemic so as to protect their liquidity. Moreover, they’re elevating their CAPEX funds for FY2023 to $300 million, which includes retailer openings, IT upgrades, together with enhancement of their digital platforms.

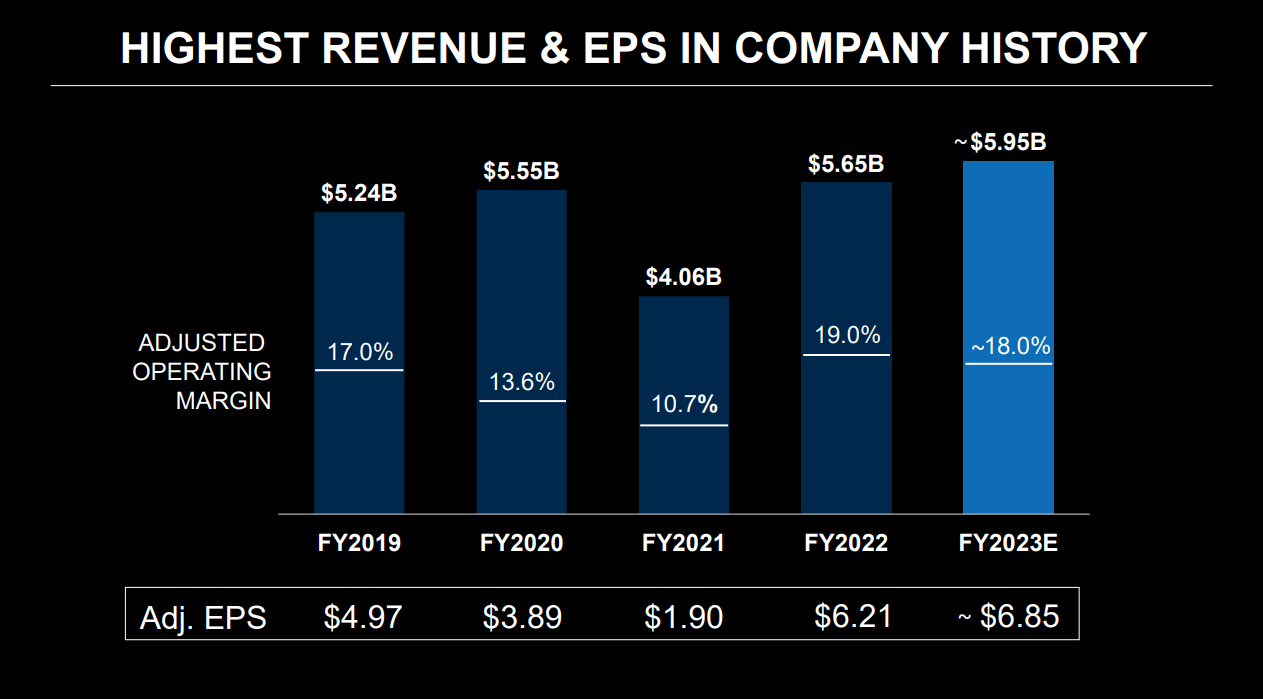

Though the administration minimize its prime line outlook in FY2023 amounting to $5.95 billion, in comparison with the $6.1 billion introduced on their Q3 2022 report, this can nonetheless produce a constructive progress for the corporate in comparison with its $4.06 billion in FY2021, $5.55 billion in FY2020 and $5.23 billion in FY2019. Contemplating the administration’s anticipated double-digit progress in its diluted EPS of $6.85 for FY2023 and its sturdy share buyback catalyst with its $1 billion share buyback authorization, CPRI stays an investable inventory.

In my view, CPRI is engaging with its managed margins and its assured administration. It’s also heading in the right direction with its rising digital presence, making it purchase forward of its retailer openings catalyst.

Path In the direction of its $7 Billion Prime Line and ~20% Working Margin

One of many attention-grabbing catalysts of CPRI is its long-term goal by the administration as quoted under.

…The facility of Versace, Jimmy Choo and Michael Kors in addition to the confirmed resilience of the posh market reinforce our optimism for the long run and our capacity to realize $7 billion in income and a 20% working margin over time. Supply: This fall 2022 Earnings Name Transcript

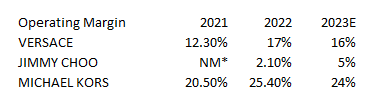

CPRI: Bettering Margin (Supply: Firm Filings, Ready by InvestOhTrader, *At Loss)

With its present efficiency, as proven within the picture above, the place all of its section’s working margin expanded at right this moment’s market sentiment and contemplating its ongoing enchancment in its know-how programs, I consider a 20% working margin additional time is very achievable, particularly contemplating its bettering outlook for FY2023 to be round 18% higher than its present 17.76% efficiency.

CPRI managed to extend its buyer database by 11.5 million new clients this FY2022 and with its $300 million CAPEX funds catalyst for FY2023 in place, I consider there will likely be new shops opening which can assist its long run $7 billion income goal.

A Much less Dangerous Guess

Contemplating the present provide chain points enhanced by the pandemic, it’s stunning to see an bettering money conversion cycle of 101 days in FY2022, higher than 116 days in FY2021 and 108 days in FY2020.

CPRI managed to deleverage and generate an bettering determine in its long run debt amounting to $1,131 million, higher than $1,220 million in FY2021 and $2,012 million in FY2020. This determine translated to an bettering debt to fairness ratio of 1.19x, higher than 1.6x in FY2021 and a couple of.02x in FY2020.

In right this moment’s rising price setting, the administration efficiently hedges its curiosity obligations and expects a internet curiosity earnings of roughly $9 million within the subsequent fiscal 12 months. With its bettering profitability and liquid stability sheet, the place its long run debt of $1,131 million is comprised of $497 million associated to its 2018 Time period Mortgage Facility, which matures in 2023, and $450 million in Senior Notes due in 2024, I consider the corporate maintains a liquid stability sheet that may climate out the anticipated recession.

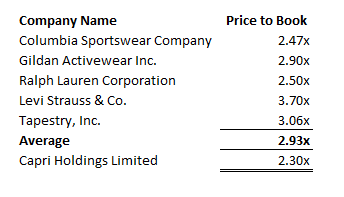

Investigating its trailing P/B ratio of two.30x in comparison with its 5 12 months common of three.09x, we will see that CPRI is getting extra essentially engaging as its worth drops, and for my part, it is going to get extra engaging at its potential concern induced drop.

CPRI: Undervalued Vs Friends (Supply: Knowledge from SeekingAlpha.com. Ready by InvestOhTrader)

Columbia Sportswear Firm (COLM), Gildan Activewear (GIL), Ralph Lauren Company (RL), Levi Strauss & Co. (LEVI), Tapestry, Inc. (TPR).

Placing its friends’ P/B ratio into consideration as proven within the picture above, we will safely assume that CPRI is among the undervalued bets as of this writing.

Getting Cheaper and Cheaper

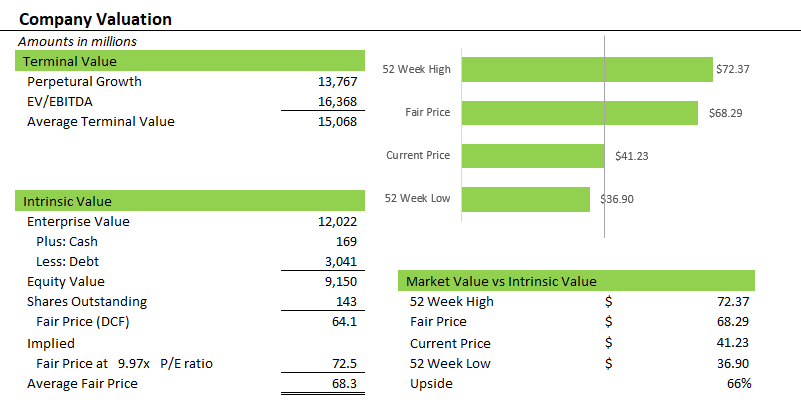

CPRI: Firm Valuation (Supply: Ready by InvestOhTrader)

Capri Holdings is getting cheaper once more in comparison with its intrinsic worth of round $68, derived from the common of easy relative valuation and DCF mannequin. Taking a look at its trailing P/CF ratio of 8.36x in comparison with its ahead P/CF ratio of 5.24x, it tells traders and merchants that the corporate’s money circulation is bettering, which is necessary particularly in right this moment’s uncertainties.

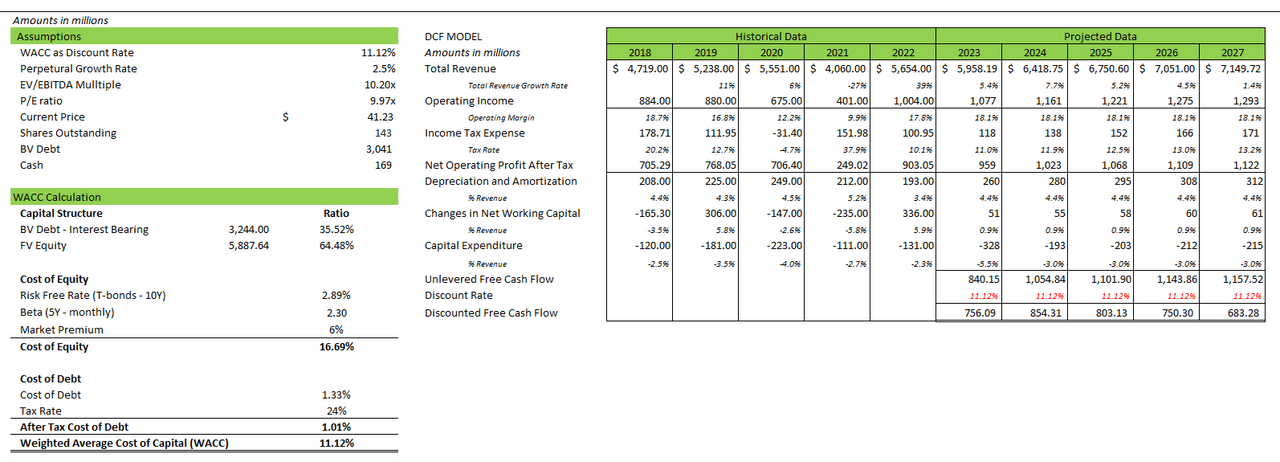

CPRI: DCF Mannequin (Supply: Ready by InvestOhTrader)

I used an analyst estimate to finish my DCF mannequin. I assumed a flat 18.1% working margin all all through the mannequin. Moreover, I used the administration’s forecasted determine on its efficient tax price and CAPEX funds for FY2023. Lastly, I calculated CPRI’s weighted common price of capital and used it as my low cost price to reach at a conservative intrinsic worth.

Threat Word

Though CPRI stays low-cost, future demand is likely to be closely affected as inflation eats up customers’ disposable earnings. Therefore, this may add as much as the uncertainties from COVID-19 and the battle in Ukraine, as quoted under.

Moreover, we now count on the expanded COVID-related restrictions in China will negatively affect income by roughly $50 million. As a reminder, our steering beforehand included the affect of the battle in Ukraine, which we estimated represented roughly $100 million in fiscal ’23. Supply: This fall 2022

On the brilliant aspect, though there’s a slowdown in client spending, I consider a constructive outlook on US employment for 2022 and 2023 could assist future spending. A miss on its prime line income consensus estimate could point out demand weak point that traders and merchants ought to monitor.

Sitting Close to Assist

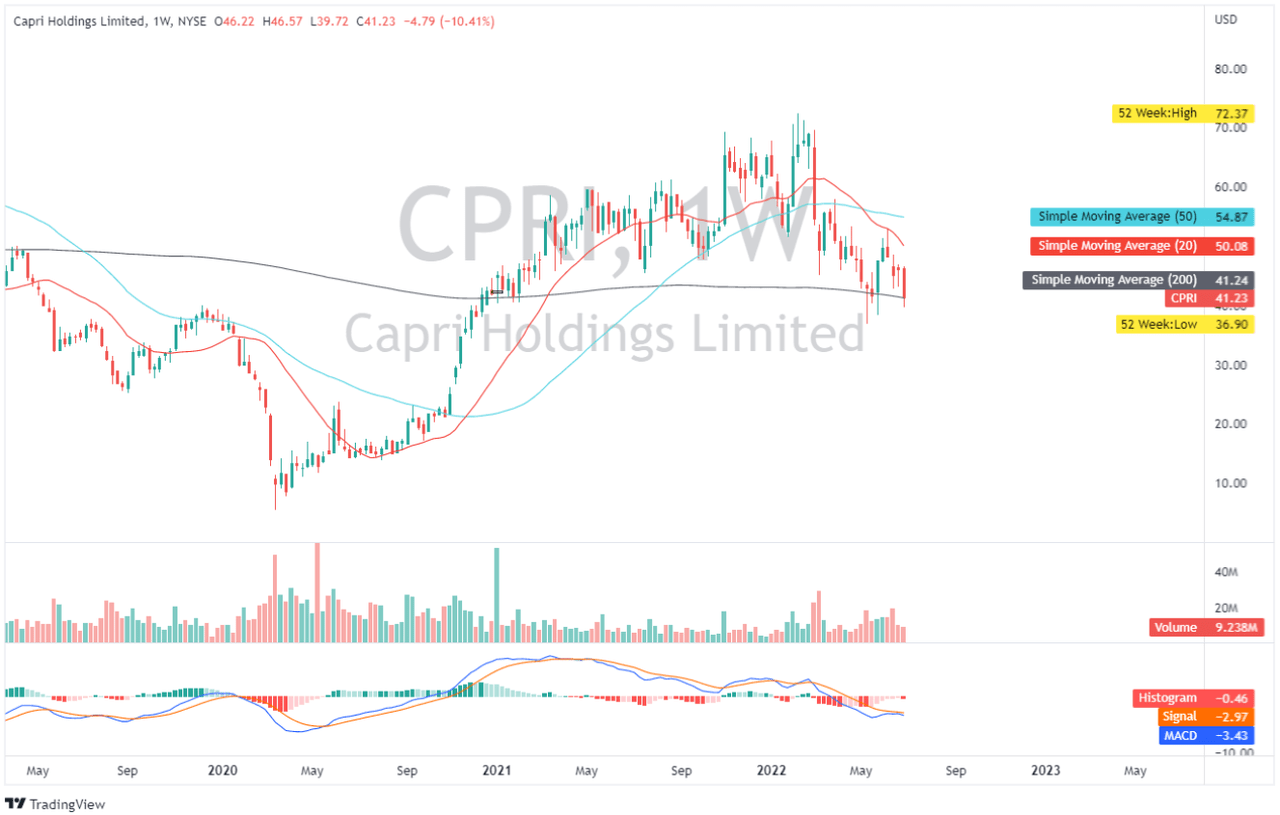

CPRI: Weekly Chart (Supply: TradingView.com)

Wanting on the chart above, we will see that CPRI is at the moment sitting at its 200 day easy transferring common. I consider the $36 to $41 zone is a powerful assist to observe. If it doesn’t maintain, we’d see it react round $30 assist. Taking a look at its MACD indicator, it stays under zero, indicating bearish sentiment. Nevertheless, a possible bullish crossover could induce a short-term bullish transfer.

Conclusive Ideas

On prime of its managed margin and thrilling long-term prime line outlook from administration, CPRI now advantages from its digital presence and its e-commerce operation truly contributes 17% of its internet income aligned with right this moment’s digitalization.

CPRI Retains Bettering With Its File Prime Line and Adj. EPS (Supply: This fall 2022 Investor Presentation)

With its secure demand outlook, bettering profitability, higher stability sheet, and powerful buyback catalyst, I consider CPRI is price shopping for throughout its weak quarters forward of its H2 2023.

Thanks for studying!