8vFanI

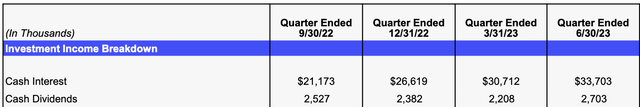

While rising interest rates have brought on higher interest expenses, the BDC industry has benefited from this trend, as most BDC’s have a big majority of floating rate investments, and a smaller amount of floating debt.

One such BDC is Capital Southwest (NASDAQ:CSWC), which has seen its cash interest investment income rise by ~59% since the quarter ending 9/30/22:

CSWC site

Management estimates that for every 50 basis point rise in interest rates, CSWC will earn $.12/share in annual NII:

CSWC site

Company Profile:

Capital Southwest Corporation is an internally managed business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, recapitalizations and growth capital investments. (CSWC site)

CSWC’s internal management structure has resulted in lower than average operating expenses, which have fallen from 3% in 2019, to 1.9%, as of 6/30/23.

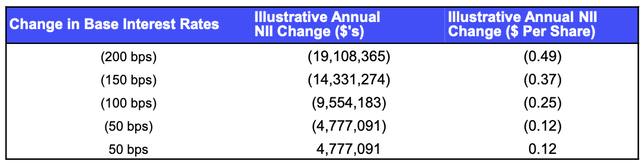

Holdings:

Management has been steadily increasing the % of 1st Lien investments, which stood at 97% as of 6/30/23. It also held 3% in 2nd Lien investments.

CSWC site

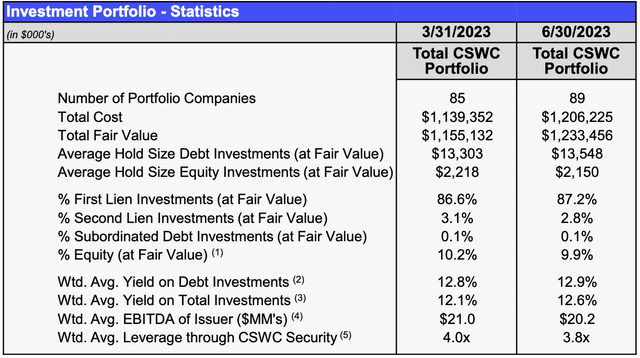

CSWC’s portfolio increased to 89 companies in the period ending 6/30/23, with a total fair value of $1.23B. Its average yield on debt investments is 12.9%, with issuer EBITDA averaging ~$20M:

CSWC site

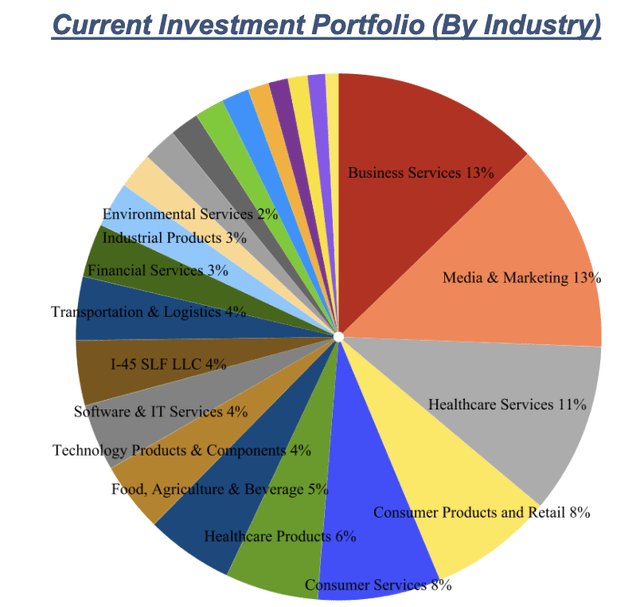

Business Services, and Media & Marketing, remained the largest industry exposure in the quarter ending 6/30/23, rising from 12% to 13%. Healthcare Services were steady, at 11%. The 2 Consumer categories totaled 16%:

CSWC site

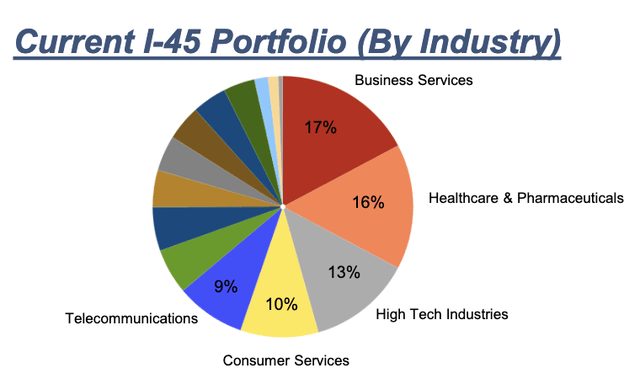

CSWC also has a JV, – its I-45 Senior Loan Fund (“I-45 SLF”), in partnership with Main Street Capital. As of 6/30/23, 95% of that portfolio’s investments remained in Senior Loans. There were ~$132M in debt investments in 33 companies, with an average issuer EBITDA of ~$71M, and a 6.4% LIBOR spread, up from 6.3% in the 3 previous quarters.

As of 6/30/23, the top 5 industries comprised 65% of this portfolio, vs. 57% as of 3/31/23, led by Business Services at 17%, up from 15%, and Healthcare at 16%, up from 14%. The average investment size was 3% of the portfolio, vs. 2.6% as of 3/31/23.

CSWC site

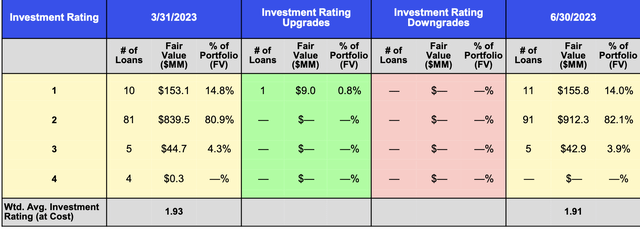

Portfolio Companies’ Ratings:

As with other BDC’s, CSWC’s management reevaluates its portfolio companies each quarter. It uses a 4-tier system, with 1 being the top tier, and 4 being the lowest. There were $9M in upgrades in the latest quarter, with no downgrades. The average investment rating was 1.91, vs. 1.93 at 3/31/23, with 96% of the investments in the top 2 tiers.

CSWC site

Earnings:

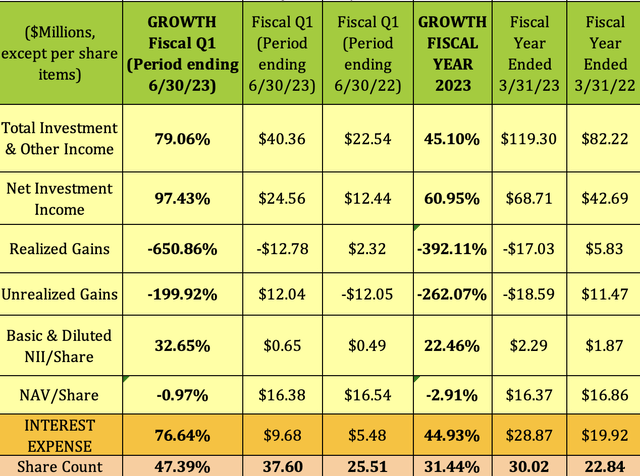

CSWC’s fiscal year ends on 3/30. Fiscal Q1 ’24 had major growth in total and Net Investment Income, of 79% and 97% respectively. NII/Share rose 32.7%, due to a 47% rise in the share count vs. a year ago. As with other BDC’s, Interest expense was up, rising $4M, but was surpassed by NII.

Fiscal Year ending 3/31/23 also had strong growth, with Total Investment Income up 45%, and NII up 61%. NII/share rose 22%, and Interest expense rose 45% for the year.

Hidden Dividend Stocks Plus

New Business:

CSWC originated $111.9M in new commitments in the quarter ending 6/30/23, consisting of investments in 6 new portfolio companies totaling $98.6M, and add-on commitments in 7 portfolio companies totaling $13.3M. CSWC received proceeds from the sale of 1 equity investment totaling $3.4M.

Dividends:

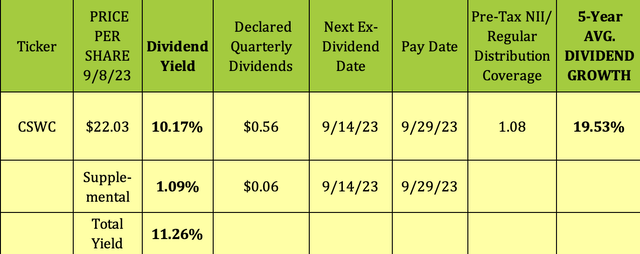

At its 9/8/23 price of $22.03, CSWC had a regular dividend yield of 10.17%, and supplemental dividend yield of 1.09%, for a total yield of 11.26%. It’ll go ex-dividend this week, on 9/14/23, with a 9/29/23 pay date.

Management raised the quarterly regular dividend for the 5th straight quarter, from $.54 to $.56, and also raised the supplemental dividend from $.05 to $.06. CSWC has one of the highest 5-year dividend growth rates in the BDC industry, at 19.5%.

Hidden Dividend Stocks Plus

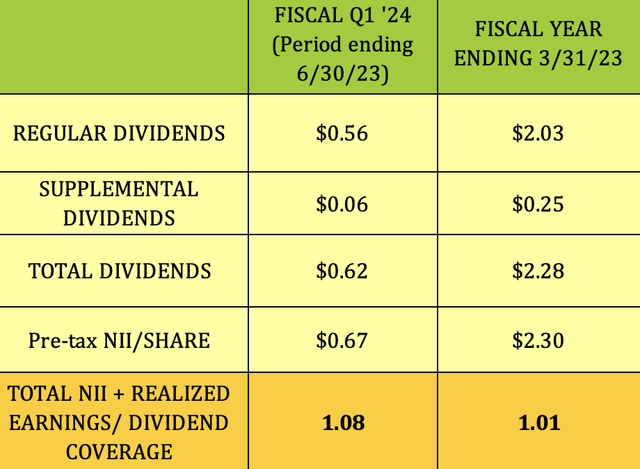

Dividend coverage was 1.08X on a Pre-Tax basis in the quarter ending 6/30/23, and 1.01X for the latest fiscal year, ending 3/31/23. That includes both regular and supplemental dividends. As of 6/30/23, management estimated that undistributed taxable income was $0.34/share.

Hidden Dividend Stocks Plus

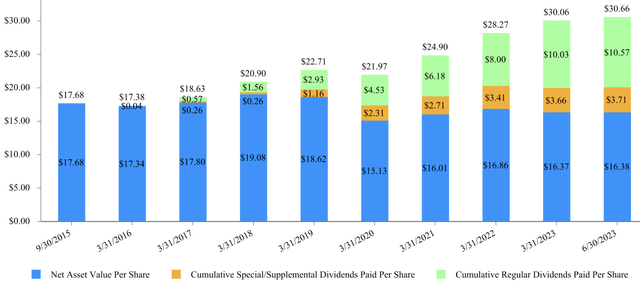

Management has delivered a total value of $30.66/share, since the 9/30/15 IPO at $17.68, comprised of $10.57 in regular dividends, and $3.71 in special/supplemental dividends:

CSWC site

Profitability & Liquidity:

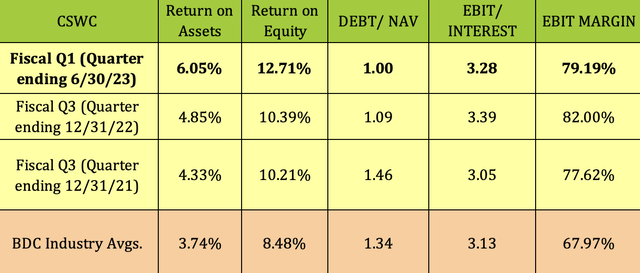

ROA and ROE both increased in the 1st half of 2023, moving higher above BDC industry averages, while EBIT Margin was a bit lower, but remained above average. Debt/NAV eased, and was much more conservative than the BDC industry average, while EBIT/Interest was slightly lower, but somewhat higher than average.

Hidden Dividend Stocks Plus

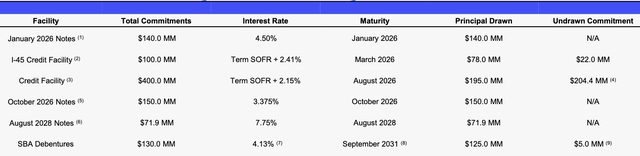

Debt & Liquidity:

CSWC’s earliest maturity isn’t until January 2026, when its $140M in 2026 Notes come due. It had ~$227M in liquidity as of 6/30/23, consisting of $12M in cash and ~$22^m in undrawn capacity.

During the quarter ending 6/3023, CSWC received investment grade ratings from both Moody’s and Fitch.

CSWC site

Performance:

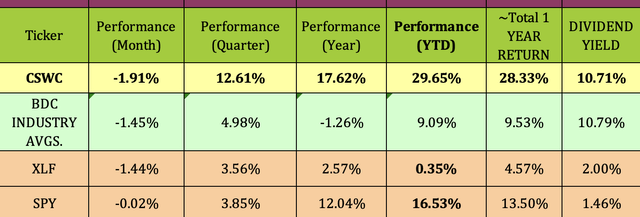

CSWC has outperformed the BDC industry, the Financial sector, and the S&P 500 by wide margins over the past quarter, the past year, and so far in 2023.

Hidden Dividend Stocks Plus

Analysts’ Price Targets:

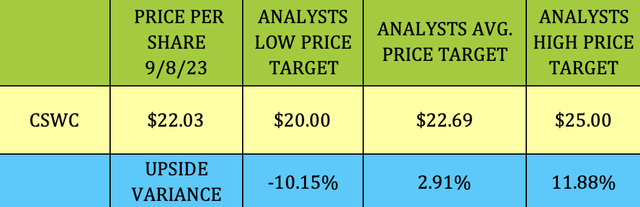

With all of that outperformance, it’s not surprising that CSWC only a bit higher than analysts’ average price target. At $22.03, it is ~3% below their $22.69 average price target.

Hidden Dividend Stocks Plus

Valuations:

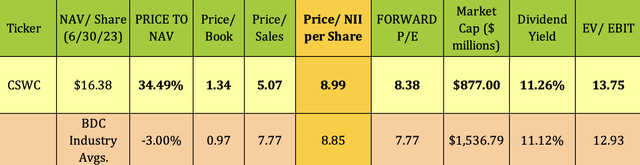

At its 9/8/23 intraday price of $22.03, CSWC was selling at a 34.5% premium to its $16.38 Price/NAV, much higher than the 3% average BDC industry discount to NAV/Share. It generally sells at a premium/NAV – it peaked at over 1.6X in late 2021. It did however, dip into negative territory in the 2020 pullback.

Its trailing NII/Share of 8.99X is in line with the BDC average, while its forward P/E of 8.38X is a bit higher than the 7.77X average.

Its 11.26% total dividend yield is in line with the BDC average, while it EV/EBIT is a bit higher than average.

Hidden Dividend Stocks Plus

Parting Thoughts:

CSWC stock is 3.75% off of its 52-week high of $22.92. We rate it a HOLD. It’s a good long term income holding, if you can manage to buy it at a much lower premium.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.