Key Takeaways

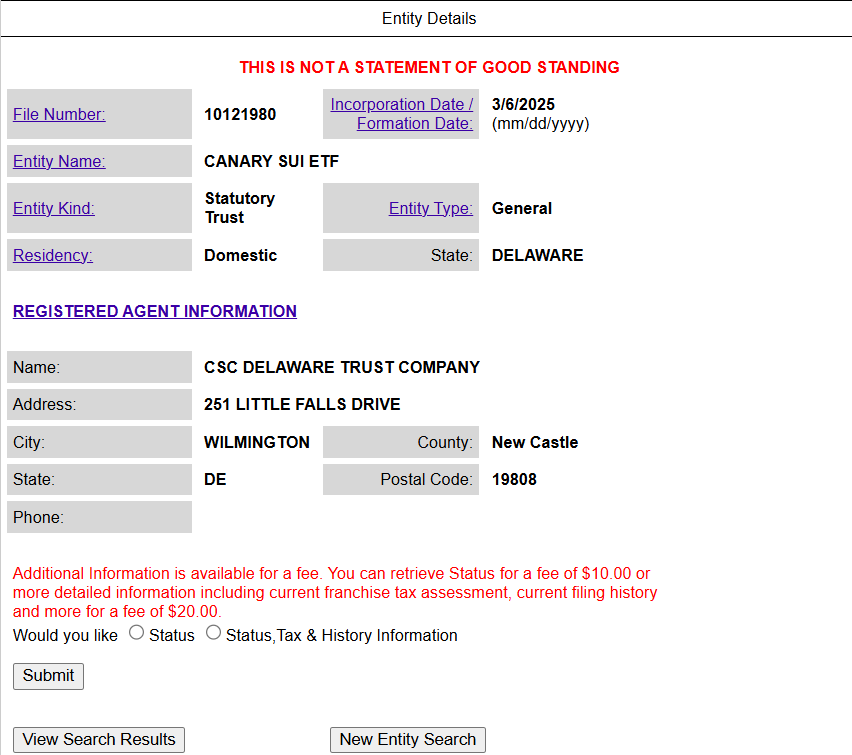

- Canary Capital filed to determine a belief for a SUI-based ETF in Delaware.

- The proposed ETF is an preliminary step in direction of SEC registration and approval.

Share this text

Canary Capital has filed to determine a belief entity in Delaware for its proposed Canary SUI ETF—a transfer that indicators a possible SEC submission for regulatory approval.

The transfer comes after World Liberty Monetary introduced its partnership with the Sui blockchain, with plans so as to add the venture’s native crypto asset, SUI, to its strategic reserve fund “Macro Technique.”

SUI jumped over 10% to $3 following the collaboration announcement. The digital asset, nonetheless, didn’t instantly react to the Canary SUI ETF information.

Canary Capital and Grayscale Investments have emerged as probably the most lively asset managers within the push for altcoin funding automobiles. Along with SUI-based ETF, Canary additionally goals for funds that observe different digital property like Litecoin (LTC), XRP, Solana (SOL), and Hedera Hashgraph (HBAR).

On Wednesday, Canary Capital filed an S-1 registration with the SEC for the Canary AXL ETF, which focuses on the AXL token powering the Axelar Community.

As soon as a SEC submitting is confirmed, Canary Capital will formally develop into the primary asset supervisor to suggest a Sui-based ETF within the US.

Share this text