Kwarkot/iStock by way of Getty Photos

[Please note that all currency references are to the Canadian dollar except if indicated otherwise.]

Canadian House REIT $44.25 (Toronto image CAR.UN; OTC:CDPYF; Residential REIT; Items excellent: 176.2 million; Market cap: $7.8 billion; www. capreit.com) is an proprietor and supervisor of multi-family residential properties positioned in Canada and western Europe. The belief commenced buying and selling on the Toronto inventory alternate in 1997 and has the most important market worth of all residential REITs in Canada.

The share value of Canadian House REIT (“CapReit”) declined sharply over the previous few months as buyers began to issue within the impression of rising bond yields on the true property market. However, the REIT owns an enviable portfolio of high quality belongings, has a sound observe document of worthwhile development, and gives a good valuation. Income and distributions ought to proceed to develop at a reasonable price providing a 5%-10% annual return over the long term.

A couple of definitions to bear in mind

Internet working revenue (“NOI”): This contains all rental revenues and different supplementary property revenue minus all direct property bills similar to property taxes, wages, and utilities. Stabilized NOI contains solely the working metrics for properties which have been held for the complete measurement interval. Funds from operations (“FFO”): This can be a measure of the money stream generated by the REIT and adjusts internet revenue for non-cash gadgets similar to truthful worth changes of funding properties, remeasurement of investments, amortization and depreciation, and deferred tax bills.

Direct capitalization: A main valuation methodology used for properties held beneath charge easy or land lease preparations. A capitalization price is utilized to the stabilized internet working revenue to find out the worth of the property.

A landlord of notice

CapReit owns and manages about 60,000 items in condominium buildings, townhouses, and manufactured dwelling communities in Canada. Properties positioned in Ontario contribute most (44%) of the web working revenue (“NOI”), adopted by Quebec (15%), and British Columbia (12%).

CapReit additionally holds a 66% curiosity within the European Residential REIT (Toronto image ERE.UN). This REIT owns 6,545 rental items within the Netherlands, Belgium, and Germany and contributed 14% of the NOI. CapReit gives administration companies to ERE and earns a charge for offering this service.

CapReit additionally owns an 18.7% curiosity within the Irish Residential Property REIT (Eire image IRES) however now not gives administration companies to this REIT.

Wonderful enterprise operations

CapReit has a strong document of rising all necessary metrics for the enterprise.

The REIT has expanded considerably over the previous decade. The residential items beneath administration have doubled, internet working revenue has trebled, and the market worth has grown five-fold.

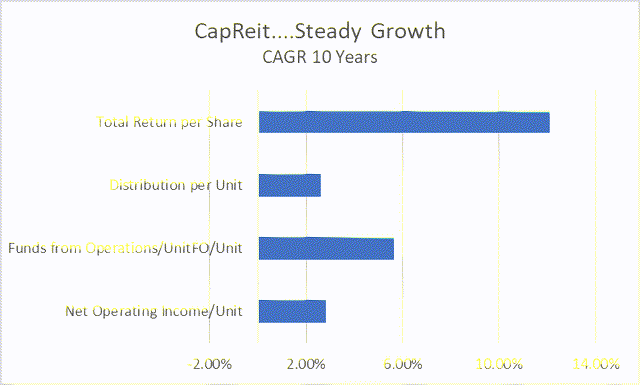

As with most different REITs enlargement is financed with debt and the difficulty of extra items. However regardless of the three-fold improve within the items, NOI, FFO, and distributions per unit compounded at between 3% and 6% per yr over the last decade (see graph).

Eikon and contributor’s calculations

Regardless of the fast enlargement, CapReit has additionally managed to run a good operation. Occupancy ranges averaged 98.1% for the previous 10 years and rents elevated by 1.5% per yr. Internet working margins averaged 61.5% and elevated yearly for the previous decade.

Unsurprisingly the items have carried out properly with a complete return of 12.1% per yr beating the general Canadian market and the REIT index by a rustic mile.

Modest development prospects

CapReit grows organically by renovating items, elevating rents, retaining vacancies low, and retaining a lid on bills. However, the REIT additionally grows by acquisitions and undertakes the event of vacant land or redevelopment of current properties.

The acquisition of extra properties happens steadily, and the whole acquisition price has averaged $690 million per yr (for a median of three,900 items) over the previous decade. The belief additionally divests, once in a while, older non-core belongings.

Over the long run, the REIT believes that it could generate modest rental development, preserve its occupancy at or close to full capability, and improve ancillary revenues – this could end in reasonable development within the stabilized internet working revenue. A resumption of Canadian immigration, the return of worldwide college students, and the normalization of workplace work are medium to long-term tailwinds for the REIT.

The market surroundings

Many of the areas the place CapReit owns and manages residential items have at the very least some measure of hire controls in place. In the course of the Covid-pandemic the provincial governments in Ontario and British Columbia additionally froze hire will increase for 2021 and launched hire improve caps of 1.2% and 1.5% respectively for 2022. The Dutch authorities launched related measures.

This hampers the flexibility of the REIT to extend rents, besides on suite turnover, regardless of sturdy demand for rental items in most of its markets. Nonetheless, hire controls additionally serve to discourage new rental developments as anticipated returns might not meet the minimal required investor returns.

The Canadian housing market was buoyant in 2020-21 as low mortgage charges inspired potential owners to purchase somewhat than hire. Nonetheless, the frenzy appears to have calmed down and with mortgage charges now sharply greater, many potential dwelling patrons might return to the rental market.

Company governance

The Chair of the board of trustees is Dr. Gina Cody, a former company govt, and principal of an engineering agency. The board at the moment has eight members of which seven are thought-about impartial. Collectively the trustees and govt officers personal 0.6% of the CapReit’s items.

Mr. Mark Kenney is the Chief Govt Officer. He has been with the REIT since 1998 and served as Chief Working Officer earlier than he was appointed CEO in March 2019.

The Chief Monetary Officer, Scott Cryer, resigned early in 2022 after a 12-year profession with CapReit. The formal seek for a substitute is at the moment underway.

The chief officers obtain a primary wage, and performance-based money and fairness rewards. The performance-based rewards are linked to the achievement of sure non-financial and monetary efficiency measures, together with FFO per unit development targets. The CEO acquired whole compensation of $4.3 million in 2021 which was 13% greater than in 2020.

The REIT is internally managed – so there is no such thing as a potential for battle of pursuits with an exterior supervisor.

Steadiness sheet in good order

The REIT had unitholders’ fairness of $10.4 billion by the top of March 2022, and whole debt of $6.8 billion.

Mortgages make up virtually the entire debt; there are principal repayments amounting to 25% of the whole debt that may come due over the subsequent 3 years. By the top of March 2022, the weighted common mortgage rate of interest was 2.53% with a time period to maturity of 5.7 years. Over 99% of the mortgage portfolio carries a hard and fast rate of interest.

Complete debt to gross e book worth amounted to 37.6% whereas curiosity is roofed 4 instances by earnings earlier than curiosity, tax, depreciation, amortization, and truthful worth changes whereas the whole debt service price (together with principal repayments) was lined 2.0 instances.

CapReit has a share repurchase program in place to purchase 17.067 million items (about 10% of the issued items) till March 2023. Given the decrease unit value, the REIT might resolve that it’s opportune to purchase a few of their very own items out there, however it’s extra seemingly that administration will resolve to step up the property acquisition program ought to engaging alternatives grow to be obtainable.

An inexpensive begin to 2022

The primary quarter of 2022 delivered an affordable end result with will increase in portfolio occupancy, common month-to-month rents, internet working revenue, and distributions. Nonetheless, because the REIT had extra items in subject, there was a small decline within the funds from operations per unit.

A spotlight of the end result was the ten.2% soar in rental uplifts on the turnover of tenants. This means sturdy demand and the potential for additional rental development as tenant turnover will increase. Much less constructive was a pointy improve in working bills as greater power costs pushed utilities price up by 14%.

Within the first quarter of 2022, the REIT acquired 1,015 suites for a complete price of $439 million. There have been no inclinations within the final quarter.

Consensus forecasts point out NOI development of seven.4% for 2022 however with a decrease margin as greater working prices will negate a few of the income enchancment. FFO per unit is predicted to come back in at $2.36, barely greater than 2021 though higher development is predicted for 2023 and 2024. The dividend must be 3.5% greater than final yr.

A daily dividend cost

CapReit pays a month-to-month distribution which has grown yearly over the previous decade. The present annual distribution quantities to S1.45 per unit with a payout ratio of 63% of the FFO.

Honest valuation however watch these rates of interest

CapReit and its exterior valuers principally use a direct capitalization price methodology to estimate the truthful worth of its properties. By the top of March 2022, the weighted common capitalization price was 3.69%, which was virtually unchanged from the year-end price. Primarily based on these estimates the properties have been valued at $17.5 billion. Together with different belongings and deducting liabilities, the web asset worth per absolutely diluted unit quantities to $58.79.

Contemplating that rates of interest have moved up sharply for the reason that finish of 2021, we will assume that the cap charges would finally observe. The corporate estimates that the truthful worth of its property portfolio declines by $2.1 billion (or 12%) for each 0.5% improve within the capitalization price. Valuations are much less delicate to modifications within the NOI – for each 1% improve in NOI the valuation will increase by 1.1%.

As an instance – assuming that cap charges transfer greater by 0.75% over the subsequent 12 months and NOI will increase by 4%, the property values decline by $2.4 billion (-14%). Assuming the liabilities and the portfolio stay unchanged, the NAV drops to $44.90 which means that the present unit value trades at a 1% low cost to our anticipated NAV. That is proper in step with the 20-year historic common which has principally diversified between a ten% low cost and a ten% premium.

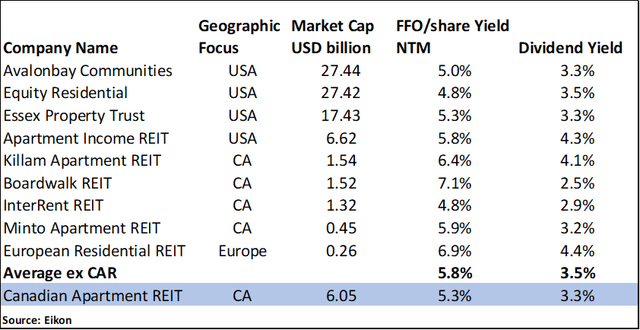

Different valuation strategies that can be utilized to worth the belief embrace the FFO yield and the distribution yield. In comparison with the a lot bigger U.S. residential REITs, CapReit seems to be barely undervalued, however the valuation is true in step with the broader universe when each Canadian and U.S. REITs are thought-about.

Eikon

Backside line… sound enterprise with an affordable valuation

CapReit has completed properly over the previous decade increase a high quality portfolio of Canadian and European multi-family residential items. Increased rates of interest will hamper additional development in internet asset worth, and hire controls will proceed to dampen the REIT’s means to extend rents. Nonetheless, demand for rental lodging stays sturdy within the REIT’s core markets and rental uplifts happen on tenant turnover.

The valuation is affordable, and the dividend ought to proceed to develop at a reasonable price seemingly providing a complete return of 5%-10% each year over the long run.

Written by Deon Vernooy, CFA, for TSI Wealth Community