DoraDalton/iStock via Getty Images

Summary

Our initial report rated Canadian Apartment Properties Real Estate Investment Trust (CAR.UN:CA / CDPYF) a Hold. While we liked its portfolio and Canadian multifamily as an asset class, we didn’t see an attractive margin of safety. This report gives an overview of CAPREIT’s Q4 2023 results and our revised target price. Despite continued strong financial performance, we continue to believe the units do not offer an attractive return profile at this time. We also continue to see no value in a long CAPREIT, short ERES (ERE.UN:CA) trade. CAPREIT’s units may be attractive for investors seeking a stable, well-managed, conservatively capitalized, and reasonably priced (n.b., ~5% below our NAVPU estimate) REIT. However, we are in the market mainly for asymmetric risk/return profiles and maintain our Hold rating.

Earnings Update

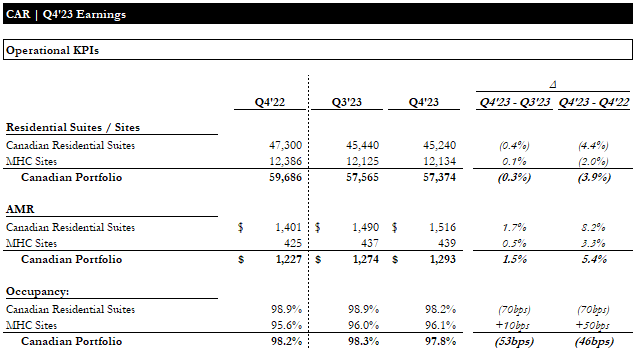

The capital recycling program continued in full force, with net dispositions causing the Canadian residential portfolio to shrink slightly QoQ (n.b., total sites and suites are ~4.4% lower than the comparable quarter in ’22). AMRs grew ~1.7% and ~0.5% QoQ for the Canadian residential and MHC portfolios, respectively (n.b., +8.2% and +3.3% YoY), driven by record turnover spreads of ~30%. Occupancy decreased slightly QoQ and YoY but remained quite strong at +98%.

Q4 Earnings | Operations (Empyrean; CAR)

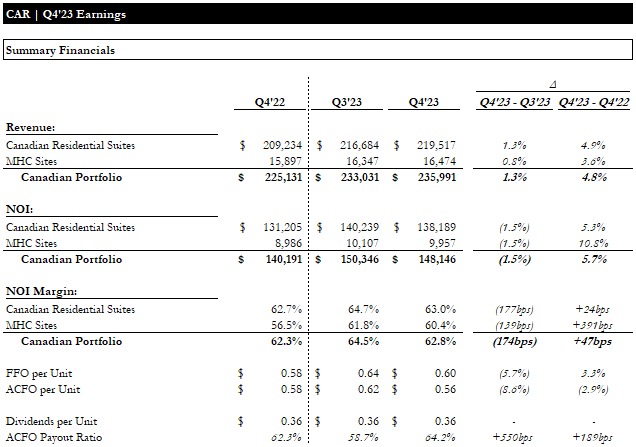

AMR growth was strong enough to offset the net loss of suite/sites and slightly lower occupancy, driving ~1.3% revenue growth QoQ. NOI declined QoQ slightly due to seasonally higher opex, but was up ~6% YoY with a slight margin increase and beat consensus estimates. Despite rising interest costs, FFO per unit increased ~3% YoY, though ACFO decreased ~3%. The payout ratio remains healthy at ~64%.

Q4 Earnings | Financials (Empyrean; CAR)

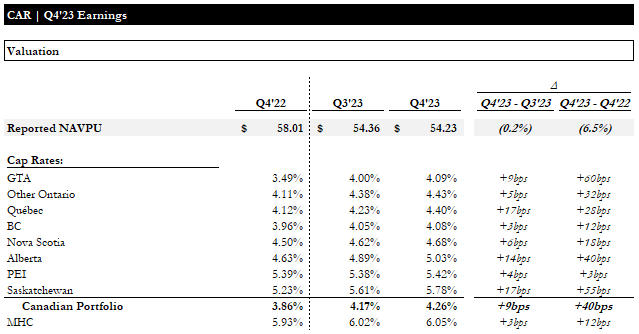

As expected, IFRS property values declined slightly due to cap rate expansion. Quebec, Alberta, and Saskatchewan saw the most significant cap rate expansions in the quarter. This drove a ~$0.13 decline in reported NAVPU.

Q4 Earnings | Valuation (Empyrean; CAR)

Overall, we view this as a positive quarter. The only new development we view as potentially concerning is the creation of a $400MM ATM program, which was filed on February 22. While management has historically demonstrated a shareholder-friendly approach to capital allocation (i.e., buybacks under the NCIB, capital recycling, etc.), we are wary of ATMs when prices are depressed. We prefer to see REITs tap equity markets when their shares or units trade well above NAV, as is the case for many industrial and single-family rental REITs. On the other hand, management may have done this in anticipation of positive market developments (i.e., lower rates, multiple expansion, opportunistic deals in a recession, etc.). This could signal a return to growth that may light a fire under the units, but we’re not ready to bank on it.

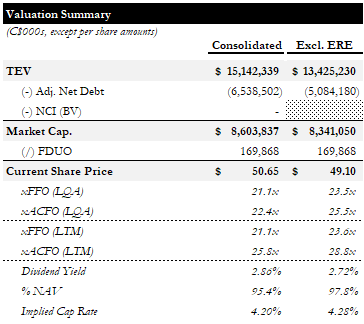

Valuation

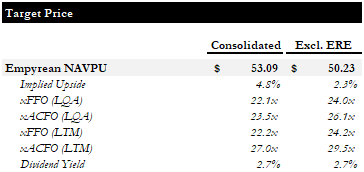

CAPREIT is now trading for 21.1x / 22.4x LQA FFO / ACFO and 21.1x / 25.8x LTM FFO / ACFO. Based on our updated NAVPU estimate, it is trading at a ~5% discount and ~4.2% implied cap rate. The “Excl. ERE” figures in the table below assume that for every CAPREIT share purchased, one sells 0.65 ERE shares to create a synthetic pure-play Canadian exposure (n.b., CAPREIT owns 65% of ERE). With ERE trading at fairly depressed levels, this trade is dilutive to valuation, and we, therefore, do not view it as an attractive alternative. Additionally, ERE offers a higher yield (n.b., ~7.2%), so the carrying cost of this position would be ~4.3%.

Valuation Summary (Empyrean; CAR)

Our updated target price fully credits our NAVPU estimate and implies a ~5% upside.

Target Price (Empyrean)

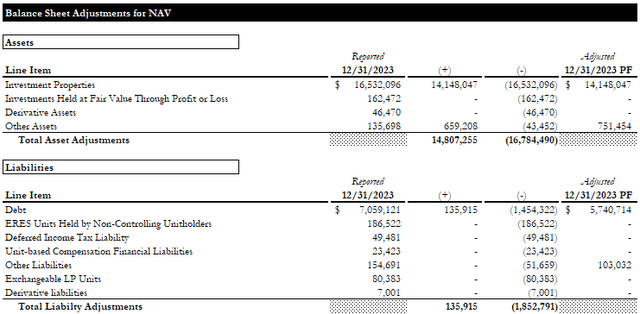

The principal balance sheet adjustments used to derive our NAV are shown in the table below.

Balance Sheet Adjustments (Empyrean; CAR)

Given the proximity to NAV, we expect the units to accrete value in line with operational performance, and we do not see a significant margin of safety. We continue to look for a lower valuation before getting bullish.

Alternative: Northview Residential REIT

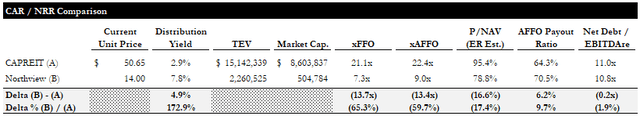

Within the Canadian multifamily REIT universe, Northview Residential REIT (OTC:NRRUF) (NRR.UN:CA) continues to be the cheapest, offering a highly asymmetric risk/return profile. You can read more about Northview in our latest article. Note that Northview’s figures in the table below are adjusted to reflect the full-quarter impact of its recent recapitalization transaction.

CAR / NRR Comparison (Empyrean; CAR; NRR)

Despite a ~40% rally since last December, Northview trades exceptionally cheap relative to CAPREIT. It yields ~7.8% (n.b., ~490bps premium to CAPREIT), ~7.3x / ~9.0x FFO / AFFO (n.b., +13x discount to CAPREIT), and a ~22% discount to NAV (n.b., ~17 point discount to CAPREIT). Before the recapitalization, Northview deserved a significant discount due to its higher capex intensity (n.b., many properties located in remote areas of Northern Canada), higher leverage, and unsustainable payout ratio. While the units have begun recovering, the discount persists due to low liquidity and sell-side coverage and a noisy Q3 that didn’t reflect the full impact of the recapitalization. Adjusting for the full-quarter impact of the recap, its payout ratio and leverage are comparable with Canadian multifamily peers. Our NAVPU estimate for Northview is ~$18 per unit, but it could trade materially higher if the market prices it on FFO/AFFO and/or yield.

Conclusion

We maintain our Hold rating on CAPREIT. While operational performance has remained solid, we believe there are far more attractive risk/return profiles within Canadian residential REITs, such as Northview Residential REIT. The current price’s proximity to our NAV estimate leads us to believe that unit performance over the short term should follow NOI and FFO growth (i.e., sector performance). We need to see more attractive valuations before getting bullish.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.