Authored by Michael Lebowitz by way of RealInvestmentAdvice.com,

Can famed traders Paul Tudor Jones and Stan Druckenmiller, who lately proclaimed they’re brief bonds, thus betting on increased yields, be mistaken? As an alternative of mindlessly assuming such legendary traders are appropriate, let’s do some homework.

First, although, let’s remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are identified for his or her aggressive buying and selling kinds. Due to this fact, we don’t know whether or not their bets are brief time period trades for a fast revenue, or longer-term bets on considerably increased yields. Furthermore, perhaps their detrimental bond commentary is simply “speaking their books” to get merchants and traders to observe them and enhance their income. Such a confirmed technique by well-known merchants could be a recipe for losses by those that attempt to mimic their trades.

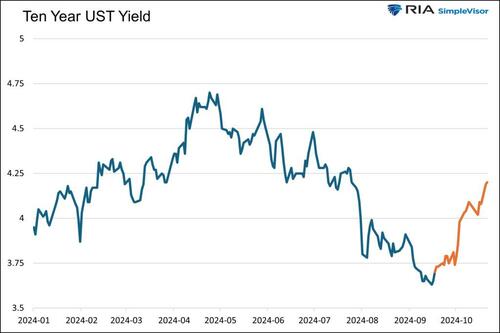

The latest 50-basis level enhance in longer-term yields began the day after the Fed lower charges by 50 foundation factors. Some bond bears declare the Fed will rekindle inflation by slicing charges whereas the economic system stays sturdy. Others worry that fiscal deficits are uncontrolled, resulting in inflation. An rising group of bond bears, led by Paul Tudor Jones and Stanley Druckenmiller, fear {that a} Donald Trump Presidency and Republican management of Congress will ramp up deficits, leading to excessive inflation.

Let’s tackle the market narratives and assess their credibility. Doing so will assist us resolve if following Paul Tudor Jones and Stanley Druckenmiller is a good suggestion.

Is One other Spherical Of Increased Inflation Probably?

Beneath is a overview of some potential causes of inflation bandied about by the inflationist crowd.

Will Excessive Inflation Reemerge

At its core, inflation is a perform of provide and demand. The 2022-2023 bout of excessive inflation occurred as a result of demand was grossly elevated by pandemic-related stimulus and strange shopper behaviors. On the identical time, the availability of many items was considerably curtailed by international lockdowns and crippled provide strains.

Each demand and provide have since normalized. If inflation rises, it is not going to be for a similar causes because the final spherical of inflation.

A Repeat Of the Seventies Is Within the Playing cards

Some traders argue that consecutive rounds of the Seventies-like inflation are inevitable.

That period and this period are very completely different, as we lately wrote in a four-part sequence. As an alternative of requoting from these articles, we share the hyperlinks (ONE, TWO, THREE, and FOUR).

“The 2020s aren’t the Seventies by any stretch of the creativeness!” – Half 4

Authorities Spending Will Increase Inflation

Paul Tudor Jones and plenty of others warn that uncontrollable federal deficits will enhance inflation. We may also tackle this matter within the Debunking Deficits part, however earlier than doing so, it’s value a fast lesson on an financial time period known as the detrimental multiplier. To take action, we share a piece from our article Stimulus Right this moment Prices Dearly Tomorrow:

As we be aware, debt rising quicker than financial progress proves that borrowing and spending are unproductive. Unproductive authorities debt or non-public sector debt additionally ends in a detrimental financial multiplier. Primarily, the last word expense of the debt outstrips its advantages over the long term.

Economists outline the multiplier impact because the change in revenue divided by the change in spending. Over an prolonged interval, if the change in spending is extra vital than the change in revenue, the impact of stated spending is detrimental. Change GDP for revenue and authorities debt for spending to compute the federal government’s spending multiplier.

Multiplier = Change Earnings / Change Spending

Authorities Multiplier = Change GDP / Change Debt Excellent

Backside line: authorities debt stimulates the economic system. Nevertheless, the debt detracts from progress over time, greater than offsetting the preliminary advantages. If you happen to assume the federal government is all of the sudden spending productively, then inflation might have an upward bias. Nevertheless, assuming the federal government continues to spend unproductively, increased deficits are deflationary and weigh on financial progress.

The U.S. Will Import Inflation

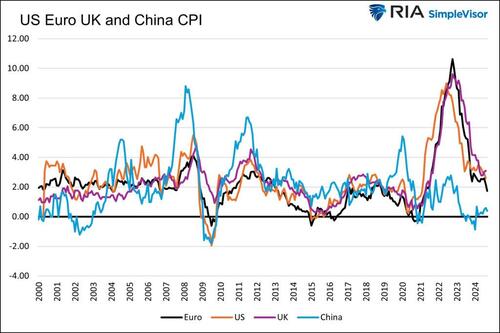

Some say we are going to import inflation. The primary graph beneath reveals that inflation within the Eurozone, China, and the U.Okay., three of our largest buying and selling companions, is falling alongside that of the US. China’s inflation is close to zero. Japan, not proven, has seen meager inflation with bouts of deflation for the final 25 years.

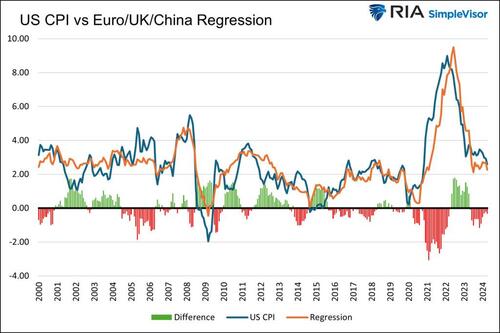

We additionally ran a a number of regression to forecast U.S. inflation based mostly on the inflation of China, the U.Okay., and the Eurozone. The second graph reveals a big correlation, with an r-squared of .86. Furthermore, the mannequin states that U.S. CPI must fall by 0.3% to align with the historic relationship.

Each charts result in the query of who we are going to import inflation from.

Debunking Deficits

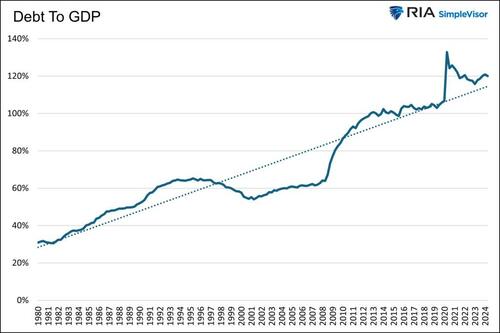

Earlier than we put context to the latest deficit spending, it’s vital to caveat that we imagine, and have written on many events, that the nation’s constant deficit spending and accumulating debt are a substantial headwind to financial progress. We, on no account, condone the latest deficit spending or the extreme spending for a lot of the final forty years. We’re additionally effectively conscious that nations with debt-to-GDP ratios above 1.0 haven’t fared effectively.

That stated, contemplating bond returns for the following yr or two, we should assess the state of affairs for what it’s at present and never let the narratives and hyperbole surrounding the market sway our decision-making.

We now overview just a few fashionable arguments claiming that the trajectory of deficits has modified significantly, and the change is inflationary.

Latest Spending Is Obscene

A standard argument from the rising bond bears is that latest deficits are obscene in comparison with previous ones. Accordingly, bond bears assume these elevated deficits shall be inflationary and require increased yields to fulfill Treasury traders.

Whereas that could be true, the argument lacks context. They fail to say that the economic system has grown considerably over the previous couple of years.

The economic system is about $8 trillion, or 33%, bigger than it was on the eve of the Pandemic. Due to this fact, it’s not stunning the quantity of debt has grown commensurate with that quantity.

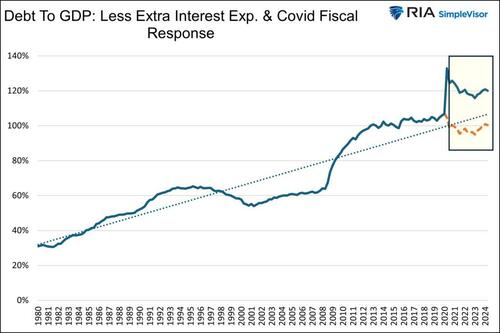

The graph beneath reveals the debt-to-GDP ratio and its development line since 1980. After the ratio jumped increased on huge COVID-related spending, it settled down barely above the place it was earlier than the Pandemic. Moreover, it has been flat for the final two years.

Now, let’s take the evaluation one step additional and theoretically calculate what the present debt progress would seem like had the Pandemic by no means occurred. We admit that this isn’t a standard strategy to assess debt, however it does present distinctive context on the debt excellent in comparison with GDP.

To do that, we scale back the debt by the estimated $5.6 trillion spent on COVID reduction. Moreover, we assume the curiosity expense of the Treasury debt would have stayed on the pre-inflation development. For perspective, this cuts roughly $500 billion of added curiosity expense prior to now yr.

The graph beneath reveals the revised debt to GDP in orange. May or not it’s honest to say that with out the Pandemic, present debt issuance can be on par with pre-pandemic debt to GDP ranges given the economic system’s dimension? Moreover, regardless of the pandemic, spending, debt, and GDP progress have primarily been aligned for the final two years.

Deficit Spending Will increase The Cash Provide

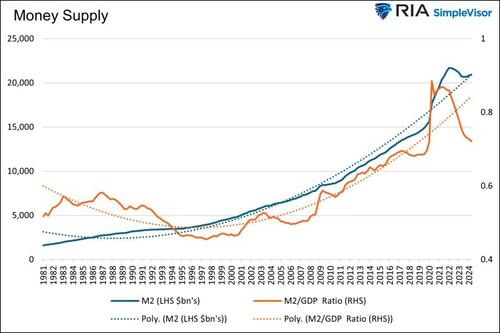

Cash is lent into existence. Such is a truth; subsequently, bigger deficits (borrowing) enhance the cash provide. Nevertheless, because the graph beneath reveals, the cash provide (M2) is on the pre-COVID development. Extra importantly, M2 as a ratio of GDP, a greater measure of cash provide, is decently beneath the pre-COVID development.

Additionally, for consideration, the availability of cash is barely a part of the inflation equation. The opposite vital half is the rate of cash, or how usually it’s spent. Presently, the rate of M2 is on the identical degree as firstly of 2020.

The availability and velocity of cash have erased the pandemic-related anomalies and are just like the place they stood in late 2019. At the moment, inflation was persistently operating at 2%. The present provide and velocity of cash mustn’t lead one to imagine that inflation is ready to extend. If something, the figures argue that inflation will return to the Fed’s 2% goal.

We Are Following Japan’s Path

Paul Tudor Jones mentions a similarity between our fiscal state of affairs and Japan’s. He refers to Japan’s extreme authorities debt and its central financial institution, which retains rates of interest terribly low to assist service the debt.

Japan has a debt-to-GDP ratio of 263%, greater than twice that of the U.S. Its central financial institution has set rates of interest at or beneath zero and relied on huge quantities of Q.E. for the final 20 years. The result’s longer-term bond yields, as proven beneath, of two% or much less and sub-1 % inflation with extended intervals of deflation.

Following Japan’s path appears awfully bullish strictly from a bond holder’s perspective.

Extra From Jones

Paul Tudor Jones additionally believes that inflating away the debt is the one strategy to resolve the problem with out taking strict fiscal steps. Possibly he is aware of one thing we don’t, however Japan proves that’s not essentially the case, not less than not but.

Jones additionally feedback that we have to “get to the purpose the place we stabilize debt to GDP to the place it’s proper now.” As we confirmed earlier, the debt to GDP is secure and never rising.

Donald Trump and a Republican Sweep

Paul Tudor Jones and Stanley Druckenmiller voice concern over inflation and bond yields if Donald Trump turns into the President and the Republicans sweep Congress.

Let’s take their assumption a daring step additional and assume Donald Trump instantly makes an attempt to chop taxes, spend like loopy, and rack up huge deficits. Even so, he should take care of Democrats, who will nonetheless have practically 50% of the votes in Congress, and the Republican Freedom Caucus, which desires to curtail authorities spending and stability budgets. The Caucus and Democrats may very well be unusual bedfellows in that circumstance.

Abstract

The bearish arguments we talk about on this article have advantage. Nevertheless, when taken in correct context, we imagine a few of them usually are not as worrying because the headlines could seem. Additional, as we see in Japan, there’s fairly seemingly extra financial coverage runway earlier than issues escalate.

We imagine the slowing financial progress and decrease inflation traits that endured earlier than the Pandemic are reasserting themselves. It could sound ridiculous at present, however we wouldn’t be shocked if traders and the Fed have been once more fearful about deflation within the coming years.