tadamichi

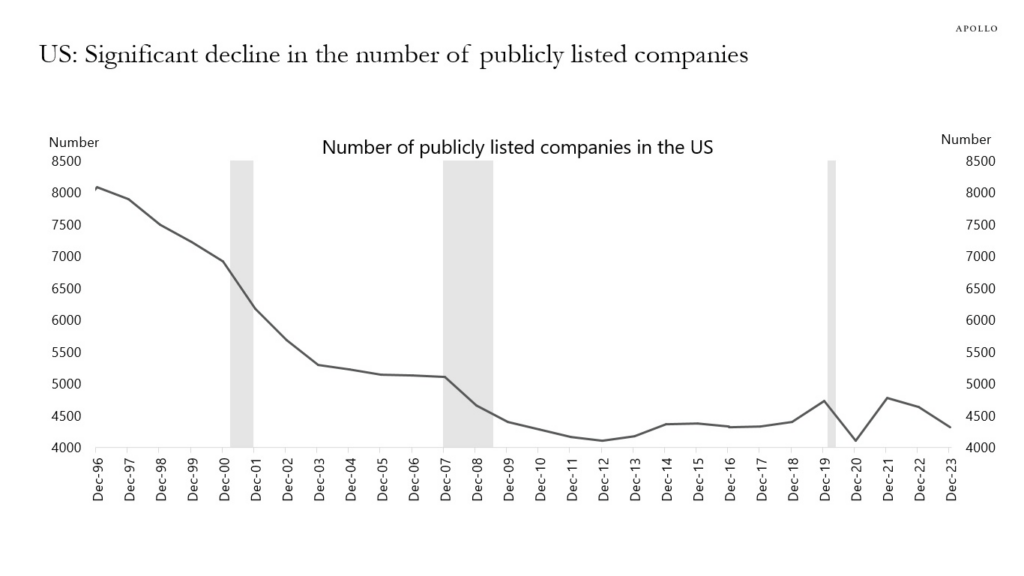

Over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) shares have dominated market returns. The query is whether or not that dominance will proceed and if the identical firms stay the leaders. It’s an attention-grabbing query. The variety of publicly traded firms continues to say no, as proven within the following chart from Apollo.

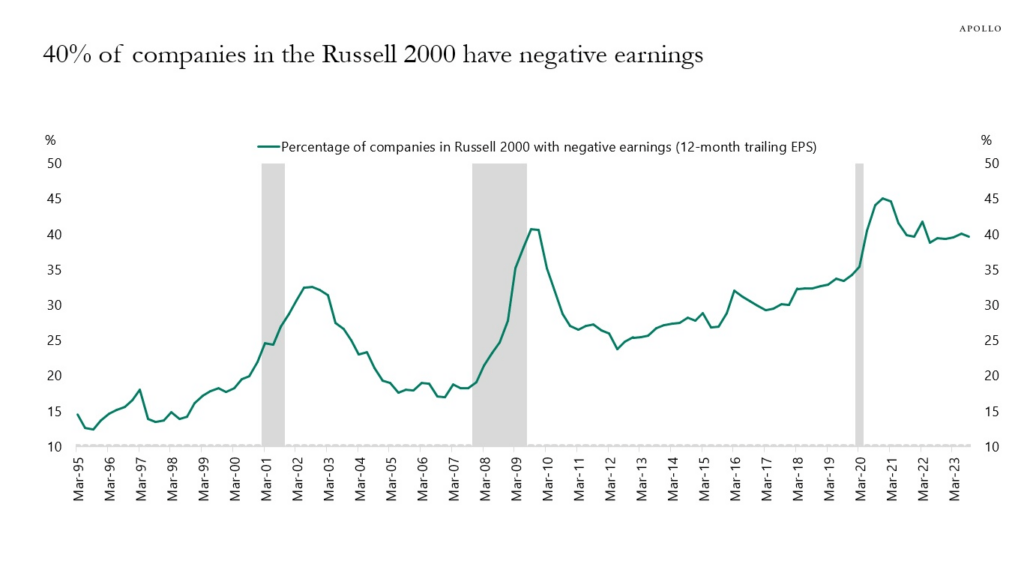

This decline has many causes, together with mergers and acquisitions, chapter, leveraged buyouts, and personal fairness. For instance, Twitter (now X) was as soon as a publicly traded firm earlier than Elon Musk acquired it and took it personal. Unsurprisingly, with fewer publicly traded firms, there are fewer alternatives as market capital will increase. Such is especially the case for big establishments that should deploy massive quantities of capital over quick intervals. With almost 40% of the businesses within the Russell 2000 index presently non-profitable, the alternatives are restricted even additional.

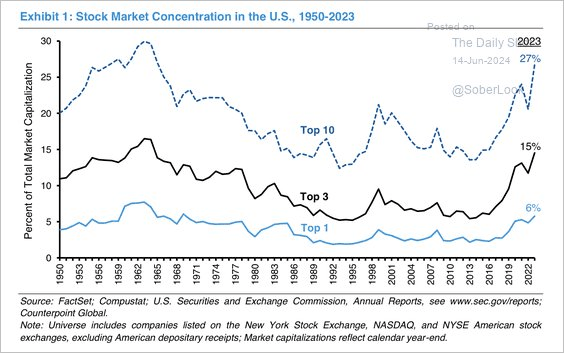

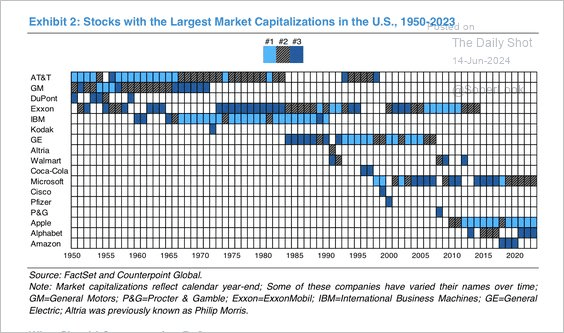

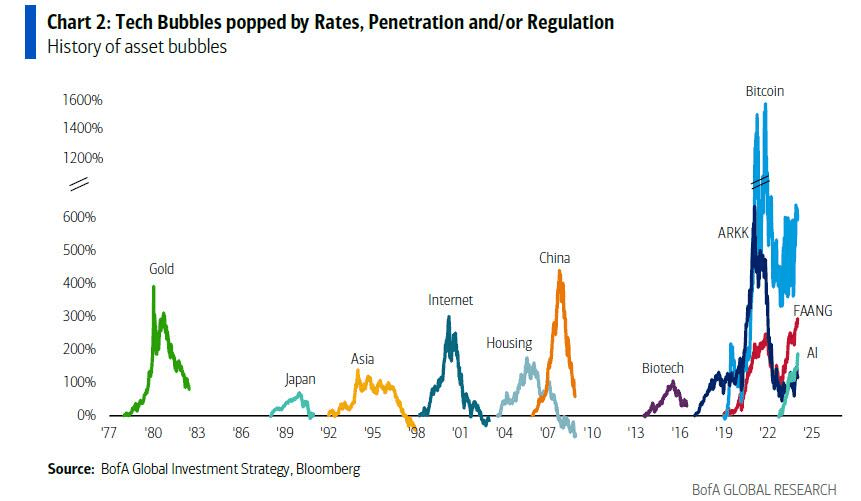

Nonetheless, this era’s focus of market capitalization into a couple of names will not be distinctive. Within the Nineteen Sixties and Nineteen Seventies, it was the “Nifty 50.” Then, within the late ’90s, it was the “Dot.com” darlings like Cisco Methods (CSCO). At the moment, it’s something associated to “Synthetic Intelligence.”

As proven, the leaders of the previous should not at this time’s leaders. Notably, Nvidia (NVDA) will get added to the listing of the biggest “mega-cap” firms for the primary time in 2024.

Nonetheless, traders should determine whether or not Microsoft (MSFT MSFT:CA), Apple (AAPL, AAPL:CA), Google (GOOG, GOOGL), and Amazon (AMZN, AMZN:CA) will stay the leaders over the approaching decade. Simply as AT&T (T) and GM (GM) had been as soon as the darlings of Wall Road, at this time’s Know-how shares might grow to be relics of the previous.

Earnings Progress

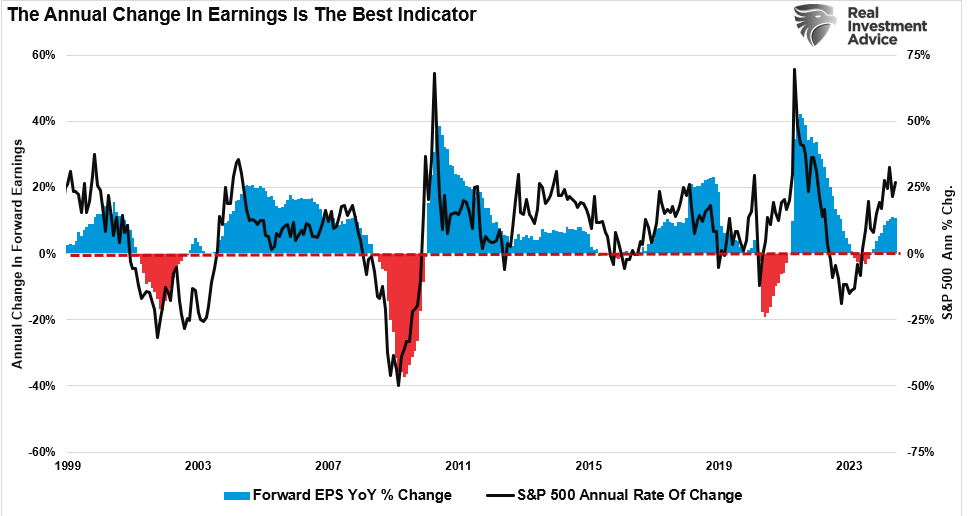

One main determinant in answering that query is earnings development. As needs to be apparent, traders are prepared to pay greater costs when company earnings are rising.

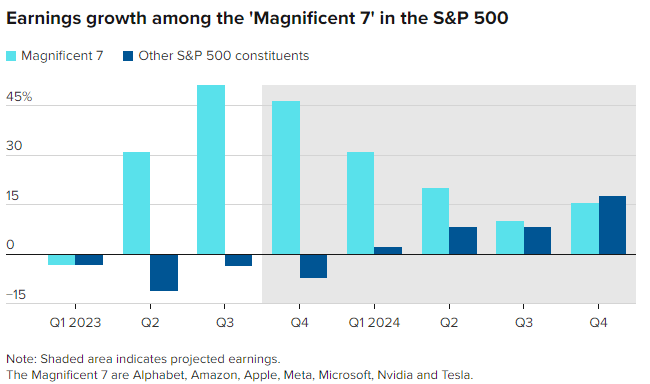

The issue is that in 2023, all of the earnings development got here from the index’s top-7 “mega-capitalization” shares. The S&P 500 (SPX) would have had damaging earnings development excluding these seven shares. Such would have seemingly resulted in a extra disappointing market end result. Notably, whereas analysts are optimistic that earnings development for the underside 493 shares will speed up into the top of 2024, with financial information slowing, these hopes will seemingly be dissatisfied.

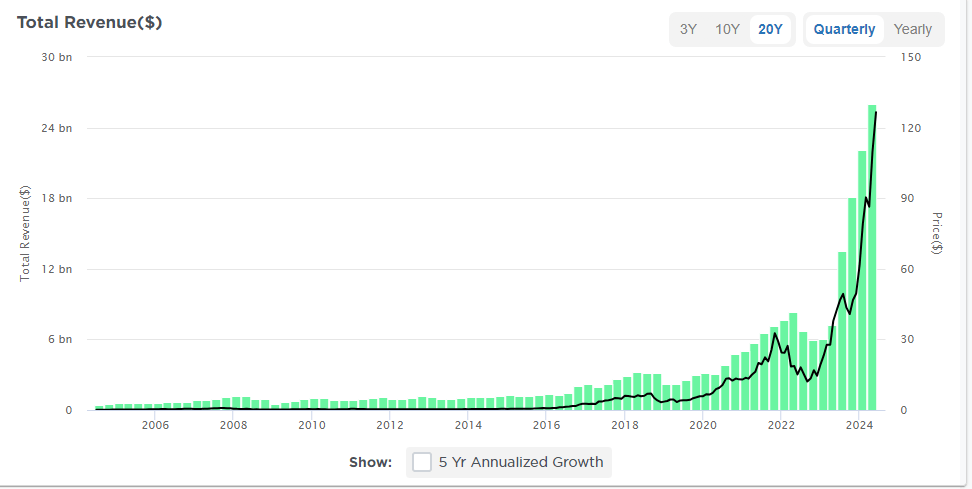

Over the subsequent decade, firms like Microsoft, Apple, and Alphabet will face the problem of rising revenues quick sufficient to maintain earnings development charges elevated. On condition that Nvidia is a comparatively younger firm in a fast-growing trade, it has been in a position to enhance revenues sharply to help greater valuation multiples.

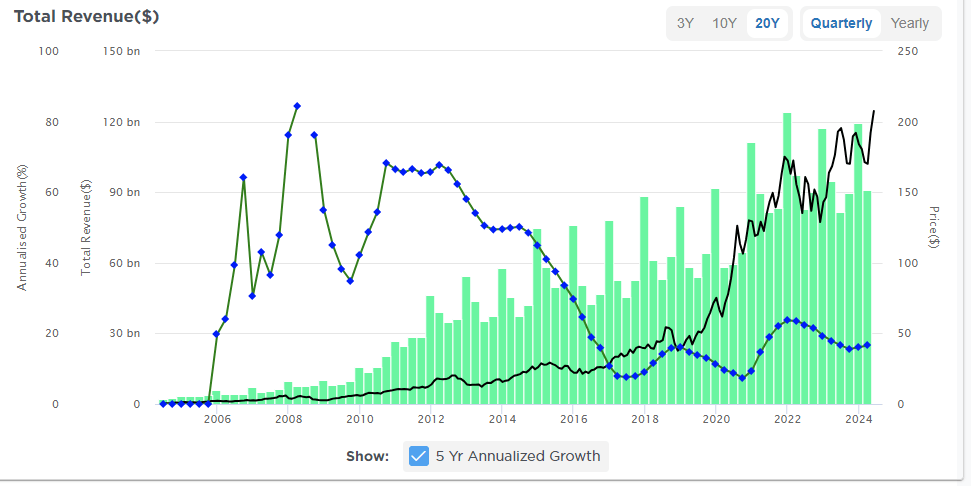

Nonetheless, Apple, a really mature firm, can not develop revenues at such a excessive fee. Such is just due to the legislation of huge numbers. I’ve included a 5-year annualized development fee of revenues as an instance the problem higher.

That’s the place the Wall Road axiom “Timber don’t develop to the sky” comes from.

In investing, it describes the hazard of maturing firms with a high-growth fee. In some instances, an organization with an exponential development fee will obtain a excessive valuation primarily based on the unrealistic expectation that development will proceed on the similar tempo as the corporate turns into bigger. For instance, if an organization has $10 billion in income and a 200% development fee, it’s straightforward to assume it should obtain 100s of billions in income inside a couple of quick years.Nonetheless, the bigger an organization turns into, the harder it turns into to realize a high-growth fee. For instance, a agency with a 1% market share may shortly obtain 2%. Nonetheless, when a agency has an 80% market share, doubling gross sales requires rising the market or coming into new markets the place it isn’t as sturdy. Companies additionally are likely to grow to be much less environment friendly and revolutionary as they develop as a result of diseconomies of scale.

Because of this, a lot of at this time’s high market-capitalization weighted shares will not be the identical in a decade. Simply as AT&T is a relic of yesterday’s “new know-how,” such could also be true with Apple a couple of years from now when nobody wants a “smartphone” anymore.

Passive Investing’s Influence

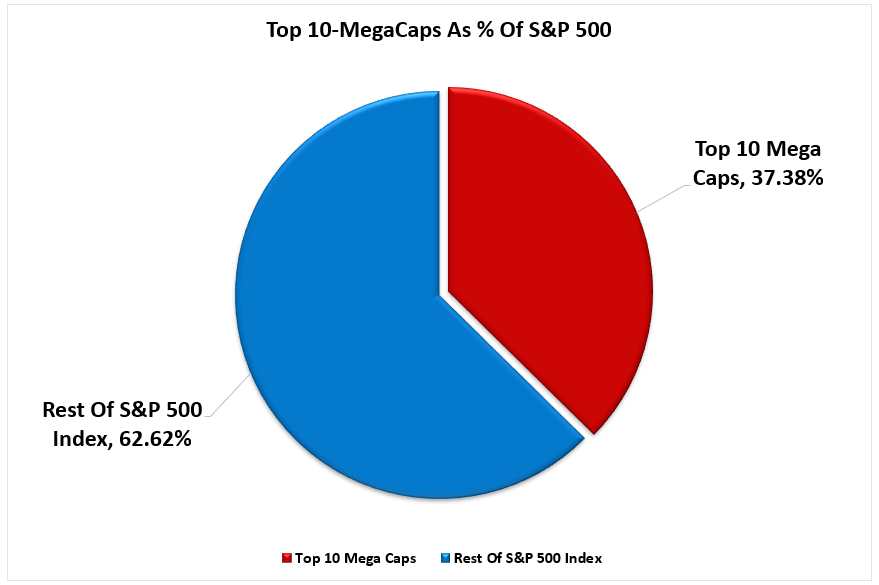

During the last twenty years, the rise of passive investing has been one other attention-grabbing change within the monetary markets. As mentioned beforehand, the top-10 “mega-capitalization” shares within the S&P 500 index comprise greater than 1/third of the index. In different phrases, a 1% achieve within the high 10 shares is similar as a 1% achieve within the backside 90%. As traders purchase shares of a passive ETF, the ETF should buy the shares of all of the underlying firms. Given the large inflows into ETFs over the past 12 months and subsequent inflows into the highest 10 shares, the mirage of market stability is no surprise.

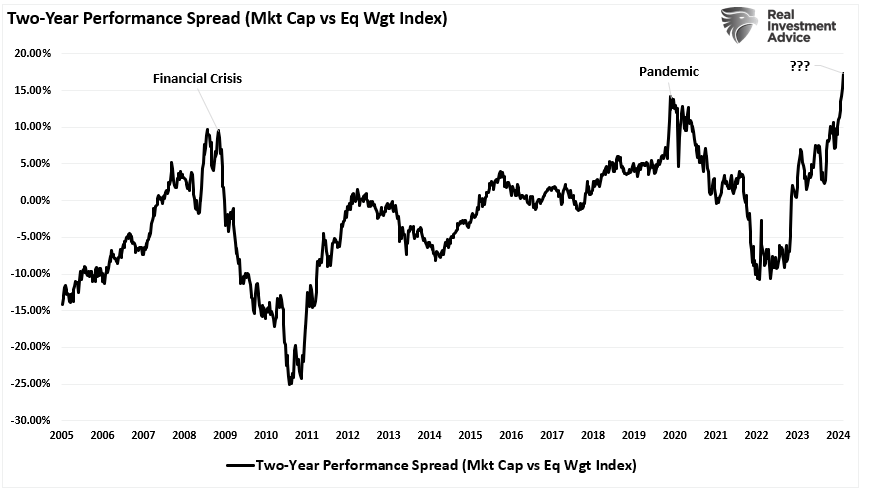

Unsurprisingly, the pressured feeding of {dollars} into the biggest weighted shares makes market efficiency seem extra sturdy than it’s. That can be why the S&P 500 market-capitalization weighted index has outperformed the equal-weighted index over the previous few years.

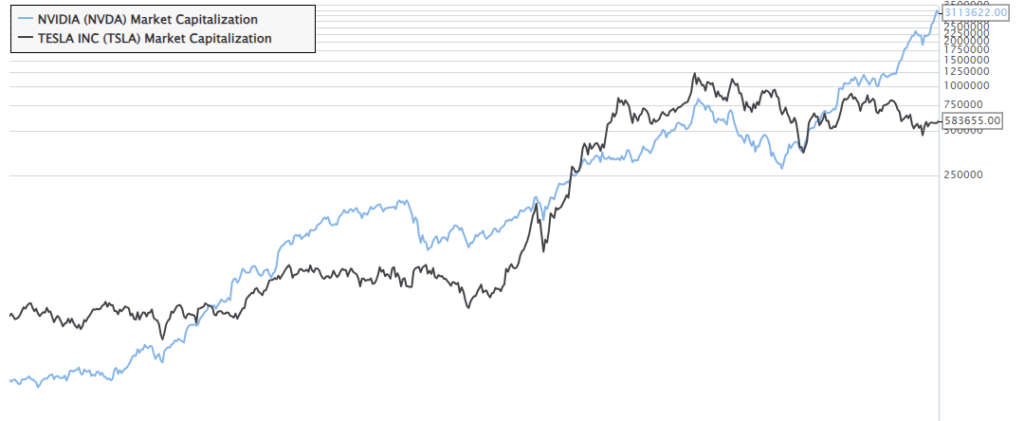

Traders usually overlook this double-edged sword. For instance, let’s assume that Tesla ([[TSLA], TSLA:CA) was 5% within the S&P 500 index earlier than Nvidia entered the highest 10. As Nivida’s fast share value elevated its market capitalization, Tesla’s was diminished as its inventory value fell. Due to this fact, all index funds, passive fund managers, portfolio managers, and many others., needed to enhance their weightings in Nvidia and scale back their possession in Tesla.

Sooner or later, regardless of the subsequent technology of firms garners Wall Road’s favor, the present leaders might fall out of the highest 10 because the “passive” flows require extra promoting of at this time’s leaders to purchase extra of tomorrow’s.

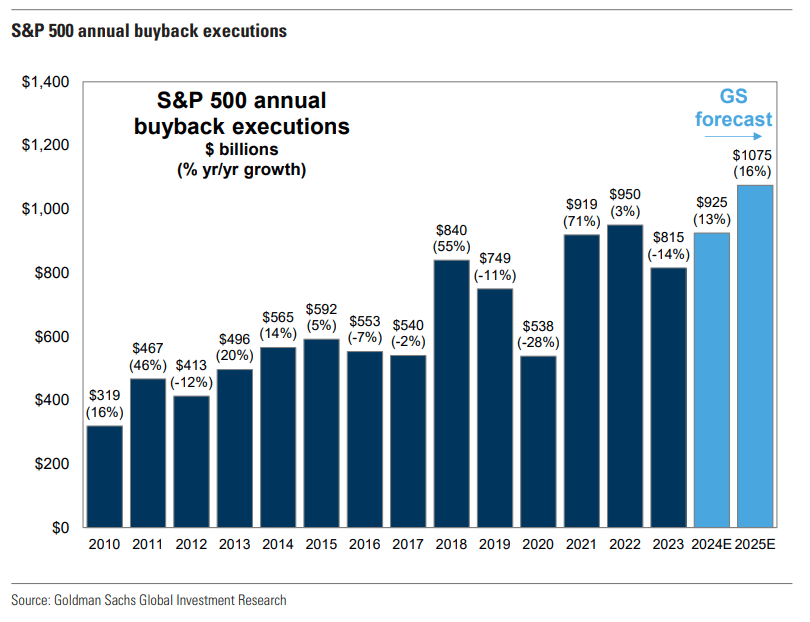

Share Buybacks

Lastly, company share buybacks, anticipated to method $1 trillion and exceed that in 2024, might weigh on present management. That’s as a result of the biggest firms with the money to execute massive multi-billion greenback packages, like Apple, Microsoft, Alphabet, and Nvidia, dominate buybacks. For instance, Apple alone will account for over 10% of 2024 buybacks.

When you don’t perceive the significance of share buybacks in sustaining the biggest firms’ present market dominance, right here is a few primary math.

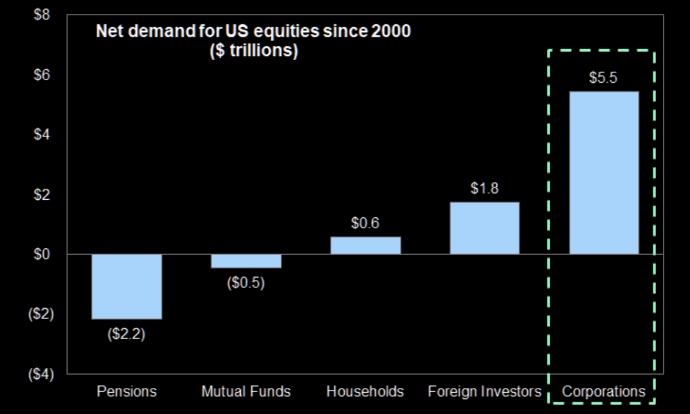

- Pensions and MF = (-$2.7 Trillion)

- Households and International = +$2.4 Trillion

- Sub Complete = (-$0.3 Trillion)

- Firms (Buybacks) = $5.5 Trillion

- Internet Complete = $5.2 Trillion

In different phrases, since 2000, companies have supplied 100% of all the web fairness shopping for.

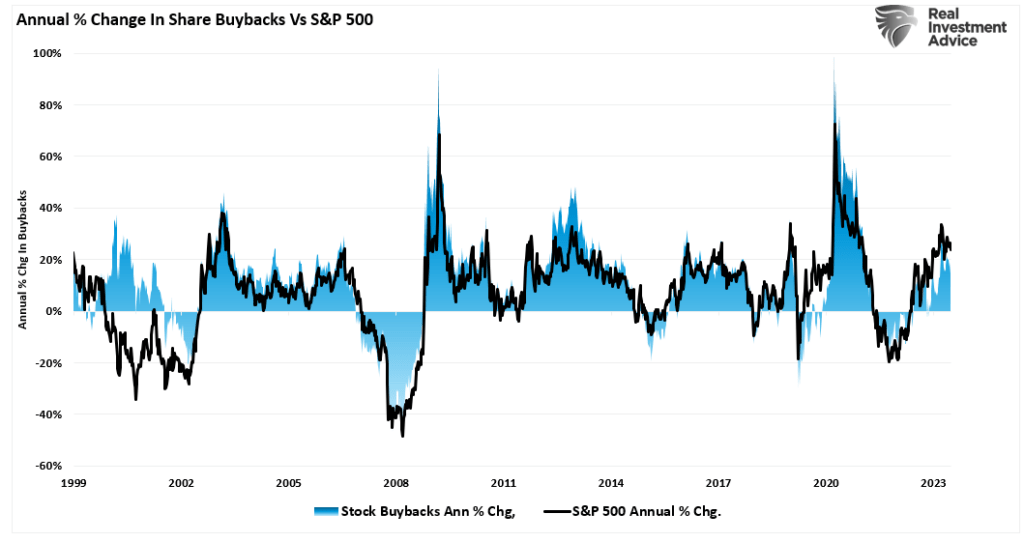

Due to this fact, it needs to be unsurprising that there’s a excessive correlation between the ebbs and flows of company share buybacks and market efficiency.

Due to this fact, so long as companies stay the highest patrons of their shares, the present dominance of the “Mega-caps” will proceed. After all, there are causes the present fee of company share repurchases will finish.

- Modifications to the tax code

- A ban on share repurchases (they had been beforehand unlawful as a result of their means to control markets)

- A reversal of profitability, making share repurchases onerous.

- Financial recession/credit score occasion the place companies go on the defensive (i.e., 2000, 2008, 2022)

Regardless of the purpose, the eventual reversal of buyback packages might severely restrict the present chief’s market dominance.

I’ve no clue what occasion causes such a reversal or when. Nonetheless, a reversal might undo mega-cap dominance since company share buybacks have supplied all the web fairness shopping for for the biggest shares.

Conclusion

The present dominance of the biggest “Mega-capitalization” firms is unsurprising. As famous, they make up the majority of earnings development and revenues of the S&P 500 index, the biggest purchasers of their shares. These are additionally the identical firms in the midst of the present “Synthetic Intelligence” revolution, as has been the case for the final decade.

Nonetheless, given the velocity at which know-how and the economic system quickly change, such means that leaders of the final decade will not be the leaders of the subsequent.

As traders, it’s important to know the dynamics of every market cycle and make investments accordingly. Nonetheless, these shopping for shares at this time at a number of the most excessive valuations we’ve got seen over the past century and anticipating these shares to dominate over the subsequent decade may very well be dissatisfied.

Many variables help the present secular bull market cycle. Nonetheless, as has been the case all through historical past, a myopic method to investing has led to poor outcomes.

Make investments accordingly.

Authentic Submit

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.