Dazman/E+ via Getty Images

Vale (NYSE:VALE) is scheduled to announce Q3 earnings results on Thursday, October 27th, after market close.

The consensus EPS Estimate is $0.55 and the consensus Revenue Estimate is $10.16B (-19.9% Y/Y).

Over the last 3 months, EPS estimates have seen 0 upward revisions and 4 downward. Revenue estimates have seen 0 upward revisions and 3 downward.

The miner said its Q2 earnings fell sharply from a year earlier, smacked by declining iron ore and copper prices at the end of the quarter but partially compensated by higher iron ore sales. Its average realized iron ore sales price fell 31% Y/Y to $113.30/metric ton, while free-on-board cash costs rose 11% due to more expensive fuel and exchange-rate swings.

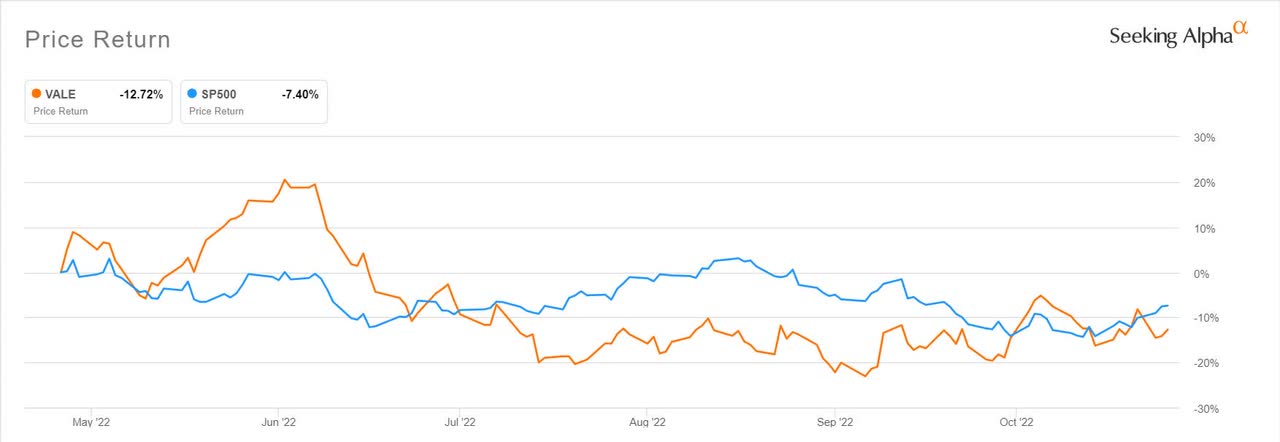

The latest quarter has seen shares take a tumble amid weakness in metal prices. Iron ore prices hit their lowest level in the year amid a gloomy outlook for global steel demand. Copper prices too plummeted to their lowest in nearly two months in September, weighed by the strong dollar and fears of a recession that would hurt demand for industrial metals.

Investors will look out for guidance amid weak iron and copper prices, despite Vale seeing a pickup in production.

Earlier this month Vale (VALE) reported Q3 iron ore production rose more than expected while nickel output soared as refineries resumed operations. Production edged up 1.1% Y/Y but jumped 21% Q/Q to 89.7M metric tons and beat the 87.2M-ton average estimate among analysts tracked by Bloomberg.

Q3 nickel production surged 71.5% to 51.8K metric tons, as refineries resumed after a maintenance period, but nickel sales gained just 6%.

Vale (VALE) is now reconsidering a near-term spinoff of its base metals business and an eventual public listing, ring-fencing the copper and nickel unit from the iron ore business.