clearstockconcepts/iStock Unreleased through Getty Pictures

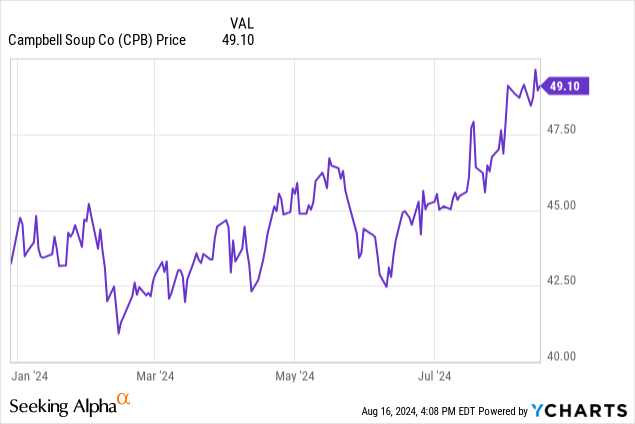

In January, I wrote an article about Campbell Soup Firm (NYSE:CPB), specializing in the corporate’s broad pursuits in meals and snacks aside from soup. Since that point, the corporate has risen in value virtually 14%.

As we speak, I wish to revisit Campbell Soup’s worth on the larger value, and after they accomplished the acquisition of Sovos Manufacturers in March for $23 per share. The deal price about $2.7 billion, however provides Campbell Soup entry to the precious Rao’s model in a bid for synergies that they are saying they anticipate will save round $50 million over the subsequent two years.

Price financial savings are properly and good, however the actually compelling a part of the Sovos Manufacturers acquisition is that it makes Campbell Soup a significant participant within the sauce market. Model power is a crucial a part of Campbell Soup’s worth, and this has given them a good stronger presence.

Consolidated Stability Sheet

Money and Equivalents | $107 million |

Complete Present Belongings | $2.1 billion |

Complete Belongings | $15.2 billion |

Complete Present Liabilities | $3.4 billion |

Lengthy-Time period Debt | $5.7 billion |

Complete Liabilities | $11.3 billion |

Complete Shareholder Fairness | $3.9 billion |

(supply: most up-to-date 10-Q, SEC)

Since I wrote the final article, Campbell Soup has seen a rise in debt from each its short-term and long-term borrowings. That’s comprehensible as a result of they simply made a giant acquisition. The corporate’s debt shouldn’t be inconsequential, however the firm has been regular earnings with some progress on the horizon, so it’s not so large that it makes for a severe concern going ahead.

The corporate trades at a value/ebook worth of three.73 at current, which is a little bit of a premium, however given the corporate’s legendary model names, I really feel it’s a justifiable premium.

The Dangers

Not that Campbell Soup’s acquisition of Sovos Manufacturers doesn’t include some dangers. They guess fairly a bit of cash on the worth of the Rao’s model of sauces, and what cash may be produced from their very own mixed sauce division. However there isn’t any assure that they are going to be capable of execute on this plan correctly, or that buyers shall be supportive of that.

Studies are that inflation has been cooling off a bit, but it surely nonetheless poses a threat to harm the underside line if the price of the corporate’s uncooked materials continues to rise, or in the event that they should attempt to go on elevated prices to the shopper.

As talked about earlier than, model worth is a big a part of Campbell Soup’s value, and that’s as a result of these manufacturers imply one thing to prospects. Something that occurs to weaken the general public notion of Campbell Soup’s manufacturers, or something that enables a competitor to surpass them, may very well be a threat.

And competitors throughout the array of various meals and snacks Campbell Soup gives is important. This raises dangers of getting to compete on value, which may very well be a drag on margins.

Assertion of Operation: An Estimate of Development

2021 | 2022 | 2023 | 2024 (9 months) | |

Web Gross sales | $8.48 billion | $8.56 billion | $9.36 billion | $7.34 billion |

EBIT | $1.54 billion | $1.16 billion | $1.31 billion | $923 million |

Web Earnings | $1.00 billion | $757 million | $858 million | $570 million |

Diluted EPS | $3.29 | $2.51 | $2.85 | $1.91 |

(supply: most up-to-date 10-Ok and 10-Q from SEC)

Campbell Soup has been steadily rising its gross sales yr to yr, and after the acquisition of Sovos Manufacturers, there’s each purpose to anticipate that to proceed. The present estimates are that 2024 will are available at $9.66 billion with earnings per share of $3.08, and in 2025 that can develop to $10.54 billion and $3.24 per share.

That offers us a P/E ratio of round 15.91, and a ahead P/E ratio of 15.12. That’s not unhealthy for a corporation that instructions such a robust presence throughout the American grocery store and has excessive hopes after the Sovos Manufacturers deal.

The corporate continues to pay an inexpensive dividend at 37¢ per quarter. That could be a dividend of a little bit over 3% and Campbell Soup earnings proceed to be lots to keep up the payout.

Conclusion

Campbell Soup was very interesting again in January, and after the inventory elevated virtually 14% in worth, I’m going to keep up a purchase ranking on it on the grounds that the Sovos Manufacturers buyout went by way of with out a hitch and should proceed to permit Campbell Soup to be a robust participant within the sauce market.

I really feel that the inventory nonetheless has room to extend in value going ahead, if at a bit slower price than it did earlier than. To see an actual surge in costs, the corporate actually must make itself the go-to model names for sauces. That’s the corporate’s future.

I’d hold an in depth eye on Campbell Soup’s acquisitions in the event that they begin to attempt to purchase too many firms, as that will put them at a threat of taking over an excessive amount of debt in doing so. Hopefully, the corporate can stay disciplined and solely purchase firms that actually make sense to their bigger total technique.