Luis Alvarez

Finding Pockets of Opportunity in Uncertain Markets

John P. Calamos, Sr., Founder, Chairman, and Global Chief Investment Officer

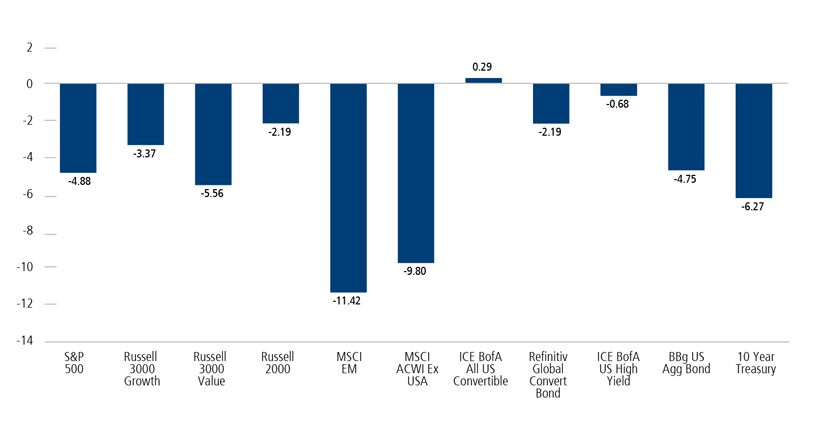

Capital markets struggled through another volatile quarter as investors worried about Fed tightening, inflation, recession, and geopolitical conflict. A mid-quarter rally raised hopes, only to give way to renewed turmoil when markets careened in the wake of worse-than-expected inflation data and the Fed’s third consecutive 0.75% rate hike in September. As the Fed dug into its tightening cycle and global central banks followed suit, the yield of the US 10-year Treasury touched 4% for the first time since 2010. Volatility surged even more during the final days of the quarter, as global economic anxiety intensified, and stock and bond markets were rattled by a surprise move by the UK government to encourage growth.

Asset Class Performance: 3Q 2022 Total Return %

Source: Morningstar. Past performance is no guarantee of future results.

There are times when macro or geopolitical concerns—such as Fed policy, inflation, or the war in Ukraine—drive most of the market’s activity. This is the sort of the environment we find ourselves in today. The US economy is holding up better than the headlines may indicate, but we expect heightened volatility as markets seek clarity about whether a recession is indeed on the horizon or has perhaps already begun.

Investing through periods of rapid change is never easy, but it’s important to maintain long-term perspective. For example, a 4% yield on the 10-year Treasury feels ominous to many people today and is significantly higher on a percentage basis from its pandemic lows, but it’s far less disconcerting relative to its long-term history.

That said, we remain highly attuned to potential risks—monetary policy errors and geopolitics are top of mind and so is fiscal policy. The impact of US midterm elections will be highly consequential for the markets and an economy at a crossroads. Regulations that unduly disincentivize entrepreneurial activity create headwinds that may be felt by businesses first but eventually ripple over to households. Similarly, policies that encourage unchecked and excessive demand without a corresponding increase in supply ultimately come home to roost, including in the inflation we see today.

Despite the challenges and uncertainties, in the end and over the long term, fundamentals win out. Recognizing this, our teams continue to focus on security analysis and managing fundamental risks. They are looking through the short-term noise to identify pockets of opportunity—including among innovative companies with quality fundamentals, those in thematic niches, and those that can demonstrate long-term resilience regardless of the macro backdrop. In a rising interest rate environment, P/E multiples can come down even if earnings are good, so our teams remain particularly mindful to valuations.

Thoughts on Asset Allocation

The “new normal” of the past decade was characterized by stable but low growth, low inflation and, therefore, very low rates. In a zero interest rate environment, the traditional 60% / equity 40% fixed income asset allocation came up short, leading many investors to seek out the “bond surrogate trade” to create some yield. Now that interest rates have risen and are more likely to remain high, it makes sense to ask if we are returning to the “old normal”—built around owning stocks for capital appreciation and bonds for yield. Certainly, we see traditional fixed income as becoming more important in asset allocation. Because managing interest rate risk within fixed income allocations is paramount, we see especially attractive tailwinds for short-term bonds as interest rates continue to adjust upward.

Asset allocation is always evolving, and today investors have new alternatives to consider for “old normal” type problems. There are new approaches for investors to consider. For example, we believe the case for establishing or increasing allocations to liquid alternatives remains strong, to complement either traditional fixed income or equity allocations. (To learn more, see our fixed income alternative, Calamos Market Neutral Income Fund, and our equity alternatives, Calamos Phineus Long/Short Fund and Calamos Hedged Equity Fund.)

Returning to traditional asset classes, we also see opportunities in the small and mid cap segment of the market. Many small and mid cap stocks provide a compelling blend of fundamental strength and valuations with healthy upside potential. Convertible securities, which are often issued by small cap and mid cap companies, offer another way to tap into this opportunity—with fixed-income characteristics providing the potential advantage of downside equity risk mitigation.

In the commentaries below, our teams share more details about where they are finding opportunities—in the areas I’ve mentioned above as well as elsewhere across asset classes. We have strong conviction in our proprietary research and processes, and we thank you for your continued trust.

The Road to Price Stability Is Paved with Unstable Prices

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

Most investors will agree that the path of inflation will dictate the direction of financial markets into 2023. Disinflation will almost certainly lead to higher equity and bond prices including improved prospects for the US economy.

Two key arguments support this. The first is history itself, which highlights that an inflection in the inflation cycle is commonly coincident with the direction of equity prices. The second is Fed policy. Today, investors fear the Federal Reserve because they know that the Federal Reserve fears inflation.

We are firmly in the disinflation camp and believe the inflation surge of the past five quarters will reverse symmetrically over the next four to five quarters. Pricing pressures are easing broadly, in some places modestly but decisively in others.

Markets appear to agree with our assessment, with the bond market anticipating inflation to fall to 2% in 12 months*. Should we trust the bond market, which is telling us that the US economy will weaken enough or inflation will fall hard enough to allow the Fed to shortly end its tightening cycle? Or should we trust the statements of Fed policymakers? History has shown that the bond market is more right on future Fed policy then Fed policymakers themselves.

If the Fed is unwilling to acknowledge the easing inflation pressures, what exactly is it looking for? We expect Chairman Powell to shortly intimate that employment conditions are key to its thinking. Another measure that will impact Fed thinking is the inflation expectations embedded in bond markets. The 5-year forward inflation expectation peaked at 3.7% in March. It ended September at 2.4%, only slightly above the 2% trend of the pre-pandemic era. If this figure declines to below 2%, we think the Fed will admit “enough is enough.”

The likelihood is that these debates will largely be resolved by November. Between now and then, investors should be positioned for heightened volatility. Yet corporate profitability remains resilient and valuation excesses have been wrought out of most stocks. Investor sentiment is at negative extremes, highlighting that much of today’s concerns are “in the price.”

Importantly, we do not see incremental policy tightness by the Fed, which implies the bad news on the policy side is almost certainly priced into markets. Traditional analysis implies we will not see the economic consequences of this tighter policy until much later in 2023. This creates a window of opportunity for investors starting at some point in October and lasting until sometime next spring.

*After peaking at 6% in March, the 1-year inflation forward contract has fallen to 2.4%. Source: Bloomberg

Alternatives Fund Update: Calamos Market Neutral Income Fund, Calamos Hedged Equity Fund

Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX)

Eli Pars, CFA

Calamos Market Neutral Income Fund is designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on interest rates.

We actively manage allocations to the strategies based on our view of market conditions and relative opportunities. The fund ended the quarter with 51% in hedged equity and 49% in arbitrage, which is in line with where we started the quarter at 52% in hedged equity and 48% in convertible arbitrage.

Currently, the composition of the arbitrage strategy is roughly the same as it was at the start of the quarter. Convertible arbitrage represents the largest allocation at 37% of the overall fund. Special purpose acquisition (SPAC) arbitrage follows at 10%, with merger arbitrage at 2%.

Despite the double-digit declines in stocks and bonds, our arbitrage strategies have held up fairly well, in our view. A small loss in convertible arbitrage was largely offset by a positive performance in merger arbitrage, while the fund’s SPAC arbitrage allocation essentially broke even. Although we go into every quarter hoping to make money, this quarter presented an unusually challenging environment—but one that does not change our long-term conviction in our approach. Additionally, we have seen a significant cheapening in our book that should provide a tailwind to the fund going forward.

Convertible arbitrage returns have historically been linked to overnight money. This is partly because the rebate in our short positions is directly indexed to the federal funds rate or an equivalent rate. The 300-basis point rise in the federal funds rate (which is likely to increase to 400 basis points) moves our forward-looking expected return in convertible arbitrage up by a like amount. With the cheapening we have seen, plus the better forward-looking return profile, we are seeking opportunities to grow our convertible arbitrage allocation.

As was the case during the first half of the year, the hedged equity sleeve continued to be the fund’s biggest loser during the third quarter because of its higher beta. Although hedged equity strategies in general have had a subpar year, our recent relative performance has improved a bit in this sleeve. Our delta is currently on the higher side of our historic range. We continue to get there with a smaller call-write position and a larger put purchase and continue to use put spreads to enhance our hedge.

Calamos Hedged Equity Fund is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. As we discussed in our July post, “Navigating Option Skew: When the Smile Turns Into a Smirk,” this year’s market environment has presented unusual challenges for option-based strategies. Although our fund has not been immune, we believe the decline in bonds shows the value of using strategies such as CIHEX instead of a traditional 60%/40% allocation between stocks and bonds.

As it was at the start of the quarter, CIHEX’s hedge is at about the middle of our targeted range. The hedge continues to be positioned with a larger put purchase and the use of put spreads, above and beyond the outright long put allocation we consistently maintain in the fund. However, the call-write position remains smaller than it generally has been.

Finding Opportunities in Balanced Convertibles

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA and Joe Wysocki, CFA

October 3, 2022

Volatility continued in the third quarter as persistent inflationary pressures and further monetary policy tightening contributed to high levels of uncertainty across the financial markets. We expect heightened volatility to persist until there is greater clarity on the path of these risks, but also believe that short-term volatility can create longer-term opportunity.

Our focus through these uncertain times remains on managing the risk/reward trade-offs within Calamos Convertible Fund. Convertibles are hybrid securities that can act like equities or bonds, depending on movements in the markets. The asset class is diversified across market caps and sectors, but small and mid-cap companies are well represented. Equity valuations have declined materially, particularly among small and mid-caps, including many companies that have issued convertibles to fund their growth initiatives. To take advantage of the reset in the equity markets, we have maintained our emphasis on balanced convertibles with favorably asymmetric risk/reward profiles. Because they offer a healthy blend of equity and fixed income characteristics, these balanced convertibles can provide upside equity participation while also potentially dampening downside volatility.

Additionally, as credit spreads have widened across fixed income markets, we have selectively invested in convertibles with more pronounced fixed income attributes (“busted convertibles”) that we believe can benefit from spread improvement and provide a positive yield to maturity. However, consistent with our focus on risk management, we are avoiding the most distressed portion of the busted convertible market.

Growth sectors such as technology, health care and consumer discretionary remain the largest allocations in the fund. We are favoring companies that are executing well despite macro uncertainties and that can potentially benefit from increased demand for productivity enhancement products and services as an offset to rising corporate costs. We are also emphasizing companies positioned to benefit from longer-term secular themes such as energy efficiency and cybersecurity. Financials are the largest relative underweight in the fund. Convertible structures in the sector tend to have unfavorable risk/reward characteristics, and many issuers are susceptible to the negative impact of higher rates.

Convertible new issuance remains subdued but did accelerate to the strongest quarterly total this year. We believe the pace will ramp up further once macro uncertainty subsides and could return to a brisk clip. Typically, after periods of volatility-induced slowdowns in new capital market issuance, the convertible market has tended to be one of the first to reopen, and the initial deals tend to be attractively priced. We also anticipate—and would welcome—higher cash coupons given the overall rise in interest rates across the markets.

Although three months is a short time, we are encouraged by the positive convexity convertibles have shown in the third quarter. Having participated in the rally earlier in the quarter and holding up better more recently, they have performed well relative to other risk assets.

Finding Good Things in Small—and Microcap—Packages

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

The third quarter was uncomfortable for the bulls and the bears. During the first half of the quarter, stocks came back strong and had the bears squirming and wondering if a new bull market had begun. The rally in July and the first half of August was so fierce that at one point, 50% of the bear market damage had been recouped. All of that changed when Federal Reserve Chairman Powell gave a hawkish speech in Jackson Hole, Wyoming, spooking the bulls. His remarks, along with concerning inflation figures and rising bond yields, triggered weakness in the equity market that lasted until the end of the quarter, testing the June lows in the process. There are many signs the economy is slowing. The ongoing debate relates to the potential magnitude of weakness. In the meantime, the bears appear to be back in charge … for now.

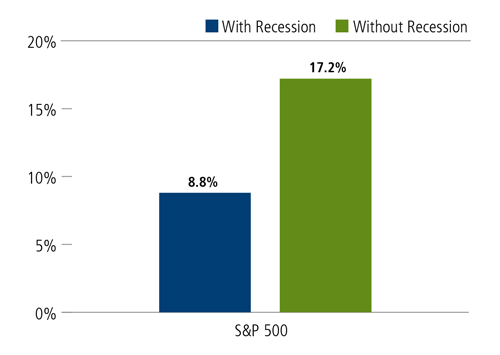

Despite the recent negative stock market momentum, there are some bright spots, especially as it relates to small cap and SMID cap growth stocks. For one, inflation has likely peaked and typically, that has triggered a rally in stocks over the next 12 months, with or without a recession. Specifically, since 1942, there have been 17 spikes in inflation and the S&P 500 Index has rallied an average of 13.2% over the following 12 months after each spike, gaining 17.2% in the absence of a recession (nine of 17 occasions) and 8.8% with a recession (eight of 17 occasions).

Stocks Have Rallied After Spikes in Inflation—Recession or Not

Average 12-month return following spike, since 1942

Past performance is no guarantee of future results. Source: Leuthold Group

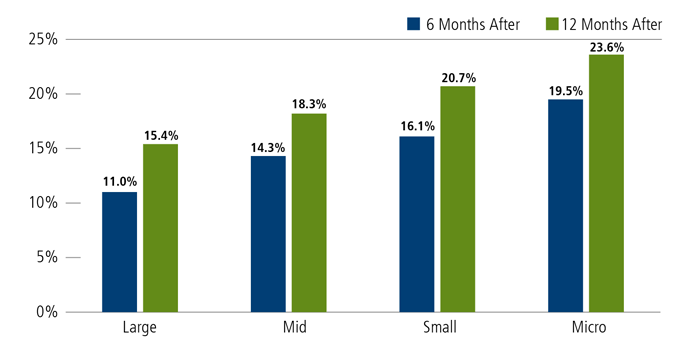

Additionally, seasonality is about to go from negative to positive, although we expect volatility to continue. Since 1982, stocks have typically rallied beginning 26 business days prior to the November midterm elections.1 This year, that period would begin October 3. Also, stocks historically have tended to rally over the six-month and 12-month periods after the midterm elections, with small caps and microcaps leading. This time around, small caps and microcaps also happen to be entering this period with extremely low relative valuations.2

Performance Across the Capitalization Spectrum: Large, Mid, Small and MicroAverage performance %, post US midterm elections, Since 1930

Past performance is no guarantee of future results. Source: Center for Research in Securities Prices, University of Chicago Booth School of Business, Jefferies.

Another important point: we have invested through big drawdowns like this before and believe we are advantageously positioned for a snapback and the long term. Our portfolios are also smaller cap than our average Morningstar category peers.3 Thus, if conditions normalize and small caps assume a leadership role in line with the long-term historical trend, we believe our portfolios will be well positioned.

These are certainly intriguing statistics, but we would note that each cycle brings its own dynamics. This time, for the rally to begin and be sustained, we likely need bond yields to settle down and the Federal Reserve to become less hawkish at the margin.

Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund continue to have exposure to long-term secular growers and certain cyclical growth stocks that we believe should benefit meaningfully from specific pockets of strength in the economy. A noteworthy portfolio change we made during the third quarter was increasing the funds’ exposure to certain health care stocks, a sector that has tended to have more recession-resistant business models. We also further increased exposure to certain consumer staples while cutting exposure to more recession-vulnerable consumer discretionary stocks.

Finding Income Opportunities Across the Risk Spectrum

Calamos High Income Opportunities Fund (CIHYX), Calamos Total Return Bond Fund (CTRIX), Calamos Short-Term Bond Fund (CSTIX)

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Volatility has been the catchphrase for the most recent quarter, and given the uncertainty and broad range of viable outcomes surrounding the midterm elections, labor markets, geopolitical events, and capital investment, we do not anticipate a more sanguine environment in the coming quarters.

Not much about the big picture has changed since we last shared our outlook in July. Inflation remains the most challenging issue for markets and the Federal Reserve. Consumers continue to face higher costs for goods and services, and while wages are increasing, they are failing to keep pace with other inflation measures. Although wages are not keeping up with inflation in goods and services, they are still accelerating enough to complicate the Fed’s primary task of reducing inflation. Our expectation is that labor—across industries—will continue to demand more and more compensation to maintain living standards. The current freight rail negotiations exemplify this.

Many view the recent cooling of energy markets as a welcome reduction of headline inflation. It’s a welcome change to the backdrop, certainly, but we would advise caution about reading too much optimism about inflation into these developments. China is still operating on a zero-Covid policy, shutting down full swaths of its economy at a time. Meanwhile, no one can predict what global weather trends will bring this winter and what stressors may appear as a result. The breadth of potential outcomes remains wide enough to drive a truck through. As we have said in quarters past, the shift away from goods inflation and into services inflation runs the risk of fueling another wage-price spiral.

Complicating matters is the well-documented lag between changes to monetary policy and the resulting changes in economic activity. In prior cycles, the lag effect has measured between six and 18 months. We believe that the adaptation of technology and its application to financial markets (even since the Great Financial Crisis) argue that the lag is near the short end of historical norms. If true, the first policy changes from early this year are just now taking hold. Some are justifiably concerned the Fed will push policy too tight while so-called “super-sized” policy adjustments are still working through the system. This concern is valid, but consumer and business balance sheets are quite healthy despite this year’s market correction, and Fed credibility is on the line. We expect the Fed to maintain course until it is convinced that inflation is cooling across a broad range of sectors. The Fed is specifically trying to change behavior, and there is some early evidence within survey and market-based measures that its policy is working, namely within housing and durable goods sectors.

Positioning implications. As the cycle matures, we are adhering to our time-tested philosophy and process—as we always do. By focusing on being adequately compensated for risks taken, we continue to find compelling income opportunities across the risk spectrum of fixed income assets. We have taken advantage of several low-cost opportunities to migrate portfolio quality higher through senior and secured structures and have extended portfolio durations again over the past quarter. Our appetite for credit risk and duration risk are roughly at parity, given the increasing likelihood of recession. Although we continue to doubt that the above-trend inflation environment will lead to drastically higher interest rates in long-dated maturities, we are maintaining slightly cautious duration positioning across our fixed income portfolios.

Global Opportunities: India, Asia Reopening, and Small Caps

Calamos Evolving World Growth Fund (CNWIX), Calamos Global Opportunities Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX) , Calamos International Small Cap Growth Fund (CSGIX)

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

We expect global market volatility will remain elevated in the near term as asset classes adjust to elevated inflation and tighter monetary conditions. The pace at which global central banks have tightened monetary conditions has increased the risk of a policy mistake, which has supported a more cautious positioning within our portfolios. Nevertheless, we continue to identify opportunities to put capital to work and position our portfolios to benefit from this evolving landscape. We highlight a few of these attractive near-term opportunities below:

India: India’s equity market has proved relatively resilient this year. The MSCI India Index is only down 1.92% year to date through September 28, 2022, in local currency terms, outperforming global markets (although weakness in the rupee versus a strong dollar has resulted in a -10.42% return in US dollar terms). As we wrote in our September 2021 post, “India’s Stealth Bull Market,” we believe India is one of the most compelling long-term growth stories in emerging markets. With a population of 1.3 billion, India has favorable demographics, an educated workforce, pro-growth government policies, and a large consumer base.

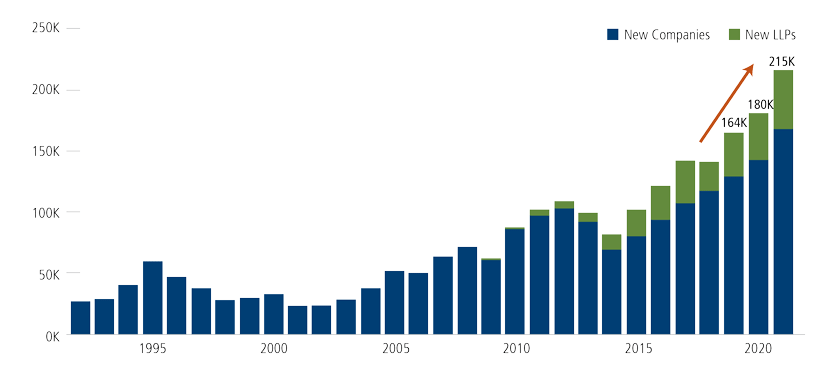

One of the most powerful tailwinds we see is the government’s Make in India initiative launched in late 2014 to promote local design and manufacturing. India imports a large amount of consumer electronics, and part of the original intent of Make in India was to establish more domestic manufacturing of these locally consumed products, thereby creating more jobs and growth for the Indian economy. Since then, India has further encouraged manufacturing sector growth by launching a Production Linked Incentive program, which provides $35 billion of incentives to manufacturers adding capacity in India. The Indian government has targeted increasing manufacturing as a percent of gross domestic product to 25% by 2030, compared to 17% currently. As these initiatives progress and gain momentum, we see strong growth tailwinds over the coming decade.

Additionally, Indian companies and the Indian economy are positioned to benefit from the continued relocation of manufacturing and supply chain reorientations. This is a powerful secular trend driven by many factors and will create demand for capital goods and new jobs. The ramp up in US–China trade tensions several years ago and more recent supply chain disruptions resulting from China’s Covid shutdowns have caused many companies to seek alternatives to China as a manufacturing hub. India’s sizable educated workforce and relatively low cost of labor make it an ideal location in Asia for manufacturing, and we continue to see consumer goods manufacturing, such as for mobile phones and televisions, move there. Additionally, India’s defense companies are also set to benefit because a large amount of India’s defense purchases have historically been imported from Russia.

New Business Registrations in India: Significantly Improved Momentum Over Past Three Years

Annual New Business Registrations (Companies and LLPs)

Source: Macquarie Research, September 10, 2021, using data from the Ministry of Corporate Affairs, IndiaDataHub, Macquarie Research, January 2022.

International Small Caps: Many tailwinds in the international smaller market capitalization space have set the stage for promising opportunities for active managers. The international small cap universe includes younger, earlier lifecycle companies, many of which have historically generated stronger earnings growth rates. Smaller cap companies are also beneficiaries of higher rates of merger-and-acquisition activity because of the higher probability they will be acquired and generate premium value upon acquisition. Also, international small caps have been less affected by passive flows because they have investor bases characterized by relatively higher levels of insider ownership and stakeholders who have larger vested interests in delivering strong and sustainable returns. Smaller cap companies globally tend to have more localized exposure, which has the potential to align well for incremental corporate investment amid deglobalization and supply chain realignment trends. Additionally, less brokerage coverage of smaller-cap companies provides active investment managers an opportunity to benefit from market inefficiencies. Valuations are also attractive: current market multiples in the international small cap space compared to the international all-cap space sit at a sizeable discount versus historical levels. (Calamos International Small Cap Growth Fund, which taps into our extensive experience in international small caps provides a dedicated approach to capturing these tailwinds.)

Asia Reopening: China’s economy continues to struggle under the weight of Covid restrictions and tighter monetary and fiscal conditions. However, we are encouraged by the recent loosening of travel restrictions in Hong Kong and Macau, and we believe an approval of Chinese mRNA vaccines later this year will ease local travel restrictions on the mainland and spur economic activity. Although we remain broadly underweight the Chinese equity market, the combination of attractive valuations and potential catalysts leave us ready to add exposure as our confidence builds in the coming quarters.

Meanwhile, other Asian countries, including Japan, Hong Kong, Singapore, and Taiwan, have recently lifted restrictions. We expect significant recovery in travel- and tourism- related industries, such as airlines and airport operators, hotels and lodging, resorts, and select consumer goods and retail. Additionally, several Asian countries—Japan in particular—have experienced meaningful currency depreciation over the past year. This revaluation makes the prices of goods and services more attractive for overseas visitors and can further contribute to a rebound in travel and tourism-related sectors.

Surfacing Global Convertible Opportunities Despite a Murky Macro Outlook

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

The global macro outlook continues to get murkier. Rates are going up in the US and the Federal Reserve seems determined to break the back of inflation. Although this is good news in the long run, we do worry the Fed will break something else in the process. Maybe that something else is the most over-levered parts of the UK pension industry that the Bank of England essentially bailed out last week. The US labor market has remained surprisingly resilient, but conditions point to a recession on the horizon. In Europe, the outlook is bleaker. The recent pipeline sabotage and Russian annexation of parts of Ukraine have not helped, nor is the strength of the dollar making it any easier for Europe to get through its energy crisis.

We remain focused on maintaining a good risk/reward profile in Calamos Global Convertible Fund. Convertible securities vary in their levels of equity and fixed income sensitivity, and we adjust the fund’s overall exposures on an ongoing basis. During the quarter, we added equity exposure through investments in new issues. However, this was offset by the decline in the delta of the global equity markets. As a result, the fund’s overall level of equity sensitivity remained broadly unchanged versus the start of the quarter and in line with the global convertible market as measured by the Refinitiv Global Convertible Bond Index.

Although global convertible issuance is running at a pace still well below the past two years, the quarter saw a bounce in new issuance. In the US, companies brought $11 billion in convertible securities to market in the third quarter compared with only $9 billion in the first half. Not surprisingly, much of this upswing occurred earlier in the quarter, and the rollover in equities in the second half of the quarter put a damper on issuance as the period came to a close. Although levels are still below where would expect if we had a stable equity and bond market background, it was good to see issuance perk up when skies briefly got calm in the last quarter.

Despite the slowdown in issuance this year and the challenging market environment, we are still finding opportunities to put cash to work and rebalance the portfolio in response to evolving market conditions. We continue to identify the most opportunities among US issuers, followed by companies in Asia. The fund remains underweight Europe, reflecting both the bottom-up opportunity set and the concerning macro environment. Our largest sector weightings include information technology, consumer discretionary and health care.

The Opportunity of Fortress Growth Remains Intact

Calamos Growth Fund (CGRIX)

Matt Freund, CFA, Michael Kassab, CFA

The third quarter proved the adage that investors should “never fight the Fed.”

Growth stocks started the quarter supported by an optimistic mood. Although year-to-date prices were down significantly, the market seemed to regain its footing in mid-June and began to rally. Investors had a long list of worries, but they held out hope that inflation was peaking and interest rates would follow suit, the war in Ukraine was contained, and earnings would be better than feared. The rally gained steam in late July after Federal Reserve Chairman Powell indicated that rate hikes had brought short-term rates to “neutral” at a modest 2.25% to 2.50%.

This enthusiasm proved to be premature. Chairman Powell made it clear the following month that inflation was dangerously high and that short-term rates would continue to be increased until inflation was closer to the Fed’s 2% target. Growth markets quickly gave up their gains and ended the quarter modestly in the red. As volatility increased, investors preferred the certainty of larger companies with strong balance sheets and predictable growth plans. As a result, small cap growth stocks and unprofitable technology companies underperformed.

Volatile markets are never easy, but looking ahead, we are confident the current wall of worry will be less than feared. Interest rates are expected to end the year around 4% to 4.25%, but future rate hikes should be more modest from there. Supply chains are healing rapidly, and inventory levels are now healthy. At the same time, consumers still have relatively strong balance sheets, and the job market remains healthy overall. All of these conditions should lay the foundation for solid earnings growth going forward.

Although we believe volatility will remain elevated as US midterm elections near and the European energy crisis plays out, long-term investors will look back and realize the earnings power of US growth companies was not permanently damaged. America remains one of the most dynamic financial markets in the world, and we don’t believe this will change. As interest rates stabilize and earnings growth resumes, we believe the rally in growth stocks will resume as well.

We continue to see many attractive opportunities to position Calamos Growth Fund in what we call “fortress growth” companies. Recently, many of these companies have been unduly caught up in the broader market sell-off. However, these are industry champions with well-established economic moats and reliable cash flow generation for years to come. We are also maintaining our exposure to a handful of smaller-cap, dynamic growth names that should generate outsized revenue and profit growth despite a potentially weakening US economy.

As always, we continue to believe that prudent stock selection, constant risk management, and patience are the keys to success in markets such as these.

Maintaining a Near-term Defensive Posture

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

As we have discussed in the past, in challenging economic and market environments, we believe balancing the long-term and short-term outlooks provides the best insights on portfolio positioning. Focusing on either one exclusively can lead to overly optimistic or pessimistic positioning that may not be warranted in the volatile markets.

We remain confident that the positive long-term growth trajectory of the US economy and the cash flow generation capabilities of US companies are intact. The ability of management teams to identify emerging short- and long-term trends and the adaptability of business models and cost structures are central to our long-term favorable view. We see attractive long-term upside in the US equity market from current market levels, which we view at fair value or below fair value for a majority of US companies.

In the short term, the extreme conditions (both positive and negative) that occurred during these two years have not yet reverted to a more normal environment or to the long-term mean. Since mid-2021, our expectation has been for a lower growth environment in 2022 and 2023. This slower growth outlook has been exacerbated by the war in Ukraine and China’s Covid-19 shutdowns. These two factors have also worsened the inflation environment, causing most central banks around the world to raise interest rate, which should further slow growth. As we have seen so far in 2022, slowing growth, high inflation and rising interest rates have led to significant declines in asset prices. We have yet to see significant reductions in earnings estimates, but we can expect that to occur in the near term for any number of reasons.

A mean reversion transition needs to occur for the challenging short-term environment to migrate to the more normalized long-term trend. We are watching several factors that would indicate this trend is occurring. These include improved labor market participation, a normalization of consumer spending versus income including lower real goods consumption, lower retail inventory levels, improved supply chain for certain areas of manufacturing sector, improved supply/demand for commodities (oil and food), central banks slowing their restrictive policies, resumption of China activity, and a reduction in military activity in Ukraine. This list is long and many of these factors may take a long time to occur. However, the equity markets are forward looking, so improvement in any of these factors should be positive for asset markets.

We continue to believe that the best positioning for this environment remains a defensive posture with a focus on lower-risk areas including lower-beta, high-quality balance sheets and higher return-on-capital businesses. Areas such as healthcare, lower beta staples, defense, software (cyber defense and system software) and parts of telecom provide some of those attributes. We have been positive on the supply/demand environment for energy, but we are turning somewhat cautious on this area as global growth slows. From an asset class perspective, cash and short-term Treasuries are now a useful tool to lower volatility in a multi-asset class portfolio given their now-positive yields. Despite elevated absolute volatility, we are selectively using options to gain some cyclical exposure in case our watch factors surprise to the upside.

Finding Opportunity Among High-Quality Global Leaders

Calamos Global Sustainable Equities Fund (CGSIX)

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

“The lesson is clear. Inflation devalues us all.”

—Margaret Thatcher

Inflation data continues to dominate the investing ecosystem. The stock market reflects the cost of inflation, and central banks are increasingly willing to pay for it at the expense of the economy. We are closer to the end than the start of this tightening cycle, but the drainage of liquidity hasn’t fully taken hold yet. As such, inflation and volatility are likely to stick around for a while longer.

We all know that the stock market isn’t the economy, but it’s a decent proxy for the outlook for growth. Economists are slashing their growth forecasts while boosting inflation outlooks. Wall Street analysts are cutting earnings estimates as higher costs and rate pressures weigh on corporate margins. How should investors respond? By concentrating on high-quality “global leaders” with strong balance sheets and environmental, social, and governance (ESG) characteristics that can withstand tougher times. These globalE leaders will emerge from the downturn in a position of competitive strength with increased market share and shareholder returns.

We are fiduciaries seeking superior financial returns with less risk. ESG investing clearly aligns with this goal. ESG is not an asset class or an investment style. It is an enhancement to the investment process, which provides a more holistic and complete view of risk and opportunity. ESG integration is the consideration of material non-financial factors, which are often unpriced externalities with long term risk-and-reward implications. We use this material nonfinancial information to make better investment decisions and build stronger portfolios.

Companies with strong ESG management and oversight are less likely to experience disruptions to their growth trajectory, cash flows and earnings visibility. These are the primary drivers of stocks prices and valuation multiples. If companies don’t manage their ESG risks and opportunities well, they won’t keep up with their competitors. Firms that don’t adapt to rising environmental constraints, changing consumer preferences, and societal shifts will face significant challenges. Raising capital, attracting talent, and maintaining a positive brand image will be more difficult.

1 Source: RBC, Pulse of the Market

2 Source: Leuthold Group

3 Source: Morningstar. The Morningstar Small Growth Category (Calamos Timpani Small Cap Growth peer group) includes small-growth portfolios that focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. The Morningstar Mid-Cap Growth Category (Calamos Timpani SMID Growth peer group) includes funds comprising mid-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.