VPanteon

This AI Investment Thesis Is Only For Swing Traders

We have previously covered C3.ai (NYSE:AI) in March 2023, highlighting its speculative nature from the ongoing AI hype. True enough, the stock has returned to its pre-November-2021 levels at the time of writing, suggesting the strength of the AI hype despite its lack of profitability and underwhelming performance thus far.

For example, the company reported FQ4’23 revenues of $72.41M (+8.6% QoQ/ inline YoY), achieving its modest guidance. However, its operating expenses have swollen to $121.1M (+4% QoQ/ +8.6% YoY), naturally impacting its margins to -101.2% (+6.9 points QoQ/ -23 YoY).

For FY2024, the AI company only guides revenues of $307.5M (+15.2% YoY) and an adjusted loss from operations of -$62.5M at the midpoint (+8.2% YoY). It also expects to achieve adj. profitability by the end of FY2024 (April 2024), with minimal impact on cash/ investments at $700M at the lowest.

The latter guidance is rather optimistic indeed, given the deteriorating balance sheet with cash/ investments of $812M (+2.7% QoQ/ -18.1% YoY). This cadence means that its stock-based compensation expenses may expand from $216.5M reported over the last twelve months (+90.9% sequentially), on top of the growth in its share count to 112.75M (+1.8% QoQ/ +6.5% YoY) by the latest quarter.

Either way, assuming that the AI company is able to achieve its cash-positive plan over the next few quarters, we suppose the stock may then continue its upward trajectory, similarly lifted by the growing generative AI demand and the ongoing bull run.

AI Stock’s Rally YTD

Trading View

The SPY has already recorded a +22.4% recovery since the October 2022 bottom, sending market analysts into euphoria. With the benchmark index already signaling the end of the bear market, we suppose the optimistic sentiments may continue for a little longer, as similarly witnessed with other AI-related stocks YTD, such as Palantir (PLTR), CrowdStrike (CRWD), and Nvidia (NVDA).

This is on top of the management’s strategic choice to go with turnkey AI applications, which comprise 83% of its bookings in the latest quarter. Furthermore, its consumption-based pricing model has reduced sales friction, as similarly highlighted by Tom Siebel, the CEO of AI, in the recent earnings call:

In the old days, one and two years ago to do business with us was $5 million, $10 million, $20 million, $50 million to open the door. And now the transaction is pretty much, you know, we’ll bring the application live in six months or $0.5 million. If you like it, keep it and pay $0.55 per CPU hours to be CPU hour, so we’re pretty easy to do business with. And so we’re seeing the number of transactions increase dramatically as we’d expect. (Seeking Alpha)

This strategy has boosted the AI company’s customer engagement to 287 (+16.1% QoQ), aided by the shorter sales cycle. As expected, this cadence has also triggered a negative impact on its gross margins to 74.4% (-6.6 points QoQ/ -1.6 YoY) by the latest quarter. Given the projected increase in its pilot accounts, we expect to see its margins compressed for a little longer before the company reaches a satisfactory economy of scale.

So, Is AI Stock A Buy, Sell, Or Hold?

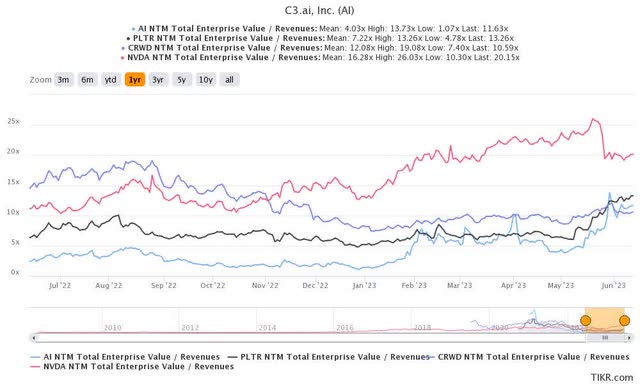

AI 1Y EV/Revenue

S&P Capital IQ

The generative AI hype is also visible in the AI stock’s valuations at an elevated NTM EV/ Revenues of 11.63x, compared to its 1Y mean of 4.03x. The same cadence is also visible with other players, which have seen their valuations surge as the demand for AI booms.

AI 2Y Stock Price

Trading View

For now, the AI stock has also rallied to over $40s at the time of writing, likely to retest its previous 2021 support levels. This buoyancy is surprising indeed, due to the mixed factors discussed above.

Combined with the stock’s eye-watering short interest at 34.55%, we suppose it may remain highly volatile in the near term, with the stock market still swinging wildly between peak recessionary fears and a bull run. As a result, one may attempt to time the market and profit from swing/ short trading, in our view.

However, here is where we prefer to exercise caution, since market analysts do not expect the AI company to achieve GAAP profitability through FY2025, suggesting its relatively speculative nature. Since it does not fit within our investing profile, we prefer to cautiously rate the AI stock as a Hold (Neutral) here.

While investors may want to establish a small position to capture a potential winner in the generative AI space, they may want to do so once there is a meaningful retracement from this euphoria. Do not chase this rally.

.jpg?itok=M3byDxVI)