David Gyung

Investment Thesis

C3.ai, Inc. (NYSE:AI) reported fiscal Q4 2023 results that didn’t live up to investors’ expectations. The company with arguably the best ticker for the present time guided for mediocre growth rates for the year ahead.

And yet, to be clear, it’s not all negative and there are some positive elements for the bulls to hang onto in this report.

However, one thing is clear, for all the narrative coming out of C3.ai, Inc., this is evidently not a fast-growing company.

Why C3.ai? Why Now?

C3.ai leverages artificial intelligence, or AI, and machine learning technologies to drive customer innovation and operational efficiency.

C3.ai’s CEO Tom Siebel used the company’s earnings call to describe to investors how the market’s enterprise for AI is expanding at a very rapid rate. Any investor looking into C3.ai would not have expected anything less.

Furthermore, Siebel used the earnings call to highlight to investors C3.ai’s rapidly growing and diver partner ecosystem. Here’s a pertinent quote:

The C3.ai partner ecosystem is increasingly effective at opening new doors with our partners, who are able to provide prospects, the assurance of success and the highest quality service.

In fiscal year ’23, we closed 71 agreements with and through our partner network, including Google Cloud, AWS, Microsoft, Baker Hughes, and Booz Allen.

In short, we can conclude that C3.ai is seeing increasing diversity in the industries it serves.

But putting C3.ai’s compelling narrative aside momentarily, I believe it’s helpful to get some more context.

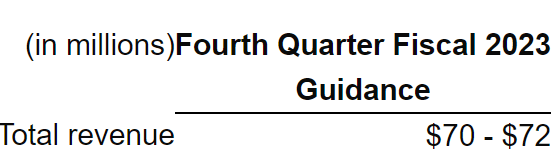

Recall, a few weeks ago, C3.ai updated investors that it was expected to exceed its own guidance. Let’s rewind the clock to get the context:

AI Q3 2023

At the time of its fiscal Q3 2023 result, C3.ai’s guidance for fiscal Q4 2023 pointed to $72 million at the high end.

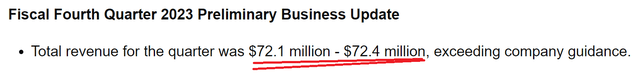

Then, a few weeks ago, C3.ai deemed it newsworthy to highlight to investors that it was on track to beat analysts’ expectations, see below.

AI update

What you see above is that C3.Ai was guiding for less than $1 million in higher revenues. And then, what did the results actually come out as?

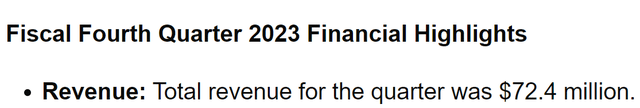

AI Q4 2023

C3.ai delivered a hair above the high end of its previous guidance provided last quarter. Basically, if we put aside the decimal point here, there’s really no exceeding of guidance provided last quarter.

But there are some positive elements, too, in this report, which we’ll turn to now.

Revenue Growth Rates Are Expected to Improve

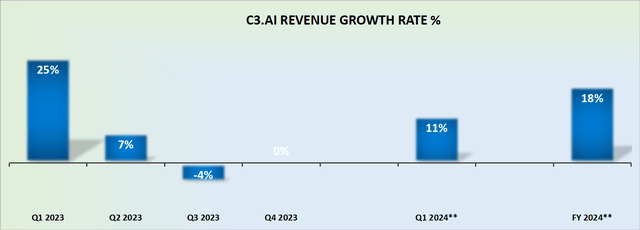

AI revenue growth rates

Looking out to fiscal 2024, the next twelve months, C3.ai’s revenue growth rates are expected to increase by approximately 18%, to $320 million.

On the one hand, needless to say, this revenue stream is still relatively small in the grand scheme. And furthermore, this growth rate leaves a lot to be desired. Evidently, this is not a rapidly growing company.

That being said, given that the quarter just reported C3.ai had flat y/y revenue growth rates, the good news here is that the outlook for the upcoming year looks substantially better.

In summary, the second half of fiscal 2024 (ending April 2024) should see C3.ai’s revenue growth rate pick up more momentum. Next, let’s turn to discuss C3.ai’s profitability profile.

Profitability Expected to Improve

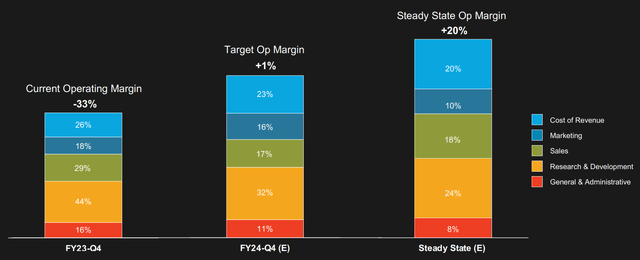

AI Q4 2023 presentation

Above, we see that C3.ai just finished the quarter with negative 33% non-GAAP operating margins.

That being said, C3.ai proclaims that over the next twelve months, C3.ai will deliver meaningful improvement in its underlying profitability profile so that fiscal Q4 2024 will end with positive 1% non-GAAP operating margins.

Significant improvements are expected throughout its cost structure, starting with its cost of revenue line. Now, as a point of reference, consider this:

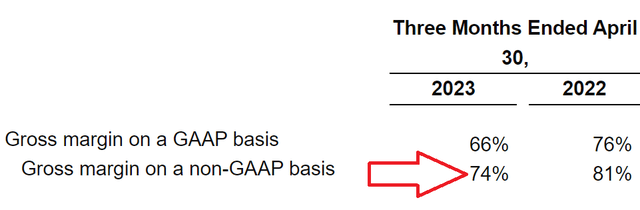

AI Q4 2023

What you see above is that C3.ai’s non-GAAP gross profit margins compressed by 700 basis points y/y. Consequently, I rhetorically put forward the question, does it appear for now that C3.ai is moving in the right direction with its profitability? I don’t believe that’s the case.

Here’s what we can assuredly see:

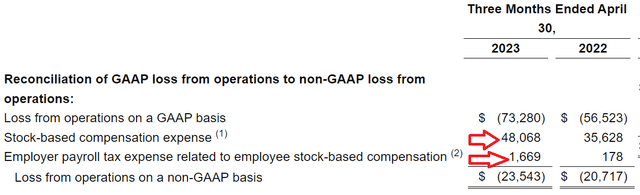

AI Q4 2023

What you see above is that management’s stock-based compensation was up 40% y/y, while revenues essentially grew by 0% y/y.

Altogether, this translated into C3.ai’s non-GAAP loss from operations turning slightly more negative in Q4 2023 compared with the same period a year ago.

The Bottom Line

C3.ai, Inc. recently reported financial results that did not meet investor expectations, with guidance suggesting mediocre growth rates for the upcoming year.

However, there are positive aspects to consider. C3.ai’s CEO highlighted the expanding enterprise market for AI and the growing partner ecosystem.

While C3.ai, Inc.’s narrative is compelling, it is not experiencing rapid growth. Looking ahead, C3.ai’s revenue growth rates are expected to improve by approximately 18% for fiscal year 2024, and profitability is also expected to increase.

However, C3.ai, Inc.’s recent performance has shown flat y/y revenue growth and negative operating margins. Profitability improvements are anticipated, but there are concerns about the cost structure and its stock-based compensation.