NVS

A fundamental truism of investing is stocks is that capturing maximal gains from an investment requires buying it before the crowd does.

Ideally, an investor would buy a full position in a stock when it’s down, then other investors will gradually or quickly pile in, pushing the stock price up.

That sounds nice in theory, but in reality, human psychology often gets in the way. We are tribal creatures, and going against the tribe in hopes that they will follow feels uncomfortable and unnatural. In most areas of life, it doesn’t make sense to go against the crowd. That’s why, for most of us, investing is a learned skill instead of an innate talent.

I would argue that income-oriented investors and dividend growth investors have a rare opportunity right now to buy ahead of the crowd. That opportunity is in real estate investment trusts (“REITs”).

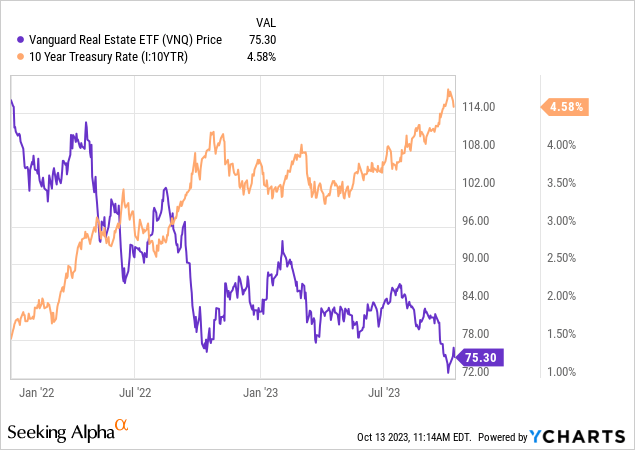

There has been a ~35% drop in the REIT index, measured below by the Vanguard Real Estate ETF (VNQ), since the beginning of 2022:

This selloff has been inversely correlated with the movements of the 10-year Treasury yield, which has soared over that time period.

REITs are more than just bond alternatives. Unlike bonds, REITs offer inflation protection from property value appreciation and rent growth, which generally flow into rising dividends. But, despite my repeated protestations to the contrary, the market still treats them like bond proxies, as exemplified by the tight, inverse correlation between REIT stock prices and bond yields, as seen above.

In what follows, I’m going to argue that interest rates have or are very close to peaking, that the Fed is done with the current hiking cycle, that interest rates are likely to come down in 2024, and that this will be the catalyst for REITs to shift from underperformance to outperformance.

Interest Rates Will Come Down

There are multiple reasons why Treasury yields have surged so much, such as government deficit spending and fading demand from foreign buyers, but I would argue the primary catalyst for rising rates is the Federal Reserve.

Since April 2022, the Fed has dumped over $1 trillion of debt securities, most of which were Treasuries, off its balance sheet. That has created artificially high supply of Treasuries as rates have risen, just as the Fed’s asset buying program created artificial demand for Treasuries when rates were low and/or falling.

Plus, demand for Treasuries is driven largely by what the Fed is doing and expectations of what the Fed is going to do with the Fed Funds Rate. The coordinated “higher for longer” narrative from Fed officials in recent months has done exactly what it was intended to do: cause long-term interest rates to rise.

The Fed thinks this will help anchor inflation back at its 2% target rate. I think this move will end up doing more harm than good.

The fact of the matter is that real-time inflation is already back to the Fed’s target.

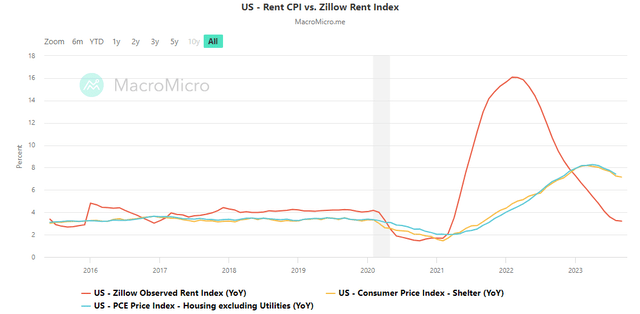

The market briefly panicked over the “hotter than expected” inflation data in the September reading. But the 3.7% headline CPI rate is only that high because of the shelter component, which lags real-time changes in rents by about a year.

Compare the YoY growth in US shelter CPI (gold line below) to the Zillow Rent Index (red line):

MacroMicro

In September, shelter CPI still showed 7.1% YoY growth, but we know from Zillow that actual YoY rent growth was only 3.2%.

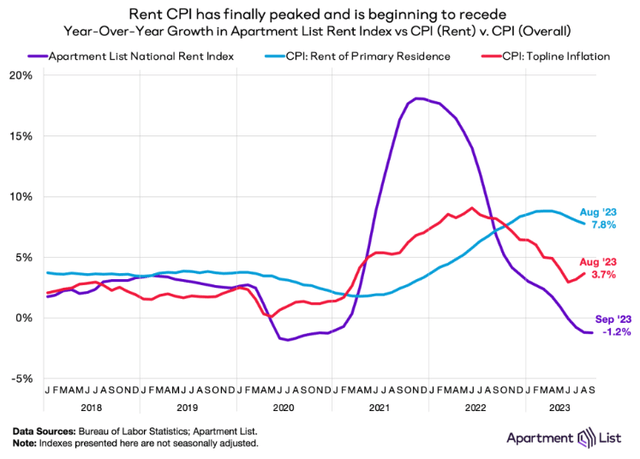

Apartment List’s latest National Rent Report shows an even lower rent growth metric of -1.2% for September:

Apartment List

The same story holds true for home prices. Using Realtor’s most recent data from July 2023, median home listing prices dropped 0.9%, while the S&P Case-Shiller index showed a 1.0% YoY gain.

However you measure real-time housing cost changes, actual shelter inflation is far below the 7.1% YoY rate reported in the CPI.

And the shelter component of headline CPI represents about 35% of the overall index. Thus, about 2.5 percentage points of the 3.7% CPI rate came from this inaccurate shelter input.

What was the CPI rate in September if you exclude this lagging shelter component? Answer: 1.99%.

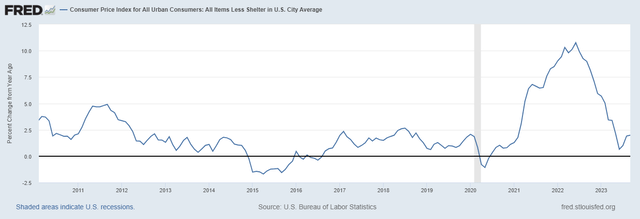

US CPI ex Shelter YoY:

St. Louis Fed

The biggest reason there has been a slight bounce in CPI ex shelter since June is the rebound in oil prices, but even this appears to be temporary. Recently, the International Energy Agency reported that oil prices near $100 caused meaningful demand destruction, hence the stagnant price now in the $80s.

If instead of the CPI’s inaccurate 7.1% YoY growth in shelter costs you used Zillow’s 3.2% YoY rent growth number, headline CPI would be 2.4%.

If you used Apartment List’s -1.2% number, you would get a headline CPI reading of 0.9% for September.

Inflation has already been whipped. It’s just a matter of time before it shows up in the official data and the Fed acknowledges it.

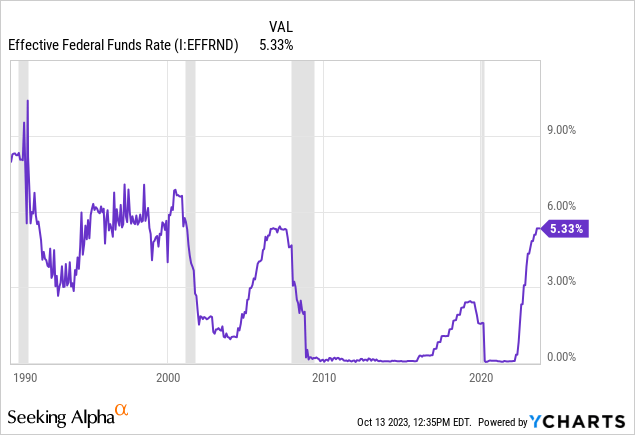

Both the forward SOFR curve and the Fed’s dot plot shows interest rates on the short end coming down slowly next year. I think the drop in interest rates will be much faster and sharper than the market seems to think, because I believe we will get a recession in the near future.

Anytime in modern history that the Fed has hiked rates this fast, it has precipitated a recession. And during every recession in modern history, the Fed has pushed rates down quickly and significantly (by an average of about 500 basis points).

Therefore, shouldn’t the burden of proof be on those who claim (contrary to the historical record) that the Fed will be able to achieve a soft landing, avoid recession, and ease the Fed Funds Rate down slowly over the course of several years?

Even if I’m wrong and the Fed does ease the FFR down slowly over the course of a few years, I still think this will put downward pressure on Treasury yields across the curve as the lagged shelter inflation falls and allows CPI readings to come down further.

Now, with all of the above said, recall my earlier point that the market treats REITs like bond proxies.

If REITs fall because interest rates rise, then what should happen when interest rates begin declining (whether fast or slow)?

Of course, some investors will object that a recession would be bad for REITs, causing an even further selloff. This is pure conjecture, and not very well informed conjecture at that. This objection seems to imply that every recession will be just like the Great Financial Crisis of 2008-2009, which was very damaging to real estate and REITs.

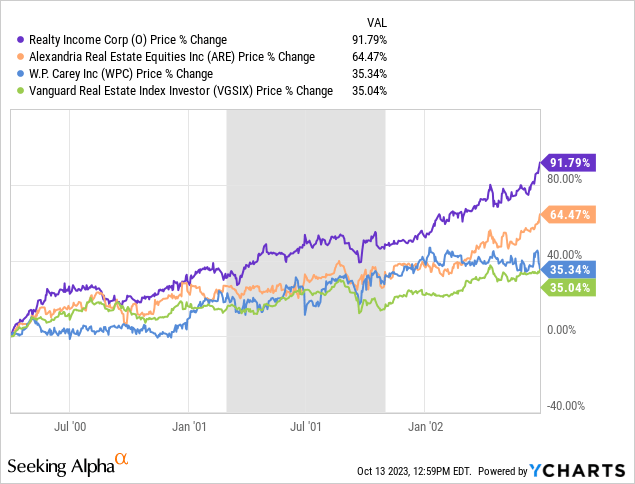

But most economic forecasts today see a milder recession on the horizon, more akin to the short and shallow recession of 2001.

How did REITs perform through that recession? Answer: swimmingly.

The Fed quickly pushed down the FFR in response to economic weakness, which corresponded with a drop in long-term interest rates.

From April 2000 through June 2022, the Vanguard Real Estate Index (VGSIX) gained 35% (15.5% annualized), while real estate stalwarts like Realty Income (O), Alexandria Real Estate Equities (ARE), and W. P. Carey (WPC) gained even more.

Buying Opportunity In High-Quality REITs

The line of thinking above isn’t some sophistry I’m using to try to bail out my underwater REIT positions. (As if anything I write could move the markets anyway!) This is my actual view. I truly think REITs, especially the higher quality names that typically trade at large valuation premiums, offer an incredible buying opportunity right now, and I’m putting my money where my mouth is.

Here are several of the blue-chip REITs I’ve been buying hand-over-fist lately.

Agree Realty (ADC)

- Dividend Yield: 5.3%

- 5-Year Average Yield: 3.8%

- Price/AFFO: 13.5x

- 5-Year Average P/AFFO: 19.5x

ADC owns single-tenant net lease properties leased to the nation’s largest and strongest retailers. Its portfolio is highly defensive, recession-resistant, and resilient to competition from e-commerce.

ADC September Presentation

Moreover, ADC enjoys among the strongest and best-positioned balance sheets in all of REITdom, with very little debt maturing until 2028.

CEO Joey Agree and his top management team are highly shareholder-aligned, illustrated recently by significant insider buying.

For a deeper dive on ADC, check out “Why Agree Realty Is My Largest Holding.”

Alexandria Real Estate Equities (ARE)

- Dividend Yield: 5.0%

- 5-Year Average Yield: 2.7%

- Price/AFFO: 11.0x

- 5-Year Average P/AFFO: 24.5x

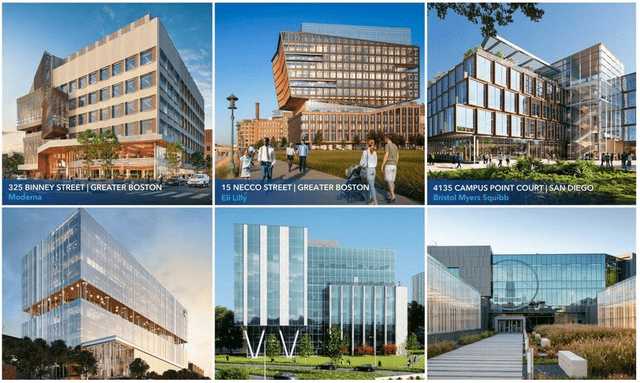

ARE owns and develops a portfolio of state-of-the-art life science campuses located in the nation’s most productive innovation clusters like Boston, Washington DC, and Raleigh/Durham. These are generally triple-net leased properties occupied by the world’s strongest biotech companies.

ARE Q2 2023 Earnings Release

ARE has suffered a pullback due to worries over cyclically slowing VC investment spending in the biotech space as well as a wave of life science supply coming to market. But ARE’s quality of building design and location should act as a moat, blunting the impact of these temporary headwinds.

Meanwhile, ARE’s balance sheet is top notch, boasting a BBB+ credit rating, over 13-year weighted average debt maturity, and no loans maturing until 2025.

For more on ARE, see this article written in 2019 explaining why I wanted to own it, even though I thought it was too expensive to buy at the time. It’s definitely not too expensive anymore.

Crown Castle (CCI)

- Dividend Yield: 6.6%

- 5-Year Average Yield: 3.4%

- Price/AFFO: 13.3x

- 5-Year Average P/AFFO: 23x

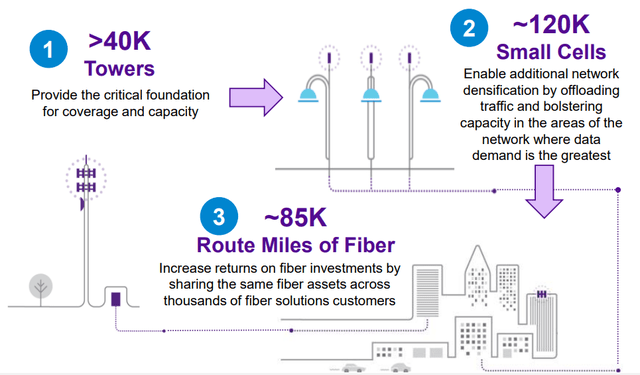

CCI boasts perhaps the largest telecommunications infrastructure network in the United States, with all the benefits of scale that comes with it. This network includes over 40,000 cell towers, ~85,000 miles of fiber, and ~120,000 small cell nodes.

CCI Investor Presentation

In addition, CCI enjoys a strong balance sheet with a BBB+ credit rating and a very manageable amount of debt maturing over the next few years.

The few headwinds CCI currently faces, such as its 9% floating rate debt exposure and Sprint’s lease cancellations as a result of its merger with T-Mobile (TMUS), are expected to disappear by the end of 2025. Meanwhile, mobile data is projected to keep growing at a double-digit clip, necessitating further investments from carriers into infrastructure.

For a deeper dive into CCI, see “Crown Castle: Take Advantage of The Market’s Short-Termism.”

Extra Space Storage (EXR)

- Dividend Yield: 5.5%

- 5-Year Average Yield: 3.4%

- Price/AFFO: 15.2x

- 5-Year Average P/AFFO: 22.3x

Now that EXR has completed its acquisition of Life Storage (LSI), it has become the largest US-focused self-storage REIT. It enjoys massive benefits of scale as well as an efficient operating platform that, when rolled out for LSI’s properties, should produce some nice synergies.

EXR September Presentation

In addition, it has a strong balance sheet with a credit rating of BBB+ that should give it the ability to handle refinancing the relatively small amount of upcoming debt maturities.

Right now, self-storage is suffering a hangover from the huge growth during the pandemic, and low home sales volume and job growth mean few people are moving. The standard catalysts for customers getting a storage unit are not heavily present right now, but that situation won’t last forever.

For more on EXR, see “REIT Meltdown: 3 Rarely Discounted Buying Opportunities.”

Mid-America Apartment Communities (MAA)

- Dividend Yield: 4.25%

- 5-Year Average Yield: 3.2%

- Price/AFFO: 14.4x

- 5-Year Average P/AFFO: 21.4x

MAA owns and develops a diversified portfolio of apartment communities across the Sunbelt, from Las Vegas to Norfolk. This is a recession-resistant asset class, and MAA’s portfolio is ideally suited to benefit from the long-term trend of above-average population and job growth in the Sunbelt.

Mid-America Apartment Communities

The balance sheet is likewise rock-solid, sporting an A- credit rating.

There’s a wave of new supply coming to many of MAA’s markets, but I explained in detail why the REIT won’t be hurt nearly as bad as the market thinks in “Mid-America Apartment Communities: Advantages Being Ignored Amid Supply Glut.”

Rexford Industrial Realty (REXR)

- Dividend Yield: 3.1%

- 5-Year Average Yield: 1.9%

- Price/AFFO: 22.8x

- 5-Year Average P/AFFO: 39.4x

REXR owns infill industrial properties in the extremely supply-constrained market of Southern California. These properties enjoy one of the biggest mismatches between supply and demand in the United States. New supply under development is only about 2-3% of the total supply, while demand is growing significantly faster than that.

Rexford Industrial Realty

The result is double-digit rent growth as far as the eye can see.

REXR also boasts an incredibly strong balance sheet, low debt, and a BBB+ credit rating that greatly minimizes the negative impact of high interest rates.

For more on REXR, see “REIT Crash: The More They Drop, The More I Buy.”

VICI Properties (VICI)

- Dividend Yield: 5.7%

- 5-Year Average Yield: 5.0%

- Price/AFFO: 13.6x

- 5-Year Average P/AFFO: 14.8x

I call VICI the “landlord of Las Vegas,” because it is the largest owner of casino-resort real estate on the famous Strip, including the iconic Caesar’s Palace from which it derives its name.

Caesar’s Entertainment Group

VICI’s balance sheet is in good shape with “only” a BBB- credit rating, while its long-duration leases enjoy some inflation protection. Management has proven themselves disciplined about growth, acquiring only when it is accretive to the bottom line.

For more on VICI, see “If I Could Only Own 7 REITs, It Would Be These.”

W. P. Carey (WPC)

- Dividend Yield: 7.9% (~7% Post-Spinoff)

- 5-Year Average Dividend Yield: 5.5%

- Price/AFFO: 10.4x

- 5-Year Average P/AFFO: 15.1x

WPC is a net lease REIT focused on single-tenant industrial and, to a lesser extent, retail and self-storage properties across the US and Western Europe.

W.P. Carey Inc.

Lately, WPC has taken a beating over its decision to quickly exit its office segment and downsize its dividend by 10-15%. But I actually like this decision. Single-tenant net lease office has become an extraordinarily unattractive property type that will likely endure very poor returns going forward. I only wish management would have ripped this band-aid off sooner.

Plus, selling its office properties now gives WPC the liquidity to manage its 2024 and 2025 debt maturities. Even though it has a BBB+ credit rating, I like that management is “killing two birds with one stone” by eliminating the office exposure and prepaying maturing debt in one fell swoop.

For more on WPC, see “Despite Inflation Protection, WPC is Best Suited For Low Interest Rates.”

Bottom Line

The primary reason why REITs have shed over 1/3rd of their value since their peak has been rising interest rates.

Therefore, as interest rates peak and begin to steadily decline going forward, we should expect the REIT recovery to pick up steam.

I of course cannot time the bottom and don’t believe anyone can. But I believe the valuations offered right now by high-quality REITs like the 8 discussed above provide ample margin of safety as well as massive upside.