Sean Gallup

Shares which can be leveraged to financial energy in a technique or one other have been destroyed this 12 months. Once you couple that with shares that thrive in low-rate environments, you get a very horrendous excellent storm. That’s how perennial market leaders like Alphabet (NASDAQ:GOOG) find yourself shedding a 3rd of their worth, which is precisely what occurred earlier this 12 months.

Alphabet has bought off with the remainder of the promoting shares equivalent to Snap (SNAP), Meta (META), Pinterest (PINS), and so on. Clearly, the injury has been way more extreme with these names, however that’s as a result of they don’t function a monopoly in one of many world’s largest enterprise, which Alphabet enjoys with Google. As Alphabet was dragged down – unfairly in my opinion – and the truth that web shares at the moment are again in favor on Wall Road, Alphabet is a screaming purchase.

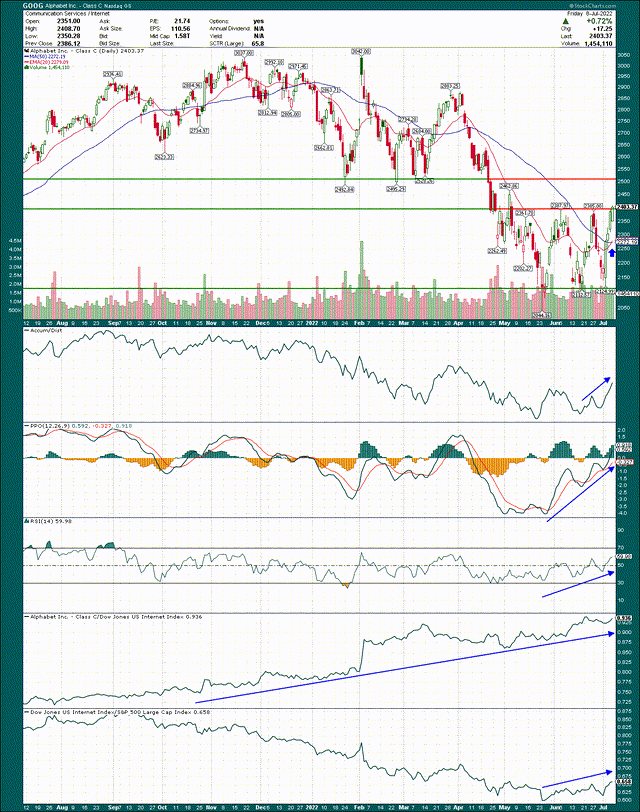

Let’s start with the chart, which reveals a large consolidation that Alphabet goes to interrupt this week, or very shortly thereafter.

StockCharts

I’ve drawn within the strains for the consolidation they usually correspond roughly to $2,100 and $2,400. These are your strains within the sand in terms of buying and selling across the consolidation, however on this case, I believe Alphabet has consolidated sufficient that you simply simply need to maintain it, quite than threat lacking the large transfer to the upside.

The reason being as a result of the entire indicators look nice at this level for the bulls. The buildup/distribution line has turned sharply larger, indicating huge cash is shopping for dips quite than promoting rips.

The PPO has exploded larger, indicating not solely vendor exhaustion, however outright bullish momentum. That is the sort of factor we see at key bottoms, which typically result in sustainable rallies. The 14-day RSI is displaying the identical factor.

Alphabet has outperformed its friends for a very long time, which surprises nobody. However importantly, web shares are lastly gaining some floor on the broader market, which hasn’t been the case for a while. Whereas web shares are removed from a number one group proper now, I consider the chance is there for them to turn out to be precisely that, and Alphabet is a confirmed winner within the group.

Lastly, maybe one of the vital bullish issues on this chart is the truth that the 20-day EMA has simply crossed over the 50-day SMA. This occurs when the development has modified, and we all know that it occurred a number of months in the past when the inventory topped out. The reverse is occurring now, and these strains ought to turn out to be assist on the best way up, simply as they have been resistance on the best way down.

Given the momentum we’re seeing, I believe the chances of Alphabet breaking out earlier than later are very excessive, however even when this one is rejected this week, purchase Alphabet on the pullback on the 20-day EMA.

Let’s now check out the elemental case for Alphabet to see if it’s greater than only a bottoming inventory.

Recession ache priced in

Everyone knows about Alphabet’s companies, which embrace search, YouTube, Cloud, Community, and its enterprise capital fund Different Bets. The Search enterprise is by far the biggest by no matter metric you need to use, and it’s additionally the one that’s reliant upon companies desirous to spend cash promoting. That’s why the inventory fell so sharply into the center of 2022, however as we all know, the Search enterprise is actually a monopoly, and on condition that, it’s so massive that it isn’t as cyclical as different promoting platforms. That’s why Alphabet shares haven’t fallen almost to the extent different promoting shares have, and why there’s important upside from right here.

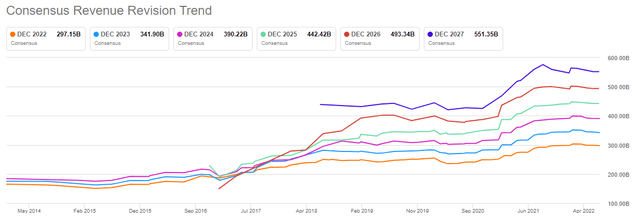

Searching for Alpha, income revisions

We will see with income revisions that analysts have made downgrades for a number of months, however there are two essential factors I need to make. First, revisions downward are very small in magnitude, and nothing just like the ~30% decline within the share value we noticed. Second, they’ve flattened out in current months, as you’d count on given {that a} recession is mostly priced in earlier than it arrives. The upside of that is that now that estimates are decrease, which suggests sentiment is weaker, and that estimates have flattened out, it could take a brand new shock to maneuver them meaningfully decrease once more. Meaning the trail of least resistance is larger, and that’s precisely after we need to purchase the inventory.

Take note additionally that Alphabet has grown its advert enterprise by all types of headwinds earlier than, all of which regarded a lot worse than the present surroundings. These embrace the “ad-pocalypse” from 2020 and 2021 following COVID lockdowns, the place advert spending fell off a cliff in unprecedented trend. However you wouldn’t realize it by wanting on the beneath.

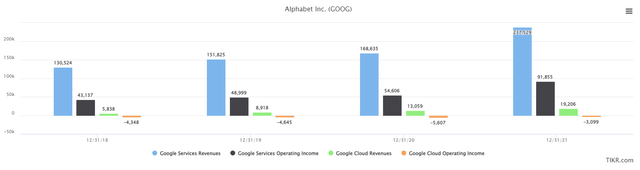

That is annual income by phase for Google Companies and Google Cloud, in addition to working earnings for each, in hundreds of thousands of {dollars}.

TIKR, phase outcomes

Companies income simply strikes larger over time, because it doesn’t appear to matter what’s occurring within the financial system. If search income can survive the malaise that adopted the preliminary COVID outbreak, I actually can’t consider the rest that would threaten it.

However what about pricing? Properly, that was nice too, with 2020 working earnings for the phase shifting up 11% in 2020, within the face of a 100-year pandemic. Final 12 months it was up 68%, and whereas that’s clearly unsustainable, it reinforces my level that if you happen to’re frightened a few recession’s influence on Alphabet, you’re frightened in regards to the improper factor.

Now, one potential tailwind that’s coming within the near-term, apart from continued world domination of search, is the corporate’s Cloud enterprise. Clearly, Alphabet has been investing very closely in Cloud capabilities, each by acquisition and by spending internally. It has consumed an enormous amount of money lately, but it surely’s rising strongly, and is close to breakeven. We noticed this mannequin with Amazon’s (AMZN) AWS, the place the corporate spent billions of {dollars} at a loss till it gained enough scale, and now it’s an enormous money cow. Whereas Cloud received’t be as essential to Alphabet’s working earnings as AWS is to Amazon, merely eradicating this headwind is, in and of itself, a tailwind.

The purpose is that Alphabet being bought off with economically delicate shares, together with advertisers, is quite lacking the purpose that this firm isn’t like different advertisers, and as such, shouldn’t be handled that manner.

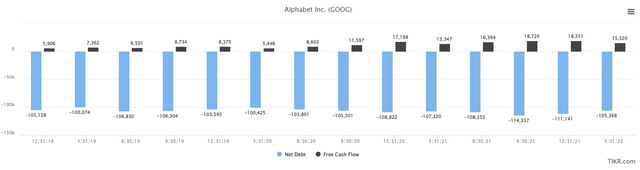

One other tailwind is the corporate’s ample spending on buybacks, which it could actually do as a result of it has one of many cleanest steadiness sheets on the planet.

TIKR, web debt and FCF

Internet money has been over $100 billion for years, and stays as such at the moment. However as we will see, the corporate can be producing $15 billion to $18 billion in new web money per quarter, which it’s largely spending on share repurchases. Whereas that will not look like a lot within the context of a $1.6 trillion market cap, it means there’s a continuing purchaser of the inventory, and in huge portions. As well as, it steadily reduces the share rely over time, juicing EPS by way of a decrease float.

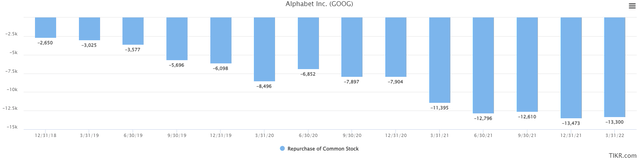

Here is what it seems to be like in observe.

TIKR, share repurchases

Keep in mind these are quarterly numbers, so Alphabet is shopping for roughly $200 million of its personal inventory each buying and selling day in the mean time. Not unhealthy.

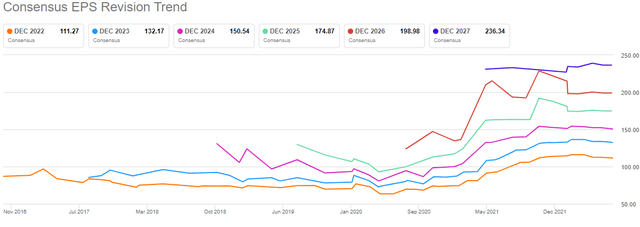

This all boils all the way down to EPS projections, and we will see they’ve an analogous trajectory to income. Whilst you may count on that given Alphabet’s superior margins, the share value isn’t behaving like EPS is unbroken.

Searching for Alpha, EPS revisions

The minor downward revisions are a lot smaller than what the share value has priced in, and that’s the place the chance is at the moment. I received’t learn the chart to you, however the level right here is that estimates proceed to go up and to the left, and there’s ample area between the years, indicating robust progress over time. What extra may you need?

How about an inexpensive valuation?

We’ve got that as effectively with Alphabet, because the inventory has been punished too severely for precise circumstances. Under we’ve value to adjusted ahead earnings for the previous 5 years to provide us some context on the present valuation.

TIKR, ahead P/E

It’s very apparent what’s occurring right here, which is that Alphabet is definitely simply as low cost because it was through the worst of the COVID promoting 2+ years in the past. It traded for ~26X earnings pre-COVID, and ~30X after COVID, however is 21X at the moment. There’s merely no strategy to reconcile that, and it means the inventory is much too low cost. For a enterprise that continues to develop at high-teens charges yearly, and actually has what quantities to a monopoly on a enterprise billions of individuals use each day, this valuation is simply begging to be purchased.

May the surroundings for promoting deteriorate additional? Certain, something is feasible. However it’s a must to ask your self if a valuation that is the same as that of the worst of the COVID promoting is smart after we’re not dealing with a brand new pandemic and the uncertainty that brings. It appears plain to me that Alphabet has turn out to be far too low cost, and that after it breaks out from the consolidation famous above, we may simply be off to the races to not less than 25X ahead earnings. That may be ~20% larger from right here, and that appears to me to be simply the beginning.