DestinoIkigai/iStock via Getty Images

Introduction

At our Conservative Income Portfolio service, we are constantly looking at all sectors and asset classes to find relative mispricing opportunities to increase our member’s portfolio yields and/or to reduce risk. Finding mispricings not only provides opportunities to swap one of your securities for a better one but can also be useful in identifying undervalued stocks/bonds for outright purchase without a need to swap.

There are no objectively cheap or expensive securities. Securities are only cheap or expensive relative to other securities. Thus, in order to identify the best values in the market, you really need to cover all sectors and all asset classes (preferred stocks, baby bonds and traditional bonds). If you are only covering a certain sector or a certain asset class, or a subset of securities, then it is very difficult to assess whether a security is undervalued or not.

For example, if you only cover baby bonds and not traditional bonds, you may find that you are not in the best bonds. If you only look at preferred stocks and not baby bonds, you may also find that you are not in the best securities. And if you only cover bank preferred stocks or REIT preferred stocks, you will also likely find that you are not in the best investments.

We understand that it is very time consuming for individuals, and even other stock services, to cover such a wide range of securities which is one of the reasons that our Conservative Income Portfolio exists. In this article we present opportunities for swaps or for simply taking long positions in various sectors and asset classes.

Mortgage REITs

Mortgage REITs, or mREITs, own mortgages. They can own agency (government guaranteed) residential mortgages, non-agency residential mortgages as well as commercial mortgages. And some can hold a mix of agency and non-agency mortgages.

mREITs make money by borrowing at low interest rates and using that money to buy higher yielding mortgages, hopefully making a profit on the interest rate spread. While agency mREITs like Cherry Hill (NYSE:CHMI) and Armour Residential (NYSE:ARR) hold only agency mortgages, and thus have no credit risk, other mREITs hold mortgages that can default so they do carry credit risk. Both types of mREITs carry interest rate risk and pre-payment risk.

Cherry Hill Mortgage

Company website

Cherry Hill Mortgage (CHMI) owns residential mortgages that are backed by the U.S. government, so they carry no credit risk. Additionally they own some mortgage servicing right (MSRs) in which they earn a fee for servicing these mortgages. MSRs should be very stable now because the big risk with MSRs is that the mortgages that they service get refinanced or paid off when the home is sold.

Currently, we are in an excellent environment for MSRs that were purchased when interest rates were much lower. Nobody is refinancing their loans now with rates currently much higher than their current mortgages. Additionally, people will be very reluctant to move and lose their low interest mortgage and have to take on a much higher cost mortgage in order to purchase a different home.

So MSRs should provide a very stable stream of income to CHMI, whereas the mortgages owned by mREITs are subject to the risks of an inverted yield curve, higher long term interest rates hammering book value, a higher cost of short term borrowing, failed hedging strategies and a possible continuation of a widening yield spread between treasuries and mortgage backed securities (MBS).

Armour Residential Mortgage

Company Website

Armour Residential Mortgage (ARR) was once a hybrid mREIT owning both agency and non-agency mortgages. However, they were by and large an agency mREIT since over 90% of their mortgages were agency mortgages. During the COVID stock market meltdown, they took a beating and had to sell a lot of their mortgages at fire sale prices. Shortly after the COVID market bottom, they decided to sell their non-agency mortgages and become a strictly agency mREIT.

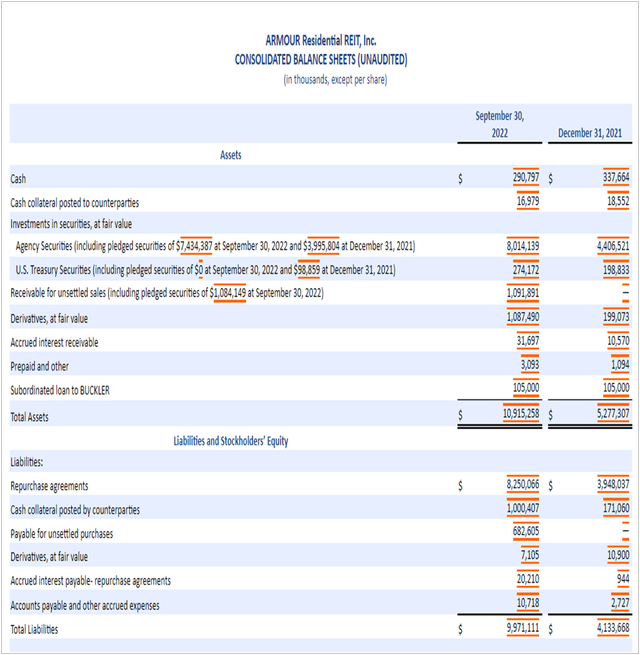

Whereas ARR operated at fairly low leverage for some time, ARR has rapidly been increasing their leverage this year. It seems like investors haven’t noticed this and are still willing to purchase ARR Preferred “C” (NYSE:ARR.PC) at a much lower yield than Cherry Hill Preferred “A” despite the fact that ARR’s leverage is now higher than CHMI’s. Here is the most recent ARR balance sheet which also shows a comparison of the current quarter’s leverage to the leverage at the beginning of this year.

SEC

As you can see, at the beginning of the year, ARR’s total liabilities were only 78.5% of total assets. However, as of September 30th, total liabilities are now 91.3% of total assets.

Buy Cherry Hill Preferred “A”, Sell Armour Residential Preferred “C”

What makes these 2 preferred stocks easy to compare is that they both operate in the same business, and these are the only 2 agency mREIT preferred stocks that have a fixed dividend. Most mREIT preferreds that have IPO’d in recent times have been fixed-to-floating rate preferreds. So if you like owning an agency mREIT preferred stock where you can lock in a high fixed-income, CHMI Preferred “A” is the one to own. Here is why:

- The first and most obvious reason to buy Cherry Hilll Preferred “A” (CHMI.PA) and sell Armour Residential Preferred “C” (ARR.PC) is the very large difference in yield. While ARR.PC yields only 8.67%, CHMI.PA yield’s 9.8%.

- CHMI operates at lower leverage. While CHMI’s total liabilities, including preferred stock, are 8.8 times its common stockholder’s equity, ARR’s total liabilities plus preferred stock are 12.1 times its common stockholder’s equity. That is quite high leverage for ARR.

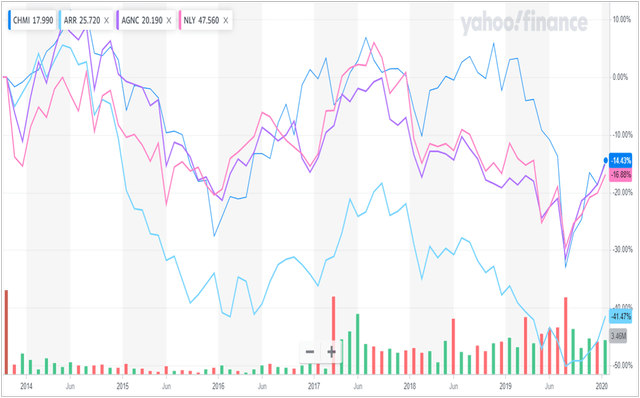

- Cherry Hill’s common stock has well outperformed ARR’s common stock as the charts below show.

Yahoo Finance

Here is a price chart comparing CHMI to ARR before the COVID meltdown when ARR was mostly an agency mREIT but not completely. The period is from the inception of CHMI in 2013 to the beginning of 2020 before the COVID market meltdown. As you can see, CHMI performed significantly better than ARR as ARR was down 41% during this period. I threw in the charts of the big agency mREITs, NLY and AGNC, to show that CHMI performed equally well to their more famous peers.

Since the March 18th, 2020 COVID bottom in the market, CHMI has also outperformed ARR.

I believe agency mREIT preferreds are very safe. They have no credit risk and since they issue common stock to raise cash when leverage starts to rise, this mitigates balance sheet risk. Thus, I believe that CHMI.PA is a very good value with a 9.8% fixed yield. While many own the fixed-to-floaters of agency mREITs AGNC and NLY, these currently involve a bet on LIBOR (or its replacement) remaining high. This is not a bet that I would personally make. I believe that locking in a 9.8% yield will look really good when the Fed slows the economy and rates start coming down. And given its large discount from par, there is a lot of room for CHMI.PA to move higher in price.

And I believe that ARR.PC should be sold. It is simply overpriced relative to its closest peer, and you have an excellent alternative in CHMI.PA.

Other Swapportunities

Sell OPINL and Buy the OPI 2025 Bond

OPINL is a bond from Office Properties, an office REIT. It doesn’t mature until 2050 and carries a 9.3% yield to maturity (YTM). Yet you can buy their much shorter term traditional bond, a bond that matures on February 1st, 2025, at a current YTM of 12.28%. The CUSIP of this bond is 81618TAC4.

Because OPI is managed by RMR, many investors are turned off to the common stock and to the company in general. While I don’t have good feelings about OPI itself, and I wouldn’t want to bet on a bond of theirs that doesn’t mature until 2050, when I see a huge yield on a bond that matures in a little more than 2 years, I become interested.

While I only own a small position in this OPI bond, I think it is very unlikely that this company goes bankrupt in such a short period of time. RMR certainly wants this company to survive so that they can continue collecting management fees, and I would be shocked if they didn’t issue stock to raise cash if it becomes necessary. And office property leases tend to be many years in length which adds to the security of these bonds.

Buy PEB.PG and Sell Hersha Hospitality (HT) Preferred Stocks

Both Hersha Hospitality (HT) and Pebblebrook (PEB) are hotel REITs. In my opinion, PEB.PG (PEB.PG) currently represents the most undervalued hotel REIT preferred stock relative to all others. But it looks particularly undervalued relative to the HT preferred stocks due to PEB’s much better balance sheet. A swap from HT preferred stocks to PEB not only gets you a better yield, but a better balance sheet and a bigger discount from par providing more long term price upside.

HT has 3 preferred stocks, HT.PC, HT.PD and HT.PE. The current stripped yield on these is around 8.4% and they sell at an average price of $20.00. PEB.PG sells at $17.72 with a 9.12% current stripped yield. It is the only hotel REIT preferred stock among many with a better than 9% yield.

But if that isn’t enough to make you want to swap into PEB.PG, the difference in balance sheet leverage should convince you. While HT’s total liabilities plus preferred stock is 3.1 times its common stockholder’s equity, PEB’s is only 1.55 times. Additionally, during the big 2020 market selloff, HT suspended its preferred stock dividends while PEB has never done so.

Sell RILYL Preferred Stock and Buy a RILY Baby Bond (RILYM or RILYT)

This one is pretty simple. The B Riley (RILY) preferred stock with the ticket RILYL looks very overvalued and should be sold. RILY has much better securities to swap into then RILYL. Even their other preferred stock is a much better value, but the RILY baby bonds present extremely better values than RILYL.

RILYL current sells for $24.22 for a 7.65% current yield. Even their other preferred stock, RILYP, is much better with an 8.32% current yield and much more price upside at a price of $19.90.

But the best values are in the RILY baby bonds which provide more security, being higher in the capital stack, but also maturity dates which makes them much less susceptible to interest rate changes and the security that you will get $25 back if you hold to maturity. Unless there is a bankruptcy, all RILY bonds will end up higher in price in the future.

My 2 favorites now are:

- RILYM has an excellent YTM of 9.77% and a relatively short maturity date of 2/28/2025. RILYO currently has a YTM of 8.07% YTM and matures 9 months earlier. Getting a whole 1.7% better yield for simply going out 9 months further in duration looks to be a relative bargain.

- RILYM, with a 10.11% YTM which allows you to lock in this high yield for a longer period of time if you wish. It matures on 1/31/2028 and currently offers a higher YTM than RILYZ which matures later in 2028 than RILYT.

Summary

As I wrote in the introduction, at Conservative Income Portfolio we are constantly on the lookout for undervalued preferred stock, baby bond and traditional bond opportunities in all sectors in order to improve member’s portfolio yields and to reduce risk. In the world of investing, there are no objectively cheap or expensive securities. There are only relatively cheap or expensive securities. In this article we presented the following mispricing opportunities or “swapportunities” as I call them which cut across all sectors and asset classes:

- Buying CHMI.PA and selling ARR.PC, improving your yield from 8.67% to 9.8%, and reducing risk with a lower leveraged company with a better track record.

- Buying a much shorter yielding bond from OPI with a 12.28% YTM, and selling a very long term bond from OPI whose YTM is only 9.3%.

- Buying the Pebblebrook preferred stock symbol PEB.PG, with a 9.12% current yield and a 1.55 times leverage, and selling Hersha Hospitality preferred stocks, HT.PC, HT.PD, and HT.PE, with their lower yields of around 8.4% and much more leverage of 3.1 times.

- Buying either RILYM or RILYT with YTMs of 9.77% and 10.12% respectively, and selling RILY’s preferred stock, RILYL, with only a 7.65% current yield and very little price upside potential.