monsitj

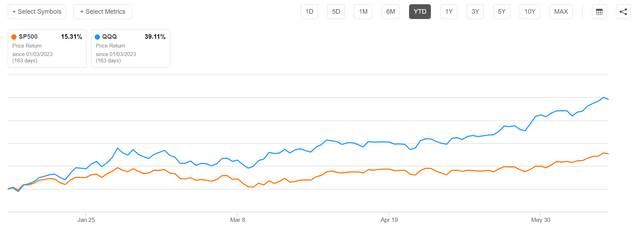

There is a narrative floating around that stocks are overvalued and the ‘FED will crush the Bulls’ with more rate hikes outstanding (suggested reading, see here, here, here). But it is worth pointing out that these arguments have been promoted since early 2023, missing out on an exceptional bull market, with the S&P 500 (SP500) up more than 15% and the Nasdaq 100 (NDX) up close to 40% YTD.

Seeking Alpha

Personally, I do not see that stocks are overvalued, and I view the recent ‘Hawkish pause’ by the FED not as a pause, but as a full stop. Accordingly, I argue that bearish arguments will likely continue to argue into the void, while the bull market keeps raging.

Stocks Are Not Overvalued

Stocks are overvalued. Really? Based on what – earnings, cash flows, equity risk premia? Observing and pointing to rapid price appreciation is hardly a sufficient fundamental analysis to argue that equities are priced expensively. As an investor, the core argument for valuation must always be anchored on “what are you paying” in relation to “what value do you get”.

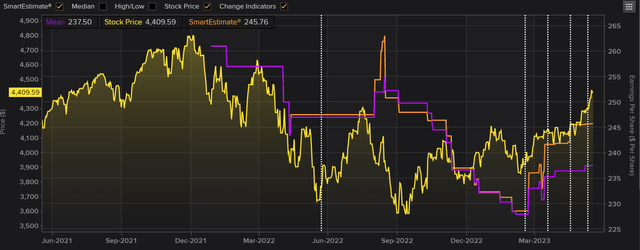

Referencing FY 2024 consensus earnings estimates for the S&P 500 of $246 as collected by Refinitv, the index is currently priced at a FWD P/E of ~x18.

Refinitiv

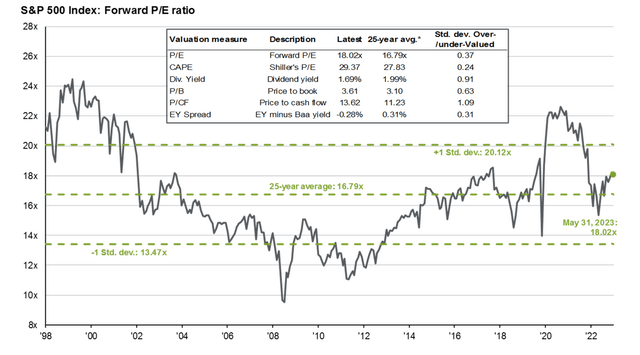

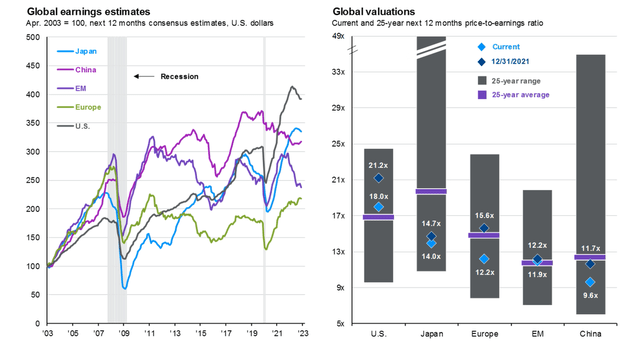

According to research by J.P. Morgan (JPM), the current FWD P/E for the S&P 500 of ~x18 is slightly above the 25-year average respective metric of x16.8. A similar argument can be made for the CAPE, which stands at x29.4 currently versus x27.8 for the average 25 years.

JP Morgan Research

Investors should consider how minuscule this valuation premium is. In fact, the valuation premium versus the 25 years average for FWD P/E and CAPE is only ~7% and ~6% — hardly worth an argument of an overvaluation. Moreover, I would like to point out that the current FWD P/E is not even touching the +1 standard deviation reference, which would imply a metric of x20.

Now, if we accept a P/E of ~x18 for the S&P 500, we can calculate the index’ earnings yield by taking the inverse of the fraction. Doing the math implies a yield of ~5.5%. Needless to say, this is about 45% higher than what the US 10 year treasury yield is currently yielding, priced at ~3.8%.

Some Stocks Are Cheaper Than Others

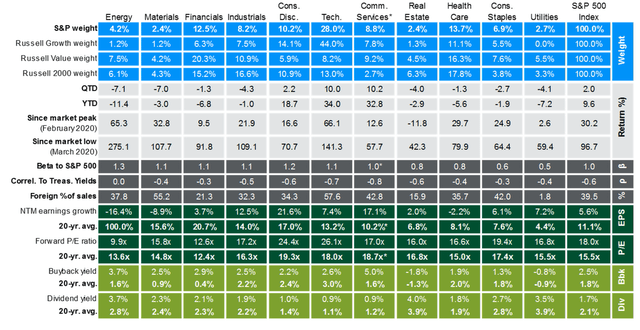

Building an argument that stocks are expensive – or cheap for that matter – it is false to push all the stocks into one basket, because there is clearly a difference between sectors and industries. Specifically, I would like to point your attention to the relatively cheap valuation multiples of Financials, currently priced at x13 P/E, Energy, currently priced at x10 P/E and Health Care, currently priced at about x15 P/E.

JP Morgan Research

Moreover, there is clearly a difference between U.S. stocks and international equities. While U.S. stocks are trading at a minor premium vs historical average, Europe is still loafing around at a steep discount – priced at a x12 FWD P/E versus x15 being the historical average. A similar argument can be made for equities listed in Japan and China.

JP Morgan Research

Hiking Cycle – Likely A Full-Stop, Not A Pause

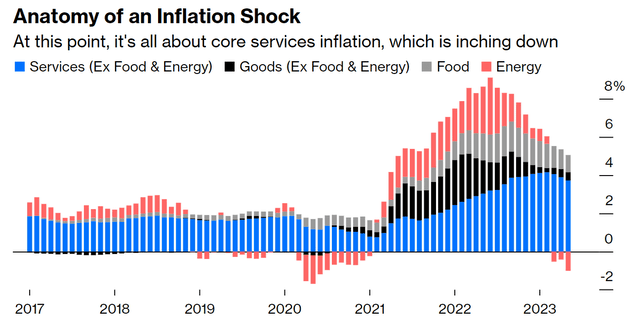

For May, the consumer price index came in cooler than expected, reporting a 4% YoY increase compared to the same period last year. Notably, this was the slowest growth rate since March 2021. All major inflation buckets, including core services excluding housing, food, energy and goods lost steam – with energy prices falling for the 3rd consecutive month.

Bloomberg

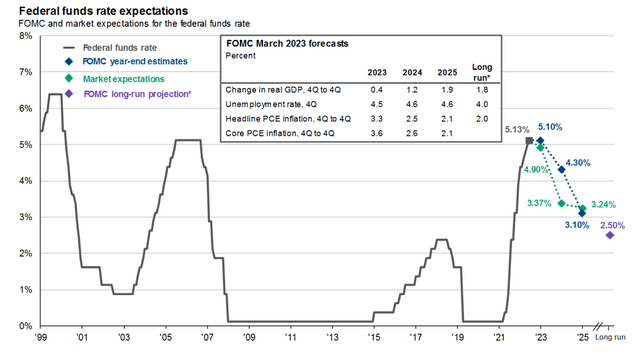

The encouraging CPI report prompted FED officials to leave the federal funds rate unchanged at 5% to 5.25, bringing the long awaited “FED pause”. Although the FED minutes imply two additional quarter-point increases by year-end, investors should consider that these rate hikes are far from guaranteed. In fact, market reacted very skeptically to the communication that borrowing costs will rise as high as estimated by the FED: Following the FED announcement, the highest rate on swap contracts for future meetings stood at approximately 5.29% for both September and November, while July’s rate was at 5.26%.

As inflation is already decelerating, there is a strong argument to be made that the FED will stop pushing against the rates ceiling and increasingly focus on the health of the economy and financial stability. For context, Bloomberg economists currently estimate the probability of a recession within the next 12 months at 100%. And the FED is certainly not ignorant to the likelihood of a recession, with respective risks to the economy. Traders price accordingly, with a deeply inverted yield curve, seeing rate cuts from late 2023/ early2024 onwards through 2025.

JP Morgan Research

Conclusion

Stocks are priced attractively. And some stocks are priced more attractive than others – pointing to opportunities in Financials and international equities.

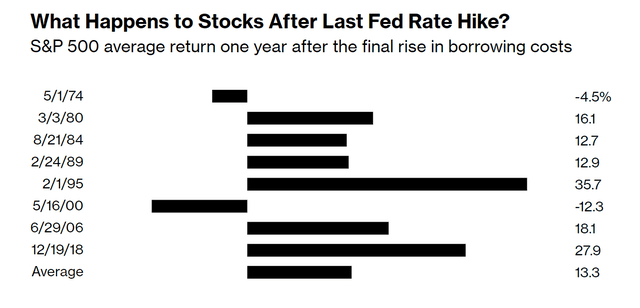

Analyzing historical trends, it seems that the equity markets may experience a rally if the Federal Reserve indeed decides to pause or reverse its cycle of interest rate hikes. This observation is supported by evidence from eight previous periods of monetary tightening reversals, which prompted a 13% share price appreciation on average within the subsequent twelve months.

Bloomber

I have previously argued that the S&P 500 will close at ~4,500 by year-end, suggesting a x18 P/E multiple for FY2024 FWD. I now raise my EOY expectation to ~4,900, as I believe that price momentum, paired with a dovish FED turn, will push valuation to a x20 P/E.