There seems to be a debate going on today between economists and market technicians (!?) as to whether we are in a bull or bear market. I’ve defined markets in the past (see this) so those who want to delve deeper can.

Regardless of where fall in the bull/bear spectrum – I have been constructive here – allow me to point out some bullish items you may have overlooked (I’ll discuss bearish concerns next week).

Simply Red: We begin by noting there was nowhere to hide in 2022: last year saw losses for stocks and bonds, with Bonds off 12.9%, the S&P 50 Index down 19.7%, the Russell 2000 off 21.7%, and the Nasdaq 100 down 33.4%.

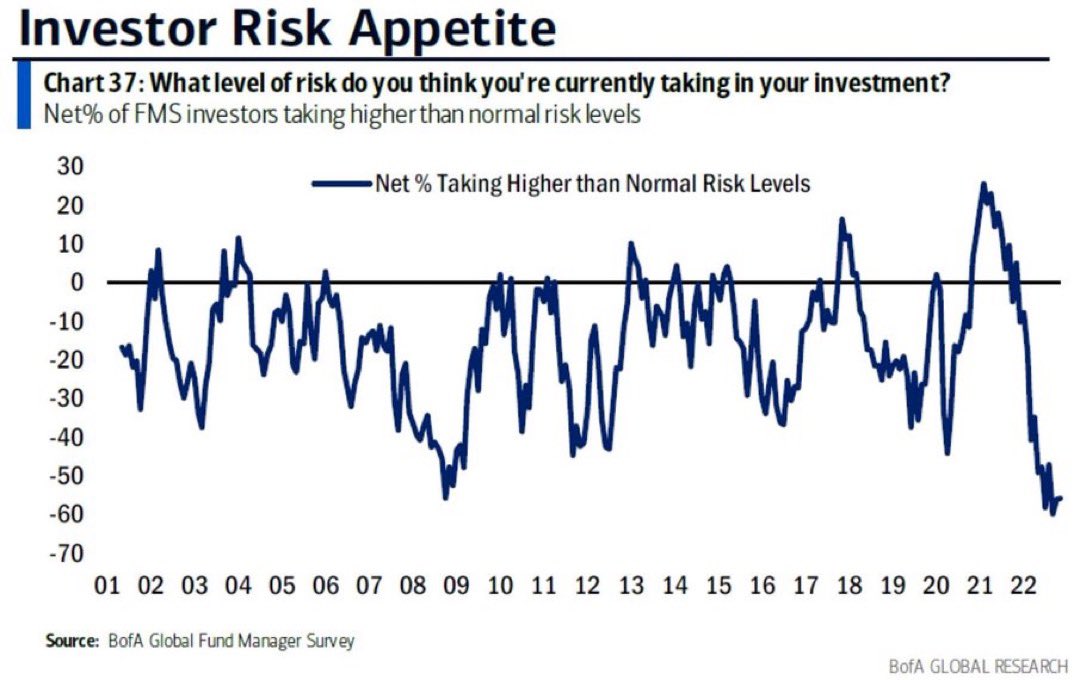

Risk Appetite: Fund Managers surveyed by Bank America Merrill Lynch (BAML) are as negative about as they ever get. It’s rare to see stocks as hated as they were in the middle of 2008-09, but that is a very contrarian signal. Most of the bottoms signal excellent equity entry points.

Getting Better: Nasdaq was the big loser in 2022, but (as Paul sang) it’s getting better all the time. The chart up top does not do justice to how much many of these high fliers have recovered. These stock gains since the bear market lows show some big gains:

Big Tech Gainers

Netflix: +99%

Roblox: +66%

Coinbase: +65%

Nvidia: +62%

Facebook: +52%

Uber: +47%

Tesla: +26%

Airbnb: +24%The Rest of FAANG:

Amazon: +18%

Microsoft: +11%

Apple: +10%

Google: +10%

Recall how far many of these fell during the worst of their 2022 drawdowns…

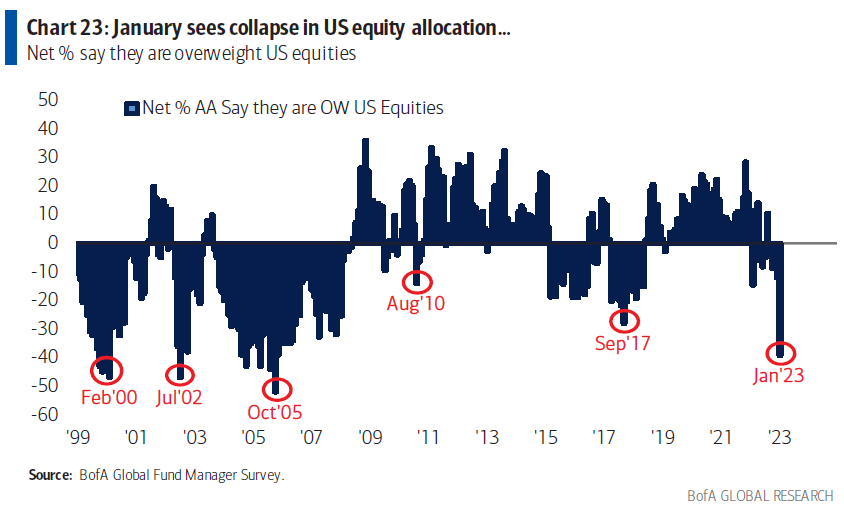

Lose Weight: BAML notes that “Investors are most underweight on US stocks since 2005;” When retail investors are underinvested in stocks following a down year in markets, it has historically been a long-term bullish set-up in equities.

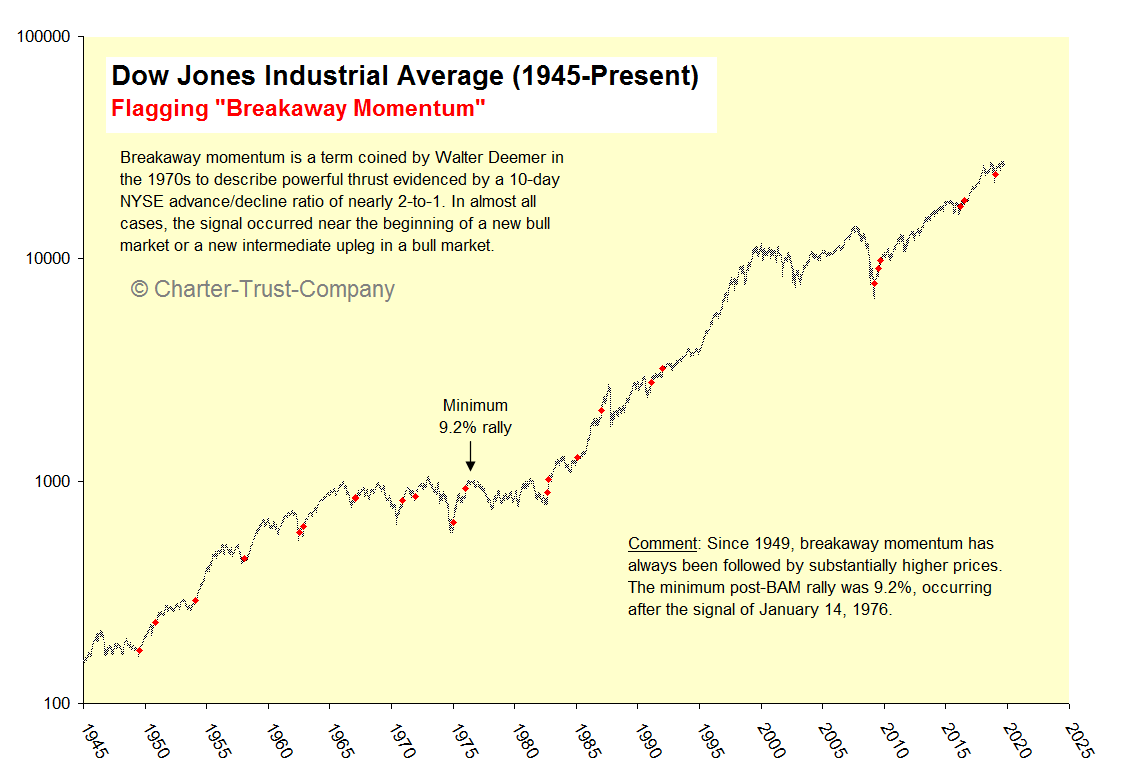

Breakaway: For only the 25th time since World War II (an average of once every 3 1/2 years), the Dow Jones Industrials registered what technician Walter Deemer calls “breakaway momentum” (or “breadth thrust”). This often signals a new bull market (or a new intermediate upleg within a bull market).

It is noteworthy that most of the bullish signals are market-based or technical in nature. The bearish signals I am gathering for next week seem to be primarily fundamental or economic in nature…

Previously:

Observations to Start 2023 (January 3, 2023)

Groping for a Bottom (October 14, 2022)