Jitalia17

Lately, I wrote a bullish article on the JPMorgan Extremely-Brief Revenue ETF (JPST). With the Federal Reserve set to start reducing coverage rates of interest on the upcoming September FOMC assembly, the JPST ought to outperform money from the tailwind of its modest period publicity.

This text seems to be at one other ‘money substitute’ device, the Simplify Treasury Choice Revenue ETF (NYSEARCA:BUCK).

In contrast to the JPST, which makes use of modest credit score publicity to attempt to outperform money, the BUCK ETF writes choices on rate of interest indices and bond futures to reap rate of interest volatility premiums.

Whereas the entire returns are related between JPST and BUCK, I imagine BUCK’s technique could also be essentially riskier, as it’s quick convexity and should expose traders to acute underperformance, like what occurred in April 2024.

General, as a money substitute device, I desire the credit score exposures of the JPST ETF, as it’s simpler to watch. I charge the BUCK ETF a maintain.

Fund Overview

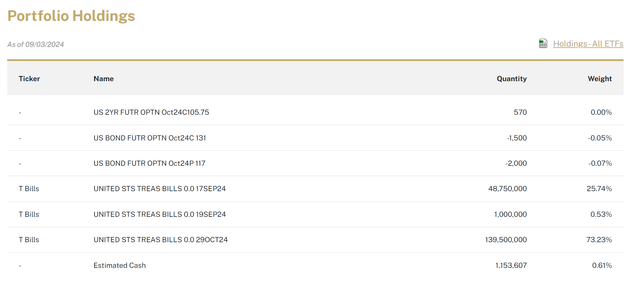

The Simplify Treasury Choice Revenue ETF (previously known as the Simplify Secure Revenue ETF) seeks to generate month-to-month earnings by investing not less than 80% of the fund’s portfolio in U.S. Treasury securities with a period of lower than 1 12 months. The fund additionally goals to generate further earnings by writing choices on fixed-income indices, futures, and ETFs.

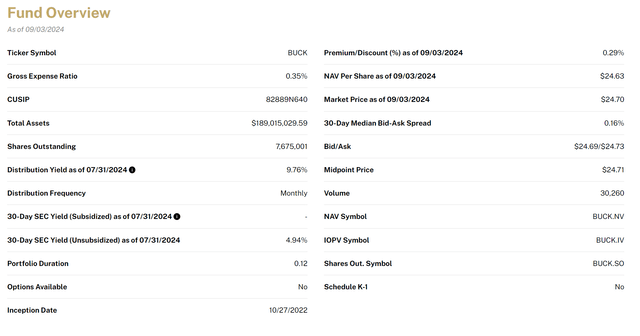

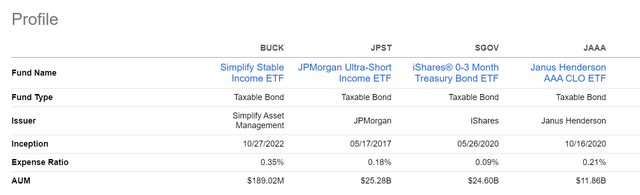

The BUCK ETF, launched in October 2022, has $189 million in belongings and prices a 0.35% gross expense ratio (Determine 1).

Determine 1 – BUCK overview (simplify.us)

Portfolio Holdings

As per its mandate, the BUCK ETF holds nearly all of its belongings in short-duration U.S. Treasury securities. As of September 3, 2024, BUCK holds 99.5% of its portfolio in treasury payments maturing in September and October. The fund has additionally written choices on bond futures (Determine 2).

Determine 2 – BUCK portfolio holdings (simplify.us)

Though BUCK at present solely holds treasury payments, the fund’s lengthy treasury place is actively managed and might spend money on securities corresponding to treasury payments, notes, bonds, and Treasury Inflation-Protected Securities (“TIPS”), relying on which securities present the best whole returns at any given time.

BUCK Pays An Enticing Distribution Yield…

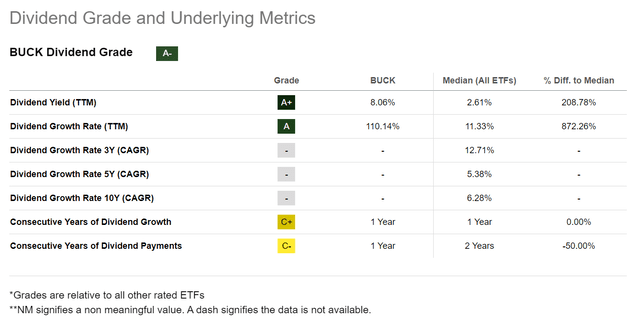

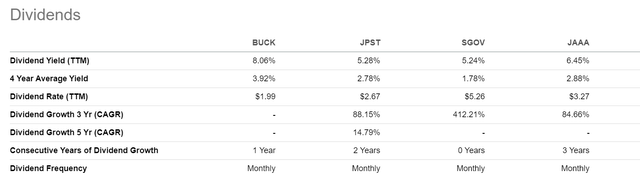

For a short-duration fund, the BUCK ETF does pay a sexy distribution yield. Previously 12 months, the BUCK ETF has yielded 8.1% from the mixture of incomes earnings from its treasury securities plus the earnings from writing choices (Determine 3).

Determine 3 – BUCK has paid 8.1% LTM yield (In search of Alpha)

…However Modest Whole Returns

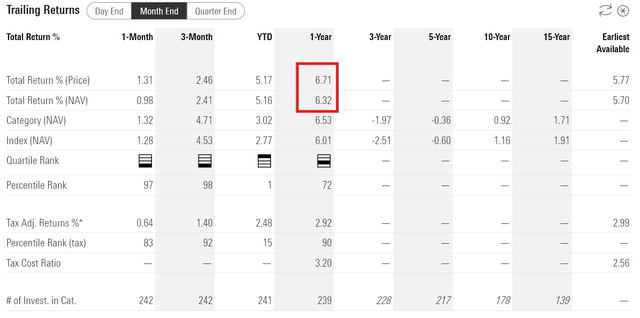

Nonetheless, BUCK’s modest whole returns, with a 1-year whole return of 6.3% to August 31, 2024, recommend there may be much less meets the attention (Determine 4).

Determine 4 – BUCK’s historic whole returns (morningstar.com)

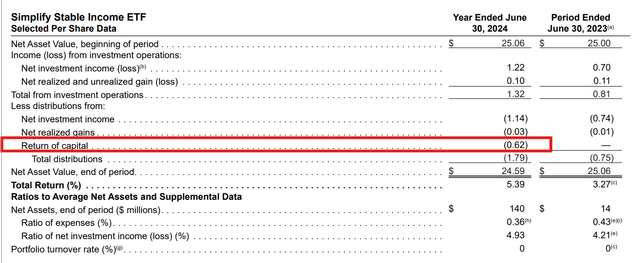

Trying via the fund’s annual monetary statements, we see that $0.62 out of the fund’s $1.79 in distributions paid within the 12 months to June 30, 2024 was deemed ‘return of capital’ (“ROC”), which implies traders had been merely paid again their very own capital via the distribution (Determine 5).

Determine 5 – BUCK makes use of ROC to spice up yield (BUCK annual report)

How Does The BUCK Examine Towards Friends?

Taking a step again, let’s check out how the BUCK ETF stacks up towards short-term money-market and cash-replacement funds just like the JPST ETF, the iShares 0-3 Month Treasury Bond ETF (SGOV), and the Janus Henderson AAA CLO ETF (JAAA).

When it comes to fund construction, BUCK is the smallest fund with simply $189 million in AUM in comparison with $25 billion for JPST and SGOV and $12 billion for the JAAA. It additionally prices the best expense ratio at 0.35% in comparison with 0.18% for JPST, 0.09% for SGOV, and 0.21% for JAAA (Determine 6).

Determine 6 – BUCK vs. friends, fund construction (In search of Alpha)

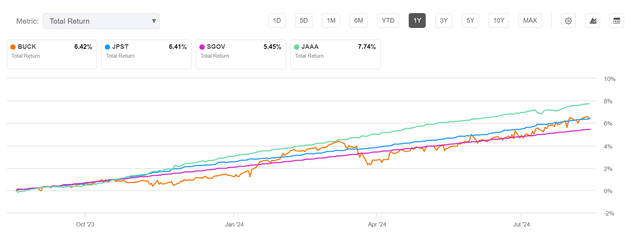

Subsequent, if we evaluate whole returns, we are able to see that BUCK’s 1-year whole return is similar to that of the JPST ETF at 6.4% and has outperformed the SGOV’s 5.5%, however has lagged the JAAA ETF’s 7.7% (Determine 7).

Determine 7 – BUCK vs. friends, 1-year whole return (In search of Alpha)

One other notable function of Determine 7 is the relative volatilities of the methods. Whereas JPST, SGOV, and JAAA all seem to have minimal volatilities, BUCK’s whole returns seem to exhibit important volatility, with a notable decline in early April.

Studying BUCK’s Q2 commentary, the BUCK ETF underperformed in Q2/2024 because of its “option-writing methods as rates of interest had been very unstable and threatened to interrupt out of their vary.”

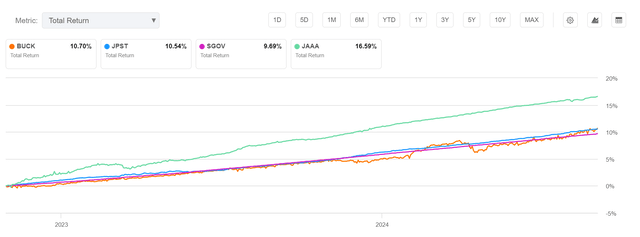

Stretching the historic returns to BUCK’s inception in October 2022 exhibits the same whole returns image, with the BUCK roughly matching JPST, outperforming SGOV, and underperforming the JAAA (Determine 8).

Determine 8 – BUCK vs. friends, since inception returns (In search of Alpha)

Lastly, evaluating the funds’ distribution yields, we see that the BUCK ETF has paid the best distribution yield (Determine 9). Nonetheless, this ought to be tempered by BUCK’s use of ROC to spice up its distribution.

Determine 9 – BUCK vs. friends, distribution yield (In search of Alpha)

General, evaluating the BUCK ETF towards different ‘money various’ funds just like the JPST and JAAA, I imagine the BUCK ETF could also be a comparatively riskier product, as it’s trying to reap rate of interest volatility premiums to spice up its whole returns. As proven in Determine 7, when rate of interest volatility rises, the BUCK ETF might underperform, as it’s quick convexity.

In distinction, the JPST and JAAA use modest credit score exposures to outperform money and could also be ‘comparatively safer’ bets, as credit score markets are nicely understood.

Key Danger To BUCK

The important thing dangers to the BUCK ETF and different ‘money substitute’ funds like JPST and JAAA are market crashes. For instance, the JPST ETF had a mini-crash in the course of the COVID-19 pandemic as credit score markets went ‘no-bid’, inflicting MTM losses for the JPST ETF (Determine 10).

Determine 10 – JPST can endure steep MTM losses when credit score markets turn out to be dislocated (am.jpmorgan.com)

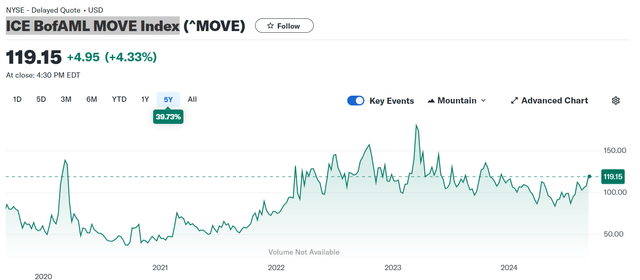

An analogous state of affairs may re-occur sooner or later throughout market stress occasions, significantly with BUCK’s quick volatility publicity. For BUCK traders, one key metric to watch is the BofA MOVE Index, which measures market rate of interest volatility, much like how the VIX Index measures fairness volatility (Determine 11).

Determine 11 – BUCK traders ought to monitor the MOVE (Yahoo Finance)

When rate of interest volatilities spike greater, like in April 2024, short-vol funds like BUCK could also be susceptible to a drawdown.

Being a discretionary fund, traders are additionally on the whim of the fund managers’ acumen. Whereas the group at Simplify is long-tenured and skilled, they’ve additionally sometimes slipped up.

Conclusion

The BUCK ETF is an progressive ‘money substitute’ fund that harvests rate of interest volatility premiums to boost the returns from holding short-duration treasuries.

Up to now, the BUCK ETF has carried out in step with related money substitute instruments just like the JPST ETF. Nonetheless, the BUCK ETF has exhibited higher volatility, as its option-writing technique could also be essentially riskier than JPST’s modest credit score exposures.

For my part, I desire the JPST and JAAA, as they’ve related or higher returns than BUCK whereas exhibiting decrease volatility. I charge the BUCK a maintain.