da-kuk/E+ by way of Getty Photographs

Introduction

The current pullback of the expertise sector within the inventory market might show to be a great alternative for earnings traders to look into development earnings funds and get into the secular development exposures.

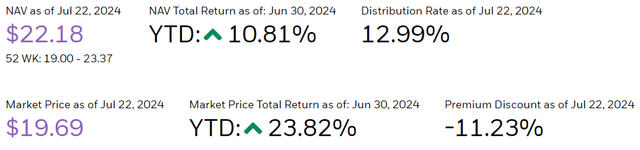

The secular development development of “AI chip rush” will proceed for years to come back. BlackRock Science and Expertise Time period Belief (NYSE:BSTZ) is providing a superb different for the traders to faucet into such AI development alternatives. It has a portfolio with heavy weights within the semiconductor trade, together with AI chip chief NVIDIA representing over 10% of the portfolio. The fund share worth is reasonable with an 11% NAV low cost. The fund not too long ago raised its dividend, reaching 12.99% yield. The excessive distribution is tremendous engaging to earnings seekers who wish to prolong their earnings portfolio to the quick development areas. The perfect factor is that they are going to receives a commission effectively whereas ready for the restoration of the expertise and chip trade markets.

BSTZ Fund Overview

BSTZ is a time period belief fund managed by BlackRock. The fund has the next official description about “funding aims are to supply whole return and earnings by a mix of present earnings, present positive factors and long-term capital appreciation.“

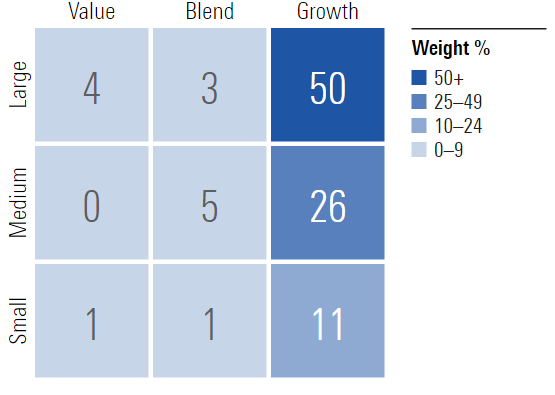

What’s particular about BSTZ is that the fund has an all-technology portfolio with a complete of 261 holdings. The next reveals its weight breakdown, the place 50% is centered within the Massive and Progress class.

BSTZ Weight Breakdown – from Morningstar.com

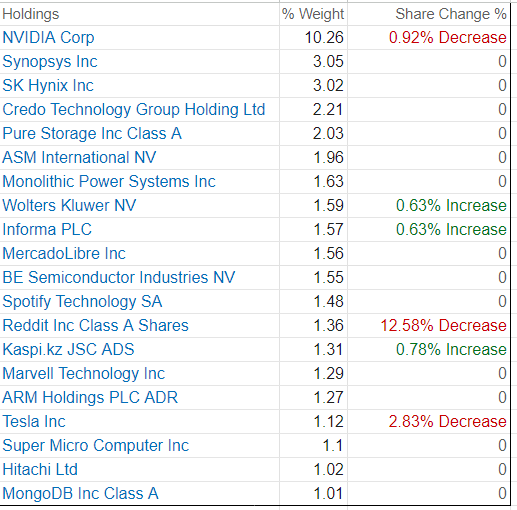

The highest 5 holdings account for 20.5%, and they’re all within the Semiconductors trade. In truth, there are lots of others within the high 20 (with weight bigger than 1) resembling #7 and #8, that are in the identical Semiconductors trade, as proven beneath:

BSTZ High 20 Holdings – Writer compiled from Morningstar.com

The chip-bias reveals a great understanding of the administration workforce within the scorching AI market, which makes the fund uniquely positioned and completely different from the opposite technology-focused fund like its sister fund BlackRock Science and Expertise Belief (BST).

The next summarizes some key market traits of BSTZ, adopted by BST CEF for comparability.

- Whole Belongings (AUM) $1.69B. BSTZ is a big CEF.

- Quantity 104,490. It’s a bit mild however tradeable.

- NAV (low cost): 11.23%. The worth is reasonable. It affords good entry factors.

- Yield: 12.99%. Month-to-month distributions have been elevated since June.

- Leverage : 0.19%.

- Expense Ratio: 1.32%. It’s excessive however typical for the managed CEF fund.

- Time period: BSTZ is a 12-Yr time period fund, that might be led to June 2031, topic to a perpetual just like what obtained BST began.

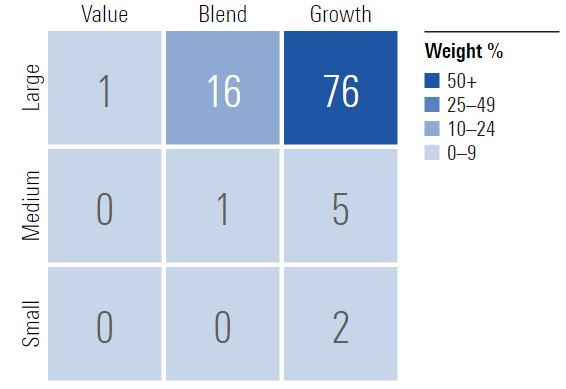

The BST fund is an CEF, additionally managed by BlackRock. The funding aims are equivalent to what’s acknowledged for BSTZ, with the identical give attention to expertise corporations. The distinction is that BST’s portfolio has extra weight within the massive cap development shares (76%), together with shares of “Magnificent 7”, as proven beneath:

BST Weight Breakdown – from Morningstar.com

The next is a abstract of BST market traits:

- Whole Belongings AUM $1.30B. BST is a big CEF however smaller than BSTZ

- Quantity 94,887

- NAV (Premium): 5.34%. It’s not a cut price worth. Will probably be topic to a much bigger sector correction.

- Yield: 8.29%. The distributions issued in 2024 are long run positive factors. This can be a good signal for BSTZ by way of fund’s returns

- Leverage (%): 0.48%

- Expense Ratio: 0.88%. It’s smaller than BSTZ’s 1.32%.

BSTZ is the precise development play for earnings traders

In comparison with BST, it ought to be emphasised that BSTZ is providing two vital double-digit benefits, making it a superb purchase. As proven beneath, the primary benefit is 11% NAV low cost. BSTZ worth is reasonable on the present stage, and a NAV reverting run will produce a sizeable worth appreciation. The second benefit is the 12.99% yield, which comes from a tech-heavy development portfolio. There, it’s a nice time to purchase some shares and lock within the 12.99% yield.

BSTZ Distribution and Low cost – from BlackRock.com

As indicated earlier, BSTZ is tilted extra aggressively in direction of fast-growing corporations. The semiconductor trade is the largest focus and weights in BSTZ’s portfolio. This has resulted in a considerable 20% weight distinction (BSTZ’s 37% vs BTS’s 7%) in Medium-Cap Progress and Small-Cap Progress classes. It’s anticipated that big-cap market pullback from small-cap rotation may have a smaller affect on BSTZ.

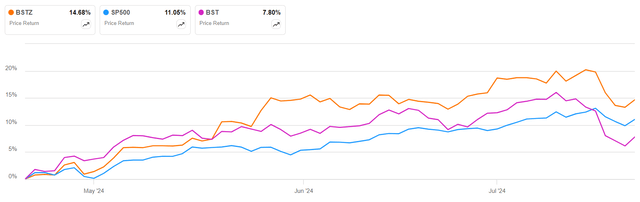

The next comparability within the final three months affords clear proof of the completely different worth behaviors. BSTZ has survived significantly better than BST in the course of the present pullback. In truth, it’s extra spectacular to note that BSTZ’s worth has gained (14.68) nearly twice as BST (7.8%) up to now in 2024. Remember, that is simply the worth comparability, the full return will produce extra hole in share factors.

Three-Month Value Comparability – from SA charting

It’s a good transfer to undertake “development earnings” strategy.

Within the close to time period, the massive expertise shares may proceed to be beneath the worth pressures as a result of (summer season) seasonality and the sector rotations, together with small-cap sentiment shift, resembling “Small-Cap Shares Soar Alongside Buyers’ Price-Minimize Expectations“, and a possible value-oriented rotation to steadiness out the record-high expertise focus.

Will probably be a wise technique for traders to take “revenue” off from their development portfolio till the rotations run by their programs. From the desk “BSTZ High 20 holdings” proven within the earlier part, it’s fairly evident that BSTZ’s administration has trimmed the weights in large-cap expertise leaders like NVDA, TSLA, and so on., maybe as a part of their trend-following actions in response to the small-cap rotation.

I believe that reallocating (some portion) cash to this type of “development earnings fund” makes excellent sense beneath the present market circumstances. On one hand, the earnings distribution is the revenue taken out each month. Then again, the fund administration will do what is critical to comply with the market-trending sector rotations. Understand that that is one thing you might be paying (excessive expense ratio) for and depend on. The administration ought to do the precise job for you.

Wanting forward, I consider that the massive expertise guys and “actual” growers will nonetheless be winners of the market in 2024. The present pullback affords a great entry level for earnings traders to select up the good “development earnings” performs resembling BSTZ. It’s also a great time to judge the efficiency in opposition to the fund technique and construction and establish the precise ones that can match one’s funding wants. It might be a a lot more durable job to do when every little thing was sun-shining. As revealed on this article, BSTZ’s AI chip chubby ought to separate it aside from the “FOMO” GenAI performs with “No Actual AI Alpha“, that are nonetheless miles away from attaining the matching enterprise development.

Dangers and Caveats

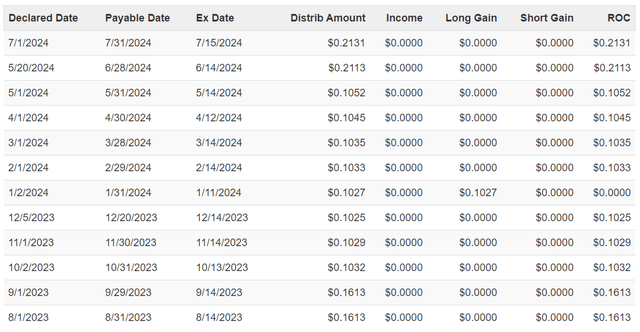

The distributions are principally ROC as proven beneath, which might be a supply of concern for some earnings traders, significantly within the mild of the current distribution increase.

BSTZ Distributions – from CEFConnect.com

The traders must also concentrate on the unstable distribution historical past in current months, as illustrated above. The distribution sustainability is a key gauge for the well being standing of the fund.

BSTZ’s portfolio is constructed with dangerous belongings within the expertise house. The portfolio will exhibit excessive volatilities, which may affect the fund’s efficiency enormously within the quick run.

Closing Ideas

The sector rotations are taking place. The massive expertise shares are quickly out of the favor and have been pulled again within the final two weeks or so. For some traders, this can be a great time to take revenue off the desk from the expansion portfolio, whereas others may even see it as a great alternative to create new earnings streams with expertise exposures. Both means, BSTZ could be a wise different for these traders to meet their funding wants. BSTZ options engaging double-digit NAV low cost and yield. Along with a portfolio targeted on the secular-growing AI chip sector, BSTZ might be a proper selection for a lot of earnings traders.