pidjoe

Brookfield Renewable Partners L.P. (NYSE:BEP) has seen its share price drop more than 33% since its peak. The company’s dividend has increased to more than 6% as rising interest rates and competition in renewables has made the company’s once lower dividend rate much less attractive. As we’ll see throughout this article, the weakness doesn’t tell the entire story.

Brookfield Renewable Partners Developments

The company has continued to invest across the world into a variety of new renewable technology.

Brookfield Renewable Partners

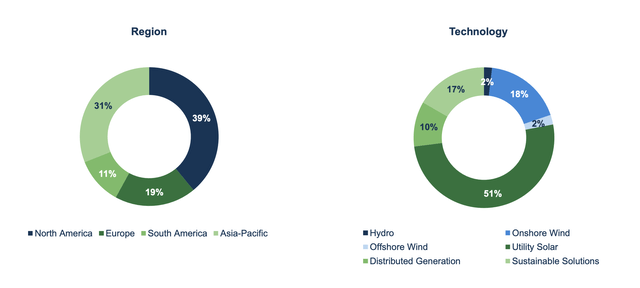

The bulk of the company’s investment is in North America, just under 40%. The next largest investment is in the Asia-Pacific region, with South America and Europe representing a smaller portion. The company’s focus on North America minimizes volatility, as the market represents one that is substantially more stable.

The company’s diversification here is a strong plus for the company and its ability to generate reliable long-term shareholder returns.

Brookfield Renewable Partners Capital

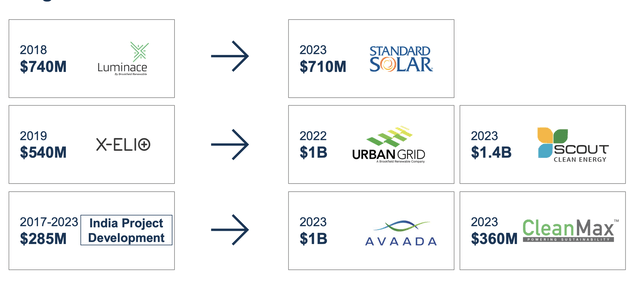

The company has started to deploy capital with non traditional means looking to build and invest in sub companies.

Brookfield Renewable Partners

This isn’t surprising as the company’s spending ramps up. The company has continuous billions that need to be deployed. There are numerous firms in a variety of renewable energy industries continuously looking for additional capital. The company’s investments here offer not only substantial diversification, but help expand potential returns.

Brookfield Renewable Partners

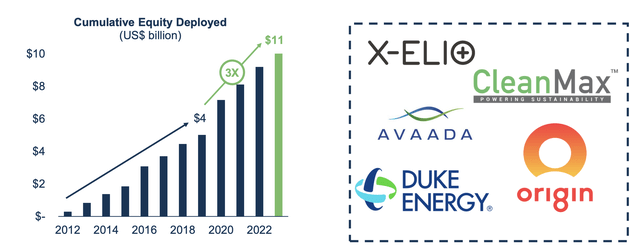

The company’s equity deployed has ramped up. From 2019 to 2023, the company’s cumulative equity deployed has tripled to $11 billion. That equity has been deployed in both existing assets and numerous other assets, as already discussed. The company’s continued deployment of a large amount of equity is essential to it achieving its growth.

Brookfield Renewable Partners Returns

Long-term, the company’s ability to be a valuable investment is based on its target of 12-15% returns annualized.

Brookfield Renewable Partners

The company current offers investors a 6% dividend yield. That’s much higher than its historic yield, but also, in a world where treasures are comfortably yield more than 5%, it’s not especially surprising. The company’s target of 12-15% on capital is an admirable goal and will support continued dividend growth. It’s also a target that we expect the company will hit.

Brookfield Renewable Partners Dividend

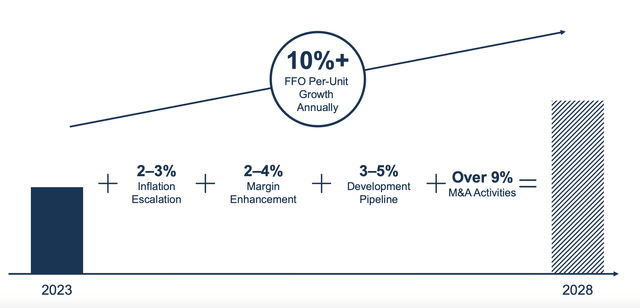

However, what matters long term is not just those paper returns, but how they turn into FFO / unit and ultimately the company’s ability to reward shareholders.

Brookfield Renewable Partners

The company expects its FFO (funds from operations) per unit to grow at more than 10% annually. That’ll be supported primarily by the company’s existing portfolio of assets, with inflation escalators and margin improvements. Its development pipeline and continued exploration activities are expected to noticeably help the company out as well though.

The risk here is that the company has amounts of its FFO that it must pay to its sponsors before dividends. Brookfield Asset Management (BAM) earns 25% of marginal dividends from Brookfield Renewable Partners, which make it harder for the company to increase its dividends. That means long-term growth is capped at 7-8%, which is respectable but also in line with the S&P 500 (SP500).

Still we expect steady long-term cash flow, more than many other industry.

Thesis Risk

The largest risk to our thesis is competition. While many utilities like hydropower have had some of the best locations consumed, many other have an incredibly low barrier to entry, such as solar. Increased competition, along with demand that lowers the required return on investment, can hurt the company’s opportunities.

Conclusion

Brookfield Renewable Partners has performed poorly recently. That’s because the company primarily focuses on cash flow to shareholders, and the risk free interest rate is increasing substantially. However, underneath that underperformance lies the story of a company with strong assets and a continued ability to generate strong cash flow.

Going forward, we expect Brookfield Renewable Partners L.P. to focus on continued reliable growth. We expect it to turn that growth into increasing dividends, despite the cash flow owed to Brookfield Asset Management, resulting in substantial long-term growth. Let us know your thoughts in the comments below.