Itaipu Hydroelectric Dam tifonimages

On our final protection of Brookfield Renewable Companions (NYSE:BEP) (BEP.UN:CA) and its company sibling Brookfield Renewable Company (NYSE:BEPC) (TSX:BEPC:CA), we urged traders go away the corporate for its most well-liked shares. The popular shares in query have been those buying and selling on NYSE (there are a ton of others on TSX), i.e. Brookfield Renewable Companions L.P. 5.25% PFD CL A (NYSE:NYSE:BEP.PR.A). This appeared like a yield chasing name, designed for greater earnings. However as all the time, we had capital preservation in thoughts.

This yield is an efficient 2% greater than BEP’s yield of 5.39%. Whereas we expect BEP’s yield is protected for the foreseeable future, there isn’t any query that BEP.PR.A’s yield is even safer. We expect this defensive safety additionally would profit from the speed lower cycle and will ship related returns to BEP, with much less danger. In our final protection of this particular safety, we had rated it as a “maintain” because it was buying and selling at $20.52. There have been much better values again then in the popular share Universe. As we speak, we’re upgrading this to a “purchase”.

Supply: Change To The Greater Yield Various

We have a look at what has occurred since then and inform you how we see the renewable vitality panorama shaping up.

The Acquisition

BEP acquired again into the acquisition sport, making a bid for Neoen.

- Brookfield has entered into unique negotiations with Impala, the Fonds Stratégique de Participations managed by ISALT, Cartusiai and Xavier Barbaro, and different shareholders to accumulate roughly 53.32% of the excellent shares of Neoen at a worth of 39.85 euros per share.

- The acquisition worth represents a 26.9% premium during the last closing worth and premia of 40.3% and 43.5% over the 3- and 6-months volume-weighted common worth, respectively. Brookfield’s supply implies an fairness worth for 100% of the shares of 6.1 billion euros.

Supply: BEP

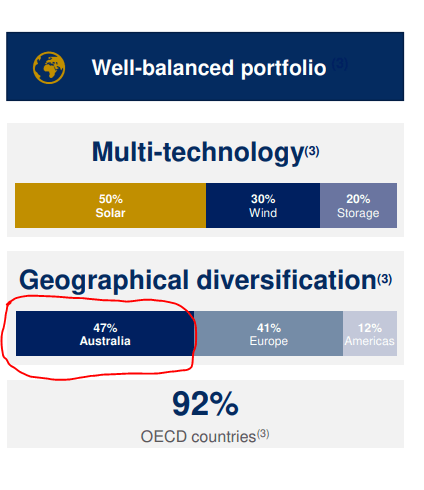

That is unlikely to maneuver the needle immediately, as Neoen is pretty small relative to the enterprise worth of BEP. As well as, due to the huge premium, the a number of differential between the 2 was pretty small on the time of the announcement. So why is BEP getting in right here? Neoen does have a set of high quality asset of about 5GW of renewable vitality. Nevertheless it additionally has a 3GW beneath development and a protracted runway of tasks that could be as a lot as 20GW. There’s the long run development right here that BEP is attempting to safe. The property are pretty younger and have leverage down the road to greater energy costs.

NEOEN Presentation

The worth paid was not the worst we have now seen, however they seemingly might have gotten a good higher deal at the moment, as a number of contract all over the place.

The Political State of affairs

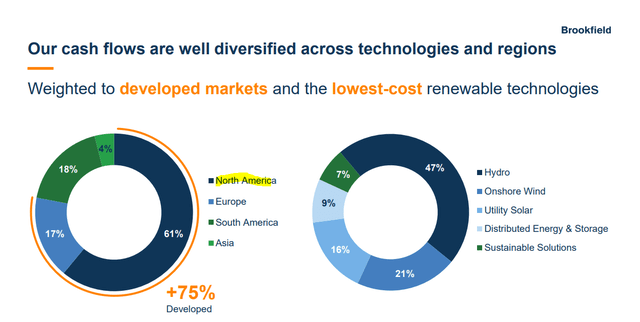

With out stepping into the political mud-slinging space, we are able to simply report the info. The chances of a Trump win have elevated materially over the previous few weeks, and that is taking part in on the renewable vitality theme. We do not imagine this could impression an organization like BEP materially. Sure, North America is a giant piece of the present pie for BEP. 61% of its money flows come from this area. However BEP’s world attain and alternative board permit it to comply with the greenback (or yen for that matter) indicators wherever they might lead.

BEP Could 2024 Presentation

The Neoen acquisition opens an enlargement doorway into Australia.

NEOEN Presentation

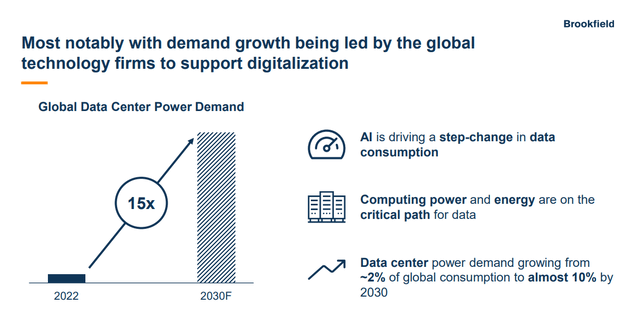

So we do not see these dangers as materials. There are some who imagine that the AI development will probably be an enormous supply of electrical energy demand even with North America and that would help renewable markets.

BEP Could 2024 Presentation

We disagree on this entrance and assume the majority of AI purposes may have zero revenues or will probably be unprofitable. We see this imploding down the road, and all these fanciful development charges will disappear on the similar tempo as clichés like Metaverse and Internet 3.0.

Valuation

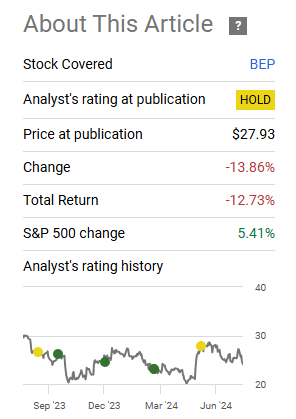

We’re nonetheless transferring right here from a “maintain” to a “purchase” on BEP. With most firms with an especially regular set of revenues and money flows, the first driver of returns at any level on the time spectrum is worth. Extra exactly, it’s valuation. Since our final replace, that is what we have now seen. BEP has dropped steeply. A 14% drop in beneath 3 months is kind of a transfer, particularly for a low beta inventory when the S&P 500 is up 5.41%.

In search of Alpha

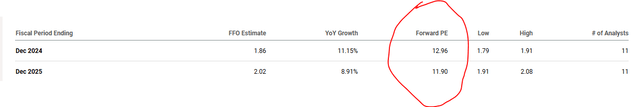

On the similar time, our urged play BEP.PR.A is up about 7% inclusive of dividends (ex-dividend July 15, 2024). In different phrases, BEP.PR.A has outperformed BEP by 22% in 80 days. At current, we expect this lovely commerce has run about so far as it could run. BEP has additionally grown extra engaging with the worth drop and now trades at 13X 2024 funds from operations (FFO).

In search of Alpha

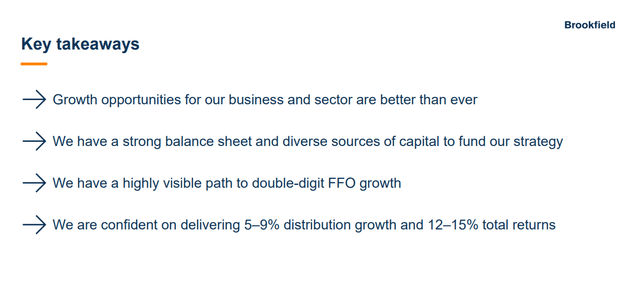

Traders may rush to conclude that’s the neatest thing since sliced bread, however we might ask them to have a look at the debt excellent first. Debt to EBITDA remains to be close to 6.5X and certain bumps up with the Neoen acquisition. In such a local weather, with reasonably excessive rates of interest, we see 11X-14X FFO has the proper a number of for BEP. We nonetheless prefer it right here and assume the widespread items now supply a bonus over the popular. The yield differential between them has additionally collapsed due to the 22% distinction of their returns since Could. At the moment, BEP yields 5.9% and BEP.PR.A has a stripped yield of seven.15%. That isn’t sufficient of a bump on the preferreds to maintain recommending it at this level. Whereas we do not assume BEP will be capable to generate the distribution development it states beneath, we expect even extraordinarily conservative assumptions warrant a change in stance.

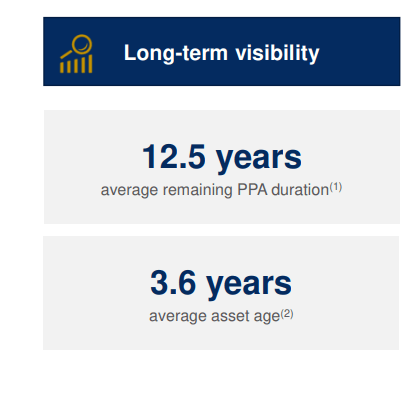

BEP Could 2024 Presentation

We’re downgrading BEP.PR.A to a Maintain. We’re upgrading BEP to a Purchase with a $27 worth goal. That offers it the potential of constructing a complete return of 18% from right here in a single 12 months.

Please be aware that this isn’t monetary recommendation. It could look like it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their aims and constraints.