Eoneren

Dear readers/followers,

I started coverage on Brookfield Corporation (NYSE:BN) back in April with a detailed article on the structure of Brookfield and a sum of parts valuation.

The conclusion I came to at the time was that BN was trading at a substantial discount relative to the value of its individual holdings (public and private). In particular, investors were essentially buying their publicly traded holdings (BAM, BPY, BEP and BBU) dollar for dollar and getting their real estate (valued at book value of $30 Billion) for free.

My conclusion was to stick with BAM though. Mainly for its easy to understand and analyze business model. I worried that BN may not be able to close the gap to fair value and saw BAM as a more certain investment.

Since then, however, I’ve dug deeper and rotated about 60% of my BAM into BN, primarily because it seems to be better aligned with management’s interests. I now hold a considerable position in both and combined, they represent my biggest position.

I posted an updated thesis on BAM several days ago and today, following BN’s Q2 2023 earnings, it’s time for an update for the corporation.

Brookfield Corporation update

First off, the sum of parts argument still holds since share prices of BN and its publicly traded subsidiaries have barely moved over the past 4 months.

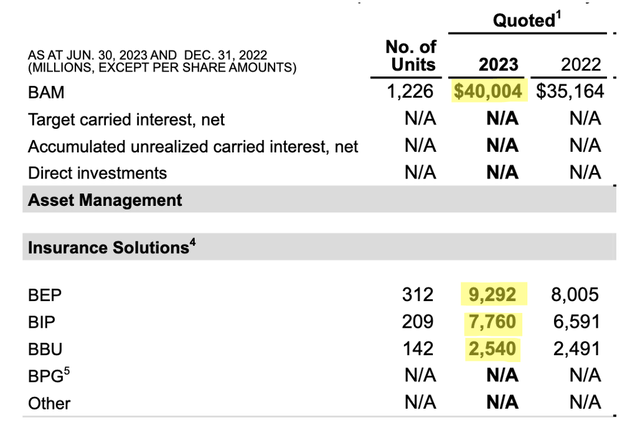

The shares of BAM, BEP, BIP and BBU held by BN are currently valued by the market at $60 Billion.

BN Presentation

Adjusting this number for net debt and unrealized carry yields value of their public holdings of $52 Billion. Note that this “value” excludes insurance which has produced distributable earnings of $600 Million over the last 12 months and real estate which alone is valued in excess of $20 Billion. Still it’s below BN’s market cap of $56 Billion. So this argument hasn’t really changed since my last article.

There are, however, a couple of things that have changed.

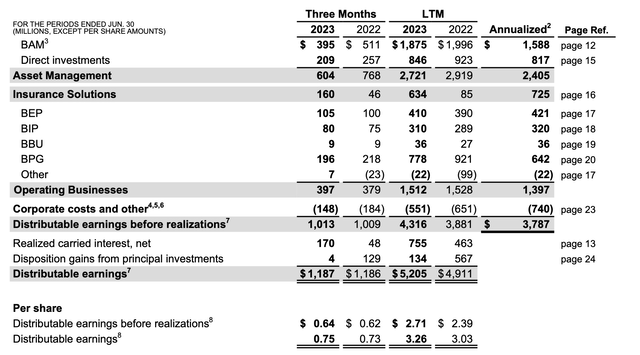

The corporation has reported a really solid second quarter with distributable earnings of $0.75 per share, above consensus of $0.68 and up 2.7% YoY.

BN Presentation

The group has also announced a major acquisition of American Equity (AEL) which is the largest annuity platform in the U.S. with a float of about $50 Billion. This acquisition will nearly double Brookfield’s insurance solutions business by adding earnings of $400 Million per year. When closed, the transaction will also benefit BAM as it will be responsible for managing the majority of the $50 Billion float.

Fundraising has been strong so far this year, with $37 Billion raised year-to-date, on top of the $50 Billion from AEL. Management sees a clear path to raising a total of $150 Billion by the end of the year, which would be a record year for Brookfield.

Management has also announced a stock buy-back program for up to 8% of float. This is something that Bruce Flatt has been talking about for a while and it would definitely be seen as extremely positive by the market. So far, share buybacks have been low though, at only $536 Million over the past twelve months (less than 1% of float).

Also, the real estate market sentiment seems to be taking a turn and since the stock is mainly down on real estate market and specifically office fears, this could be a major catalyst.

In particular, inflation has come down significantly to 3.2%, despite shelter which has about a 1/3 weight still at 7.7%. With real time shelter inflation near zero, I think it’s only a question of time, before the CPI headline number comes below the Fed’s 2% target.

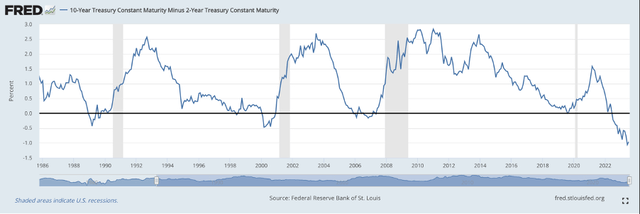

At the same time, the yield curve is the most inverted since 1980 which traditionally results in a recession. It has correctly predicted all four last recessions since 1980s. This time might be different, but I doubt it.

FRED

With inflation coming down, if the US slips into a recession, the Fed will most likely resort to cutting interest rates, as it has every time in recent history. Lower rates will likely result in real estate revaluation higher. Since the underlying cash flows have increased over the past two years, real estate could easily reach all-time highs in this scenario and consequently BN’s stock price would likely increase significantly as well.

Valuation alternatives

The sum of parts argument is nice, but the things is, that the without a clear catalyst, the gap will not close. That catalyst may come in form of stock buy-backs, a shift in the real estate market sentiment or outsized growth of BAM.

Something worth considering is that as BAM grows, the market cap of BN’s 75% stake in BAM could soon equal to 100% of BN’s market cap, meaning that the market would essentially be valuing the rest of BN’s asset at zero.

Clearly, in a rational market, we shouldn’t get to a point where the stake in BAM is valued at more than BN, that would imply negative value of the rest of BN’s holdings.

At that point the question becomes whether BAM will lift BN’s valuation or whether BN will hold BAM back. I don’t know the answer, but since management primarily holds shares of BN, I’m confident that their aim will be to maximize returns on the holding level and they will find a way to close at least part of the gap.

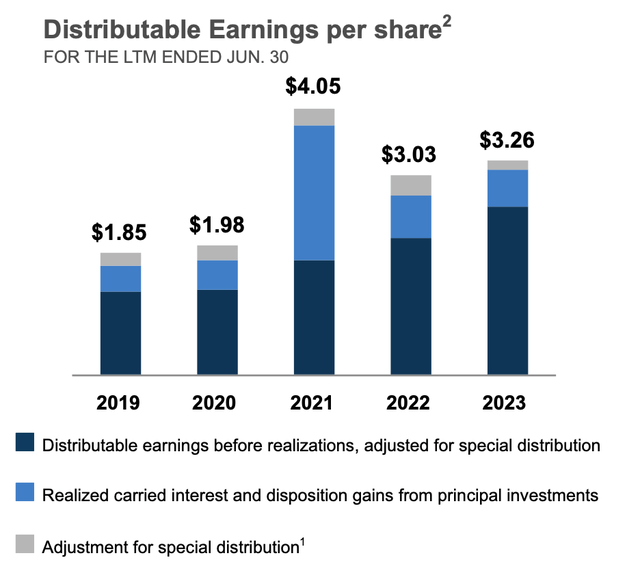

In the meantime, with distributable earnings of $3.26 per share over the last 12 months, the corporation trades around 10x earnings.

BN Presentation

The corporation also trades at a very reasonable FFO yield of 8.5% (adjusted for the disposal of 25% of BAM). Using the appropriate weights that means that we’re paying for 15% growth for BAM and the insurance business, 8% growth in BIP and BEP, and no growth in real estate. All segments are actually expected to grow faster than that (and also have historically done so). So on an FFO yield basis, the valuation isn’t expensive.

All things considered, BN remains great value in my opinion. The asset management business is doing very well, despite a tough fundraising environment and the valuation continues to be attractive from a sum of parts as well as FFO yield perspective. If you’re bullish on quality real estate at current valuation, the same way I am, Brookfield Corporation represents a great play on both alternative asset management as well as real estate. This is why I reiterate my BUY rating here at $34.50 per share and happily continue to hold my full position.