SolStock/E+ by way of Getty Photographs

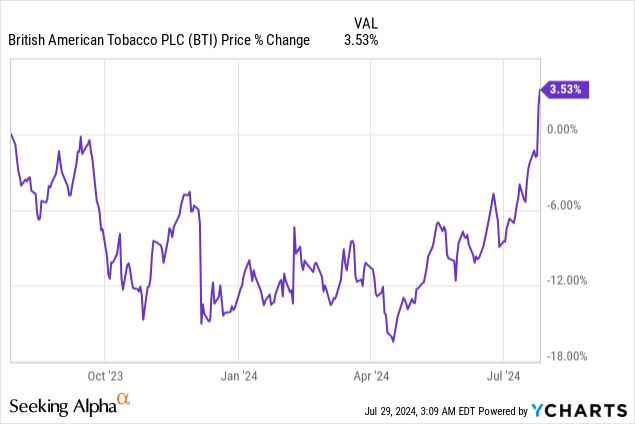

British American Tobacco (NYSE:BTI) delivered strong earnings for its first half final week, pushed by a powerful efficiency of the tobacco firm’s different merchandise class. Velo, British American Tobacco’s nicotine pouch model, did particularly effectively and its merchandise are seeing accelerating uptake by customers. I consider British American Tobacco is executing its different merchandise technique rather well, and I see sturdy EPS development potential for BTI, pushed by new product classes, particularly Velo and Vuse. With shares being priced at solely 7.2X FY 2025 earnings, British American Tobacco’s earnings potential continues to be undervalued relative to different tobacco firms within the business group!

Earlier score

I rated shares of British American Tobacco a powerful purchase — A Stable 10% Yield For Retirees –– in Might because of the tobacco agency’s strong quantity development for its different product classes throughout key markets. British American Tobacco solidified this momentum within the first half, particularly with regard to its Velo merchandise. The earnings outlook for the brand new product class is optimistic, and falling inflation could possibly be a possible tailwind for the corporate’s earnings development as effectively.

Robust different merchandise class efficiency

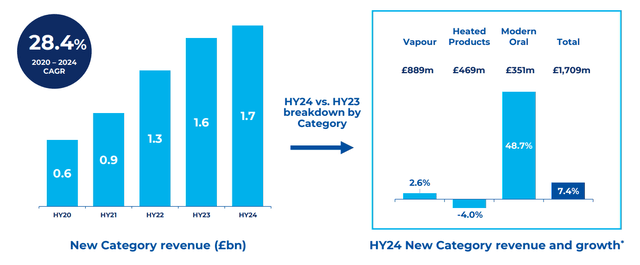

British American Tobacco continues to do extraordinarily effectively when it comes to rising revenues for its non-traditional classes together with Vuse (vape), glo (heated tobacco sticks) and Velo (nicotine pouches). BTI’s consolidated adjusted revenues hit £12.9B within the first half of FY 2024, which is the equal of $16.7B. The flamable phase, as anticipated, noticed a income decline of two.6%. New product revenues, nevertheless, reached a file of £1.7B ($2.2B), displaying a year-over-year development fee of seven.4%. New class revenues had been pushed primarily by Velo which noticed near-50% top-line development within the first six months of the present 12 months.

BTI

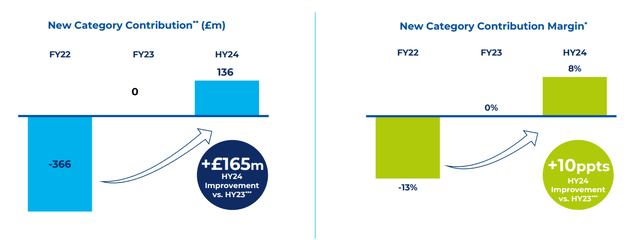

Whereas FY 2023 was a transition 12 months for BTI on condition that it reached break-even profitability in its new product classes, FY 2024 and FY 2025 are anticipated to be 12 months of great revenue development acceleration. With inflation additionally moderating, I’m particularly optimistic that the brand new product class might ship spectacular phase development subsequent development. Inflation takes stress off of customers’ budgets and will lead to a further enhance to quantity development. I might not be shock to see a doubling of earnings subsequent 12 months given the present momentum of Velo which might put full-year FY 2025 new phase earnings within the neighborhood of £500M ($643M).

BTI

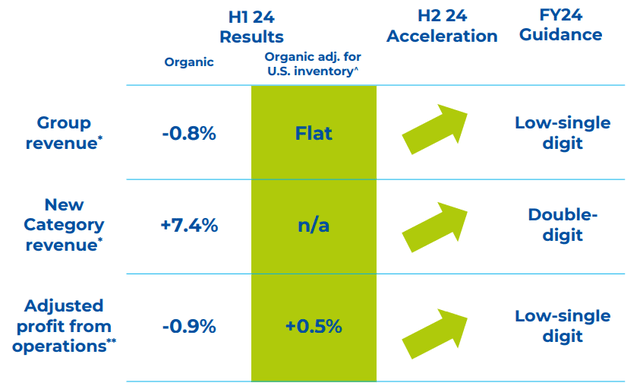

Favorable outlook

British American Tobacco’s outlook can be favorable with the corporate anticipating an acceleration in each consolidated revenues and adjusted earnings from operations within the single-digits within the present fiscal 12 months. New product classes are set to see double-digit top-line development as a consequence of sturdy Vuse and Velo product uptake, particularly by youthful customers.

BTI

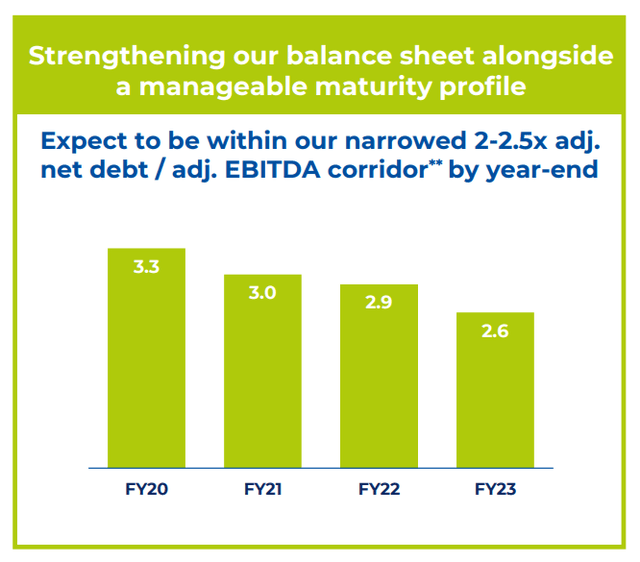

Deleveraging set to proceed

Apart from new class product development, particularly in Velo and Vuse, I see a revaluation catalyst with regard to the corporate’s continuous deleveraging. Whereas scaling up its quantity development for Velo, Vuse and glo, the corporate concurrently tackled its web debt state of affairs within the final three years. BTI made appreciable progress in lowering its leverage and introduced its net-debt-to-EBITDA (on an adjusted foundation) all the way down to 2.6X on the finish of FY 2023, representing a decline of two.1%. If the corporate achieves its goal net-debt-to-EBITDA ratio of two.0-2.5X by year-end, implying at the least a 4% enchancment 12 months over 12 months, then shares might have a revaluation catalyst as effectively.

BTI

BTI is buying and selling at a 14% earnings yield…

Apart from sturdy different merchandise class income development and enhancing profitability on this phase, I see British American Tobacco’s low price-to-earnings ratio as the only most convincing purpose to purchase into the tobacco firm. Whereas I’ve mentioned this earlier than as effectively, British American Tobacco as soon as once more continued to ship sturdy monetary outcomes, which signifies to me that the market might proceed to underprice British American Tobacco’s earnings potential.

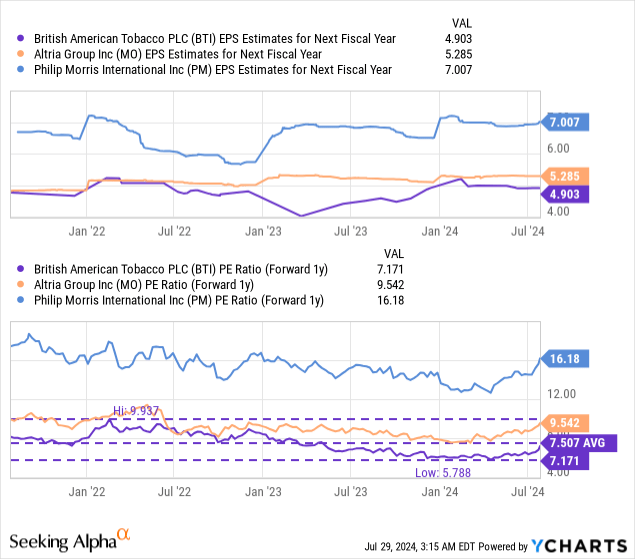

Shares of British American Tobacco are at the moment buying and selling at a P/E ratio of seven.2X, which is beneath the corporate’s long run P/E ratio of seven.5X. The tobacco business group P/E ratio is 11.0X and skewed upward because of the inclusion of Philip Morris Worldwide (PM) which is the most costly tobacco firm with a P/E ratio of 16.2X. Due to Philip Morris’ sturdy earnings development associated to its rising market focus, I named PM A High Earnings Inventory With A 6% Yield in April. Altria (MO), which I additionally advocate to revenue buyers, is buying and selling at a price-to-earnings ratio of 9.5X.

Given British American Tobacco’s sturdy new product class momentum, particularly with regard to Velo, I consider there’s a case to be made for BTI to revalue in the direction of the business group P/E ratio, particularly if the corporate can speed up its earnings development in FY 2024 and past. A revaluation to the business group P/E ratio implies a good worth of $54, which is extra of a longer-term inventory value goal for me. Within the brief time period, I count on — as indicated in my final work on BTI — shares to revalue to an 8X P/E ratio, which means a good worth of $40. The 8X P/E ratio is extra in-line with the corporate’s historic common, however as the corporate continues to show its execution potential and creates earnings visibility, I consider the short-term value goal could possibly be a stepping stone just for BTI to develop right into a a lot greater valuation long run.

Dangers with BTI

The large threat for BTI, as I see it, is a possible ban of e-cigarette gross sales, which might negatively have an effect on the corporate’s development potential for the Vuse model. Vuse is a part of BTI’s new product portfolio and a development catalyst for the corporate. If British American Tobacco’s development within the new product phase slows, the agency’s valuation issue might undergo. What would change my thoughts is that if BTI did not develop its new product class revenue considerably within the subsequent a number of years.

Last ideas

I’ve no purpose to deviate from my sturdy purchase score following British American Tobacco’s earnings scorecard for the primary half of FY 2024. BTI’s sturdy efficiency may be credited to the tobacco agency’s strong execution within the different merchandise class, and Velo particularly. I admire British American Tobacco for lots of causes, however I particularly like the corporate’s low price-to-earnings ratio and drive to cut back its web debt. Given the corporate’s favorable steering for FY 2024, I consider the honest worth of British American Tobacco’s shares sits nearer to $40 and the 8% yield continues to be price shopping for!