Luke Sharrett/Getty Photos Information

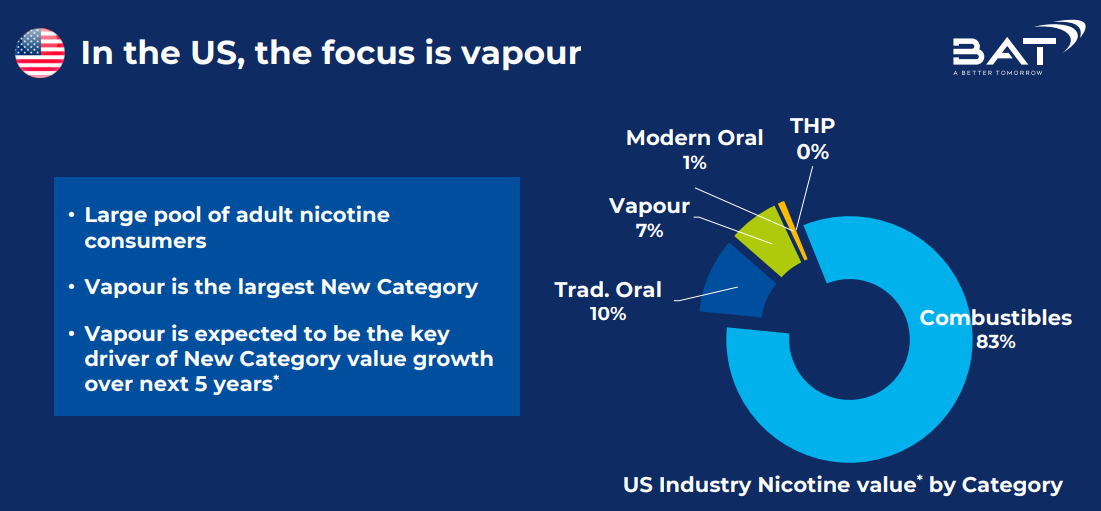

British American Tobacco (NYSE:BTI) affords shareholders a secure 6.7% dividend yield, which is turning into extra worthwhile now that we’re slouching in the direction of a doubtlessly extreme international recession. British American Tobacco is rising various tobacco product classes aggressively, and the agency targets 138% income development within the non-combustible class between FY 2021 and FY 2025. Development on the tobacco agency will proceed to be pushed by various tobacco classes, particularly vaping merchandise, within the U.S.!

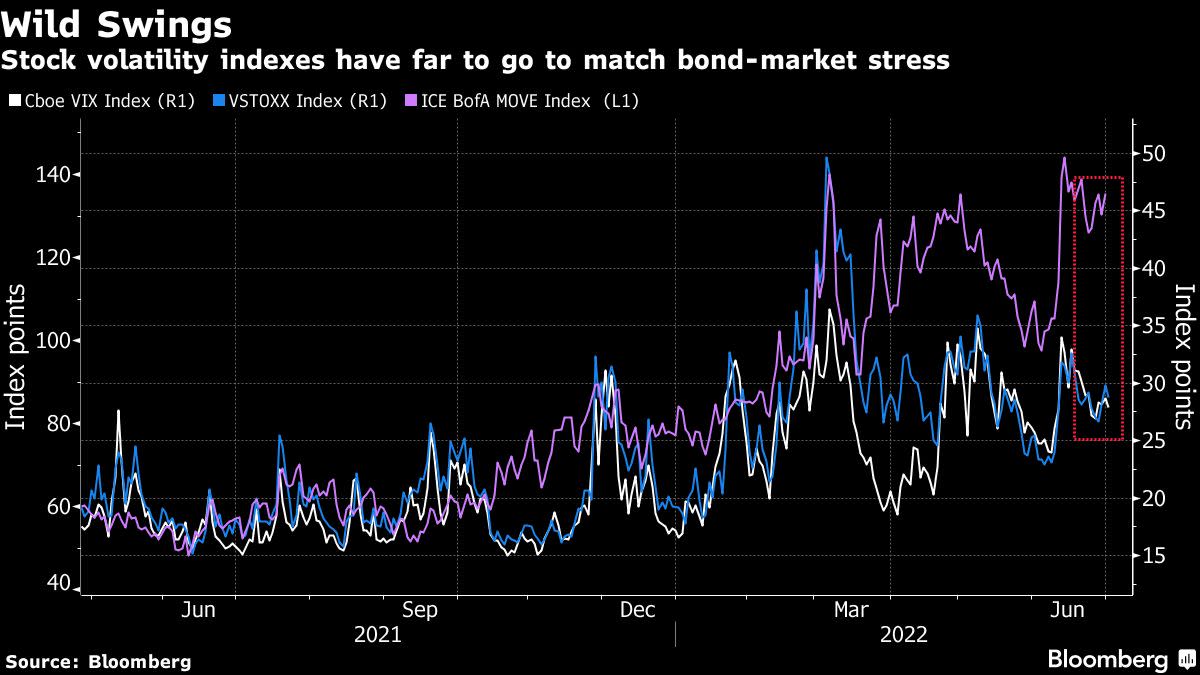

Shares of British American Tobacco gained 15.7% 12 months thus far in 2022 whereas the market had its worst first half in additional than half a century. Huge rival tobacco manufacturers like Philip Morris Worldwide (PM) and Altria Group (MO) didn’t almost in addition to British American Tobacco, which can partially be associated to expectations a few U.S. recession in addition to a current FDA ruling on e-cigarettes.

British American Tobacco: Doubling Down On Different Tobacco Merchandise

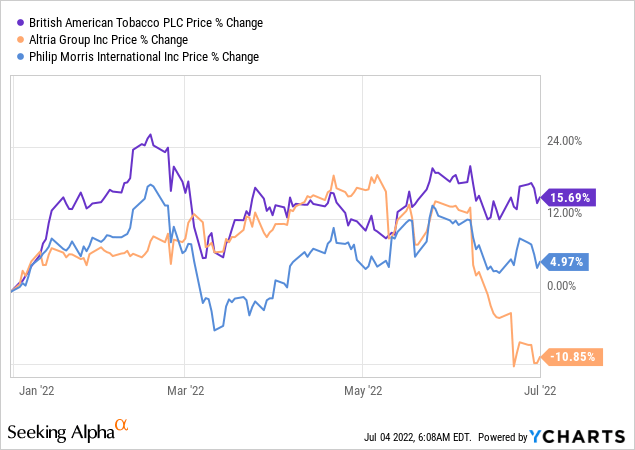

Three distinct manufacturers make up British American Tobacco’s non-combustible class: Vuse, which produces and markets vaping merchandise to mainly youthful customers, glo, which markets heated tobacco merchandise, and Velo, which is a model that consolidates British American Tobacco’s oral nicotine merchandise. These manufacturers have seen sturdy buyer adoption and quantity development lately as particularly youthful people who smoke migrated to improvements resembling vaping merchandise. British American Tobacco is doubling down on the successes it achieved within the various product class, particularly in vaping, and plans to develop its complete non-combustible revenues from £2.1B in FY 2021 to £5.0B in FY 2025. The FY 2025 income aim implies complete anticipated prime line development of 138% over a four-year interval.

British American Tobacco

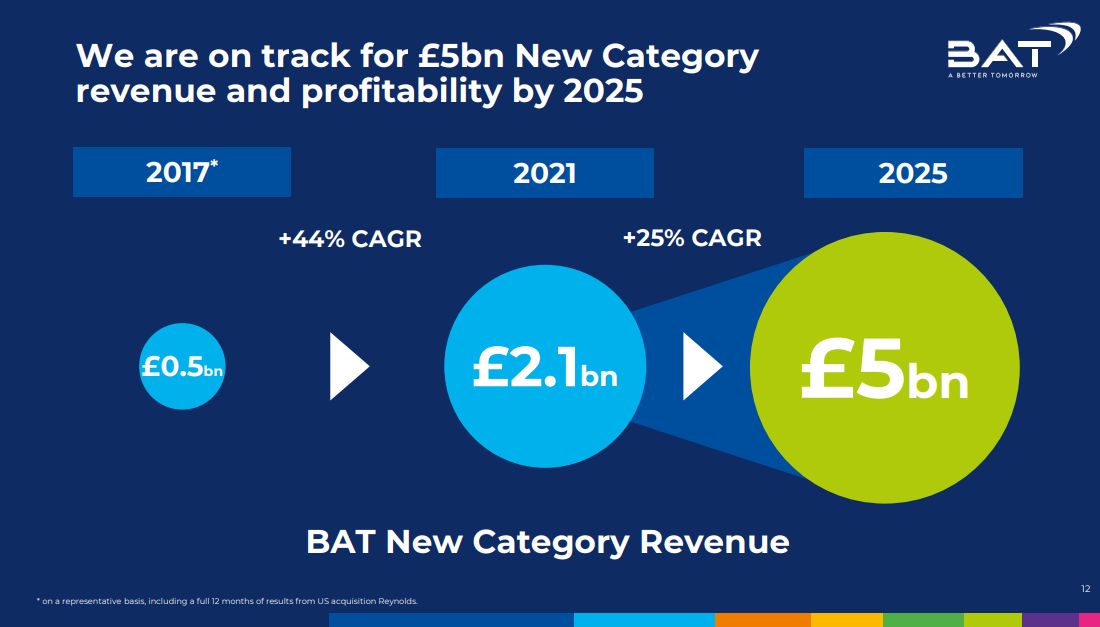

The long run outlook for vapor merchandise could be very enticing, particularly within the U.S. which is seeing fast adoption of vape merchandise. The American market represents the most important development alternative for British American Tobacco, partially as a result of vapor merchandise have a low market penetration price of solely 7%.

British American Tobacco

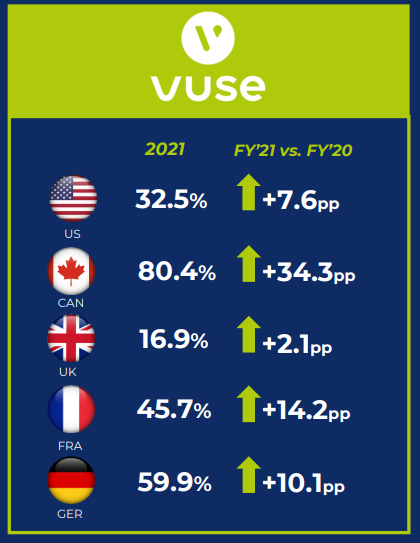

The low penetration price within the U.S. creates a chance for British American Tobacco’s Vuse model to attain quantity development and achieve market share. Vuse is already seeing sturdy demand for its merchandise within the U.S. in addition to in different markets world wide.

British American Tobacco

Latest JUUL Lab’s E-Cigarette Ban

The Meals And Drug Administration, which is tasked with regulating the U.S. tobacco market, final week banned Juul Labs from promoting its merchandise within the U.S. In keeping with an FDA launch from June 23, 2022, Juul Labs has been ordered to cease promoting and distributing the Juul system and 4 forms of JUULpods. British American Tobacco’s Vuse model competes with Juul Labs’ vape merchandise and has achieved vital success lately by closing in on its rival relating to market share. Whereas Juul Labs is interesting the choice, a everlasting ban, as unlikely as I imagine it’s, would severely lower into British American Tobacco’s income development prospects and will result in a severe revaluation to the down-side.

BTI: Sturdy Dividend Worth, Low cost P-E

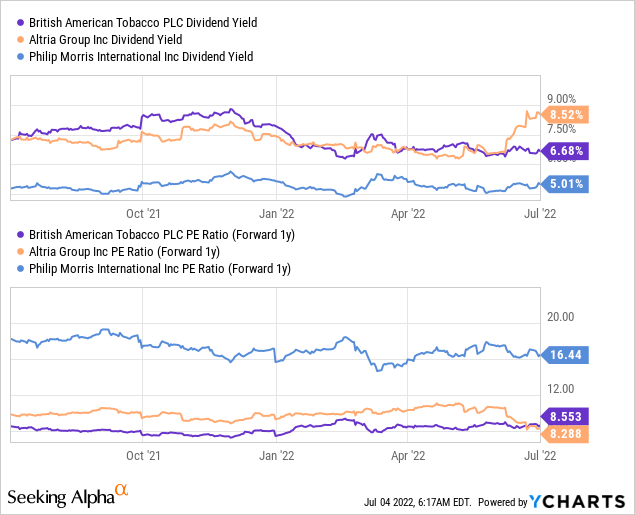

Tobacco corporations could also be underrated relating to their dividend yields. British American Tobacco presently serves up a 6.7% dividend yield whereas buying and selling solely at a P-E ratio of 8.6 X. Philip Morris is presumably probably the most unattractive funding within the tobacco trade proper now because it has the bottom yield (5.0%) and the best P-E ratio (16.4 X).

Dangers With British American Tobacco

The tobacco trade doesn’t have a repute for being a regulation-light trade. Tobacco laws and rising restrictions on nicotine commercials characterize prime line challenges for British American Tobacco in addition to the whole tobacco trade. There’s additionally a substantial threat of expensive litigation within the trade, and long run developments point out a constant decline within the share of people who smoke. Whereas British American Tobacco’s non-combustible merchandise are seeing rising buyer adoption, the final societal development in the direction of not smoking is a long run problem for British American Tobacco and its inventory. A ban of vaping merchandise would doubtless be a severely damaging growth for BTI.

Closing Ideas

With a recession all however sure to impression funding values and development prospects within the close to future, British American Tobacco affords traders a stable 6.7% dividend that would develop if the tobacco firm executes nicely towards its medium time period development and income targets within the non-combustible product class. I imagine that British American Tobacco has a really enticing threat profile, particularly with markets getting extra unstable, and each the excessive dividend yield and the low P-E ratio make BTI a purchase!