claffra/iStock via Getty Images

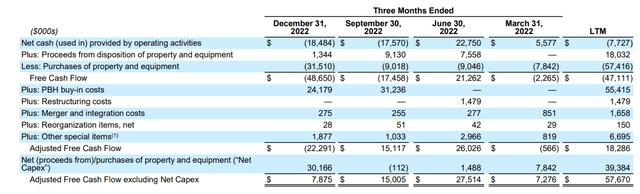

Last week, leading offshore helicopter services provider Bristow Group (NYSE:VTOL) or “Bristow” reported another set of mediocre quarterly results with free cash flow of negative $48.7 million deteriorating to new multi-year lows.

Company Presentation

Even when adjusted for a substantial amount of prepaid expenses in conjunction with new so-called power-by-the-hour (“PBH”) maintenance agreements, free cash flow was negative by $22.3 million mainly due to a massive increase in capital expenditures (“capex”).

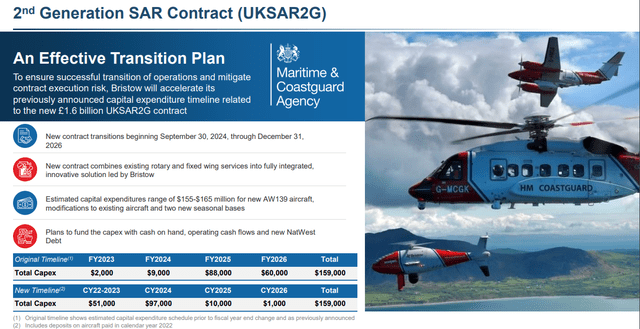

Even worse, the company perplexed investors by pulling forward $137 million out of a total of $159 million in capex required under the recently awarded second generation UK Search-And-Rescue (“SAR”) contract by up to two years “to ensure successful transition and mitigate contract execution risk“:

Company Presentation

On the conference call, Benchmark analyst Josh Sullivan poked management on the issue:

Josh Sullivan

Can you just expand on need to accelerate CapEx as it relates to the new U.K. government SAR contract? And then what you mean by contract execution risk?

Chris Bradshaw

(…) Looking at the time line to start up of the contracts, we saw an opportunity to bring the aircraft in earlier, which will give us better assurance that we’ll be able to complete the modifications and final configuration in time to ensure the successful startup on time for that important case SAR 2G contract. So really, what it is, is, again, no change in the aggregate amount of capital, a pull forward on timing and an enhancement of the assurance that we’ll be able to start on time successfully.

Quite frankly, one might ask what exactly changed since the time of the company’s last conference call in November when management projected the vast majority of capex to be incurred in FY2025 and FY2026.

While Bristow has recently changed its fiscal year to the calendar year, the new timeline still represents a substantial acceleration in capital expenditures.

Management’s explanation of an “opportunity to bring the aircraft in earlier” doesn’t hold much water either given the fact that Bristow agreed to purchase six new AW139 medium helicopters for approximately $106 million already back in October with delivery expected in 2024 as disclosed in the company’s annual report on form 10-K.

Consequently, free cash flow is likely to remain negative in both 2023 and 2024 which apparently doesn’t bode well for potential share buybacks under the company’s untapped $40 million stock repurchase program.

Following the recent refinancing of Bristow’s legacy UK equipment financing facilities with National Westminster Bank, management does not expect to incur additional debt for funding the company’s elevated near-term capex requirements.

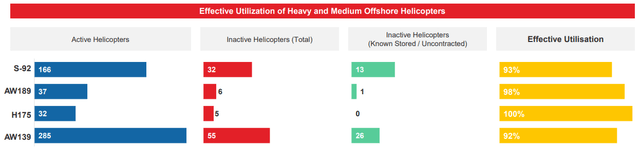

On the conference call, management highlighted increased offshore energy spending levels which have resulted in a tightening market for offshore helicopters:

Company Presentation

That said, after the recent loss of a significant contract offshore Guyana, improvements in Bristow’s oil and gas helicopter business won’t materialize before H2:

We expect that the improvement in Bristow’s financial results in 2023 will be back-end weighted to the second half of the year. As you will recall, the first quarter of the calendar year is traditionally our weakest quarter due to seasonality as shorter daylight hours and implement weather adversely impacts operations.

In addition to that typical seasonal pattern, first part of the year will see more idle aircraft, we concluded a large contract in Guyana at year-end. We are in the process of transitioning and reconfiguring those and other aircraft for new contracts that have been won on attractive terms in places like the U.S. Gulf of Mexico, Brazil and the North Sea. Those contracts are scheduled to begin later this year, which supports our view that the EBITDA run rate at year-end will be significantly higher than the first half of this year.

Unfortunately, Bristow has substantial exposure to the currently weak North Sea market with 43% of the company’s offshore energy service revenues in 2022 derived from this region.

With North Sea offshore drilling activity unlikely to pick up materially before Q2/2024, segment results are likely to remain subdued this year.

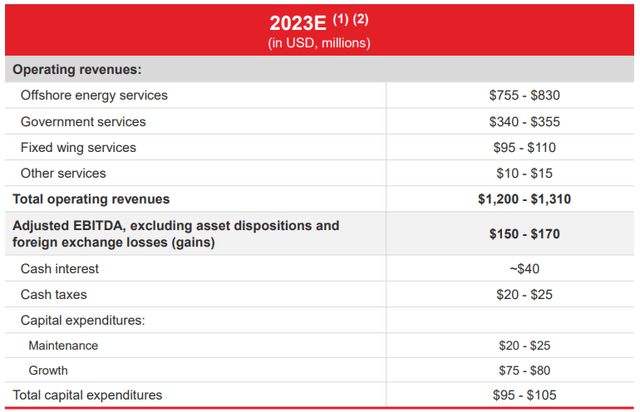

That said, management actually raised its outlook for 2023 revenues and Adjusted EBITDA but this was solely due to the recent appreciation of the British Pound relative to the U.S. Dollar:

Company Presentation

Bottom Line

Given Bristow’s mediocre financial results, disappointing near-term outlook and management’s less-than-stellar performance on last week’s conference call, it’s difficult to envision any sort of near-term catalyst for the stock, particularly with oil prices hitting new 15-month lows this week.

That said, with shares now trading at an approximately 55% discount to the company’s estimated net asset value (“NAV”), I am upgrading VTOL stock from “Sell” to “Hold“.

Investors looking for better exposure to the anticipated multi-year recovery in offshore oil and gas should consider shares of leading offshore drillers Noble Corporation (NE), Transocean (RIG), Seadrill (SDRL), Valaris (VAL), Diamond Offshore (DO) and Borr Drilling (BORR) or offshore support vessel providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI) as well as specialty services provider Helix Energy Solutions (HLX).