photoschmidt

We previously discussed Bristol-Myers Squibb Company (NYSE:BMY) in September 2023, discussing its Loss Of Exclusivity issue with its leading product, Revlimid, leading to a significant decline in annualized sales to $5.5B in 2023, compared to $12.82B in 2021.

Combined with the inability of its other pipelines to offset the losses in the near term, we had preferred to rate the stock as a Hold then.

In this article, we shall discuss why our previous Hold rating has proven to be prudent, with the BMY stock losing -12.35% of its value since then.

While the stock has bounced moderately by early December 2023, we are not certain if this bottom may hold, attributed to potential balance sheet deterioration after the all-cash $4.8B Mirati deal (MRTX) is closed by sometime in H1’24.

While the pharmaceutical company’s profitability metrics have been improving beyond expectations, we maintain our Hold rating, since it is uncertain if the recent M&A activities may bear fruit ahead.

BMY’s Dividend Investment Thesis Appears To Be Sound

For now, BMY has reported a bottom line beat in its FQ3’23 earnings call, with revenues of $10.96B (-2.3% QoQ/ -2.2% YoY) and adj EPS of $2.00 (+14.2% QoQ/ +0.5% YoY). This is an impressive feat indeed, with Revlimid’s top-line erosion of $1.42B (-2.7% QoQ/ -41.3% YoY) appearing to be decelerating as well.

Most importantly, its two other top-line drivers, Opdivo has delivered an excellent sales growth of $2.27B (+6% QoQ/ +11.2% YoY), as with Eliquis at $2.7B (-15.6% QoQ/ +1.8% YoY), partly balancing Revlimid’s decline thus far.

The BMY management has also made great efforts to improve its gross margins to 77.3% by the latest quarter (+2.3 points QoQ/ -2.5 YoY), up drastically from 69.8% in FY2019 (-1.8 points YoY) and 72.3% in FY2020 (+2.5 points YoY).

In addition, the management has optimized its operating expenses to an annualized sum of $25.48B (-0.7% QoQ/ -2.4% YoY), down from $27.35B in FY2020 (+124.7% YoY, though non-comparable due to the Celgene acquisition in November 2019).

Much of the tailwinds are also attributed to BMY’s sustained debt repayment, with FQ3’23 bringing forth lower long-term debts of $32.19B (-7.1% QoQ/ -13.2% YoY/ -33.4% from its peak debts of $48.34B in FY2020).

This has naturally contributed to its moderating annualized net interest expenses of $796M (+6.4% QoQ/ -19.4% YoY/ -36.8% from FY2020), naturally boosting its bottom line.

As a result, it is unsurprising that BMY’s dividend investment thesis remains robust, with an impressive Cash From Operations of $12.91B (-6.4% sequentially) and Free Cash Flow of $11.68B (-8.1% sequentially) over the LTM.

This implies a more than decent FCF margin of 26% (-1.2 points sequentially) compared to its pre-pandemic averages of 25% and hyper-pandemic averages of 30%.

This is on top of BMY’s consistent share repurchases over the past few years, with the pharmaceutical company reporting 2.064B of shares outstanding by the latest quarter (-38M QoQ/ -84M YoY/ -194M from FY2020).

The reduced share count has directly allowed the management to sustainably grow its dividend per share at a CAGR of +8.20% over the past three years as well.

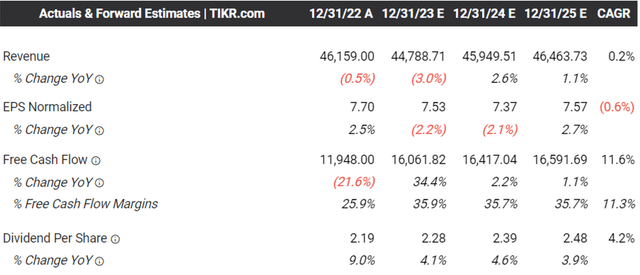

The Consensus Forward Estimates

Tikr Terminal

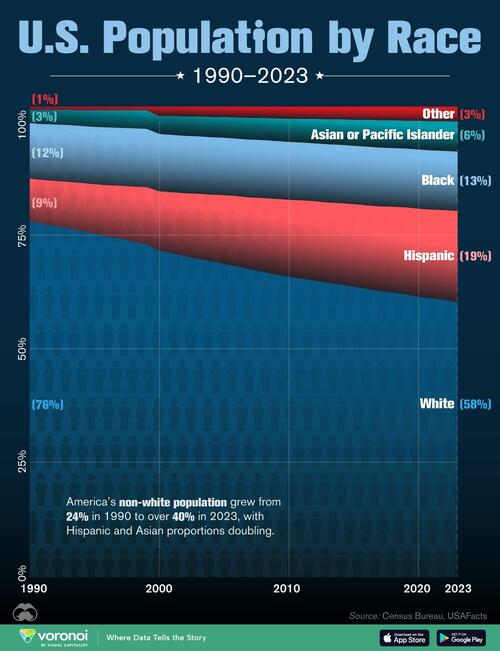

On the one hand, the consensus estimates that BMY may generate an impacted top and bottom line growth at a CAGR of +0.2% and -0.6% through FY2025, compared to its historical growth at a CAGR of +15.5% and +18.2% between FY2016 and FY2022, respectively.

On the other hand, the pharmaceutical company’s most important aspect, which is its Free Cash Flow generation, are expected to improve considerably moving forward.

As discussed above, the BMY management’s laser focus on profit expansion has shown great results thus far, with the consensus already estimating an average of FCF margin of over 35% over the next few years.

Combined with the recently raised annualized dividend to $2.40 (+5.35%), we can understand why the Seeking Alpha Quant continues to rate its Dividend Safety as a B+, despite Revlimid’s Loss Of Exclusivity issues thus far.

This is made attractive by BMY’s depressed stock prices, naturally triggering its expanded forward dividend yield of 4.61% compared to the sector median of 1.58% and 4Y historical average of 3.09%.

However, It Remains To Be Seen If BMY’s M&A Activities May Generate A Successful Pipeline

BMY has attempted to bolster its pipeline through multiple partnerships and acquisitions over the past few months, namely the Mirati Therapeutics (MRTX) all-cash acquisition worth $4.8B and partnership with SystImmune worth up to $8.4B in staged payments.

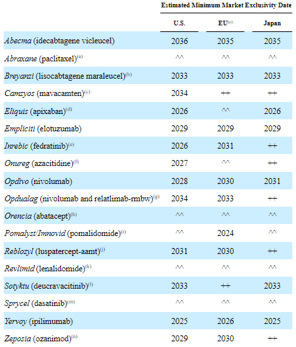

BMY’s Upcoming Loss Of Exclusivity

Seeking Alpha

This is naturally to balance BMY’s upcoming LOEs for Eliquis and Inrebic by 2026 in the US, worth an annualized revenue of $10.93B in FQ3’23 (-15.4% QoQ/ +2.1% YoY).

Based on its deteriorating net cash position, it is unsurprising that the management has priced a $4.5B of senior unsecured notes to fund the MRTX acquisition, though with a relatively well laddered maturity of between 2031 and 2063.

While SystImmune’s BL-B01D1 is potentially a first-in-class bispecific EGFRxHER3 ADC for the treatment of lung and breast cancer, with a projected TAM of $86.5B and $73.68B by 2032, respectively, the candidate is only in Phase 1 clinical trials with it remaining to be seen when and if the US FDA approval may be obtained.

With only ~8% of clinical trials being able to achieve the coveted regulatory approval, BMY’s upfront/ near-term payments of $1.3B to SystImmune appears to be hefty indeed, with the BL-B01D1 development likely to be prolonged over the next few years.

This means that we may see the pharmaceutical company’s balance sheet reverse its recent gains, with the pharmaceutical company likely to face moderate headwinds in profitability in the near term.

Readers must also note that BMY faces $6.7B of debt maturity through 2026, with another $3.2B in interest obligations at the same time.

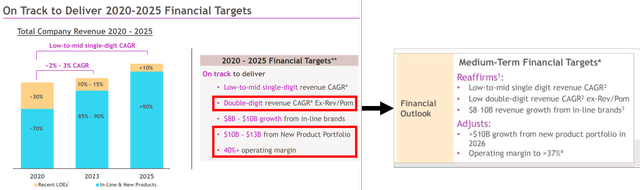

BMY’s 2025 Financial Target

BMY

While BMY continues to reaffirm its medium term guidance to a large extent, investors must also note that some numbers have been moderately downgraded.

This includes a lower double-digit growth in its Ex-Revenue segment, prolonged >$10B sales from its New Product Portfolio from 2025 to 2026, and lowered operating margin from 40% to 37%.

While this is partly attributed to the unprofitable MRTX, it is apparent that we may see BMY’s FCF generation moderately impacted in the intermediate term, worsened by the increased debt reliance and interest expenses.

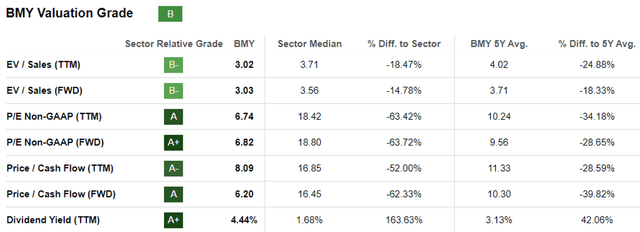

BMY Valuations

Seeking Alpha

Perhaps this is why BMY’s FWD P/E valuation of 6.82x and FWD Price/ Cash Flow of 6.20x have been drastically impacted compared to their 1Y mean of 8.05x/ 9.26x, 3Y pre-pandemic mean of 15.78x/ 18.22x, and sector median of 18.80x/ 16.45x, respectively.

Based on the stagnant projected EPS growth over the next few years, it appears that BMY may at best trade sideways from current levels, until a breakthrough is achieved and a highly profitable therapy is found, akin to Novo Nordisk’s (NVO) and Eli Lilly’s (LLY) GLP-1 drugs.

So, Is BMY Stock A Buy, Sell, or Hold?

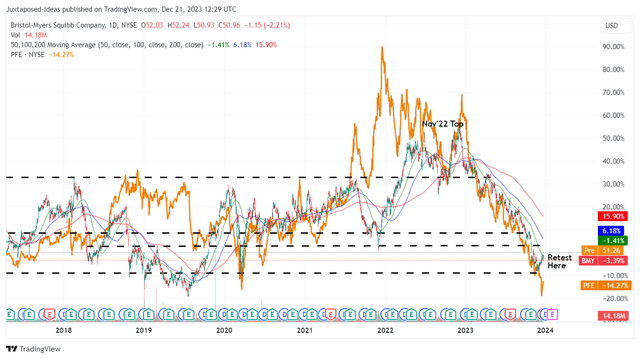

BMY 5Y Stock Price

Trading View

For now, BMY has fallen drastically by -34.9% since its November 2022 top, with it appearing to find bullish support at the $48s.

Based on its historical price chart over the past few years, it is also apparent that many investors may have been in the red, with the only consolation being its 7Y consecutive years of dividend growth.

With Pfizer (PFE) on a similarly depressing boat, we believe that BMY’s dividend investment thesis may not be suitable for everyone, especially when comparing the latter’s forward dividend yield of 4.61% and the US Treasury 3M/ 6M Yields of 5.37%/ 5.30%.

Combined with the speculative nature of its pipeline and the prolonged financial target through 2026, we prefer to continue rating the BMY stock as a Hold (Neutral) here, since it is uncertain when the correction may end and if the floor may hold at $48s.

Patience may be more prudent here.