Kwangmoozaa

Introduction

Brilliant Earth (NASDAQ:BRLT) is a jeweler with a great moat and a strong brand that could be affected by a recession. While I can see this company providing returns for shareholders as beautiful as the jewelry it sells, it is worth taking steps of caution due to its wares being categorized as discretionary and not performing well in a recession.

Company Profile

Brilliant Earth is a company that focuses on providing jewelry for their customers in the most ethical and transparent way possible. They primarily run their business in the digital world, but have been recently opening up several showrooms in key cities of the United States, primarily as a strategy to complement their digital business as some customers would like to visit them in-person whether originating online or from just walking onto a mall and coming across one of their showrooms.

I believe this is another example of a simple, but effective company that manages to make it profitable. Should their strategy to expand their retail footprint work, it can very well mesh with their digital storefront as a complement and even introduce new consumers to their brand.

Type of Consumer

The company is currently targeting Millennials and Gen Z consumers, understanding that they are a heavily tech-savvy consumer that is more up-to-date with technological advances and can take advantages of the services that Brilliant Earth can offer. So far, their strategy to be an environmentally sustainable omnichannel jeweler is very compatible with the consumer behavior so far discovered for Gen Z, and what’s been established for Millennials’ consumer habits.

However, there hasn’t been a notable wealth target that I’m able to identify as part of their marketing strategy, and as such it can be fair to assume that they are targeting the generation as a whole, which can open up to some unfortunate circumstances.

Most of their consumers buy jewelry for weddings, which is pretty well established to be one of the most significant and emotionally important events in most people’s lives. While people get married regardless of whether the country is in a recession or not, the unfortunate fact is that consumers do tone down their spending habits, probably forgo going for a traditional, expensive wedding ceremony, and prefer to use a more cost-effective courthouse wedding since there are more pressing matters threatening to kick them out of their usual livelihoods.

This is especially notable as, looking historically, companies like Brilliant Earth’s competitor, Signet Jewelers (NYSE:SIG), have been hurt very badly by the 2008 financial crisis. Considering that most jewelry is sold at three digits and above, buying that simple ring or earpiece is not going to be the best investment during hard times.

There is a silver lining, though, as their consumers are becoming more aware of the Brilliant Earth brand as management pointed out in their FY2022 earnings call:

In fact, online searches for Brilliant Earth reached an all-time high and we saw positive momentum across many other metrics, including a 38% growth in our e-mail capture

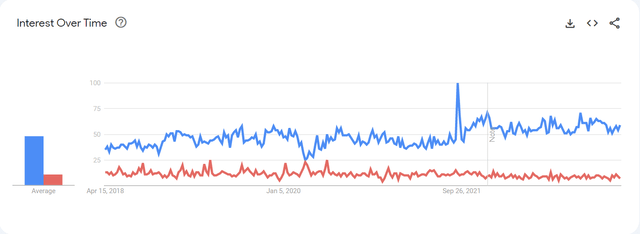

This can be confirmed via Google Trends (NASDAQ: GOOGL), which seems to show a slightly different story. While interest in Brilliant Earth peaked during its IPO, we can see that interest has remained relatively stable while Signet Jewelers has been on a decline in comparison.

Google Trends

While not the “record highs” that management claimed, they may be talking about multiple search engines like Bing and DuckDuckGo.

In the end, Brilliant Earth is targeting the right consumer and is poised to grow within this little niche in comparison to its peers. I want to point out, however, that one of Brilliant Earth’s competitors, Zales, has shown far higher interest when adding it into the mix of companies being researched. This is a double-edged sword, where the company can grow greatly as there’s plenty of market share to take, but it can also mean that the company may need to stay on top of its consumers and what they want as there are plenty of competitors that consumers are also aware of and likely trust more, even if those competitors can be implied as less ethical based on the idea that Brilliant Earth sells ethically sourced fine jewelry.

Q4 Earnings

I’m mixed about their earnings so far. As reported, their revenue was up 19% year-over-year with an EBITDA margin expanding to around 9.2%. They have now 25 showrooms around the USA as of Q4 2022 (Outside that, Q1 2023 added 2 showrooms and Q2 2023 so far has added 1 showroom based on the press releases shown on their investor relations website), and they just came off their biggest year in bridal purchases ever.

The problem is that their selling, general and administrative (SG&A) expenses have been eating up a larger portion of their revenues, now taking up 48% of revenues instead of 38.7% as recorded the year prior.

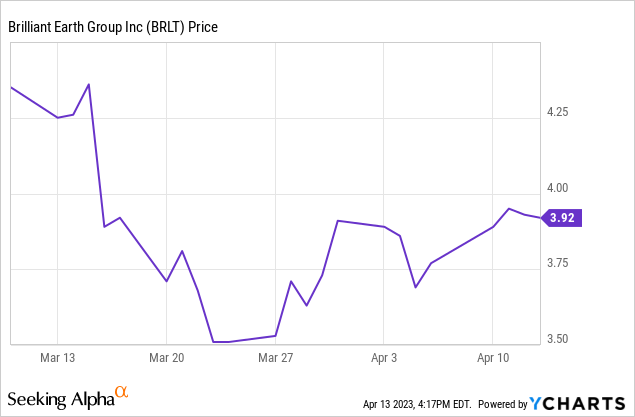

Because of this, their forecasts have been anything but stellar. Year-over-year, they expect to gain $460 to $490 million in revenues, which is an improvement from where we stood now at $439 million. However, the likely catalyst of the company’s recent dismal share price performance could be the fact that their EBITDA for the next will shrink to just $2.5 – $3.5 million over revenues of $94 to $96 million. The massive EBITDA margin contraction to just 3 to 4% reflects the dangers of higher SG&A and it doesn’t help investors that there has been no guidance for the year on the EBITDA front. Based on what we have, it’s fair to assume that EBITDA can come either above $12 million for the year, or below that and into negative territory.

As mentioned earlier, this might as well be the main cause for the stock price to nosedive almost below $3.50 per share, granted that other catalysts such as the collapse of Silicon Valley Bank also helped with the lack of confidence for investors.

While the consumer has been resilient so far, it is uncertain whether the company’s customer base will continue their current spending patterns or fold due to fears of a recession or a financial downturn finally happening.

Valuation

With that said, where can we go from here? With further decreasing profitability and lack of foresight into the business for the year, there is only so much we can do to properly value the business.

I think the first thing we can do is to determine just how asset-light the business is. While the company claims be lighter on that regard, it can be up to interpretation to figure out what they mean. In order to calculate this, I figured a few things: inventories relative to total assets, inventory, property, plant and equipment (PPE) and right-of use assets together relative to assets and total assets relative to revenue.

With these three calculations, we can compare to Signet Jewelers, their next and larger competitor, to determine if there is truth to how asset-light they are, which can help determine the weight of their equity valuation.

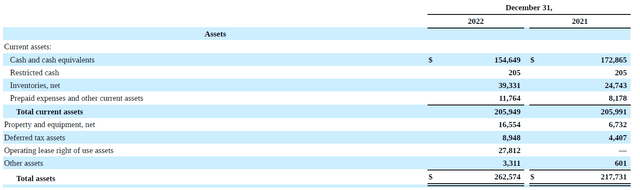

Assets (Balance Sheet) (Brilliant Earth)

*Numbers displayed for Brilliant Earth are in thousands

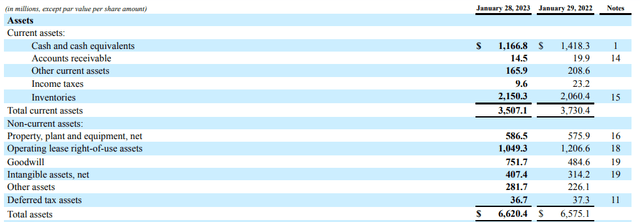

Assets (Balance Sheet) (Signet Jewelers)

So far seen here, both companies have run through their cash somewhat, and both companies have a large amount of inventory, PPE and right-of-use assets in their books. I’m more surprised about how much inventory Brilliant Earth holds, and the massive 58% increase this asset has experienced. I would have expected them to be holding about half or less in inventories than shown here, especially for the size of the business.

But, first impressions can be deceiving, so let’s pretend I have no idea what I’m talking about and use a ratio instead. To use such ratios, I’ll extract their total revenues shown on their income statement and put them here:

| Brilliant Earth | Signet Jewelers |

| $439.9 M | $7,842.1 M |

And for reference, their inventory, PPE and right-of-use assets will be summarized as physical assets. Do imply non-cash assets in that definition as well. These ratios will be shown as percentages to make it easier to digest.

| Brilliant Earth | Signet Jewelers | |

| Inventories to Total Assets | 15% | 32% |

| Physical Assets to Total Assets | 32% | 57% |

| Total Assets To Revenues | 60% | 84% |

Impressively, Brilliant Earth does seem to be much lighter in assets when compared to Signet Jewelers. I believe this is good considering that the company would then have less inventory to get rid of in a pinch compared to their bigger, bulkier counterpart.

This also means that we can take their assets and equity more seriously as they’re not plagued by a plethora of psychological intangibles and their assets aren’t so extensive that it hurts overall return on assets (ROA). Their equity of $10.9 Million attributable to the group’s current shares ($93.191 overall) can be considered one-to-one for valuation.

Since I cannot reasonably calculate a positive net income in the future, I’ll use their current net income for the group’s shares of $2.1 million, or $0.20 in EPS form, as part of the calculation for fair value, but do bear in mind that their overall earnings can change throughout 2023 should conditions for either the company or the macroenvironment change.

As for free cash flow (as in operating income – income taxes – cash used on investing activities), we currently have an unadjusted free cash flow of $14.3 million.

Revenues will be calculated 1-to-1 like equity, mainly because we don’t need revenues for now. However, I will provide a calculation at a 4x ratio for context. Net income and free cash flow will both be calculated at 20x ratio. I will maintain this standard despite the fact that Signet Jewelers trades at 12x net income, mainly as Brilliant Earth does still have some growth left before being considered as established as their competitor is.

Also, in order to easily convert metrics into an inclusive valuation of class B and class C shares or to just include class A shares, amounts can be adjusted to either 8.5 times the calculation or to just 11.7% of the calculation. The latter will be used when necessary to calculate a proper share price for the shares normal investors have available (class A).

With this in mind, here are the results for each metric to be used:

| Amount | Ratio | Valuation LLC | Valuation Group | Share Price | |

| Revenues* | $439.9M | 1x | $439.9M | $51.5M | $4.58 |

| Revenues* | $439.9M | 4x | $1759.6M | $205.9M | $18.30 |

| Net Income (EPS) | $0.20 | 20x | $382.4M | $45M | $4.00 |

| Free Cash Flow* | $14.3M | 20x | $286M | $33.5M | $2.98 |

| Equity | $10.9M | 1x | $93.2M | $10.9M | $0.96 |

*Amount used is for the LLC as a whole, not the group (class A shares)

With this in mind, it’s fair to say that it’ll be difficult to see Brilliant Earth fall below $1 per share as we are currently purchasing $1 of equity for every share we have, so we can take that as the base value we get for the company.

By weighting Revenues at 20%, equity at 30%, net income at 25% and free cash flow at 25%, we can come to see a fair valuation of $2.95 for the stock.

The fair valuation, as noted, is mostly dragged down by a very low equity valuation. Without equity and distributing its weight to the other metrics evenly, we can instead see a fair valuation of $3.82 per share, which is much closer to what we have.

Still, I cannot ignore the prior calculation nor the macroeconomic uncertainties. While I do believe that Brilliant Earth will pose a great opportunity for investors in the long run, I cannot ignore current headwinds that may come into play considering that they are a consumer discretionary business and depend on their consumers, Gen Z and Millennials, being willing to spend a considerable amount of money on beautiful gemstones.

As such, a price target of $3.50 would be reasonable and rather modest compared to the shares’ closing price of $3.93 on April 13th of 2023, which is when the bulk of this article was written.

With this in mind, the stock would be trading at a premium of around 12%, so it’s important to mind that when investing into the company.

Conclusion

In the end Brilliant Earth has a good moat among Gen Z and Millennial consumers, which has earned them their current growth over the past few years. However, with a recession in mind and seeing how consumers pull back all discretionary spending, including bridal accessories, the future looks very difficult to predict.

That said, I do believe that in the long term, Brilliant Earth can very well be a good investment. Where we can go is up to the imagination of investors, but for now, I’d say just be cautious and do your own due diligence before investing.

As it stands right now, I initialize coverage of BRLT stock with a Hold rating and provide a target price of $3.50 utilizing the calculations shown in the valuation segment.