Oscar Gutierrez Zozulia

Introduction

The development of the share price for Bridge Investment Group Holdings Inc. (NYSE:BRDG) over the last 12 months has been anything but impressive as it’s down over 30%, but seems to have reached a point where the dividend yield is almost too hard to pass up on. With a 100% payout ratio though, and a history of no consistent growth to it either, I can’t make a solid buy thesis here really. But I find it probable that the dividend will continue to be in the 6-7% range at least and that is sufficient enough to make BRDG stock a hold for now at least.

The last report did showcase some difficulties in raising the bottom line quickly and this, of course, is hurting the dividend somewhat. Where I think a highlight can be seen in the recent quarter is the AUM is still rising quickly for the company and right now sits at nearly $50 billion. This has resulted in stronger fee-earning AUM too, which should be a major benefit to the company going forward. But the lack of EPS is helping to suppress the buy case and in my opinion, the company remains to be a hold for now.

Company Structure

Established in 2009, BRDG, a real estate private equity firm, embarked on its journey to the public market in July 2021, with an initial share price of $16. This strategic move marked a significant transition for the company, opening new avenues for investors to engage with its unique offerings.

Central to the BRDG approach is its emphasis on the multifamily and workforce/affordable housing sectors, including the management of subsidized apartments. This focused specialization underscores the company’s commitment to addressing critical needs in the real estate market, aligning their investments with broader societal demands for accessible and affordable housing solutions.

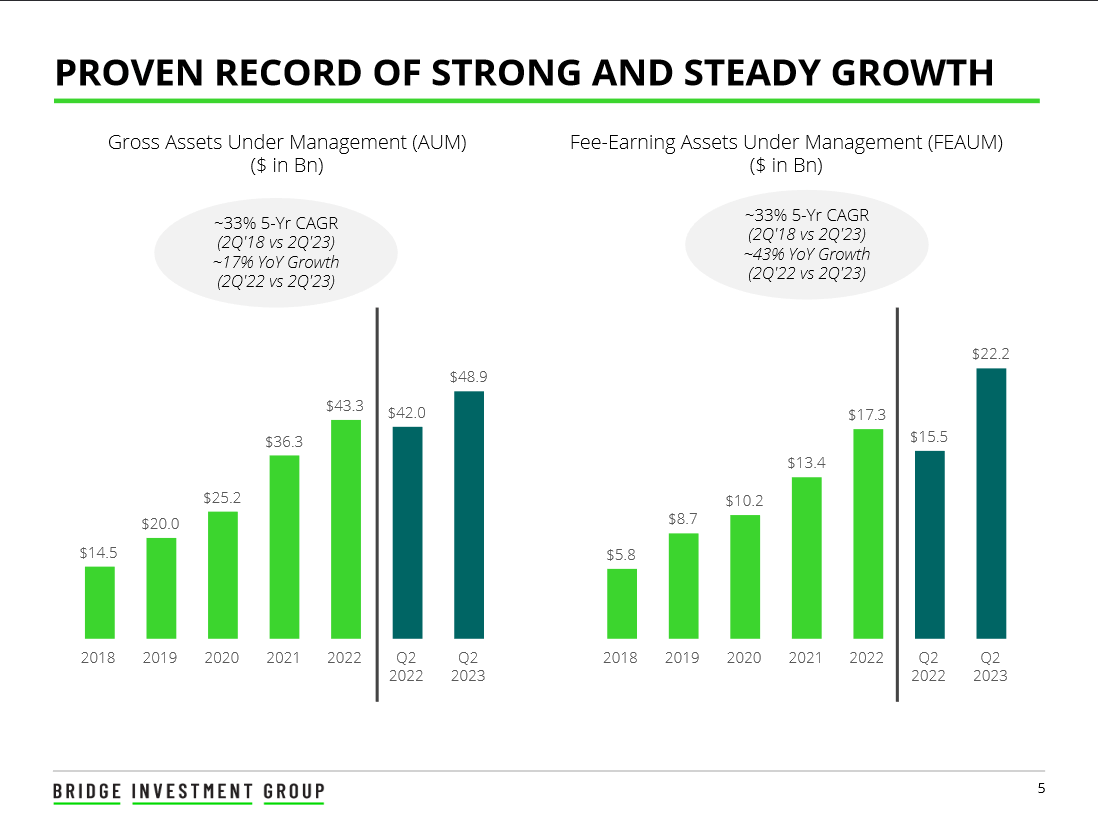

Company Growth (Investor Presentation)

The growth has over the years been solid for BDRG and this has led to the sound returns they have been able to achieve and deliver a satisfying dividend for shareholders. The rising interest rates have been very beneficial to the company as they continue to see a more rapid increase in fee-earning assets as opposed to just growing AUM. Some of the drivers for the company on this front have been from capital raises like credit, logistics, deployment, secondaries, and PropTech as well. This has highlighted the flexibility of the company and its ability to in times of difficult market conditions still grow at a sound rate.

Earnings Transcript

From the last earnings call by the company, there are some highlights I think are worth bringing up here. The executive chairman Robert Morse had the following to say.

“we have seen an improvement in the macroeconomic environment and activity levels beginning to recover at adjusted and attractive prices in the U.S. real estate markets. Bridge’s focus on selected sectors of U.S. real estate, residential rental logistics and credit and our recent expansion in the secondaries have served the company well”.

Seeing strong market improvements for the company is very reassuring. As they are operating mostly with real estate management, the rising interest did put a hold on this sector it seems as if the cost of buying assets became higher and activities dropped off somewhat. No though, the company is noting a solid recovery and I think we might see further AUM growth in the coming quarters as a result of it.

“We also had inflows into many of our newer verticals, including AMBS, Net Lease, PropTech and Secondaries as well as our Debt Strategies and Opportunity Zone vehicles. Year-to-date, we’ve raised approximately $1 billion”.

With a good relationship with many of its investors and clients, BRDG has been able to raise capital very well and this has ultimately led to the growth in AUM for the company. The more this grows, the bigger the earnings potential for the company. As interest rates go in cycles, I think if we aren’t staying with the rates we have now for a longer period, then the next cycle will likely lead to BRDG quickly building up its fee-earning AUM even faster than this time around. We should be looking at the company as a long-term investment and their performance right now tells me they can be a clear winner at the right price.

Risks Associated

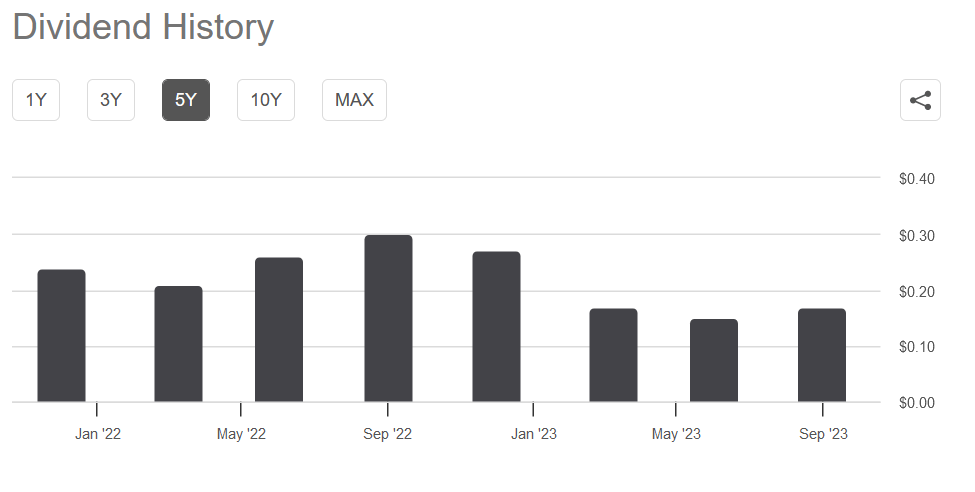

An important aspect to consider is the recent trend observed in BRDG, where they have significantly reduced their dividend payments. This strategic move has seemingly played a pivotal role in the decline of the company’s stock price, underscoring the significance of dividends as a driver of investor sentiment.

Dividend History (Seeking Alpha)

I think that the lack of consistency in the dividend history is a key risk for some investors. It makes it more difficult to anticipate how much the company can grow its dividend. With a 100% payout ratio as well, it is heavily dependent on strong earnings to grow. For a rising interest environment, it has been very beneficial, but the question arises about BRDG’s capabilities to sustain the dividend during times of lower interest rates instead. I do think though that BRDG will be able to grow the earnings base efficiently over the coming years as they have a fantastic ROIC of over 12%. This is sufficient to make the company able to grow the asset base at a fast rate and eventually deliver another rise to the dividend.

Although BRDG boasts a notably stable income profile anchored by steadfast assets and consistent fees, it’s important to recognize that it falls under the umbrella of alternative asset managers. This categorization exposes the company’s shares to inherent volatility, primarily attributed to the cyclical nature of performance fees. The dividend is driven by strong EPS growth, and if the interest rates fall quickly and BRDG isn’t able to build up stronger AUM to offset some of the losses there, then the share price might fall rather quickly.

Investor Takeaway

I think that investors still have some decent opportunities right now with BRDG as the dividend yield is looking very appealing and I think it can be sustained around 6 – 7% at least if the company can continue growing its AUM at a similar rate as last quarter.

The price right now though I still find a little expensive to buy at. A p/e of over 12 is too much for the sector, and something around 8 – 9 would be far better. But this also means that I wouldn’t be considering BRDG a buy unless it falls another 30%. That might seem extreme, but it would provide an adequate margin of safety I would be happy with. For the moment though I am rating the company a hold.