WASHINGTON, DC – JULY 27: U.S. President Joe Biden walks in to the Oval Workplace after delivering remarks on COVID-19 within the Rose Backyard on the White Home on July 27, 2022 in Washington, DC. President Biden’s physician Dr. Kevin O’Connor introduced this morning that Biden has examined detrimental for COVID-19 and can return to in individual work. (Picture by Anna Moneymaker/Getty Pictures)

It’s official. The US GDP contracted within the second quarter, which means that the financial system is in a technical recession. Now that the advance estimate confirms a nation on the decline, it makes excellent sense why the White Home was in full harm management forward of the April-June gross home product information. So, what did the numbers reveal within the earlier quarter?

US GDP Numbers Are Out

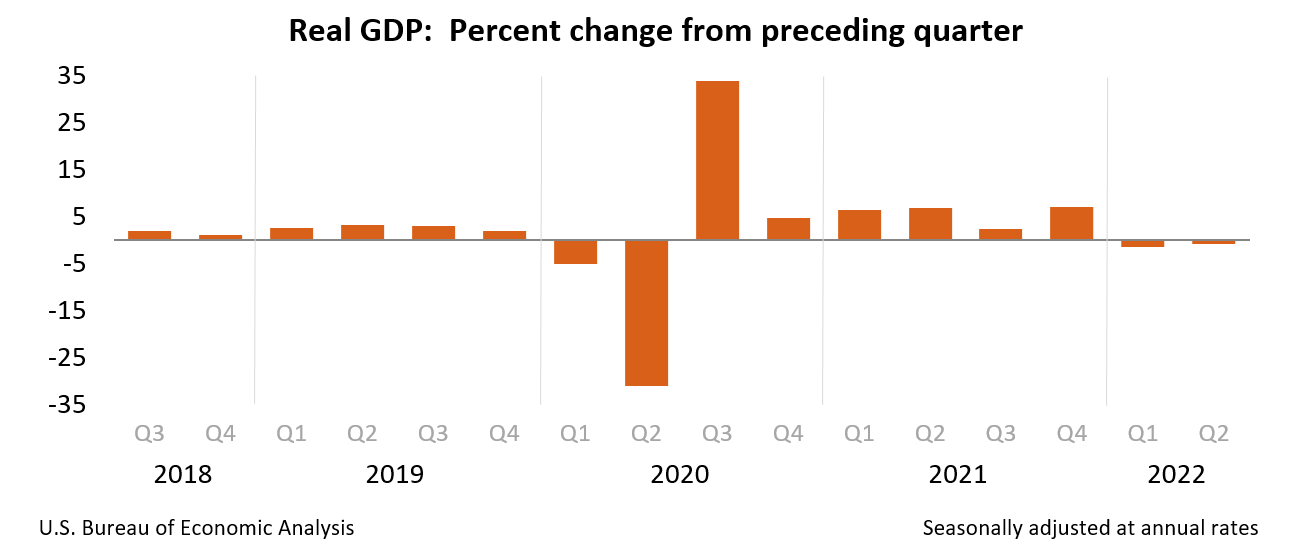

The GDP progress charge was -0.9%, in response to the Bureau of Financial Evaluation (BEA). The market had penciled in an enlargement of 0.5%, with estimates from economists and market analysts starting from -1.6% to as a lot as 1.2%. With the financial system contracting 1.6% within the first quarter, two straight quarters of contraction marks a recession. As well as, the GDP Value Index climbed 8.9% within the second quarter, larger than the median forecast of seven.9%. That is up from the 8.3% improve within the first quarter. GDP gross sales edged up 1.1%. The BEA is poised to launch two extra GDP estimates this summer time, so it’s doable that the financial system should avert a recession. Nonetheless, primarily based on the historical past of revisions, the adjustments are principally negligible.

The GDP progress charge was -0.9%, in response to the Bureau of Financial Evaluation (BEA). The market had penciled in an enlargement of 0.5%, with estimates from economists and market analysts starting from -1.6% to as a lot as 1.2%. With the financial system contracting 1.6% within the first quarter, two straight quarters of contraction marks a recession. As well as, the GDP Value Index climbed 8.9% within the second quarter, larger than the median forecast of seven.9%. That is up from the 8.3% improve within the first quarter. GDP gross sales edged up 1.1%. The BEA is poised to launch two extra GDP estimates this summer time, so it’s doable that the financial system should avert a recession. Nonetheless, primarily based on the historical past of revisions, the adjustments are principally negligible.

A lot Ado About Nothing?

It doesn’t matter what the BEA would have reported, the administration and its advocates within the mainstream media have been at all times going to dismiss the numbers. Until, after all, financial progress was above 2%.

Whereas the White Home’s makes an attempt at redefining what a recession means are comical and maybe anticipated, it’s much more laughable to see the highest financial minds within the nation emulate this identical method. Living proof, Keynesian economist and New York Instances columnist Paul Krugman, who has unsurprisingly adopted the institution viewpoint of a lot ado about nothing, regardless of not too long ago admitting that he acquired it so mistaken on inflation.

“Ignore the two-quarter rule. We’d have a recession, however we aren’t in a single now,” he wrote. “If GDP is detrimental, there can be a firestorm of calls for that Biden/NBER declare a recession, and claims that they’re transferring goalposts in the event that they don’t. (They received’t be.) If it’s constructive, anticipate many claims about cooked books.”

(Picture by Anna Moneymaker/Getty Pictures)

Politico joined the enjoyable, tweeting that if the GDP does spotlight a contraction within the April-June interval, it might be “presumably inaccurate and sure to be revised.” The publication’s Ben White additionally purported on Twitter that two straight quarters of shrinking GDP “wouldn’t present the financial system is at the moment in recession.” What made this comment befuddling is that he used this definition in March 2020.

Let’s face it: That is all about politics and defending President Joe Biden and the Democratic agenda. The proof might be present in Nationwide Financial Council (NEC) Director Brian Deese and the distinction in his feedback from 2008 and most not too long ago. Throughout a White Home press briefing on July 26, Deese asserted that “two detrimental quarters of GDP progress is just not the technical definition of recession.” Nonetheless, in 2008, Deese possessed a special understanding: “Economists have a technical definition of recession, which is 2 consecutive quarters of detrimental progress.”

Third Quarter and Past

Whether or not the second quarter confirmed contraction or enlargement, Wall Road and economists have been nonetheless anticipating poor financial performances within the coming months and years. In consequence, many funding corporations, monetary establishments, and market strategists have downgraded their outlooks. The prognostications vary from full panic mode to barely treading above water. The financial information, together with lots of the metrics the White Home refers to usually, highlight a slowing financial system, one thing the White Home and the central financial institution concede. Even the scorching labor market, which is alluded to as proof that the US is just not in a recession or pre-recession, is cooling off.

The July numbers are starting to roll in, and they don’t seem to be portray a reasonably image of the world’s largest financial system simply but. The IBD/TIPP Financial Optimism Index stays in subzero territory, regional Fed surveys are in contraction mode, and the current S&P World US buying managers’ index (PMI) readings weakened significantly. Everybody might want to brace themselves because the narratives can be written, the analyses will defy conventions, and the financial system will proceed to get weirder.

Keep in mind to take a look at the online’s greatest conservative information aggregator

Whatfinger.com — the #1 Various to the Drudge

.jpg?itok=zuVTp4ad)