Joa_Souza/iStock Unreleased via Getty Images

Note: I previously covered Braskem (NYSE:BAK). In my previous take, I highlighted the potential of the ADNOC acquisition, bringing a 100% upside potential. Since my note, BAK’s shares have moved up 51%. In today’s article, I will discuss the later updates on the deal and discusses BAK’s rating.

Braskem is one of those rare opportunities where everything seems so negatively aligned. Counter intuitively, the downside risk is much lower in such cases because all nightmare scenarios are already priced in. When I wrote my article on BAK, the risk-reward ratio was excellent, at BAK’s share price around $7. The present stock price is $10.31. Is the BAK share a good buy at the present price?

Braskem deal updates

BAK remains in the spotlight for potential acquisition. In addition to ADNOC (Abu Dhabi National Oil Company), a few others are considering the opportunity to acquire the sixth-largest chemical company in the world. Saudi Arabian company SABIC (Saudi Basic Industries Corp.) was rumored as a potential acquirer. SABIC’s major shareholder is Saudi Aramco, which has 70% ownership. Later in February, SABIC released a statement denying its interest in acquiring BAK.

Another Middle East candidate in Kuwait’s Petrochemical Industries Company (PIC). During his trip to the region, Petrobras CEO Jean Paul Prates met with the oil industry executives and shared his intentions for future partnerships. PIC was among the names referred to. However, until now, PIC has not yet submitted a formal proposal.

For now, only ADNOC is progressing toward the acquisition. Meanwhile, Petrobras (PBR) is also getting involved in due diligence. PBR already owns 47% of BAK.

In February, ADNOC acquired a 24.9% stake in OMV. Many investors interpret this move negatively as related to the BAK acquisition. I have a different opinion. ADNOC and Mubadala Fund (an Abu Dhabi sovereign fund and major shareholder in ADNOC) are flush with cash plus ADNOC does not have operations in Western Hemisphere. Hence, BAK seems tempting proposition.

Mataripe Refinery (RLAM) might be involved to speed up the deal. RLAM accounts for about 10% of Brazil’s total oil refining capacity. Petrobras CEO Prates affirms the company’s intentions to negotiate with Mubadala to sell the refinery. In 2021, Mataripe was sold to the previous Mubadala management for $1.65 billion.

On the other hand, ADNOC (and Mubadala) seek opportunities to park its cash. BAK is among them. In my previous note, I pointed out the political dynamics as the decisive factor. I still hold the same view. The deal heavily depends on Lula’s administration’s will to proceed. At least for now, the politics act as a tailwind, increasing the odds of a successful deal.

Below is a quote from an article on Lula’s plans for the Brazilian oil industry.

Lula wants Petrobras to hold on to more of its refining capacity to displace fuel imports. The main goal is to check pump prices for the benefit of local consumers, who have been clobbered by double-digit inflation this year.

“There is a consensus within the Lula camp that they want to close the gap between domestic (fuel) production and imports,” says Mark Langevin, a senior advisor to Horizon Access Consulting and former policy advisor to the president-elect. “They want to make sure that domestic prices reflect the cost of production and not the interests of large Petrobras shareholders — including the federal government — that want large dividends.”

The Brazilian President Lula expressed implicitly its support to take back Mataripe. In my opinion, Mubadala/ADNOC and the Brazilian government seem to have what the other side wants. So, the odds for successful ADNOC/BAK deal are high.

Balance sheet

In December 2023, BAK canceled its credit rating services. Below is a comment from a previous article on what it might mean:

For example, a credit rating might be withdrawn if the company is expected to be dissolved or merged with another entity. Of course, this statement does not mean ADNOC (or whoever) will compete in the deal with BAK. It might be something else—for example, the issue in Maceio.

In February, BAK announced its credit score by S&P, BB+, with a stable outlook. Before canceling its credit rating services, BAK scored BBB- with a negative outlook.

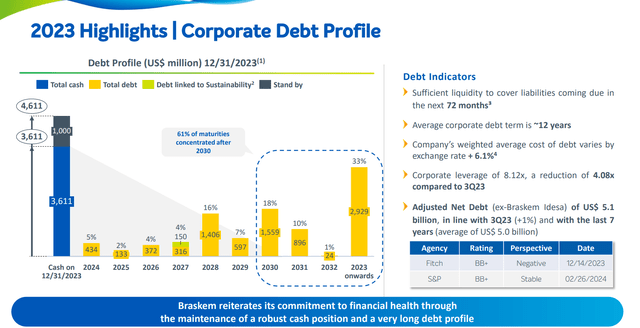

BAK’s liquidity position is more than sufficient. The company holds $3.9 billion in cash and has $12.3 billion in total debt (including $609 million lease agreements), as shown in the table below from 4Q23 presentation.

BAK 4Q23 presentation

61% of the debt maturities come after 2030. In 2024, the company must repay $434 million, and in 2025, $133 million.

As I mentioned in my last note on BAK, this is a speculative position related to the acquisition of BAK. So, my primary concern in the company’s financials is its liquidity, i.e., its ability to cover its debt installments. The revenue, income, and profit margins do not provide decisive information in that case. In conclusion, BAK’s liquidity is more than enough to cover its obligations in the coming years, mitigating the risk of premature bankruptcy.

Investors Takeaway

A significant risk is not respecting tag-along rights. That means all minor shareholders do not get the upside of the deal. Given the last news, the uncertainties around tag-along rights are diminishing. In February 2024, Petrobras exercised its rights when it sold its 18.8% share in UEG Auracaria to Ambar Energia SA.

The political environment remains supportive of the deal with ADNOC. As pointed out, the Mataripe refinery may speed up the acquisition. Lula’s administration wants to increase Brazil’s refinery capacity, while ADNOC wants to expand its business globally by buying quality assets for cents on the dollar.

The Maceio disaster carries some risks that can undermine my thesis. The implication is twofold. Firstly, ADNOC might cancel the deal because of the Maceio issue, saying they do not want to be associated with the accident by investing in BAK. In my opinion, this is possible, though not a probable scenario.

On the other hand, the political aspect of Maceio’s accident may undermine the deal. In Marich 2024, the CPI (Parliamentary Commission of Inquiring ) started a probe against BAK. The outcome of the probe will involve local politics. It depends on how far the investigation reaches. It may turn the tide even among the high-ranking officials, increasing the uncertainties around the deal with ADNOC.

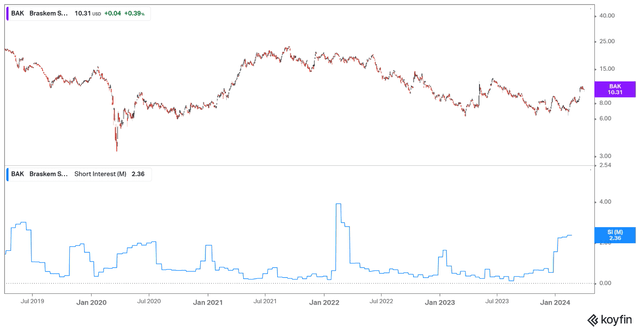

More conviction to my thesis adds BAK’s short positioning. It is not extremely high, but it seems good enough for a short squeeze in case of positive news about the BAK/ADNOC deal.

Koyfin

Short interest is not a prerequisite for a Buy. However, it adds value to the thesis when combined with special situations. A prime example of overtly short positioning was ZIM shipping in December 2023 and PGM (platinum group metals), especially palladium. ZIM, in particular, made the intense bull move, propelled by the first Houthis attacks.

Braskem is a special situation play, betting on ADNOC’s acquisition of BAK. Since my previous report, the stars have lined up for a successful deal. The price action confirms that, since December, the price has jumped by 50%.

With the expected takeover price by ADNOC in the range of $14-$15/share and the present stock price of $10.3, the risk-reward is not skewed in our favor. BAK has adequate liquidity to service its debts while waiting for the deal competition. I expect volatility ahead following the CPI probe, so if the price drops below $9.0, I may add more size. Until then, I sit tight. I give BAK a hold rating.