koto_feja

Overview of the thesis

Brainstorm Cell Therapeutics (NASDAQ:BCLI) is developing cellular therapies for neurodegenerative diseases. BCLI has completed a phase 3 trial in ALS patients which failed to meet its primary endpoint. However, a statistically significant benefit (slowing of functional decline) was demonstrated in a pre-specified subgroup of patients with less advanced disease as well as in post-hoc analyses accounting for the “floor effect”. Supportive biomarker data in combination with Fast Track Designation (which means potential for accelerated approval pending a confirmatory trial) further strengthen BCLI’s case. The data will be discussed by an AdCom Committee on September 27, with a PDUFA action date of December 8, 2023. I expect a positive outcome from the AdCom meeting. However, a negative outcome would be catastrophic for BCLI. Furthermore, any upside from a positive outcome could be short-lived given BCLI’s precarious financial situation.

Overview of ALS

ALS is a devastating progressive neurodegenerative disorder that causes muscle weakness, disability, and eventually death, with a median survival of three to five years.

Management of ALS include symptomatic and disease-modifying treatments. The latter aim to slow disease progression, i.e. to slow functional decline, prolong time to the need for tracheostomy or permanent assisted ventilation, and/or prolong survival. BCLI’s candidate is a disease-modifying treatment. Current disease-modifying treatment options include; riluzole, edaravone and the recently approved PB-TURSO (from AMLX) and tofersen (from BIIB). The first 3 options are recommended for all ALS patients, while tofersen is approved only for SOD1-associated amyotrophic lateral sclerosis (which accounts for about 15% of familial ALS cases).

Riluzole is administered orally, edaravone can be administered orally or intravenously, PB-TURSO is administered orally, and tofersen is administered intrathecally by lumbar puncture (initially every 14 days for three doses, then every 28 days). NurOwn administration is more complicated; the first step is to collect bone marrow from the patients, which is then shipped to BCLI’s manufacturing facility, where the mesenchymal stem cells undergo a series of steps to create a therapeutic product. The product is then administered intrathecally every 8 weeks.

Generally, treatment benefit is modest at best (see table below), meaning there is a lot of room for improvement and new therapies. The earlier the treatment is started the more the benefit, while benefit is limited when treatment is started too late. For example, edaravone was not significantly better than placebo in an early trial, although there was a benefit in a post-hoc subgroup analysis of patients with early-stage ALS. A subsequent trial confirmed the benefit in early-stage ALS (disease duration <= 2 years, independent living status, scores >=2 on all items of ALSFRS-R, and an FVC of ≥80%).

Table 1: Comparisοn of phase 3 trials of available disease-modifying treatments

| Study size | Population | Baseline ALSFRS-R score | Mean change in ALSFRS-R score vs placebo | |

| Edaravone | n=137 | disease duration ≤ 2 years, independent living status, scores ≥ 2 on all items of ALSFRS-R, and an FVC of ≥80%. 91% were on riluzole | 41.8 | -5·01 vs -7·50, difference 2.49 over 24 weeks |

| PB-TURSO | n=177 | disease duration ≤ 1.5 year, SCV>60% predicted. 71% were on riluzole, 34% on edaravone and 28% on both | 36 | -6.94 vs -9.30, difference 2.35 over 24 weeks |

| Tofersen | n=108 of which 60 were included in the primary analysis | documented SOD1 mutation, FVC ≥50%. 62% were on riluzole, 8% on edaravone. | 37.0 | –6.98 vs –8.14, difference 1.2 over 28 weeks (p=0.97) |

| NurOwn | Total: n=189, ALSFRS‐R ≥ 35: n=58 | disease duration ≤ 2 years, SCV ≥ 65% predicted,decline of ≥3 ALSFRS-R points in a 12-week pre-treatment period. 61% on riluzole | 30.8 | Total: −5.52 vs −5.88 , difference 0.37 over 28 weeks. ALSFRS‐R ≥ 35: -1.56 vs -3.65, difference 2.09 (p=0.05). |

The lower the ALSFRS-R (revised ALS functional rating scale) scores the higher the functional decline. References; 1, 2, 3, 4, 5

Phase 3 trial and the “floor effect”

NurOwn phase 3 trial failed to meet either the primary or secondary endpoints in the total study population. However, clinically meaningful and statistically significant benefit was found in a pre-specified subgroup of participants with earlier-stage ALS. BLCI attributed trial failure to the “floor effect” (which I will explain in the next paragraph) and showed that excluding patients affected by the floor effect NurOwn was significantly better than placebo.

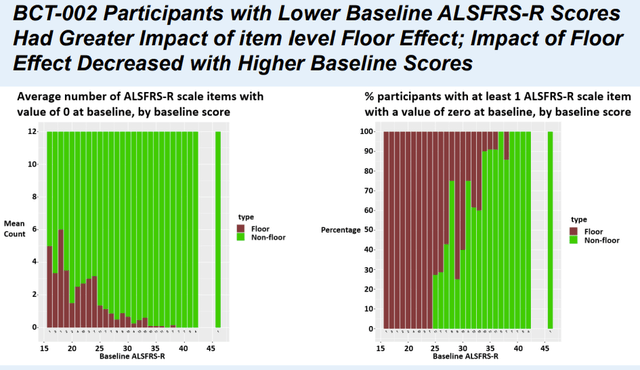

ALSFRS-R scale consists of 12 items assessing different functions with scores ranging from “0” (no ability) to “4” (normal ability) for each item. Obviously, a patient starting from zero on any item cannot deteriorate further on that item. In other words, NurOwn (which aims to slow disease progression) cannot demonstrate an effect on items with baseline scores of zero. Notably, as demonstrated in the table above, ALS patients enrolled in NurOwn phase 3 trial had much lower baseline ALSFRS-R compared to other ALS trials, with 23% of study population having a baseline ALSFRS-R ≤ 25. The lowest the baseline ALSFRS-R score, the higher the number of items starting from zero (Figure 1).

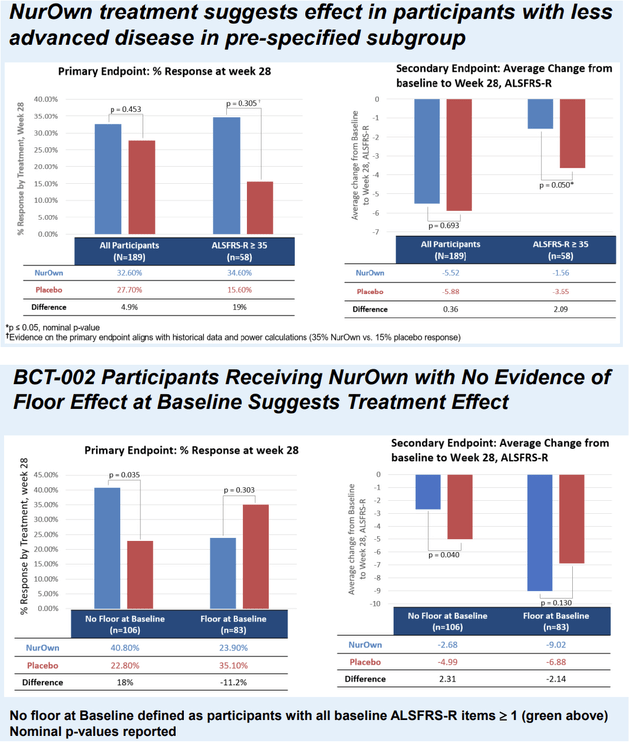

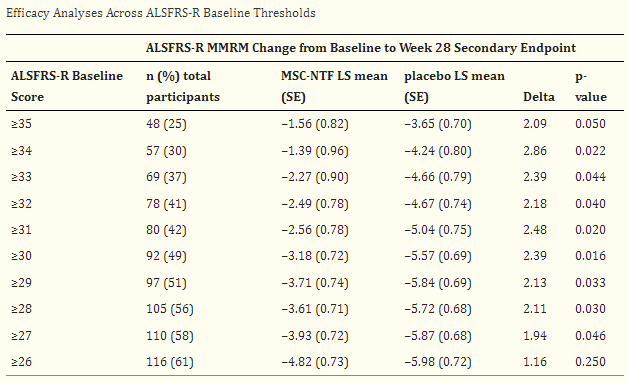

Focusing in a pre-specified subgroup of patients with earlier-stage ALS (ALSFRS-R > 35, n=58), i.e. patients minimally affected by the floor effect, the response rate (primary endpoint) was >2 times higher in NurOwn-treated patients vs placebo (34.6% vs 15.6%, p=0.305). In the same subgroup, average decline in ALSFRS-R (pre-specified secondary endpoint) was significantly lower in NurOwn-treated patients (Figure 2, upper image). Post-hoc sensitivity analyses confirm the above findings across all ALSFRS-R thresholds ranging from >=27 to >=34 (Table 2 below). Additionally, in a post-hoc analysis excluding patients affected by the floor effect (i.e. including only patients with score >=1 in all ALSFRS-R items) a clinically meaningful and statistically significant benefit was shown in both the primary (40.8% vs 22.8% response rate, p=0.035) and key secondary (ALSFRS-R change -2.68 vs -4.99, p=0.04) endpoints (Figure 2, lower image). Results were consistent in additional sensitivity analyses account for the floor effect. Finally, NurOwn’s activity on biomarkers was not impacted by the floor effect.

Figure 1. To simply explain the figure the more brown the higher the impact of the “floor effect” (Poster Presentation at the 2023 MDA Clinical and Scientific Conference)

Figure 2 (Poster Presentation at the 2023 MDA Clinical and Scientific Conference)

Table 2: Post-hoc efficacy analyses across ALSFRS-R baseline thresholds (From phase 3 publication, doi: 10.1002/mus.27697)

Supportive biomarker data

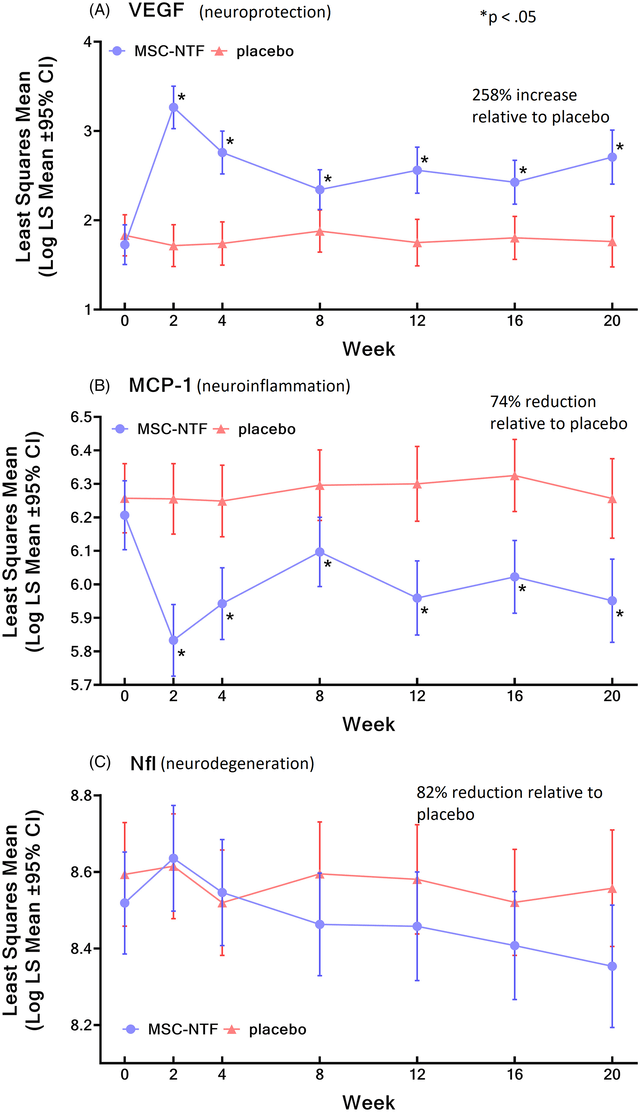

In the phase 3 study, treatment with NurOwn significantly elevated markers of neuroprotection, and lowered markers of neuroinflammation and neurodegeneration over time, while in placebo arm those markers remained unchanged. Most notable changes involved the following biomarkers; VEGF (neuroprotection), MCP-1 (neuroinflammation) and Nfl (neurodegeneration). However, a treatment effect was demonstrated on various other biomarkers. Furthermore, a correlation of clinical outcomes with various biomarkers was shown. Importantly, using casual interference analysis BCLI supported that NurOwn driven reductions in Nfl are associated with less decline in the ALSFRS-R from baseline to week 28.

Changes in biomarkers by NurOwn treatment vs placebo (Phase 3 publication)

Tofersen AdCom and implications for NurOwn

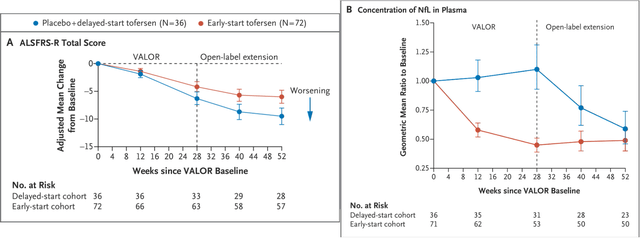

The phase 3 trial for tofersen included a 28-week placebo-controlled period followed by an open-label extension study during which all patients were treated with tofersen. Despite trend showing benefit the study failed to reach statistical significance in either the primary or secondary endpoints at 28 weeks. Nevertheless, meaningful and statistically significant reductions in Nfl were demonstrated at 28 weeks. Furthermore, clinical benefit was evident and statistically significant at the end of the

open-label extension study.

Results in primary endpoint (ALSFRS-R) in tofersen phase 3 trial (NEJM publication, doi: 10.1056/NEJMoa2204705)

Considering above results FDA requested for an AdCom. The AdCom panel was asked to reply to the following 2 questions:

- “Is the available evidence sufficient to conclude that a reduction in plasma neurofilament light chain ((Nfl)) concentration in tofersen-treated patients is reasonably likely to predict clinical benefit of tofersen for treatment of patients with SOD1-ALS?” The Committee voted unanimously yes (9 yes to 0 no), for consideration of a potential accelerated approval.

- “Does the clinical data from the placebo-controlled study and available long-term extension study results, with additional supporting results from the effects on relevant biomarkers (i.e., changes in plasma NfL concentration and/or reductions in SOD1), provide substantial evidence of the effectiveness of tofersen in the treatment of patients with SOD1-ALS?” The Committee voted 3 (yes), 5 (no) and 1 (abstain), for consideration of a potential traditional approval.

Based on Committee’s unanimous agreement that reduction of NFL is sufficient for consideration of a potential accelerated approval I don’t see why the same would not apply to BCLI. Notably, NurOwn resulted in a non-significant 82% reduction in CSF Nfl relative to placebo at week 20 according to the phase 3 publication. However, in a subsequent poster adjusting for baseline characteristics a decrease of just 11% was reported, which was statistically significant. This discordance is a bit concerning. Of note tofarsen’s Nfl data were measured in plasma (vs CSF in NurOwn phase 3).

Problems

I can spot the following problems with regards to prospects for a positive AdCom outcome/approval;

- Lots of reported results supporting the benefit of NurOwn were based on post-hoc analyses which are generally not considered sufficient evidence, as post-hoc analyses can be manipulated. Nevertheless, I don’t see any evidence of manipulation since results are consistent across ALSFR-S baseline thresholds and in multiple sensitivity analyses accounting for the floor effect. Furthermore, clinically meaningful and statistically significant benefit was shown in the pre-specified efficacy subgroup of patients with earlier-stage ALS.

- The number of patients in the subgroup analyses is very small (n=25 to 58 depending on the ALSFRS-S threshold selected). Nevertheless, the number of patients is higher (n=106) in the analysis excluding patients affected by the floor effect, which however was a post-hoc analysis. For comparison, the number of patients in tofersen phase 3 trial was n=108, of which n=60 were included in the primary analysis.

- The role of NurOwn as add-on therapy to edaravone or the recently approved PB-TURSO is unclear. Nevertheless, considering different mechanism of action there should be potential for use as an add-on to other available therapies. It is possible that patients in a future confirmatory trial will be on a combination of available treatments at baseline before treatment with NurOwn.

- The necessary confirmatory trial is still in the design stage, although BLCI plans to provide “an update prior to the ADCOM”. This is bad because “FDA strongly recommends that the confirmatory trial(s) be well underway if not fully enrolled at the time of accelerated approval”.

- According to a recent poster NurOwn resulted in only a small (11%) reduction in CSF Nfl compared to placebo, albeit statistically significant. In other words Nfl reductions by NurOwn were not as impressive in tofersen trial.

- Another consideration is that NurOwn phase 3 was published in “Muscle & Nerve” (Impact Factor 3.4), while tofersen phase 3 was published in “New England Journal of Medicine” (Impact Factor 158), the latter being by far a more respectable journal. The fact that NurOwn phase 3 was not published in a better journal is a bit concerning.

What are the chances of approval after missing the primary endpoint?

Missing the primary endpoint in a pivotal trial typically means no NDA and no approval. However, this is not always the case! Below are some useful statistics from a recent study that reviewed 210 FDA drug approvals between 2018 and 2021;

- 21 drugs (10%) were approved despite null findings for one or more primary efficacy endpoints in pivotal studies!

- 10 of these 21 drugs (47.6%) were designed as orphan drugs (a reminder here that NurOwn has orphan designation for ALS).

- 13 of these 21 drugs (61.9%) were granted expedited review (a reminded here that NurOwn has been granted Fast track, which means eligibility for accelerated approval and priority review).

- Four drugs received FDA approval despite null findings in primary endpoints in a single pivotal study.

- Among cited reasons for approval by FDA; secondary or exploratory endpoint positive outcomes in 10 approvals (47.6%) and “favorable post hoc analysis” in 7 approvals (33.3%). As discussed above, NurOwn showed consistent and clinically meaningful improvements in the pre-specified efficacy subgroup and post-hoc analyses accounting for the floor effect.

- In 7 drug approvals, the agency “required or requested post-marketing studies”.

Based on above stats, NurOwn fulfills several variables that improve chances of approval; orphan designation, Fast track designation, positive outcome in a pre-specified efficacy subgroup, favorable post hoc analyses accounted for the floor effect, supportive biomarker data (meaning potential for accelerated approval), and significant unmet need for ALS patients despite available treatments.

My prediction on AdCom outcome

I expect a positive (potential for accelerated approval based on available data) AdCom considering the following;

- Personally, I find BCLI’s data very convincing and sufficient for accelerated approval.

- Benefit from available treatments are moderate at best and ALS remains a devastating disease, meaning there is still a significant unmet need for ALS patients.

- Fast Track Designation allows potential for accelerated approval based on support from biomarker data.

- Positive AdCom for tofersen based on biomarker data supports a similar outcome.

- Approval is possible even for drugs that missed primary endpoint in pivotal trials.

An important clarification here. FDA’s questions to the AdCom Committee are not yet released (the relevant documents are typically released a few days before AdCom, and often result in a dip to the stock price). I am assuming questions similar to those posed for tofersen’s AdCom, i.e. I am assuming there will be a question for the potential of accelerated approval based on available clinical and biomarker data. I expect a positive AdCom vote on such a question. However, the outcome of a vote for potential full approval is less predictable and in my opinion would be negative.

Financials

And here comes the major problem. BCLI has very little cash! Cash, cash equivalents and short-term bank deposits were approximately $0.75M at the end of June 2023. Subsequently (in July) BCLI raised approximately $7M. Total operating expenses were $5.5M (R&D $2.8M, G&A $2.7M). With current cash balance BCLI cannot fund commercialization of NurOwn or a confirmatory trial. In other words dilution should be expected. Nevertheless, impact of such dilution should be much lower following a positive AdCom.

Risks to the thesis

- The major short-term risk is a negative AdCom, which would be catastrophic for BCLI’s stock price given current cash balance.

- Another important risk is that BCLI will still have little cash after a positive AdCom. So there is high risk of dilution and any spike in BCLI’s stock price could be short-lived.

- Even if the AdCom is positive there might be significant regulatory delays.

- It is possible there may be a better entry point for buying BCLI. For example, a dip following the release of FDA’s questions/concerns before the AdCom is common. Waiting for AdCom decision would certainly be safer.

Conclusions

I feel confident about BCLI’s data and I expect a positive AdCom on potential for accelerated approval, which could significant boost BCLI’s stock price. However, there are too many risks and I could be wrong. Given BCLI’s financial situation the upside potential immediately post-AdCom may well be lower than the downside risk. Waiting for the AdCom outcome is a much safer approach. At the least I suggest waiting for release of FDA’s material and questions to the AdCom Committee (this typically occurs within a few days before the AdCom and can be found here).

Your feedback is appreciated

Please comment below if you have any feedback (negative or positive), if you spot any mistakes or if you believe I missed something important in the article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.